Helen Steers, Pantheon Partner and lead manager of Pantheon International Plc (ticker code: PIN), discusses the recent annual results of one of the longest established private equity investment companies.

Pantheon International Plc (“PIP”) is a FTSE 250 private equity investment company managed by Pantheon, a leading global private markets investor, and overseen by an independent Board of Directors. PIP provides investors with exposure to many of the best private equity managers in the world that may otherwise be difficult to access for many types of investors. These managers are backing high growth, exciting companies many of which are in niche sectors.

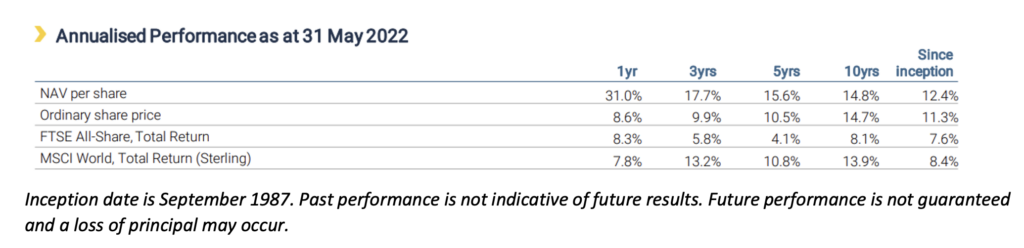

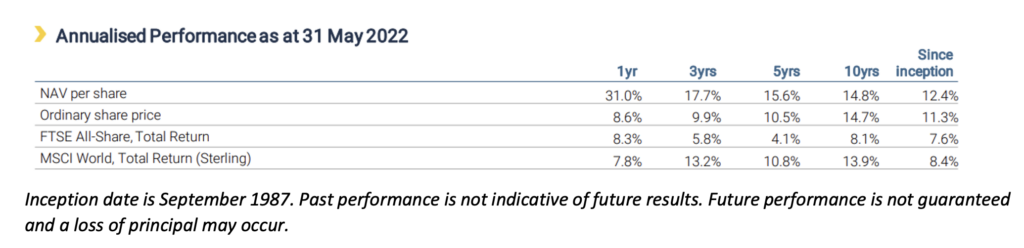

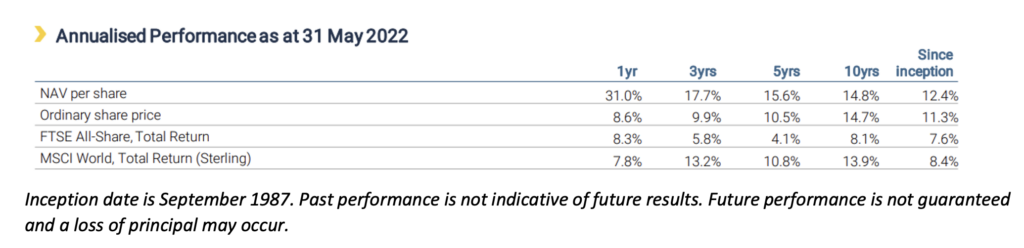

Consistent outperformance over 35 years

As shown in its recent annual results, PIP had an outstanding year, reporting record growth in the value of its net assets (“NAV”) as well as record net cash flow and investment activity for the 12 months to 31st May 2022. PIP’s NAV grew by 31.0% during the financial year and in the 35 years since PIP’s inception, it has grown by an average of 12.4% each year. This performance is stated net of all fees.

PIP has had an excellent year in terms of both new commitments and exits from existing companies held in the portfolio. PIP’s portfolio is being managed to provide ample cash that can be recycled into new investments. During the year, PIP received cash of £419m from its investments relative to £187m of calls from existing commitments to private equity funds, resulting in net cash flow of £232m. PIP made 70 new investments worth a combined £496m in the year and we expect its strong pipeline to continue to drive deal flow over the coming months.

We have continued to increase the number of direct company holdings in the portfolio and nearly 45% of the portfolio is now invested directly in companies. The increased concentration provides shareholders with greater exposure to the potential for individual companies to provide a boost to performance while, importantly, the benefits of diversification are not lost as PIP continues to invest in a well balanced portfolio of private equity funds and direct investments in companies.

PIP had its largest ever single company exit in its history during the financial year. PIP co-invested in EUSA Pharma, a pharmaceutical company focused on oncology and rare diseases, in 2015 alongside EW Healthcare which is one of the longest established private equity managers in the healthcare sector. EUSA Pharma was sold to a strategic buyer, Recordati, in December 2021, providing PIP with proceeds of £49.5m which equates to c.5.0x invested cost.

PIP has a strong balance sheet with good liquidity. We recently agreed a new, enlarged £500m five-year multi-currency, revolving loan facility to replace the previous lending agreement and there is an option to extend the facility by one year at a time beyond its expiration in July 2027. This facility, combined with £178m of cash at 31 July 2022, gives PIP even greater flexibility to meet its outstanding investment commitments and to continue to invest in compelling deal opportunities over the coming years.

Investing in exciting companies in growth sectors

PIP’s portfolio has been actively managed to be resilient in a variety of market conditions including in times of economic stress. The portfolio is tilted towards Information Technology and Healthcare, both of which are sectors that are benefitting from long-term secular trends that are not dependent on the macroeconomic environment.

The IT businesses that we invest in are typically mission-critical software and IT infrastructure businesses and those that are supporting the move towards automation and digitalisation across many sectors. These are high quality, cash generative companies with strong recurring revenues. For example, during the year PIP invested in TriMech, which is a provider of 3D design, engineering and manufacturing solutions in North America. We believe that this business is particularly interesting as TriMech is one of the few businesses operating at scale in an attractive 3D printing and design market which is set to continue to grow as companies utilise 3D software as part of their product development. TriMech has already made numerous acquisitions and they are likely to be a key component of its growth story.

We like Healthcare as a sector due to the positive tailwinds from ageing demographics and increased demand for high quality healthcare products and services from the growing middle classes in emerging economies. PIP has invested in Seqens which is a pharmaceutical ingredients manufacturer, headquartered in France, and is a leading supplier of pain relief ingredients for both the Paracetamol and Aspirin supply chains. Seqens is a great example of a company that is strongly positioned to benefit from western reshoring initiatives, which de-risk supply chains, and the growth in outsourcing of pharmaceutical supply chains.

We have continued to invest PIP’s capital in a thoughtful, responsible manner. Pantheon was an early signatory to the UN PRI in 2007 and we continue to enhance our ESG strategy. Sustainable investment can also create opportunities and we have invested in companies that have positive ESG angles. One such example is Satlink, a global leader in the development of technological solutions for the maritime sector with a focus on sustainable fishing. They recently won a United Nations Global Compact award in February 2022 for their contribution to a more sustainable fishing industry and the preservation of marine life.

Download PIP’s latest newsletter

Outlook

The impact of substantially lower economic growth globally, coupled with supply chain issues, higher energy, food and input costs, and the lingering effects of the COVID-19 crisis, is creating an unenviable mix of challenges which are being faced by both individuals and businesses. While we are cautious in these difficult times, we believe that our industry will continue to experience significant growth in the coming years. Private equity managers have a long-term investment horizon and they offer access to subsectors that are generally under-represented in the public markets and that continue to innovate and offer compelling investment opportunities.

PIP’s portfolio is orientated towards small and medium-sized businesses and those in the growth phase of their development. Within those businesses, there are a number of levers that our private equity managers can pull to create value and there are also several routes for them to sell the businesses on. The majority of the exits in PIP’s portfolio are to corporate buyers, executing their M&A strategies, or to other private equity managers who have a different set of skills to take the business to the next stage of its growth. The managers we are backing are not dependent on the IPO market being open. In fact, just 7% of the exits in PIP’s portfolio during the financial year were due to companies being taken public. Furthermore, PIP’s portfolio is tilted towards asset-light companies, which typically have no debt (in the case of companies in the growth capital stage), or lower levels of debt (in the case of small and mid-sized businesses), compared with large and mega sized firms.

For the past 35 years, Pantheon has managed PIP through numerous economic cycles to deliver long-term outperformance over its public market benchmarks. Investors must assess carefully what is suitable for them and their investment objectives and tolerance/appetite for risk but PIP’s access, through Pantheon, to many of the best private equity managers globally provides us with confidence that PIP can continue to provide attractive returns to shareholders over the long term.

Important Information

This article and the information contained herein may not be reproduced, amended, or used for any other purpose, without the prior written permission of PIP. This article is distributed by Pantheon Ventures (UK) LLP (“Pantheon”), PIP’s manager and a firm that is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom, FCA Reference Number 520240.

The information and any views contained in this article are provided for general information only. Nothing in this article constitutes an offer, recommendation, invitation, inducement or solicitation to invest in PIP. Nothing in this article is intended to constitute legal, tax, securities or investment advice. You should seek individual advice from an appropriate independent financial and/or other professional adviser before making any investment or financial decision. Investors should always consider the risks and remember that past performance does not indicate future results. PIP’s share price can go down as well as up, loss of principal invested may occur and the price at which PIP’s shares trade may not reflect its prevailing net asset value per share.

This article is intended only for persons in the UK. This article is not directed at and is not for use by any other person. Pantheon has taken reasonable care to ensure that the information contained in this article is accurate at the date of publication. However, no warranty or guarantee (express or implied) is given by Pantheon as to the accuracy of the information in this article, and to the extent permitted by applicable law, Pantheon specifically disclaims any liability for errors, inaccuracies or omissions in this article and for any loss or damage resulting from its use. All rights reserved.