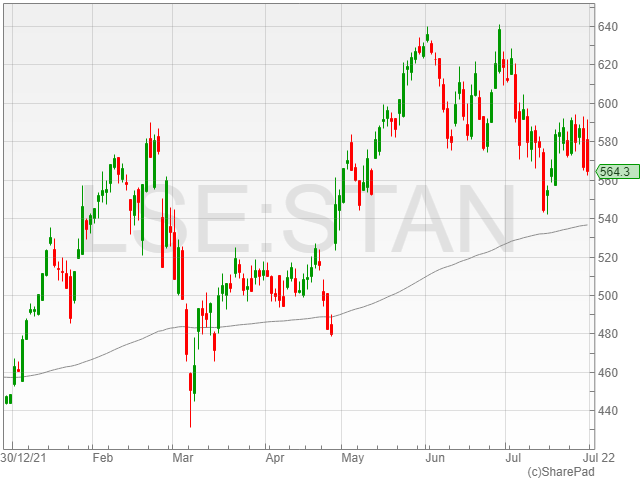

Standard Charted shares fell 0.5% to 563.7p in late afternoon trading on Friday following an announced HY1 2022 pre-tax profit growth of 19% to $2.8 billion, beating market expectations.

The banking firm benefited from rising interest rates, with the latest Bank of England meeting hiking rates 1.25% in a move to tackle soaring inflation.

Analysts projected a $2.4 billion profit for the group in the interim term, along with a CET1 ration of 13.9%.

Standard Chartered confirmed it was on track to reach a 10% return on tangible equity by 2024 at the latest.

Meanwhile, the banking giant reported a higher dividend of $119 million, representing 4c per share.

Standard Charted also announced the launch of a $500 million share buyback, which is scheduled to kick off imminently.

“We remain disciplined on expenses, with significant savings delivered and maintained a strong capital position, with a CET1 ratio of 13.9%,” said Standard Chartered CEO Bill Winters.

“We are also announcing today a new $500 million share buy-back to start imminently. We remain confident in the delivery of the financial targets we set out in February.”