AB InBev scraps dividend despite growth in revenue

AB InBev has reported a 4% increase in revenue, which is against analyst expectations of a 4% loss.

The world’s largest brewer said on Thursday that it had experienced a jump in sales over the third quarter, however, profits had dipped.

Costs of packaging, cans and bottles, as opposed to the cheaper costs of kegs delivered to pubs, has driven up costs for the brewer.

Beer and soft drink volumes grew by 1.9% in the third quarter, following a 17% drop in the previous quarter. Combined revenues of the group’s global brands, Budweiser, Stella Artois and Corona, increased by 6.8% globally and by 8.1% outside of their respective home markets.

“Our third-quarter results reflect our fundamental strengths as the world’s leading brewer and the resilience of the global beer category. We delivered a strong and balanced top-line performance by quickly adapting to meet the evolving needs of our customers and our consumers. In an ongoing volatile and uncertain environment, we remain focused on being part of the solution by prioritizing the health and well-being of our people, communities and customers,” said Carlos Brito, chief executive of the group.

AB InBev has scrapped its interim dividend due to the “uncertainty and volatility” amid the pandemic.

Foxtons revenue down 10%, shares fall

Foxtons shares (LON: FOXT) are down 5% on Thursday morning after the group reported a dip in revenue.

The London estate agent chain said in its latest trading update for the third quarter ended 30 September 2020 that group revenue was £28.5m, down 10% on the previous year.

A significant reduction in the number of overseas student tenants and corporate relocations led to an 8% decrease in lettings revenues.

Revenue generated from lettings totaled £19.5m, down from £21.3m a year previously.

Revenue from sales in the quarter also fell by 18% to £6.9m due to “depressed levels of exchanges, a hangover from the spring lockdown.”

Sales have since picked up, thanks to pent-up demand post lockdown and Stamp Duty relief. Revenue in September picked up by 9% on the previous year.

Mortgage revenue was £2.2m, up 4%, which reflects increased levels of re-mortgage activity.

The Bank of England said on Thursday that mortgage approvals in the UK have hit a 13-year high.

“The number of mortgage approvals for house purchase continued increasing sharply in September, to 91,500 from 85,500 in August. This was the highest number of approvals since September 2007, and is 24% higher than approvals in February 2020,” said the Bank of England.

Commenting on Foxton’s update, chief executive Nic Budden, said: “Foxtons has made good progress in the third quarter, during which we were able to capitalise on increased levels of market activity, driven by the decision to build back capacity soon after the lockdown ended. We have successfully re-built the sales commission pipeline to its highest level in 3 years, delivered a resilient lettings performance and progressed our lettings book acquisition strategy.

“Although the London residential market has gained momentum, we remain cautious as economic uncertainty causes more sales transactions to fall through and is putting downward pressure on rents. During these uncertain conditions, the energy and commitment of our people to go the extra mile enables us to deliver exceptional customer service whilst keeping our customers and employees safe.”

Foxtons shares (LON: FOXT) were down 5% this morning. Shares in the group have fallen over this past year from a high of 98.00p.

Housing boom continues as mortgage approvals hit 13-year high

Mortgage approvals have hit a 13-year high according to new figures from the Bank of England.

In September, banks approved 91,500 mortgages – the highest figure since September 2007.

Demand has been fuelled by the demand for more space since lockdown as well as the stamp duty holiday.

“The number of mortgage approvals for house purchase continued increasing sharply in September, to 91,500 from 85,500 in August. This was the highest number of approvals since September 2007, and is 24% higher than approvals in February 2020,” said the Bank of England.

“Approvals in September were around 10 times higher than the trough of 9,300 approvals in May.”

Net mortgage borrowing rose to £4.8bn in September, up from £3bn in August.

Lloyds Bank returned to profit for the third quarter thanks to the boom in the housing market. After posting a loss in the first half of the year, the lender has returned to profitability after a surge in demand for home loans.

Andrew Montlake, managing director of mortgage broker Coreco, commented on the figures and said that the boom is likely to lose steam.

“The post-lockdown bull run is already over. Lenders have been pulling down the shutters due to ongoing struggles with capacity and concerns over rising unemployment levels, specifically the impact on house price growth,” he said.

UK on-demand digital pharmacy Phlo surpasses £1.65m funding target on Crowdcube

Sponsored by Phlo

Phlo, the UK’s first real-time, on-demand Digital Pharmacy service hit its £1.65m crowdfunding target on Crowdcube in less than 24 hours and is now overfunding. The funding round has already attracted over 600 investors and has raised over £1.8m to date.

Phlo Digital Pharmacy, launched in November 2019, now plans to extend their crowdfunding campaign due to the high level of demand.

Phlo is the UK’s first same-day, on-demand digital pharmacy service, and is a is a fully authorised NHS pharmacy, underpinned by a state-of-the-art technology platform which combines their pharmacy operations, logistics and patient communications.

Founded by former banker Nadeem Sarwar, the firm has established a strong foothold in London, where it delivers medication to patients in under four hours.

This real-time, on-demand service is not currently offered by any other online pharmacy service in the UK and Phlo aims to expand their service to other major cities across England, including Birmingham and Manchester.

Phlo’s laser focus and commitment to patient care is reflected in their five star Trust Pilot reviews. They have also recently secured a contract with Babylon, the UK’s leading telemedicine provider.

Scaling Up

Mr Sarwar, who had the idea for the business five years ago when he visited Babson College near Boston with Adam Hunter, now Phlo Chief Commercial Officer, said the plan is to scale up “city by city”.

He commented:

“There are 36 million patients on prescription in England. About 1% have gone online. My firm belief is the next five million patients will go online in the next two years – it is our job to go and grab a nice slice of that market share.”

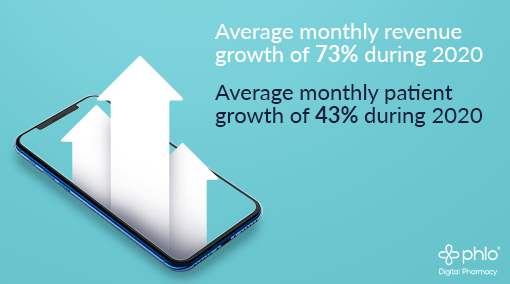

From launch last year, demand and patient numbers have been growing consistently, but in the period since COVID-19 became a significant public health issue, growth has exceeded all expectations.

Since the start of the year, Phlo has seen an impressive average 73% growth in MOM revenue, 43% average growth in MOM patient numbers and a 93% uplift in staff numbers. Phlo has serviced over 5000 patients to date from Jersey to Orkney.

Phlo is headquartered in Glasgow and currently employs 32 members of staff across high-value pharmacy and technology roles. The Pharmacy operations team is situated in central London.

First Digital Pharmacy Crowdfund in UK

This is the first UK Digital pharmacy crowdfund and interest has been high. The initial target of £1.65m was hit in the first 24 hours and the campaign is set to continue until 11thNovember 2020.

Mr Sarwar commented: “I’ve been blown away by the level of support we have received both from our patients and the public. The funds raised from this crowdfunding round will help us to expand our operations in major cities in England and allow us to continue on our path to building the most technology advanced digital pharmacy platform in the UK”

Phlo has also received investment from the UK Government Future Fund in the form of a convertible loan note. Investments will pay 8% interest until they are converted to shares at the completion of a follow – up investment round. Longer term, the company is eyeing up venture capital funding.

To find out more about Phlo’s crowdfunding opportunity, please visit www.crowdcube.com/phlo.

Scaling Up

Mr Sarwar, who had the idea for the business five years ago when he visited Babson College near Boston with Adam Hunter, now Phlo Chief Commercial Officer, said the plan is to scale up “city by city”.

He commented:

“There are 36 million patients on prescription in England. About 1% have gone online. My firm belief is the next five million patients will go online in the next two years – it is our job to go and grab a nice slice of that market share.”

From launch last year, demand and patient numbers have been growing consistently, but in the period since COVID-19 became a significant public health issue, growth has exceeded all expectations.

Since the start of the year, Phlo has seen an impressive average 73% growth in MOM revenue, 43% average growth in MOM patient numbers and a 93% uplift in staff numbers. Phlo has serviced over 5000 patients to date from Jersey to Orkney.

Phlo is headquartered in Glasgow and currently employs 32 members of staff across high-value pharmacy and technology roles. The Pharmacy operations team is situated in central London.

First Digital Pharmacy Crowdfund in UK

This is the first UK Digital pharmacy crowdfund and interest has been high. The initial target of £1.65m was hit in the first 24 hours and the campaign is set to continue until 11thNovember 2020.

Mr Sarwar commented: “I’ve been blown away by the level of support we have received both from our patients and the public. The funds raised from this crowdfunding round will help us to expand our operations in major cities in England and allow us to continue on our path to building the most technology advanced digital pharmacy platform in the UK”

Phlo has also received investment from the UK Government Future Fund in the form of a convertible loan note. Investments will pay 8% interest until they are converted to shares at the completion of a follow – up investment round. Longer term, the company is eyeing up venture capital funding.

To find out more about Phlo’s crowdfunding opportunity, please visit www.crowdcube.com/phlo.

Scaling Up

Mr Sarwar, who had the idea for the business five years ago when he visited Babson College near Boston with Adam Hunter, now Phlo Chief Commercial Officer, said the plan is to scale up “city by city”.

He commented:

“There are 36 million patients on prescription in England. About 1% have gone online. My firm belief is the next five million patients will go online in the next two years – it is our job to go and grab a nice slice of that market share.”

From launch last year, demand and patient numbers have been growing consistently, but in the period since COVID-19 became a significant public health issue, growth has exceeded all expectations.

Since the start of the year, Phlo has seen an impressive average 73% growth in MOM revenue, 43% average growth in MOM patient numbers and a 93% uplift in staff numbers. Phlo has serviced over 5000 patients to date from Jersey to Orkney.

Phlo is headquartered in Glasgow and currently employs 32 members of staff across high-value pharmacy and technology roles. The Pharmacy operations team is situated in central London.

First Digital Pharmacy Crowdfund in UK

This is the first UK Digital pharmacy crowdfund and interest has been high. The initial target of £1.65m was hit in the first 24 hours and the campaign is set to continue until 11thNovember 2020.

Mr Sarwar commented: “I’ve been blown away by the level of support we have received both from our patients and the public. The funds raised from this crowdfunding round will help us to expand our operations in major cities in England and allow us to continue on our path to building the most technology advanced digital pharmacy platform in the UK”

Phlo has also received investment from the UK Government Future Fund in the form of a convertible loan note. Investments will pay 8% interest until they are converted to shares at the completion of a follow – up investment round. Longer term, the company is eyeing up venture capital funding.

To find out more about Phlo’s crowdfunding opportunity, please visit www.crowdcube.com/phlo.

Scaling Up

Mr Sarwar, who had the idea for the business five years ago when he visited Babson College near Boston with Adam Hunter, now Phlo Chief Commercial Officer, said the plan is to scale up “city by city”.

He commented:

“There are 36 million patients on prescription in England. About 1% have gone online. My firm belief is the next five million patients will go online in the next two years – it is our job to go and grab a nice slice of that market share.”

From launch last year, demand and patient numbers have been growing consistently, but in the period since COVID-19 became a significant public health issue, growth has exceeded all expectations.

Since the start of the year, Phlo has seen an impressive average 73% growth in MOM revenue, 43% average growth in MOM patient numbers and a 93% uplift in staff numbers. Phlo has serviced over 5000 patients to date from Jersey to Orkney.

Phlo is headquartered in Glasgow and currently employs 32 members of staff across high-value pharmacy and technology roles. The Pharmacy operations team is situated in central London.

First Digital Pharmacy Crowdfund in UK

This is the first UK Digital pharmacy crowdfund and interest has been high. The initial target of £1.65m was hit in the first 24 hours and the campaign is set to continue until 11thNovember 2020.

Mr Sarwar commented: “I’ve been blown away by the level of support we have received both from our patients and the public. The funds raised from this crowdfunding round will help us to expand our operations in major cities in England and allow us to continue on our path to building the most technology advanced digital pharmacy platform in the UK”

Phlo has also received investment from the UK Government Future Fund in the form of a convertible loan note. Investments will pay 8% interest until they are converted to shares at the completion of a follow – up investment round. Longer term, the company is eyeing up venture capital funding.

To find out more about Phlo’s crowdfunding opportunity, please visit www.crowdcube.com/phlo. WPP reveals drop in Q3 revenue

WPP (LON: WPP) has revealed a 9.8% fall in revenue for the third quarter to £2.97m.

Like-for-like sales fell 5.5% to £2.97bn, however, the drop was smaller than the 11.5% fall in the second quarter.

“WPP continues to demonstrate its resilience in a challenging market. We have maintained our new business momentum as clients seek out our creativity and our skills in media, technology, data and ecommerce,” said chief executive Mark Read.

“This month, Uber joined a growing list of major assignment wins that includes Alibaba, Dell, HSBC, Intel, Unilever and Whirlpool, and we continue to lead the new business rankings. We have also renewed and expanded our relationship with Walgreens Boots Alliance to encompass its data- and technology-driven marketing strategy.

“Given the tightening of COVID restrictions around the world and uncertainty in the global economic outlook, we remain cautious about the pace of recovery. It is important that we maintain our strong financial position and we are on track to achieve cost savings towards the upper end of our £700-800 million target.”

WPP said it has seen improvement in North America as clients are returning to spending more on media ads.

Shore Capital analysts said in a note: “Notwithstanding continuing uncertainty over short-term advertising spend, we are encouraged by the momentum flagged in this morning’s update, continue to view WPP as a quality business and like the way in which it is been repositioned.”

WPP shares (LON: WPP) were down 3.25% in Thursday morning trading.

Lloyds returns to profit amid housing boom

Lloyds (LON: LLOY) has reported a pre-tax profit of £1bn, beating expectations for the third quarter.

After posting a loss in the first half of the year, the lender has returned to profitability after a surge in demand for home loans.

This quarter has seen the biggest growth in demand for home loans since 2008, which led to mortgage lending at the bank of £3.5bn.

The temporary stamp-duty holiday has led to a boom in the housing market, also helped by people wanting more space amid the pandemic.

Chief executive Antonio Horto-Osario commented: “Although our performance has clearly been impacted by the pandemic and the associated challenging economic environment, I am pleased that we are now seeing an encouraging business recovery and, with impairments significantly lower, a return to profitability in the third quarter.”

“Our customer-focused strategy and the strength of the group’s business model will allow us to continue to help Britain recover and play our part in helping to return the UK to prosperity.”

Horta-Osorio will be leaving the lender next year after a decade at the helm.

Lloyds shares (LON: LLOY) opened 2.6% at 28.37p. Shares this year have fallen 53% from previous highs of 69.99p.

BT raises profit guidance despite 20% fall in profits

In the latest trading update, BT (LON: BT.A) has reported a 20% fall in half-year profits.

The telecoms giant revealed post-tax profits of £856m – falling from last year’s £1.07bn.

Revenue at the group fell 8% to £10.6bn.

Despite the fall in revenue and profits, BT has raised its full-year guidance to £7.3bn – £7.5bn.

“BT delivered financial results in-line with expectations for the first half of the year, thanks to strong operational performance during exceptional circumstances. Customer demand during the pandemic has shown how critical our networks have become, and our significant network investments have helped us double the number of Openreach’s FTTP orders compared to this time last year and have seen our leading 5G network expand to 112 towns and cities across the UK,” said chief executive, Philip Jansen.

“We continue to invest to make BT more competitive and I’m pleased to see the quality of our products and services improving. At the same time we are firmly on track with the delivery of our modernisation programme and have delivered £352m in cost savings in the first half of the year.

“This performance has given us confidence to raise the lower end of our EBITDA outlook range for this year and publish an EBITDA expectation of at least £7.9bn for 2022/23, with sustainable growth from this level forward. This growth will be driven by the continued recovery from Covid-19, enhanced by sales of our converged and growth products, and by significant savings from our modernisation and cost saving programme. In combination these factors will more than offset legacy product declines.

“The growth in EBITDA underpins the planned reinstatement of our dividend next year whilst ensuring that we can continue to drive value-creating investments in our networks and products.”

BT shares (LON: BT.A) opened +5% at 107,10. Over the past year shares in the group have fallen almost 50%.

Three reasons why New Year’s Eve may be an eventful time for equities

It’s still an election, twenty new COVID policy measures, and a Christmas dinner away, but its worth trying to anticipate what equities will look like as the clock strikes midnight on New Year’s Eve. And, here are three factors to consider.

The Christmas COVID Crunch

Despite the police commissioner’s misguided tough guy comments about breaking up gatherings in breach of COVID rules, it seems almost inevitable that families across the Western world will come together to celebrate Christmas. And, with this in mind, we can make the assumption that the days following Christmas will be filled with headlines fretting about spikes in cases. Of course, the extent to which this comes to pass will be influenced by the lockdown measures in place over the festive period. However, many Twitter users in the UK and US have been vocal about their intentions to see loved ones, regardless of official restrictions. Should this be the case, we can expect further downside for Western equities. Politicians may be keen to avoid stringent lockdown measures over Christmas, but this might require tougher measures before – and, importantly – after the holiday period. While new lockdown measures between now and Christmas are already being priced in by shaky indexes this week, the severity of new case numbers will have a hand in steering the range of restrictions in place as we enter the New Year.Equities will love the duck no longer being lame

In a roundabout way: the new US president will stop being a lame duck in January. Save for the nightmare outcome of a close result in the presidential election next week, the next US president will be inaugurated in January. At present, bookies have three likely outcomes – a Democrat clean sweep, a Biden win but mixed legislature, and a Trump win with mixed legislature. Now, both candidates look likely to implement a new stimulus package once they take office, and whoever is in power will normally drop some breadcrumbs about what new support measures will look like ahead of time. Certainly, there have been reports saying that markets have priced in a Biden win next Tuesday, and such an outcome would likely result in more generous stimulus being introduced in the New Year. While markets would rub their hands eagerly at such a prospect, they’ll recoil in disgust at his new taxation policy plan. Trump will implement more modest stimulus, and thus the excitement for new support, while present, while be more muted. In contrast, Biden will likely bring in more extensive support, but – and despite BlackRock debunking some of the practical fears being raised – the giddy sentiment this incites will to some extent be cancelled out by equities pricing in heavier taxation.New Year, new hope

Perhaps the variable offering the strongest potential upside is the ultimate light at the end of the tunnel: a vaccine. With status updates being posted this week on the potential efficacy of the Oxford-AstraZeneca vaccine candidate, and Pfizer flexing the muscles of its vast vaccine roll-out logistics operations, any hope of there being an end in sight should have been rekindled. Indeed, just today, GSK and Sanofi announced a joint Statement of Intent to supply 200 million doses of its vaccine to the COVAX initiative, once approval has been received. Regarding a timeframe for these promising words to become reality, GSK hopes to achieve regulatory approval within the first half of 2021, and their effort doesn’t even seem to be the current front-runner. With that in mind, we may be on the brink of a vaccine candidate being made publicly available in the early stages of 2021 – or at least, that’s what’s currently being alluded to. Failing this, we’ll no doubt have more sweet nothings to sate our appetite for good news. And, if nothing else, some promising updates at the turn of the New Year may be enough to leave equities in a good mood.Hogma-nay or Hogma-yay?

I’m opinionated but not an oracle, and I won’t give you a clear answer I’ll regret at a later date. What I will say, though, is that you take time off over the holiday period at your peril. Even with just the three themes we’ve discussed, family arguments around the dinner table are unlikely to be the main sites of drama as the year draws to a close.UPS delivers 16% revenue growth but shares price in future downside

US-based international parcel company, UPS (NYSE:UPS) saw its shares drop on Tuesday, despite posting some healthy financial gains during third quarter trading.

The company booked Q3 consolidated revenue of $21.2 billion, up 15.9% year-on-year. Similarly, the company’s consolidated average daily volume increased 13.5% on-year, while net income rose by 11.8% and 10.7% on an adjusted basis, to $2.0 billion.

The company also recorded a third quarter operating profit of $2.4 billion, up 11.0% versus last year, and 9.9% on an adjusted basis. Fundamentals appeared equally peachy for UPS shareholders, with adjusted diluted earnings per share bouncing 10.1% year-on-year.

“Our performance highlights the agility of our global integrated network amid the ongoing challenges of the pandemic. Our results were fuelled by continued strong outbound demand from Asia and growth from small and medium-sized businesses,” said Carol Tomé, UPS chief executive officer.

“UPSers are everyday heroes who are keeping the world’s supply chains moving. I want to thank our team for their ongoing commitment to our customers and the communities we serve.”

In its US operations, the company saw its profits fall by more than $100 billion during Q3, even though daily average volume increased by 13.8%.

In its International Segment, volumes rose by 12.1% and profits spiked by over $300 million.

For its Supply and Freight business, revenues increased by 16.5%, and profits rose by around $50 million.

“Our Better, not Bigger approach had a positive impact on our performance in the quarter, specifically through the revenue-quality actions we’ve taken. Additionally, we recently launched new initiatives to further reduce our costs,” said Brian Newman, UPS chief financial officer.

“Looking ahead to the fourth quarter, we are collaborating with our customers and using our proven tools to control volume and ensure the resiliency of our network. We are focused on delivering a successful peak and generating cash returns.”

Following what was seemingly a positive update, UPS shares dipped by between 4% and 5%, down to just over $163 a share. This price dip perhaps anticipates some bounce-back against the rapid rise of deliveries during lockdown, and prices in the effect of a possible increase in face-to-face retail activity as vaccines start to be administered in the new year.

At present, the UPS price is around 10% ahead of analysts’ target of $146.75 a share. Analysts currently have a consensus ‘Buy’ rating on the stock; it has a p/e ratio of 32.05; and the Marketbeat community has a 51.90% ‘Underperform’ stance on the stock.

Ibstock reports decline in revenue, shares fall

Ibstock (LON: IBST) shares are down on Wednesday after the group issued a trading update for the period to 30 September 2020.

Group revenues for the period were 88% of those compared to the same period last year.

Ibstock has seen a continuing recovery in demand, with trading conditions improving steadily across the third quarter.

“As volumes have continued to improve, the benefit of the cost and capacity actions taken since the start of the second quarter have resulted in an encouraging recovery in margins across both businesses which are trending towards pre-COVID-19 levels on a run-rate basis,” said the manufacturer of clay bricks and concrete products.

“We have continued to operate our manufacturing sites in line with the recovery in customer demand and to ensure we have capacity in place to deliver on our volume expectations for the final quarter. As has been the priority since the onset of the pandemic, this has been done whilst ensuring the health and safety of our colleagues, with revised working protocols, including social distancing measures and onsite temperature checks, in place at all of the Group’s locations.”

Ibstock adjusted EBITDA for the 2020 financial year to be approximately £50m.

Joe Hudson, the chief executive of Ibstock, commented: “We are encouraged by the continued recovery in demand seen in the third quarter in both our Clay and Concrete businesses, although we remain mindful that there is significant uncertainty in the period ahead.

“We remain confident in the recovery of our markets over time and that the actions we have taken in the business leave us both with the necessary flexibility to meet current challenges and an organisation well positioned to take full advantage of future opportunities,” added Hudson.

Ibstock shares (LON: IBST) are -9.86% at 161,20 (1442GMT). Over the last year, Ibstock share price has been traded in a range of 191.7, hitting a high of 323.6, and a low of 131.9.