Retail sales slump amid new restrictions

Advanced Oncotherapy presents at the UK Investor Magazine Virtual Conference 20th October

Advanced Oncotherapy is a specialist developer and provider of a breakthrough proton therapy system, the LIGHT system, which is the result of 25 years of work at CERN and ADAM.

Our focus is on developing and supplying technologies to maximise the destructive effect of radiation on tumours whilst minimising damage to the patient’s healthy tissues.

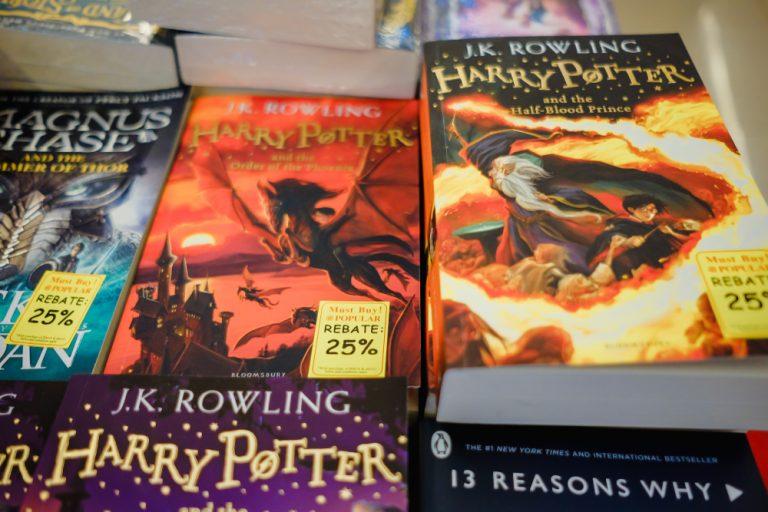

Bloomsbury Publishing posts record H1 performance, shares rise

Genius Sports to go public in $1.5bn deal

BP beats analysts’ expectations and swings to profit

HSBC reveals 36% slide in profits

Santander swings to profit, lender raises forecast

Whitbread profits plunge 483% amid hotel closures

Global equities floored ahead of big week with election, company data and COVID

Global equities hardly elated over the election

Quaking in their boots just over a week out from the US election, global equities watch in horror as the Biden lead that was priced in, is slowly but surely being gnawed away at by a resilient Trump campaign. Having performed terribly early on – and bagged the Biden campaign a 12% poll lead – team Trump has now narrowed the consensus poll margin to 9%, with some outlandish pollsters now forecasting a Trump lead in voter sentiment – let alone electoral college votes.Now, sure, Rasmussen are Trump’s favoured pollsters, and they may well be trying to manifest a Trump lead into existence, but data such as these may still be enough to shake the confidence of some investors who’d previously banked on a Biden victory. Speaking on the markets’ preferences for election outcomes, Kingswood CIO, Rupert Thompson, said: “The market’s preferred outcome seems to be for a clean sweep by the Democrats which will allow the implementation of a sizeable fiscal stimulus. If by contrast, there were split control of the Presidency and Congress, this would effectively lead to a continuation of the status quo with divided government a major constraint on new policies. Worst of all, however, would be a close and contested result with possibly weeks of rancour and confusion in prospect.”National GE: Trump 48% (+1) Biden 47%@Rasmussen_Poll, LV, 10/21-25https://t.co/Okfy9Js3ZJ

— Political Polls (@Politics_Polls) October 26, 2020

Company data expected to be positive, but preparing for disappointment might add to Monday’s downside

Another factor weighing on global equities is the anticipation of blue chip company data being published during the week. And, while much of this earnings data is expected to have a positive tone, pricing in positive results creates the possibility of disappointment, and there’s every chance those kind of jitters have been amplified by Monday’s other worries. Some of the companies set to publish their performance data this week include the American big tech cabal, including Microsoft, Amazon, Apple, Alphabet and Facebook. Further, there will be a Q3 GDP reading on Thursday, on which, Spreadex Financial Analyst, Connor Campbell, comments: “That should, at least, be a positive, with analysts forecasting growth of 32% at the annualised rate, compared to Q2’s 31.4% contraction.”Nothing short of COVID carnage

The third and final factor weighing on Monday’s global equities performance, are ongoing COVID updates. With case numbers expanding rapidly across Europe, equities losses were led by Germany, with SAP shares down some 22%, and seeing the DAX shed 3.43% on Monday. IG Analyst, Joshua Mahony, adds:“The German focus has also been highlighted by the latest Ifo business climate figure, with the survey reversing lower for the first time since the height of the crisis in April.”

Following behind the German fall was the French CAC, down 1.50% as cases hit ‘record highs’, while Spain enters a state of emergency, and TUI and Carnival shares falling sees the FTSE shed 0.97%. Mr Mahony adds:

“While we are seeing nations attempt to stifle the spread of the virus through more localised and tentative restrictions, it seems highly likely that we will eventually see a swathe of nationwide lockdowns if the trajectory cannot be reversed.”

While further restrictions appear likely, hope prevails for a COVID vaccine to be developed during the early stages of next year. These hopes, however, were not enough to see Eurozone equities regain their composure, with the Dow Jones delivering a late gut shot, by opening down over 2.50%.Reluctance to invest during the pandemic could cost 5% of your returns per year

“The suitability processes of many wealth management businesses are typically too human heavy, inefficient, and front loaded to the beginning of the client relationship to keep up with rapidly changing client circumstances at scale during a crisis. Understanding of client financial personality is typically limited to risk profiling – often badly – and subjective human assessment.”

“Very few wealth management propositions are using the sort of objective, science-based measures that are needed to provide a comprehensive picture of their clients. There is too much guesswork and not enough technology.”

The company adds that there are common behaviours that investors adopt during volatile periods, which include focusing too heavily on the present and on small details, and feeling compelled to take action when the best solution might be a mroe hands-off, patient approach. These behaviours can lead to underinvestment, selling low, and decreased diversification, as clients choose to invest in the familiar.

Oxford Risk has launched a free Market Emergency Survival Kit which allows retail investors to measure six key dimensions of financial personality, which the company has identified through extensive research into investor psychology and financial wellbeing. The service also provides personalised recommendations on how best to invest, which are based on the findings.

Speaking on the measures investors can take, Oxford Risk’s CEO< Marcus Quierin, PhD, comments:

“Many of these actions will mean that investors turn paper losses into real ones. If they don’t need to withdraw money for immediate expenses, then the losses are only virtual… until they panic and make them real.”

“The investments in the news are not your investments. Retail investors should avoid watching the markets day-to-day as this will only increase anxiety to no useful end, and make you feel like you should be doing something, without any useful guidance to what that should be. Long-term plans should be looked at through long-term lenses.”

Mr Quierin adds that investors should focus only on factors that they can control, and in turn might postpone discretionary spending, and use volatile periods as an opportunity to take stock of long-term financial plans. He finishes by saying that consumers would benefit from choosing to invest in the ‘risk premium’. Put simply: the long-term reward for owning shares that eventually weather every short-term risk that can be thrown at them.