Bidstack announces collaboration with Codemasters

Bidstack (LON:BIDS) has announced a collaboration with Codemasters to deliver native advertising for the game Dirt 5.

Bidstack are a digital advertising specialist that focus on native advertising in computer games and the Codemaster agreement builds on a number of other deals including an agreement with Epic Games, the company behind the hit game Fortnite.

Today’s announcement relates to advertising to be placed in the Dirt 5 game for the next generations of both the Xbox and Playstation consoles. The game is set to be released in October 2020.

“It’s great to be working with Codemasters, using our technology to deliver native in-game advertising for DIRT 5, which is the first racing game to be confirmed for the all-new Xbox Series X,” said James Draper, CEO of Bidstack.

“The launch of the Xbox Series X and PlayStation®5 later this year will bring a new level of gaming to gamers throughout the world. Where our technology is deployed within the games, brands and the global advertising agencies we are dealing with will be able to engage with gamers in a completely natural way.”

In addition to signed deals with games producers, Bidstack have inked a deal with advertising agency Dentsu Aegis.

Establishing the infrastructure through deals such as the one with Codemaster’s provides Bidstack with the digital real estate to place adverts, but essential to the success of their model is securing agency agreements to ensure channels to brands.

Part of the distribution of adverts through Bidstack’s technology involves a programmatic platform that allows clients to manage their inventory through a self-serve backend similar to interfaces offered by giants such as Google and Facebook.

However, despite the revolutionary approach employed by Bidstack the company only posted revenue of £140,000 in 2019. The development costs incurred meant Bidstack’s adjusted loss before tax of £5.3m.

The company had a cash balance of £3.1m as of 31st December.

FTSE 100 reverses early gains as global economies move towards reopening

The FTSE 100 rose in early trade on Monday as major global moved to ease lockdown measures to help restart economies.

The FTSE 100 traded as much as 0.9% higher at 5,994 in the first hour of trade on Monday, before selling off to turn negative on the day.

London’s leading index was closed on Friday and missed a strong session in the US following the release of the monthly US jobs report. US Non-Farm payrolls recorded a drop of 20.5 million jobs in the United States in April, which was marginally better than the expected 21.5 million.

The better than expected figure sparked a rally in global equities and followed through to a strong session on Monday in Europe. A stronger jobs report. although abysmal, analysts looked through the numbers to a potential recovery.

“Going in we knew we were going to see staggering job losses. But what we are looking at are temporary job losses, which gives us hope that those jobs could come back. But overall it’s a bleak report,” said Charlie Ripley, Senior Market Strategist at Allianz.

The post Non-farm payrolls rally built on steady gains last week that materialised as major global economies began to reopen their economies.

The UK was the latest country to lay down plans for a gradual easing of lockdown measures as Boris Johnson changed his message to ‘stay alert’ in a speech on Sunday.

In a speech highly criticised for its lack of clarity, Johnson said some workers could begin to return to work and people were allowed to take unlimited exercise.

The Prime Minister also announced a 14-day quarantine for people flying into the UK.

This hit the UK’s listed airlines with easyJet over 7% weaker and IAG shedding 2.5%. Ryanair was down 1.5%.

Johnson Matthey was the FTSE 100 risers as the lockdown easings increased the prospect of higher levels of car manufacturing.

Despite the potential for increased economic activity, there are warnings the recovery may not be as sharp as people had previously thought.

“The market’s confidence in positive news on coronavirus is looking overly optimistic and there is a sizeable risk that the opening up of the economy will be much slower than many people think. But we do expect the trough to be reached in the second quarter of the year, followed by significant improvement in corporate earnings in the second half,” said Ewout van Schaick, Head of Multi Asset at NN Investment Partners.

Bank of England sees the UK economy contracting 14% in 2020 and strong recovery in 2021

The Bank fo England announced its rate decision early on Thursday and kept rates on hold but warned the UK economy could contract 14% in 2020.

The contraction in the economy would be the result of a 25% slump in activity through the spring due to the COVID-19 lockdown.

Despite the dire warnings for economic activity during the coronavirus lockdown, the Bank of England said it saw economic activity bouncing back sharply in 2021.

Sterling rose on the news with GBP/USD touching 1.2418 before falling back.

“The headline takeaways are all rather terrifying: a 14% contraction in the UK in 2020 (and a 25% slump in Q2), with unemployment of 9% fast approaching. Globally the central bank is expecting to shrink by 20% in the second quarter.,” said Connor Campbell, analyst at Spreadex.

“Crucially, it did also state that it expects an aggressive rebound in 2021, with growth of as much as 15% in the UK.”

Interest rates

The Monetary Policy Committee voted unanimously to keep interest rates at hold at 0.1%. The Bank of England made a series of rate cuts, including an emergency cut to interest rates, at the start of the spread coronavirus to help stabilise the financial system as the economy shutdown. Despite not acting to change policy today, the Bank of England Governor said they would act again if needed. “However the economic outlook evolves, the Bank will act as necessary to deliver the monetary and financial stability that are essential for long-term prosperity and meet the needs of the people of this country,” said Andrew Bailey, Governor of the Bank of England. The Bank of England said it saw CPI inflation falling beneath 1% in the coming months due to a drop in energy prices. Oil prices have been rocked by a demand shock and price war between Russia and Saudi Arabia. As well as taking action themselves, The Bank of England instructed UK banks the cease payouts, including dividends, to increase liquidity through the crisis.BT cancels dividends until 2022, shares plummet

BT Group (LON:BT) cancelled their dividend on Thursday as the telecoms group announced an accelerated investment programme amid the COVID-19 crisis.

BT said they would not pay a dividend until 2022 as they invested in the adoption of 5G and increased the rollout of Fibre internet.

The market did not take the announcement well and BT shares traded as low as 101p in early trade on Thursday, down over 10%, before recovering.

Notwithstanding the scrapping of the dividend until 2022, BT posted disappointing full year earnings as adjusted EBITDA fell 3% to £7.9bn. Revenue also fell 3%, but this was broadly inline with expectations.

“BT had a positive year delivering results in line with expectations and completing our £1.6bn phase 1 transformation programme, one year ahead of schedule,” said Philip Jansen, Chief Executive

“Covid-19 has changed everybody’s world and I am immensely proud of how BT has responded to the challenges the Covid-19 crisis has presented. Our strong and resilient networks, both fixed and mobile, have proved critical to the continuing functioning of the UK economy, providing unrivalled connectivity and services for the nation.”

“Of course, Covid-19 is affecting our business, but the full impact will only become clearer as the economic consequences unfold over the next 12 months. Due to Covid-19, BT is not providing guidance for 2020/21, at this time.”

“BT has the best network infrastructure in the UK. We have the leading 4G network and are rapidly expanding our leadership position in 5G, that today covers over 80 towns and cities. We have the largest and most extensive fixed network and are leading the UK on the next generation Fibre-to-the-Premises (FTTP) network where we now pass 2.6 million premises.”

“Today we are announcing a rapid acceleration of our FTTP build with a target of 20 million premises passed by the mid- to late-2020s, including a significant build in rural areas.”

Jansen continued to explain the decision to cut the dividend was part of a broader investment plan that involved the roll out of 5G.

“In order to deal with the potential consequences of Covid-19, allow us to invest in FTTP and 5G, and to fund the major 5-year modernisation programme, we have also taken the difficult decision to suspend the dividend until 2022 and re-base thereafter,” Jansen said.

“These decisions, particularly on the dividend, network investment and transformation are key to underpinning BT’s investment case; driving network strength, competitive strength and financial strength, providing more clarity to the market, and driving long-term value for shareholders. I am confident that these decisions position us really positively for the future.”

The difficultly in coming to the decision to cut the dividend was reiterated the the BT Chairmen who said BT realised the “importance of dividends to our shareholders” who will now not see any income from their investment in BT until 2022.

“BT had a positive year delivering results in line with expectations and completing our £1.6bn phase 1 transformation programme, one year ahead of schedule,” said Philip Jansen, Chief Executive

“Covid-19 has changed everybody’s world and I am immensely proud of how BT has responded to the challenges the Covid-19 crisis has presented. Our strong and resilient networks, both fixed and mobile, have proved critical to the continuing functioning of the UK economy, providing unrivalled connectivity and services for the nation.”

“Of course, Covid-19 is affecting our business, but the full impact will only become clearer as the economic consequences unfold over the next 12 months. Due to Covid-19, BT is not providing guidance for 2020/21, at this time.”

“BT has the best network infrastructure in the UK. We have the leading 4G network and are rapidly expanding our leadership position in 5G, that today covers over 80 towns and cities. We have the largest and most extensive fixed network and are leading the UK on the next generation Fibre-to-the-Premises (FTTP) network where we now pass 2.6 million premises.”

“Today we are announcing a rapid acceleration of our FTTP build with a target of 20 million premises passed by the mid- to late-2020s, including a significant build in rural areas.”

Jansen continued to explain the decision to cut the dividend was part of a broader investment plan that involved the roll out of 5G.

“In order to deal with the potential consequences of Covid-19, allow us to invest in FTTP and 5G, and to fund the major 5-year modernisation programme, we have also taken the difficult decision to suspend the dividend until 2022 and re-base thereafter,” Jansen said.

“These decisions, particularly on the dividend, network investment and transformation are key to underpinning BT’s investment case; driving network strength, competitive strength and financial strength, providing more clarity to the market, and driving long-term value for shareholders. I am confident that these decisions position us really positively for the future.”

The difficultly in coming to the decision to cut the dividend was reiterated the the BT Chairmen who said BT realised the “importance of dividends to our shareholders” who will now not see any income from their investment in BT until 2022.

“BT had a positive year delivering results in line with expectations and completing our £1.6bn phase 1 transformation programme, one year ahead of schedule,” said Philip Jansen, Chief Executive

“Covid-19 has changed everybody’s world and I am immensely proud of how BT has responded to the challenges the Covid-19 crisis has presented. Our strong and resilient networks, both fixed and mobile, have proved critical to the continuing functioning of the UK economy, providing unrivalled connectivity and services for the nation.”

“Of course, Covid-19 is affecting our business, but the full impact will only become clearer as the economic consequences unfold over the next 12 months. Due to Covid-19, BT is not providing guidance for 2020/21, at this time.”

“BT has the best network infrastructure in the UK. We have the leading 4G network and are rapidly expanding our leadership position in 5G, that today covers over 80 towns and cities. We have the largest and most extensive fixed network and are leading the UK on the next generation Fibre-to-the-Premises (FTTP) network where we now pass 2.6 million premises.”

“Today we are announcing a rapid acceleration of our FTTP build with a target of 20 million premises passed by the mid- to late-2020s, including a significant build in rural areas.”

Jansen continued to explain the decision to cut the dividend was part of a broader investment plan that involved the roll out of 5G.

“In order to deal with the potential consequences of Covid-19, allow us to invest in FTTP and 5G, and to fund the major 5-year modernisation programme, we have also taken the difficult decision to suspend the dividend until 2022 and re-base thereafter,” Jansen said.

“These decisions, particularly on the dividend, network investment and transformation are key to underpinning BT’s investment case; driving network strength, competitive strength and financial strength, providing more clarity to the market, and driving long-term value for shareholders. I am confident that these decisions position us really positively for the future.”

The difficultly in coming to the decision to cut the dividend was reiterated the the BT Chairmen who said BT realised the “importance of dividends to our shareholders” who will now not see any income from their investment in BT until 2022.

“BT had a positive year delivering results in line with expectations and completing our £1.6bn phase 1 transformation programme, one year ahead of schedule,” said Philip Jansen, Chief Executive

“Covid-19 has changed everybody’s world and I am immensely proud of how BT has responded to the challenges the Covid-19 crisis has presented. Our strong and resilient networks, both fixed and mobile, have proved critical to the continuing functioning of the UK economy, providing unrivalled connectivity and services for the nation.”

“Of course, Covid-19 is affecting our business, but the full impact will only become clearer as the economic consequences unfold over the next 12 months. Due to Covid-19, BT is not providing guidance for 2020/21, at this time.”

“BT has the best network infrastructure in the UK. We have the leading 4G network and are rapidly expanding our leadership position in 5G, that today covers over 80 towns and cities. We have the largest and most extensive fixed network and are leading the UK on the next generation Fibre-to-the-Premises (FTTP) network where we now pass 2.6 million premises.”

“Today we are announcing a rapid acceleration of our FTTP build with a target of 20 million premises passed by the mid- to late-2020s, including a significant build in rural areas.”

Jansen continued to explain the decision to cut the dividend was part of a broader investment plan that involved the roll out of 5G.

“In order to deal with the potential consequences of Covid-19, allow us to invest in FTTP and 5G, and to fund the major 5-year modernisation programme, we have also taken the difficult decision to suspend the dividend until 2022 and re-base thereafter,” Jansen said.

“These decisions, particularly on the dividend, network investment and transformation are key to underpinning BT’s investment case; driving network strength, competitive strength and financial strength, providing more clarity to the market, and driving long-term value for shareholders. I am confident that these decisions position us really positively for the future.”

The difficultly in coming to the decision to cut the dividend was reiterated the the BT Chairmen who said BT realised the “importance of dividends to our shareholders” who will now not see any income from their investment in BT until 2022. Virgin Money shares rally despite COVID-19 hit

Shares in Virgin Money rose sharply on Wednesday despite the bank setting aside £232m in provisions for the impact of COVID-19.

The £232m hit meant, like the UK’s top traditional banks, challenger bank Virgin Money’s profit was almost entirely wiped out by the negative impact of COVID-19.

Virgin Money’s profit fell to £120m, but would have been £352 before the impairment charge due to coronavirus.

A profit of £352m would have represented a 3% drop in first half profit from a year ago, which was expected due to a reduction in net interest margin.

The market has been rewarding those banks who recorded strong performance before the impact of COVID-19, and this was the case with Virgin Money.

Virgin Money shares were up as much as 11% before falling back in afternoon trade.

“The COVID-19 outbreak and its impact on the nation’s businesses and consumers has markedly changed the operating environment, driving an increased impairment charge of £232m against future loan losses and a reduction in underlying profitability,” said David Duffy, Chief Executive Office of Virgin Money.

“While we delivered a resilient performance and continued to make good progress on our self-help strategy in the first half of the year, our primary objective now is safeguarding the health and well-being of our colleagues, customers and communities while also protecting the bank.”

The Virgin Money CEO continued to say the impact of the pandemic will persist for a prolonged period but he felt Virgin Money had the necessary measures in place to continue delivering their services.

“Amid the uncertainty, it is clear that the pandemic will have long-lasting and wide-ranging effects on how companies do business and on what customers will expect from the organisations they choose to interact with.”

“Although the full impacts from the COVID-19 outbreak will take time to emerge, I’m confident that our agility, digital capabilities and focus on disrupting the status quo will make us stronger and well-equipped to support changing customer needs and play our part in the UK’s economic recovery.”

Virgin Money shares were up as much as 11% before falling back in afternoon trade.

“The COVID-19 outbreak and its impact on the nation’s businesses and consumers has markedly changed the operating environment, driving an increased impairment charge of £232m against future loan losses and a reduction in underlying profitability,” said David Duffy, Chief Executive Office of Virgin Money.

“While we delivered a resilient performance and continued to make good progress on our self-help strategy in the first half of the year, our primary objective now is safeguarding the health and well-being of our colleagues, customers and communities while also protecting the bank.”

The Virgin Money CEO continued to say the impact of the pandemic will persist for a prolonged period but he felt Virgin Money had the necessary measures in place to continue delivering their services.

“Amid the uncertainty, it is clear that the pandemic will have long-lasting and wide-ranging effects on how companies do business and on what customers will expect from the organisations they choose to interact with.”

“Although the full impacts from the COVID-19 outbreak will take time to emerge, I’m confident that our agility, digital capabilities and focus on disrupting the status quo will make us stronger and well-equipped to support changing customer needs and play our part in the UK’s economic recovery.”

Virgin Money shares were up as much as 11% before falling back in afternoon trade.

“The COVID-19 outbreak and its impact on the nation’s businesses and consumers has markedly changed the operating environment, driving an increased impairment charge of £232m against future loan losses and a reduction in underlying profitability,” said David Duffy, Chief Executive Office of Virgin Money.

“While we delivered a resilient performance and continued to make good progress on our self-help strategy in the first half of the year, our primary objective now is safeguarding the health and well-being of our colleagues, customers and communities while also protecting the bank.”

The Virgin Money CEO continued to say the impact of the pandemic will persist for a prolonged period but he felt Virgin Money had the necessary measures in place to continue delivering their services.

“Amid the uncertainty, it is clear that the pandemic will have long-lasting and wide-ranging effects on how companies do business and on what customers will expect from the organisations they choose to interact with.”

“Although the full impacts from the COVID-19 outbreak will take time to emerge, I’m confident that our agility, digital capabilities and focus on disrupting the status quo will make us stronger and well-equipped to support changing customer needs and play our part in the UK’s economic recovery.”

Virgin Money shares were up as much as 11% before falling back in afternoon trade.

“The COVID-19 outbreak and its impact on the nation’s businesses and consumers has markedly changed the operating environment, driving an increased impairment charge of £232m against future loan losses and a reduction in underlying profitability,” said David Duffy, Chief Executive Office of Virgin Money.

“While we delivered a resilient performance and continued to make good progress on our self-help strategy in the first half of the year, our primary objective now is safeguarding the health and well-being of our colleagues, customers and communities while also protecting the bank.”

The Virgin Money CEO continued to say the impact of the pandemic will persist for a prolonged period but he felt Virgin Money had the necessary measures in place to continue delivering their services.

“Amid the uncertainty, it is clear that the pandemic will have long-lasting and wide-ranging effects on how companies do business and on what customers will expect from the organisations they choose to interact with.”

“Although the full impacts from the COVID-19 outbreak will take time to emerge, I’m confident that our agility, digital capabilities and focus on disrupting the status quo will make us stronger and well-equipped to support changing customer needs and play our part in the UK’s economic recovery.” Halfords shares ride higher as sales beat expectations

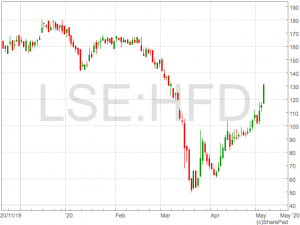

Shares in Halfords (LON:HFD) rose over 19% on Wednesday after the group announced sales that exceed the firm’s own expectations.

Sales for the four weeks to 1st May were 23% lower than in the same period last year on a like-for-like basis, beating company estimates.

The stronger than expected performance meant the company said it now expected profit to be towards the upper end of their previously guide £50-55m profit before tax.

The strength was seen in the company’s cycling business as key worker commuters changed their travel arrangements through the coronavirus pandemic.

Cycling has been a big theme for Halfords in 2020 as they actioned plans to close Cycle Republic and focus on their online business Tredz and the core in-store Halfords offering.

Graham Stapleton, CEO of Halfords, commented on the update:

“The health and safety of our colleagues and our customers remains our top priority. I am immensely proud of all our colleagues for their continued hard work and dedication to help keep the country moving.

“There may be less journeys now but those that are undertaken are even more important. As the UK’s largest provider of motoring and cycling products and services, we take our responsibility to keep the country moving seriously. We remain focused on providing essential services during lockdown, supporting key workers, including serving over 21,000 NHS front line workers so far, as well as the wider population who need to travel. Cycling has provided commuters with an important alternative to public transport and consequently we have seen significant growth within our Cycle2Work programme, cementing our position as the market-leading business in this segment.”

“Whilst trading since our last update at the end of March has been better than anticipated, driven by a strong performance in cycling, considerable uncertainty remains and as such we continue to take all necessary measures to preserve cash and protect our financial position. I am confident the actions we are taking now will put the business in a strong position when we emerge from the crisis and enable us to continue to deliver on our strategic transformation in the medium term”.

The strength was seen in the company’s cycling business as key worker commuters changed their travel arrangements through the coronavirus pandemic.

Cycling has been a big theme for Halfords in 2020 as they actioned plans to close Cycle Republic and focus on their online business Tredz and the core in-store Halfords offering.

Graham Stapleton, CEO of Halfords, commented on the update:

“The health and safety of our colleagues and our customers remains our top priority. I am immensely proud of all our colleagues for their continued hard work and dedication to help keep the country moving.

“There may be less journeys now but those that are undertaken are even more important. As the UK’s largest provider of motoring and cycling products and services, we take our responsibility to keep the country moving seriously. We remain focused on providing essential services during lockdown, supporting key workers, including serving over 21,000 NHS front line workers so far, as well as the wider population who need to travel. Cycling has provided commuters with an important alternative to public transport and consequently we have seen significant growth within our Cycle2Work programme, cementing our position as the market-leading business in this segment.”

“Whilst trading since our last update at the end of March has been better than anticipated, driven by a strong performance in cycling, considerable uncertainty remains and as such we continue to take all necessary measures to preserve cash and protect our financial position. I am confident the actions we are taking now will put the business in a strong position when we emerge from the crisis and enable us to continue to deliver on our strategic transformation in the medium term”.

The strength was seen in the company’s cycling business as key worker commuters changed their travel arrangements through the coronavirus pandemic.

Cycling has been a big theme for Halfords in 2020 as they actioned plans to close Cycle Republic and focus on their online business Tredz and the core in-store Halfords offering.

Graham Stapleton, CEO of Halfords, commented on the update:

“The health and safety of our colleagues and our customers remains our top priority. I am immensely proud of all our colleagues for their continued hard work and dedication to help keep the country moving.

“There may be less journeys now but those that are undertaken are even more important. As the UK’s largest provider of motoring and cycling products and services, we take our responsibility to keep the country moving seriously. We remain focused on providing essential services during lockdown, supporting key workers, including serving over 21,000 NHS front line workers so far, as well as the wider population who need to travel. Cycling has provided commuters with an important alternative to public transport and consequently we have seen significant growth within our Cycle2Work programme, cementing our position as the market-leading business in this segment.”

“Whilst trading since our last update at the end of March has been better than anticipated, driven by a strong performance in cycling, considerable uncertainty remains and as such we continue to take all necessary measures to preserve cash and protect our financial position. I am confident the actions we are taking now will put the business in a strong position when we emerge from the crisis and enable us to continue to deliver on our strategic transformation in the medium term”.

The strength was seen in the company’s cycling business as key worker commuters changed their travel arrangements through the coronavirus pandemic.

Cycling has been a big theme for Halfords in 2020 as they actioned plans to close Cycle Republic and focus on their online business Tredz and the core in-store Halfords offering.

Graham Stapleton, CEO of Halfords, commented on the update:

“The health and safety of our colleagues and our customers remains our top priority. I am immensely proud of all our colleagues for their continued hard work and dedication to help keep the country moving.

“There may be less journeys now but those that are undertaken are even more important. As the UK’s largest provider of motoring and cycling products and services, we take our responsibility to keep the country moving seriously. We remain focused on providing essential services during lockdown, supporting key workers, including serving over 21,000 NHS front line workers so far, as well as the wider population who need to travel. Cycling has provided commuters with an important alternative to public transport and consequently we have seen significant growth within our Cycle2Work programme, cementing our position as the market-leading business in this segment.”

“Whilst trading since our last update at the end of March has been better than anticipated, driven by a strong performance in cycling, considerable uncertainty remains and as such we continue to take all necessary measures to preserve cash and protect our financial position. I am confident the actions we are taking now will put the business in a strong position when we emerge from the crisis and enable us to continue to deliver on our strategic transformation in the medium term”. ITV advertising demand plummets during coronavirus lockdown

ITV’s (LON:ITV) advertising revenue crumbled in April as advertising demand fell by 42% due to the COVID-19 pandemic.

The update on the impact of COVID-19 on April’s trading was included in ITV’s first quarter trading state which revealed a 7% drop in total external revenue in the three months to 31st March.

Broadcast revenue was up 2% during the quarter as ITV studios revenue fell by 11% as COVID-19 restrictions started to take hold.

However, as ITV moved into April, when lockdowns were in full swing, the ITV Studios business saw most work grind to halt which is likely to have an impact on earnings for ITV’s Q2.

In addition to a pause in the Studio’s business, advertising revenue will be materially impacted due to advertiser uncertainty surrounding coronavirus.

The reduction in demand was felt across most of ITV’s advertising categories although the company did report some positives through the COVID-19 crisis.

Interaction with ITV’s library of content increased and subscription activity in Britbox also increased.

Simulcast viewing jumped 112% in the first quarter as overly online viewing rose by 77%.

ITV said they were working with advertisers on new and innovative marketing solutions but didn’t give any guidance or outlook for Q2 due to the ongoing distraction associated with coronavirus.

Carolyn McCall, ITV Chief Executive, said:

“ITV has taken swift and decisive action to manage and mitigate the impact of COVID-19, by focusing on our people and their safety, and by continuing to reduce costs and tightly manage our cashflow and liquidity. We are also ensuring that we continue to inform and entertain our viewers and stay close to our advertisers. Everyone at ITV has responded extremely well to the challenges we are facing.”

“We are now very focused on emerging from this crisis in a strong position, continuing to offer advertisers effective marketing opportunities and making preparations to restart productions safely.”

Shares in ITV (LON:ITV) rose 4.7% in early trade on Wednesday.

Oil shares help lift FTSE 100

The FTSE 100 rebounded on Tuesday in a global risk on rally sparked by optimism around the economic recovery from coronavirus.

The FTSE 100 rose over 1.9% to 5,860 and oil prices jumped with WTI up 14% and Brent up over 10%. Any increase in economic activity has the potential to avert an oil storage crisis and lift prices further.

Oil majors BP and Shell added a significant number of points to the FTSE 100 as they both posted intraday gains in excess of 8% in afternoon trade on Tuesday.

In addition to a strong rally in oil companies, financials and industrial shares posted strong gains in a broad rally with Melrose rising 5% and Barclays 3% higher.

Many countries have begun to reopen their economies or at least laid out plans for a gradual move back to some form of normality.

Any reopening of economies will have a significant impact on demand that’s been obliterated by lockdowns in the world’s leading economies.

However, the optimism in markets came during a raft of poor economic data from the United States confirming coronavirus had caused huge disruption in the manufacturing sector.

Despite the poor data, markets rallied on optimism surrounding a broad reduction in the number of new coronavirus cases and what it could mean for economic data in the coming months.

“If things continue to improve – the number of cases fall and governments reopen economies to some extent – then, while this might be a very deep recession, it might also be a very short one, so there is reason to think that stock prices will look past a short period of very bad economic growth,” said Simona Gambarini, economist at Capital Economics.

Equity markets also shook off negative comments from investor Warren Buffett who has recently sold off all Berkshure Hathaway’s airline holdings saying the economy wouldn’t return to what it was before COVID-19 for many years and airlines would feel it the most.

Power Metal Resources rated ‘buy’ at First Equity

Power Metal Resources (LON:POW) has received a buy rating from city brokerage First Equity.

Analysts wrote in a note that the company’s ‘swift’ expansion of activity in its Australian gold projects as the driver behind the rating.

Power Metal Resources has just made three new exploration applications for its 49.9% JV which would increase the acreage to 714km.

“It was only six days ago that POW first announced its entry into Australian gold exploration with the JV partnership with Red Rock Resources, which now provides investors with a broader exposure beyond African focused battery metal targeted commodities, along with one early stage US gold interest under due diligence,” First Equity wrote in a morning note.

“The new licence applications in Australia gives’ POW a sizeable footprint in a prolific gold mining district, near to the producing Ballarat mine, which currently produces 40,000 ounces of gold per annum at an average grade of 5.6 g/t.”

“POW will be able to analyse and study a wealth of historic exploration data from previous licence holders as part of an extensive desktop study ahead of the new licence applications being approved, to plan its first exploration campaign over the properties.”

Power Metal Resources shares trade on London’s AIM market and have a market cap of £1.8m.

The Royal Dutch Shell share price is still attractive despite the dividend cut

The Shell share price (LON:RDSB) should still be considered by investors, despite last week’s decision to cut their dividend.

Royal Dutch Shell made the historic decision to cut their dividend for the first time since world war two to conserve cash amid falling oil prices caused largely by the ongoing uncertainty surrounding coronavirus.

Royal Dutch Shell shares fell in the immediate reaction to the dividend amendment, meaning the company reversed most of the gains it made during April’s rally.

Given the sharp drop, Shell trades at 30x predicted earnings which is well above average and makes Shell shares look very expensive. However, this valuation will take into consideration earnings over the next 12 months which will be factoring in the decimation in revenue caused by the lower oil price.

Yet investors should look past this to a time the economy returns to some form of normality as a truer picture of what Shell’s valuation will look like in the medium and long term.

What the ‘new normal’ will look like for the global economy is very difficult to accurately forecast, but there isa wide consensus demand for oil will increase as soon as economies reopen.

When this demand returns, oil prices are likely to rise and in turn, Shell’s profits. This is where the value lies for investors in Shell shares.

A scenario where Shell returns quickly to the same level of profitability as last year is unlikely, but Shell trades at just 8.5x trailing earnings which is very difficult to overlook, especially for the largest company by market cap listed in London.

In addition to looking forward to a rebound in oil prices, long term investors should take confidence for Shell’s investments in renewable energy sources and the diversification this provides the business.

Examples of Shell’s push into renewables are the acquisition of ERM Power, one of Australia’s leading commercial and industrial electricity retailers and French wind power company Elofi.

Whilst Shell’s renewables business is still in its infancy and may not provide the revenue to pull Shell out of the current crisis, it shows they are prepared for the next chapter in the global energy market.

Shell have a history of making bold decisions in times of uncertainty and the acquisition of BG Group during the last major down turn in oil demonstrates this. BG provided a significant exposure to the natural gas market, particularly in Asia where demand is expected to grow, and Shell had a minimal presence.

Having reduced the dividend, Shell may have some spare cash to allocate to acquisitions, if lower oil prices do not persist beyond 2020. Should Shell chose to make strategic investments and forgo a quick return to higher dividend payouts, the company is a very bright prospect for the long term investor, even if income investors look elsewhere in the short term.