Invista European Real Estate Trust down 37.5%

Invista European Real Estate Trust (LSE:IERE) is one of the biggest movers this morning, falling 37.5% after releasing a trading update and results of a strategic review.

It was disclosed that the company’s investment portfolio has dropped 2.54% on its last quarter, with a valuation of 226.15 million euros. The company cites a tenant default as well as an absence of new tenants being contracted as reasons for the fall, and say that this will continue to have material adverse effect on rental income in the future.

The company’s Board has concluded that a rapid realisation of the Company’s assets is necessary to maintain the support of the Company’s lenders. A number of potential buyers have been identified by the strategic review.

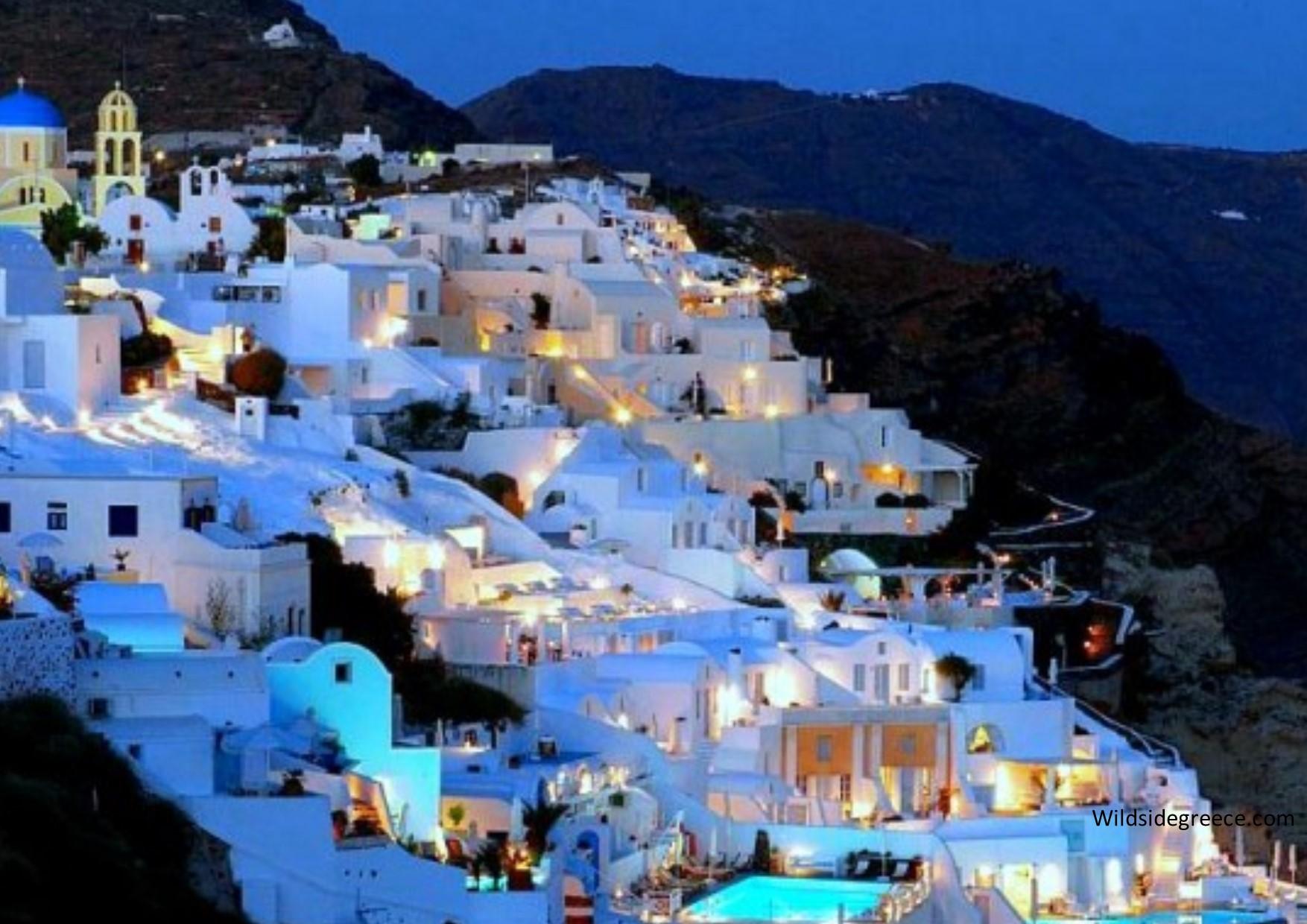

The Greeks had to be humiliated

There could be no other outcome.

The measures offered to Greece had to belittle their government in such as a way that other radical European parties would be deterred from embarking on such horse play Tsipras and Syriza had subjected the Troika to over the last six months.

The terms of the latest deal will mean years of harsh austerity in Greece in an agreement that many commentators said were designed to cause a voluntary Grexit.

After snubbing previous proposals from its creditors, the ‘last stand’ talks last night had to be incredibly harsh to prevent other Eurozone nations adopting a path that could again question the authority of the Germans and cast a shadow of doubt over their ability to keep the rest of Europe in line.

Spanish Prime Minister Rajoy is likely to lose elections later this year and could be replaced by a radical government that shares the same ideology as Syriza.

Greece’s share of Eurozone is miniscule compared to that of Spain and a similar debacle in the Iberian Peninsula would rock not only the Eurozone, but the global economy.

This would have been at the heart of the decision making process of last night’s talks and it was imperative that Merkel showed that there would be zero tolerance on radial leftist parties trying their luck with major European institutions.

Although they have remained in the Euro for now, it will be of little comfort to the Greek people have years of austerity to look forward to.

Greek deal reached after marathon talks

Talks over Greece have ended with an announcement from German Chancellor Merkel that a deal has been struck after Sunday’s talks went late into the night.

The deal has sparked furious protests in Athens as the terms of the deal are seen as complete compitulation by Tsipras who had been campaigning for a no vote against austerity.

The votes of 61% of the Greek people have been totally disregarded as Tsipras agreed to harsh austerity measures being implemented by this Wednesday.

European equities rallied in the wake of the announcement building on strong gains last week.

The terms will have to be formally accepted by all parties, but Tsipras says the deal has averted a meltdown of the Greek banking system.

The terms of the deal include the establishment of a EUR 50 billion fund to hold Greek assets that will be used to repay creditors.

EUR 25 billion will be given to Greece to recapitalise it’s banks who have suffered months of capital outflows.

There will another Eurogroup meeting this afternoon to discuss bridge financing.

Greece proposal cheered by markets

Greece have made a huge U-turn and presented it’s creditors with a proposal that goes against everything the Greek people voted for in last Sunday’s referendum.

In a proposal, very similar to one put forward by the EU Commission a couple weeks ago, Tsipras lays out plans to reform pensions, increase VAT, increase tax on shipping and many more austere measures Tsipras had been campaigning against.

The Greeks are hoping the proposals will secure a EUR 53.5 billion aid package that will enable the maintenance of current debts.

Markets cheered the changes made by Greece and many investment bank analysts said it dramatically reduced the chance of a Grexit.

The German DAX opened 2.3% higher and the Euro rallied against other major currencies.

The proposal was submitted last night and the EU Summit will decide whether the Greeks have gone far enough this Sunday.

Below you will find key extracts from the proposal text:

Budget

Adopt effective as of July 1, 2015 a supplementary 2015 budget and a 2016–19 medium-term fiscal strategy, supported by a sizable and credible package of measures. The new fiscal path is premised on a primary surplus target of (1, 2, 3), and 3.5 percent of GDP in 2015, 2016, 2017 and 2018. The package includes VAT reforms (2), other tax policy measures (3), pension reforms (4), public administration reforms (5), reforms addressing shortfalls in tax collection enforcement (6), and other parametric measures as specified below.

VAT Reform

Adopt legislation to reform the VAT system that will be effective as of July 1, 2015. The reform will target a net revenue gain of 1 percent of GDP on an annual basis from parametric changes. The new VAT system will: (i) unify the rates at a standard 23 percent rate, which will include restaurants and catering, and a reduced 13 percent rate for basic food, energy, hotels, and water (excluding sewage), and a super-reduced rate of 6 percent for pharmaceuticals, books, and theater; (ii) streamline exemptions to broaden the base and raise the tax on insurance; and (iii) Eliminate discounts on islands, starting with the islands with higher incomes and which are the most popular tourist destinations, except the most remote ones. This will be completed by end-2016, as appropriate and targeted fiscally neutral measures to compensate those inhabitants that are most in need are determined. The new VAT rates on hotels and islands will be implemented from October 2015.

Pension Reforms:

Create strong disincentives to early retirement, including the adjustment of early retirement penalties, and through a gradual elimination of grandfathering to statutory retirement age and early retirement pathways progressively adapting to the limit of statutory retirement age of 67 years, or 62 and 40 years of contributions by 2022, applicable for all those retiring (except arduous professions, and mothers with children with disability) with immediate application;

Gradually phase out the solidarity grant (EKAS) for all pensioners by end-December 2019. This shall be legislated immediately and shall start as regards the top 20% of beneficiaries in March 2016 with the modalities of the phase out to be agreed with the institutions;

Fiscal Measures

Adopt legislation to:

- close possibilities for income tax avoidance (e.g., tighten the definition of farmers), take measures to increase the corporate income tax in 2015 and require 100 percent advance payments for corporate income and gradually for individual business income tax by 2017; phase out the preferential tax treatment of farmers in the income tax code by 2017; raise the solidarity surcharge;

- abolish subsidies for excise on diesel oil for farmers and better target eligibility to halve heating oil subsidies expenditure in the budget 2016;

- in view of any revision of the zonal property values, adjust the property tax rates if necessary to safeguard the 2015 and 2016 property tax revenues at €2.65 billion and adjust the alternative minimum personal income taxation.

- eliminate the cross-border withholding tax introduced by the installments act (law XXXX/2015) and reverse the recent amendments to the ITC in the public administration act (law XXXX/2015), including the special treatment of agricultural income.

- adopt outstanding reforms on the codes on income tax, and tax procedures: introduce a new Criminal Law on Tax Evasion and Fraud to amend the Special Penal Law 2523/1997 and any other relevant legislation, and replace Article 55, ¶s 1 and 2, of the TPC, with a view, inter alia, to modernize and broaden the definition of tax fraud and evasion to all taxes; abolish all Code of Book and Records fines, including those levied under law 2523/1997 develop the tax framework for collective investment vehicles and their participants consistently with the ITC and in line with best practices in the EU.

- adopt legislation to upgrade the organic budget law to: (i) introduce a framework for independent agencies; (ii) phase out ex-ante audits of the Hellenic Court of Auditors and account officers (ypologos); (iii) give GDFSs exclusive financial service capacity and GAO powers to oversee public sector finances; and (iv) phase out fiscal audit offices by January 2017.

- increase the rate of the tonnage tax and phase out special tax treatments of the shipping industry.

Mining companies rally after Chinese stock market stabilises

Interventionist measures from the Chinese authorities are having their intended consequence and have stopped the rout in Chinese equities.

The Shanghai Composite rallied sharply last night adding to Thursday’s gains after Chinese authorities imposed selling bans and injected liquidity into the market.

Around half of the stocks listed in mainland China remain suspended leading some to think there is potential for further gains when they resume trading.

The recovery in the Chinese stock market has helped boost commodity prices providing impetus for bargain hunters to pick up beaten down mining companies.

The Greek proposal to creditors has also breathed optimism into the markets, giving investors further reason to buy.

“Greece is also aiding sentiment and traders are expressing the view that ‘Greece is solved, get involved,’ or words to that effect. The new proposals that have been announced in the early Asian session have seen a strong move higher in U.S. futures and our opening European calls also look strong,” said Chris Weston, chief market strategist at IG.

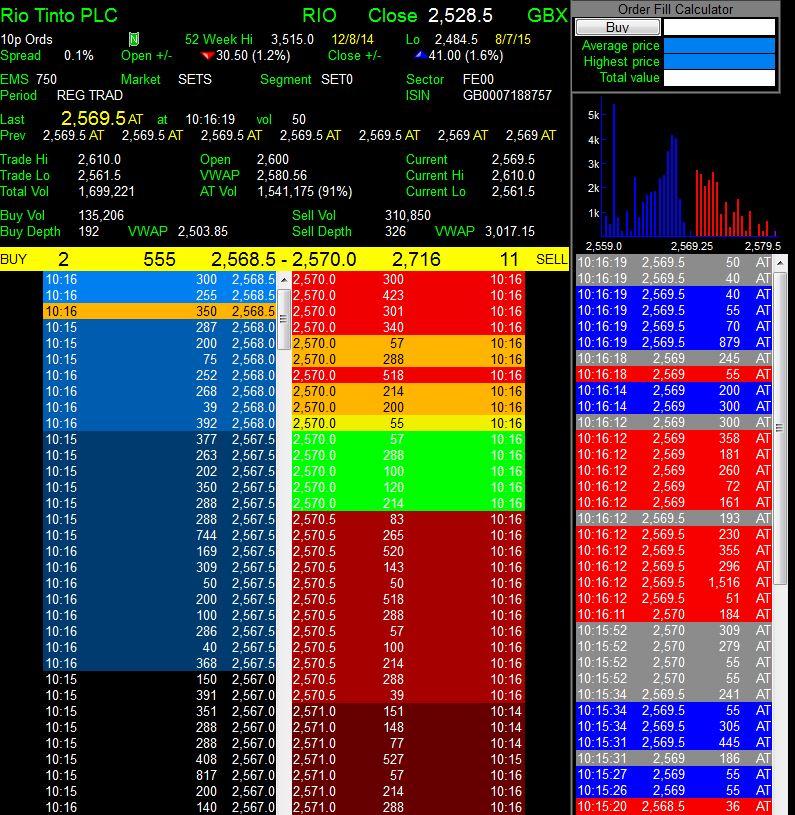

Shares in Rio Tinto (+1.59%), BHP Billiton (2.45%) and Glencore (1.8%) were among the best performers on the FTSE 100 this morning.

This is why you may be losing on your AIM stocks

Not all of you reading this will have lost money trading AIM (Alternative Investment Market) stocks, but many of you will.

Even those that are profitable are likely to have a selection of AIM shares suffering heavy losses.

Countless will be welcomed with a sea of red each time they log into their dealing accounts.

This may be why.

Ten year performance:

The numbers are very difficult to argue against.

Over the last ten years, the London AIM market has tremendously underperformed all major equity benchmark indices.

In the face of deflation, constraining demographics and natural disasters, even the Japanese Nikkei has managed to post gains.

That is not to say that all companies listed on the AIM market are basket cases, far from it. In fact, some of the best performing mutual funds focus on the AIM market.

Wood Street Microcap Investment Fund, which invests almost exclusively in AIM stocks, is up 185% over 5 years. However, the fund’s net assets are only £28.4m (31/12/14), which is dwarfed by funds that focus on Blue Chips such as Invesco Perpetual High Income (£13.2 billion) and Newton Global income (£4.54 billion).

Due to the lack of capital allocation from large fund managers, the Alternative Investment Market is dominated by inexperienced private investors who have limited capital and tend to gamble large percentages of their savings in single potential ‘multibagger’ shares touted on bulletin boards.

The participants and companies that make up the AIM have created a market that perplexes investors with baffling and unexplained price movements but keeps them coming back with the hope of getting rich quick.

Stock Spikes

A company has just had a brilliant RNS release, the long awaited approval or contract is finally here, the share price rallies sharply – only to just as quickly tumble back down.

These spikes occur all too often to companies listed on London’s AIM market. Similar to ‘pump and dump’ scams, these spikes draw unsuspecting investors in to sharply rallying stocks, that swiftly reverse, leaving many with loss making positions.

Very rarely do you see such pronounced chart patterns in FTSE 350 companies, typically strong results lead to analyst re-ratings and a continual trend higher. Of course there are bouts of profit taking along the way but these tend to be mere blips.

Extended Downtrends

One explanation for the peculiar price action in AIM stocks is that investors, who have long been sitting in losing positions, rush for the exit on the first sign of any positivity pushing prices back down.

As many stocks have been stuck is such long term downtrends, a positive update is seen by the overwhelming majority as an opportunity to cut their losses.

It’s the classic ‘I’ll get out on the next rally’.

The problem is, if everyone has the same plan a downside bias is created.

Lack of Liquidity

Exacerbating this phenomena is the lack of new funds disillusioned investors are willing to pump into offside positions they have been tied into for the last 18 months.

This lack of liquidity itself is to the detriment of many AIM stocks.

AIM stocks do not enjoy the level of coverage from investment banks that main market shares do. This means that there is a void of fresh buyers to invest on the back of a note from their broker that would provide beaten up main market stocks with some buyers.

The lack of buyers creates a situation where prices drift as investors throw in the towel, fed up with continual declines in share prices.

This only discourages other investors, creating a sluggishly slow snowball effect.

The Figures

Of the 1076 AIM listed stocks researched by the UK Investor Magazine, from a year ago, 364 are up, 634 are down and 78 are unchanged. Companies that are recorded as unchanged are either unchanged, suspended or have listed in the last year.

So of those covered, only 33.8% are up over a year against 58.9% that are down.

There is a valid argument that the AIM is a stock pickers market, indeed there are 48 companies that are up over 100% in the last year whereas only 3 stocks in the FTSE 350 have doubled.

Although there are 48 companies that have doubled, there are a whopping 225 stocks that have sunk more than 50%. That’s 20.9% of the total market.

For those that value statistics and probabilities when making investment decisions, the Alternative Investment Market will look utterly uninvestable.

That’s not to say you can’t make money from the AIM, take AB Dynamics is up 34% over the last year and Hutchinson China Meditech up 85.6% over the same period.

| FTSE 100 | 24.05% |

| FTSE 250 | 127.00% |

| DAX 30 | 133.70% |

| S&P 500 | 68.88% |

| Dow Jones | 67.62% |

| Nikkei 225 | 70.65% |

| AIM All Share | -26.25% |

| AIM 100 | -35.40% |

Microsoft announce further job cuts

Microsoft has announced that it will be cutting 7800 jobs, primarily in its Nokia phone division.

Microsoft acquired Nokia in 2011, in an attempt to muscle in on the smartphone market. However the job cuts, combined with an announcement to write off nearly all of the value of its Nokia acquisition, signal that the company now considers the deal to have been a bad move. Microsoft may now be conceding the smartphone war to other names dominating the market, including Samsung, Google and Apple.

The anouncement comes just after CEO Satya Nadella warned that there would be “tough choices” ahead for the company, who also made 18,000 job cuts last year.

Microsoft (NASDAQ: MSFT) are trading down 0.14% today.

ECB President admits it will be “difficult” to make a deal with Greece

European Central Bank President Mario Draghi has voiced doubts about the possibility of reaching a deal with Greece.

According to Italian paper Il Sole 24 Ore, the ECB chief said it was unlikely that a solution would be found for Greece, admitting that it would be “really difficult” to end the Greek crisis.

He also commented that it was unprobable that Russia would come to their aid either: “It does not seem like a real risk. They don’t have the money themselves.”

Greece have formally applied for a three-year loan from the European Stability Mechanism bailout fund, and has until midnight to present a convincing proposal.

Global markets appear to be unaffected by the Greek issue; in early trading France’s CAC added 1.2 pc, Germany’s DAX rose 0.9 pc and the FTSE 100 gained 0.6 pc.

AB Foods FTSE 100 top riser after revenues rise 2%

AB Foods were 3.3% to the good at 9:30am in London trading following the release of a trading statement that showed revenues for the 40 weeks to 20th June were 2% higher than the previous period.

Although revenues rose on a constant currency basis AB Foods were still experiencing FX headwinds that meant at actual exchange rates revenue was flat.

Primark continued to carry the group, the budget clothing store enjoyed a 13% increase in sales from a year earlier helped by new store openings in the Netherlands and Germany.

Investors would have been pleased to see that their flagging sugar business was showing some signs of recovery. A long time thorn in the side of ABF’s operations the sugar unit has been helped by a pickup in sugar prices.

The outlook for their sugar operations are improving and may provide further upside in the coming year. “As quota sugar stocks reduce, EU sugar prices, as reported by the European Commission, have shown some signs of recovery, albeit moderated by continued low world sugar prices,” the company said in a statement

Shanghai Composite posts best day since 2009

The Shanghai Composite has posted the biggest one day gain since 2009 as the Chinese government unleashed another set of measures to boost confidence in the market.

The Chinese government have put selling limits in place to prevent major shareholders liquidating their holdings. Authorities have warned they will enforce the ban on those large shareholders that sell their shares within six months.

The move is one of many interventions by the Chinese government to halt a sell off that has already wiped 30% from the value of mainland equities in the last three weeks.

“A huge amount of wealth has been wiped out … People are underestimating the damage to the real economy,” said Michiro Naito, executive director of JPMorgan in Tokyo.

Indeed, it is very difficult for anyone to sell their shares at the moment as around 50% of mainland shares, worth around $2.6 trillion, have been suspended.

The latest steps by the Chinese government have many doubting that there will be any true reforms of Chinese stock markets in the near future as equities are repeatedly manipulated by liquidity injections, restrictions and speculation that the government will actually begin to buy shares to prop up the market.

The optimism may only be temporary but it was enough to support commodities and in turn FTSE 100 mining companies that were among the top risers in early trading.