ONDO reported its first interims to August since listing in March at 12p having raised over £3m to develop its claims prevention technology for home insurers. Comparison with its former self as part of the larger HomeServe are awkward, although the 55% headline increase in revenue to £1m suggests progress. The shares are unchanged at 7.5p with a MKt Cap of £5m although due buyout from Homeserve there is £6.5m of ‘sweetheart’ debt that can be converted but gives an Enterprise Value of £9.6m as net cash is £1.9m.

Ondo owns LeakBot, which can detect a water leak anywhere in a house when...

SRT Marine Systems – up 27% in two weeks with even more to come

The interim results for the six months to end September reported a substantial uplift in the group’s prospects.

The £82m capitalised company, which is based near Bath, is the global leader in Automatic Identification Systems based maritime domain awareness technologies, products and systems, which are used for vessels, ports, environment agencies, fisheries, and coast guards that deliver enhanced monitoring, surveillance, safety and security.

It markets its ranges across the globe to port owners and operators; and national authorities such as national defence agencies, fishery ministries, navies and coast guards who require sophisticated maritime surveillance and monitoring systems.

Excellent interims point to recovery continuing apace

For the six months to end September the group has reported £18.8m in revenues, up from £4.7m previously, while pre-tax profits came out at £2.1m compared to a £3.1m loss last time, with earnings of 1.17p (1.91p loss) per share.

Commenting upon both the business divisions performing well, CEO Simon Tucker stated that the trend is expected to continue going forward driven by the fundamental demand for maritime domain awareness. He went to note that

“Our systems business is now busy delivering on existing projects, preparing for new projects that we expect to come under contract in H2, as well as progressing a growing list of future prospects.”

Analyst Opinion – 100p Target Price plus new contracts

At finnCap, the company’s brokers, its analysts Lorne Daniel and Kimberley Carstens have fixed a Target Price of 100p against the current 45.5p.

They estimate that the group could see a major increase in current year revenues, to end March 2023, of £56.6m (£8.2m), with adjusted pre-tax profits of £6.8m (£6.4m loss) and generating earnings per share of 3.8p (3.3p loss).

They stated that after securing a small new coastguard deal last week, management continues to expect significant new Systems contracts to be announced in the coming months; five in particular worth £200m are currently in the final stages of lengthy contracting processes.

Conclusion – 27% gain in last two weeks – now to 55p?

At the end of last month we concluded that the shares of SRT Marine Systems, then just 35.75p, were for buying.

Although the group’s shares are now up over our initial 45p price aim in just two weeks, a near 27% gain in a very short period, we reckon that there is a great deal more left in this company’s upside.

Reflecting the group’s potential, perhaps a recovery to 55p, the pre-Pandemic share price level, is very possible in 2023.

Tekcapital’s Guident secures electric autonomous shuttle service

Tekcapital’s portfolio company Guident has announced another major milestone in the development of their electric autonomous vehicle technology with their selection to provide an autonomous shuttle service is Florida.

Guident has developed autonomous vehicle technology that utilises a Remote Monitor and Control Center (RMCC) to meet the safety requirements of autonomous vehicles.

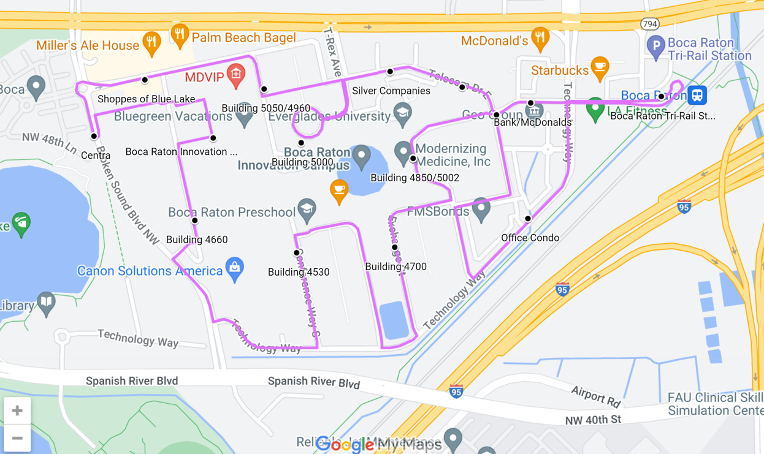

Guident will implement this technology at the Boca Raton Innovation Campus (BRiC) in Florida and deliver a 2-mile autonomous vehicle shuttle service that will connect the most frequented station in South Florida to the campus.

“We are delighted to have been selected to provide an autonomous and remotely monitored shuttle service for the Boca Raton Innovation Campus. The campus’ historic past and promising future make the perfect fit for our technology,” said Harald Braun, Chairman & CEO of Guident Ltd.

The Boca Raton campus was originally built in 1969 for IBM’s Research and Development and is home to the world’s first computer.

“We are pleased to have executed a letter of intent (LOI) with Guident to have them provide our autonomous and remotely monitored shuttle service throughout BRiC,” said Michael Perrette, General Manager of CP Group, the owner-operator for BRiC.

“Innovation and sustainability are driving forces for our business model. We look forward to partnering with Guident to contribute to these goals and the use of autonomous vehicle technology in the 21st century.”

Aquis weekly movers: Igraine drug interest

Igraine (LON: KING) says Conduit Pharmaceuticals is reversing into Nasdaq-listed Murphy Cannon Acquisition Corp. This will provide nearly $150m of funding for Conduit. Via a 2% stake in Excalibur Medicines, Igraine has an economic interest in AZD1656, which is a potential diabetes treatment, one of the assets of Conduit. Excalibur Medicines has exclusive rights to the patents on AZD1656. The Igraine share price jumped 20.7% to 0.875p.

Gunsynd (LON: GUN) investee company Rincon Resources says a preliminary report highlights similarities between its Pokali prospect and a nearby niobium rare earth discovery. The Gunsynd share price rose 12.5% to 0.45p.

EPE Special Opportunities (LON: EO.P) announced net assets of 239.2p a share at the end of October 2022, down from 242.3p a share the month before. Even so, the share price rose 7.69% to 140p.

Guanajuato Silver Company Ltd (LON: GSVR) has discovered a new transverse vein at the El Cubo mine in Guanajuato, Mexico. This has been named the San Luis vein. The company has been reinterpreting previous data. This vein is likely to have a higher gold component than the primary structures. Vein widths are close to one metre or above. The share price improved 3.64% to 28.5p.

==========

Fallers

Goodbody Health Ltd (LON: GDBY) shares slumped 37.5% to 3.75p on the week. The full year outcome will be worse than expected. Third quarter figures showed a 6% decline in revenues to £9.29m due to reductions in Covid testing revenues, while margins declined. The loss nearly doubled to £1.67m. The cost base is being reduced.

Valereum (LON: VLRM) continued to decline following the previous week’s news that it gained regulatory approval for the acquisition of the Gibraltar Stock Exchange and the deal should be completed in the first quarter of 2023. There was £132,000 of the funding facility converted into shares at 10.8769p a share. The share price fell by a further 20.7% to 10.9p.

AIM weekly movers: Appreciate bid

PayPoint (LON: PAY) is bidding for Appreciate (LON: APP) in a deal that values the prepaid vouchers and Christmas savings group at £83m – based on a PayPoint share price of 580p. The offer is 33p in cash and 0.019 of a PayPoint share for each Appreciate share. A 0.8p a share dividend will also be paid to Appreciate shareholders. The PayPoint share price has fallen to 547p, so the bid is not worth quite as much now. PayPoint believes the acquisition will be earnings enhancing. The Appreciate share price has jumped 60.1% to 41.7p.

Schroders has been building up its stake in musicMagpie (LON: MMAG) from 10.1% to 12.4%. This sparked a 58.9% share price increase to 16.05p. The April 2021 flotation price was 193p. The company has completed the roll out of SMARTDrop Kiosks in Asda stores. There are 290 stores with kiosks providing a way of recycling mobile phones.

Biome Technologies (LON: BIOM) increased third quarter revenues by 77% to £1.9m. Both bioplastics and radio frequency divisions grew. Even so, Biome is being more cautious about pre-commercial customer projects and full year revenue expectations have been trimmed from £6.8m to £6.29m, which is still higher than the £5.73m generated in 2021. A full year loss of £1.1m is forecast. The share price jumped 50% to 72p.

Harland & Wolff (LON: HARL) has secured a debt refinancing term sheet with Astra Asset Management. This would increase the available facility from £70m to £100m. The initial period would be two years. Financial close should be before the end of the year. This will provide working capital for large contracts. There has been a delay to the hearing date of the proposed Islandmagee gas storage project. Even so, the share price rose by 44.5% to 8.96p.

Further director buying at Inspecs (LON: SPEC) has helped the share price recover 43.8% to 69p. Chief executive Robin Totterman bought 850,053 shares for his pension fund at 47p each. He owns 18.3%. He sold 6.3 million shares at 195p each when the company floated in early 2020. The eyewear supplier warned about weak trading a fortnight ago.

==========

Fallers

Companies that are running short of cash are finding it increasingly difficult to raise money and they are dominating the fallers this week. Applied Graphene Materials (LON: AGM) and PCF Group (LON: PCF) have both been hit by sharp share price declines due to failure to secure cash. Applied Graphene Materials has not been able to raise cash from a share issue and more cash will be required at the beginning of 2023. The share price fell 61.2% to 4.75p. PCF Group has also been unable to raise money or secure a strategic transaction, so PCF Bank is withdrawing from the UK banking market. The PCF board wants shareholder approval for the cancellation of the AIM quotation. The PCF share price is down by 63.1% to 0.6p this week.

Sareum (LON: SAR) says the UK authorities have not approved the proposed SDC-1801 clinical trial. A further review of non-clinical data is likely to be required so the safety and tolerability trial will not happen this year. The shares declined 34.5% to 90p.

Fashion brand Joules Group (LON: JOUL) is still assessing financing options, which includes CVA planning. Joules says trading for the eleven weeks to 30 October 2022 and working capital is worse than expected. Bridge financing is required. Outerwear and knitwear sales have been hit by milder weather. Online sales have been weak, but store sales are slightly better than expected. Higher levels of promotion have held back margins. Net debt was £25.7m at the end of October 2022, which leaves little headroom after other requirements. The share price slumped 32.7% to 9.22p.

FTSE 100 held back by rotation out of defensive stocks

The FTSE 100 failed to join in a global equity rally on Friday as markets continued the risk-on trade after a better than expected US CPI data yesterday.

A contraction in UK GDP did little to dent enthusiasm the FTSE 100’s cyclical shares that rose with European and US indices, however, a rotation out of the FTSE 100’s defensive sectors was a major drag on the index.

The lower than expected US CPI data suggests inflation could be turning a corner in the US, which is a precursor for the Federal Reserve pivoting away from their tightening cycle. Yesterday, markets quickly marked down the chances of another 75 bps hike in December.

“For once talk of a pivot by the Federal Reserve might be more than just hot air, with the easing of inflationary pressures accompanied by signals from some Fed officials they might be prepared to ease up on rate hikes,” said AJ Bell investment director Russ Mould.

“Adding to the positive sentiment was further evidence of a softening in China’s zero Covid position, helping the miners to gains on the UK market this morning.”

Miners raced ahead with Rio Tinto, Anglo American and Antofagasta among the top risers. Prudential was the FTSE 100’s top riser gaining 8% on hopes the Chinese economy would reopen again and boost demand for their products.

Ocado continued their march higher and shares were nearly 100% higher than their October lows. Retailers Next and JD Sports were not phased by warnings of a recession and gained over 2%.

The FTSE 100 opened higher on Friday, tracking a monumental session in US equities where the NASDAQ closed up an astounding 7% – but the FTSE’s gains were erased due to weakness in some of the index’s heavyweights.

Defensive sector weakness

The FTSE 100 was dragged by a rotation away from stocks with defensive attributes such as pharmaceutical companies, tobacco and alcohol, and consumer staples.

The prospect of a Chinese economic reopening and a potential Fed pivot saw selling in ‘safer’ stocks including AstraZeneca, GSK, Diageo, Imperial Brands and BAE Systems.

AstraZeneca – the FTSE 100’s largest company by market cap – was down 2.5%.

These companies account for a significant proportion of the FTSE 100 and offset much of the positivity in cyclical stocks.

This defensive composition was central to the FTSE 100 has outperforming the US and many European indices this year, but is also the reason the FTSE’s likely to underperform in a sustained rally.

AIM movers: Croma Security falls, while Tlou Energy gets cash injection

Croma Security Solutions (LON: CSSG) shares have slumped 19.1% to 51.4p as pre-tax profit fell in 2021-22, although that was down to a sharp reduction in Covid-related government support. There was a cash outflow during the year. New contracts have been won, although many existing ones are coming up for renewal.

Immupharma (LON: IMM) says Avion Pharmaceuticals is continuing to support the Lupuzor clinical programme. The clinical programme for the lupus treatment is being redesigned due to FDA feedback. There is also a potential distribution agreement for Avion drugs. The share price still fell 10.9% to 2.945p after this news.

Prospex Energy (LON: PXEN) says its partner in its gas resources in southern Spain, Warrego Energy, is merging with Strike Energy and intends to dispose of its Spanish assets. This will mean that there could be uncertainty about progress with the El Romeral gas to power plant until the ownership is sorted out. That knocked 8.9% off the share price to 10.25p.

Construction claims and disputes consultancy Driver Group (LON: DRV) made an underlying loss in the year to September 2022, but management believes that the Middle East and Asian operations should return to profitability this year. Europe and the Americas remain profitable. The share price fell 5.17% to 27.5p.

Tlou Energy (LON: TLOU) has raised a further £1.7m at 2p a share from Dr Ian Campbell, taking his stake to 19.2%. He is willing to provide further funds, and this could accelerate the planned drilling campaign to produce gas to supply the proposed 10MW power project in Botswana. The share price rose 11.8% to 1.9p.

Applied Graphene Materials (LON: AGM) and PCF Group (LON: PCF) have regained some of their losses from earlier in the week. Applied Graphene Materials has not been able to raise cash from a share issue and more cash will be required at the beginning of 2023. The share price rose 10.5% to 4.75p, but it has still more than halved on the week. PCF Group has also been unable to raise money or secure a strategic transaction, so PCF Bank is withdrawing from the UK banking market. The PCF board wants shareholder approval for the cancellation of the AIM quotation. Even after a 150% jump to 0.925p, the PCF share price is still down by two-fifths this week.

Yesterday afternoon Alba Mineral Resources (LON: ALBA) raised £500,000 at 0.1p a share. Part of the subsequent fall in the share price has been clawed back today with a 7.14% rise to 0.1125p.

Shares in Bens Creek (LON: BEN) have recovered 6.16% to 23.25p after the coal miner reassured investors concerning 56.8% shareholder MBU Capital entering into a charge in favour of Bluestar Global Capital, which already has a shareholding of 3.97%, most of which were acquired at 30p each. The loan lasts for 12 months and there is no margin call related to share price performance.

Investing better with Vietnam Holding

“We are a long-term investor, and responsible investing helps us select quality companies with sustainable business models and identify and manage potential risks in our portfolio.” – Sean Hurst, Chair of VNH’s ESG Committee

Over the last year, Vietnam Holdings (VNH) has established itself as a leader in responsible investing activities in the Southeast Asian country. VNH received five-star scores for its 2021 PRI reporting, which is the largest global reporting project on responsible investment. The carbon footprint of VNH’s 2021 portfolio, meanwhile, is 67.5% lower than the Vietnam All Share Index (VNAS) benchmark, while also outperforming the VNAS index on a year-on-year basis. This can be attributed to sector allocation – with a focus on less carbon-intensive non-manufacturing sectors – as well as stock selection, featuring best-in-class companies actively pursuing emissions reduction initiatives.

Over the last 12 months, Dynam Capital, VNH’s investment manager, has also been active in company engagement through both private meetings and collaborative engagement. In March, for example, Dynam hosted a webinar for 50 companies operating in Vietnam to talk about how to increase the accuracy of carbon footprint reporting. This was organized together with Vietnam Energy and Environment Consultancy JSC.

ESG, short for Environmental, Sustainable, and Governance, is an increasingly common phrase in the corporate and investment sectors, but it is not without its critics. Hurst acknowledged these issues, while also affirming that VNH is extremely careful in approaching the topic. “There is a growing concern among some investors about the practice of ‘greenwashing,’ a fear that ESG has somehow gone too far,” he said. “For VNH, we look at each sector separately, and the ‘E’ is increasingly important, and we were one of the first funds in Vietnam to estimate the carbon footprint of our portfolio.”

Carbon footprint reporting is still new in Vietnam, with less than ten listed companies disclosing emissions data in their annual reports. VNH, for its part, uses an external professional firm to help estimate the annual footprint of each portfolio company. “But we have seen greater interest in and willingness to do so from companies in the next few years,” said Craig Martin, Chairman of Dynam Capital. “Especially since Prime Minister Pham Minh Chinh announced at COP26 that Vietnam will make efforts to achieve its net-zero targets in 2050.” This serves as crucial context for VNH’s responsible investing efforts, as the fund announced its own net-zero goals just before COP26, aligning with the Vietnam’s government’s agenda.

Officials have taken several steps down this path in the months since the climate summit. In January, a new decree outlined regulations on the reduction of greenhouse gas emissions and protection of the ozone layer. Then, in June, a circular development scheme was approved. It aims to, among other goals, reduce the intensity of greenhouse gas emissions per GDP by at least 15% by 2030. Perhaps most noteworthy is the Power Development Plan 8 (PDP8), which will guide Vietnam’s energy policy until 2030 with a vision to 2045. While the plan has not been finalized and is overdue, drafts have outlined a continuation of the country’s strong renewable energy development in recent years, especially in terms of solar and wind. The most recent PDP8 draft envisions a power mix of 50.7% wind and solar by 2045, with possibly just 9.6% of power coming from coal. Offshore wind, which remains largely untapped, is expected to be a major generator of electricity in the future.

To be sure, these are hugely ambitious goals that will require massive financial investments, but the guidelines are promising, and both investors and private companies have important roles to play.“After COP26, the government’s efforts in changing its energy strategies and relevant policies have shown the country is willing to address climate change,” Martin said. “We think institutional investors in the Vietnamese market have a role in encouraging change, alongside the government and business. Some investors are also specifically looking to invest in companies that provide low-carbon solutions and technology to help the country speed up its decarbonization journey.”

Writing credit Michael Tatarski

Westminster Group – ‘insider dealings’ have increased significantly this week

In the last few days a number of substantial share purchases have been recorded on behalf of Westminster Group (LON:WSG) ‘insiders’ and the share prices being paid has increased markedly.

At the start of September in an article titled ‘Westminster Group – giving money away’ I noted that buying the shares at 1.6p in the market looked great value.

Especially so as the group’s brokers were estimating that next year the group could well be showing earnings of 1.6p per share.

The Banbury-based company is a specialist security and services group that operates worldwide through an extensive international network of agents and offices across the globe, situated in France, Germany, Saudi Arabia, Ghana and Sierra Leone.

Delays led to downgrades

At the time a number of big contracts were still under negotiation, with a couple being close to signing-off.

Two months later the group declared that operational delays had seen a slippage in a multi-million Technology project – the news of which saw the shares drift easier to 1.425p.

It also brought about a broker’s downgrade on the group’s earnings.

The nibbling starts

However, since the beginning of this month there has been a constant nibbling away at the company’s shares.

At the start of this week, they responded to sizeable buying and edged up to 1.85p.

On Wednesday the buying persisted, closing at 2.05p.

It now transpires that three of the group’s key executives – the CEO, the CFO and the Co Sec – were buying additional holdings, at prices from 1.78p to 1.88p – a total of 2.137m shares.

Another 1.284m shares were purchased by Directors yesterday at prices ranging from 2.24p to 2.3p per share.

At the same time other company employees also bought shares.

Over 10m shares were traded in the first four days of this week, with dealing volumes up again today.

Conclusion

So close to the £7.5m group’s end of trading year, such activity can only be seen in an incredibly positive light.

‘Insiders’ – the workers on the shop floor who can always see what is going on – have limited times in which they can deal in a company’s equity.

We have already been informed that some substantial contract negotiations are underway – could any of these be close?

UK GDP contracts in Q3 as shallow recession looms

The UK economy shrank in the third quarter according to data released this morning. GDP contracted by 0.2% in the period and set the UK on a path towards recession, albeit a shallow one.

The main culprit behind the reduction in economic activity was soaring inflation that would clearly impact the economy at some point. The Bank of England has recently said the UK is heading towards a prolonged recessions and this morning’s data suggests we could already be in one.

“Technically speaking the UK won’t be in recession until it suffers two consecutive quarters of negative growth. But given the bleak economic picture and forecasts from the Bank of England, it’s quite clear this reading marks the start of what we expect to be a significant recession for the UK economy,” said Joshua Raymond, Director at online investment platform XTB.com.

Services, manufacturing and retail activity all declined in the quarter in a broad slowdown that was also impacted by the Queen’s funeral.

“It’s no surprise the service sector is shrinking, people are going as long as they can between haircuts or resurrecting lockdown methods of trimming their own locks. People are having to spend more to buy less, and they’re terrified of what a cold winter might do to already battered budgets,” said Danni Hewson, AJ Bell financial analyst.

“The manufacturing sector is struggling with a double whammy of rising energy prices and a shortage of some raw materials for some as supply issues are finally working their way through the system, but all 13 subsets of the sector were in decline.”

The initial market reaction was fairly muted with GBP/USD clinging onto gains and the FTSE 100 shrugging the data off to rise 0.3% in early trade, before falling back.

Although today’s GDP read is a stark warning for the UK economy, the better than US CPI data yesterday is by far the biggest news in town and was helping to boost risk sentiment on Friday.