This morning XLMedia (LON:XLM) issued a very positive Interim Trading Update for the six months to end June.

Having undergone a quite significant reorganisation of its websites and corporate structure, the group is starting to show through impressively.

This £79m capitalised group, which is a leading global digital publisher, owns and operates websites across a wide variety of industry verticals, including sports betting, gambling, personal finance and more.

It attracts players through online marketing techniques and directs them to gambling operators.

In return the company receives a share of the revenue generated by such players, a fee per player acquired, fixed fees or a mixture of these three income streams.

Obviously, this business model is predominantly performance-based and it aligns itself with the interest and success of the gambling operators.

The company, which is based in Henley-on-Thames, uses a variety of business intelligence tools, in order to track the flow of traffic to its customers and in seeking to identify and target high value consumers for platform operators.

It also uses these tools to analyse the quality and conversion of such traffic into revenue, in order to improve the group’s return on investment, as well as providing high quality services to its affiliates.

The group’s assets, technology, and data are the three components that helps it to continuously deliver highly valuable, engaging, timely, and relevant content to hundreds of millions of customers worldwide.

Examples of some of its websites

The group owns content-rich websites in 18 languages, which alongside its in-house technology and exclusive data makes it one of the strongest players in the industry.

Each one of the group’s top-ranked websites features an array of informative, premium content.

‘Money Under 30’ is a personal finance portal specializing in financial advice for young adults to make informed decisions about money management.

‘The Dough Roller’ is a leading personal finance site dedicated to guiding users in their investments and securing financial independence.

‘Investor Junkie’ is a leading popular investment education website providing information and reviews of various investment channels and financial products.

‘Young and Thrifty’ is a personal finance site assisting Canadians with their earnings and savings by giving users the tools for easy budget management and investing.

‘Greedyrates’ is one of Canada’s most popular credit card comparison and personal finance site, offering users rich and broad financial information.

‘WhichBingo.co.uk’ is the largest independent online bingo review site in the UK.

‘Nettikasinot.com’ is one of the largest casino review sites that the group operates.

‘Freebets.com’ is one of the leading and trusted UK sports betting affiliate sites, giving users access to bookmakers’ free bet offers and promotions. The team behind the site have significant experience in the online and offline betting industry.

‘101 Great Goals’ is a global football media news publisher with updates on live streaming information, football news, and betting tips.

Excellent client list

The Group has a very impressive and diverse list of global clients, such as 888 Holdings, mr green, Ladbrokes, Paddypower, betway, Unibet, betsson, William Hill, netmarble, souq.com, traveloka, and product madness amongst hundreds of others.

Interesting international shareholders

There are some 262.59m shares in issue, which at last night’s closing price of 30p values the group at £78.78m.

The group’s biggest shareholder is Moise Mitterand, boss of Les Nouveaux Constructeurs, the real estate development business, with 73.48m shares, representing 27.98% of the XLMedia equity.

Grupo Bethia SA, based in Chile, has a 15.16m share stake in the group, some 5.77%. Bethia provides investor and management services, focussing upon the retail, transportation, agriculture, finance, wine real estate and equestrian business sectors.

Larger institutional investors include BlackRock, Henderson Global, Canaccord Genuity Wealth, Fidelity, River & Mercantile, and Santander Asset amongst many others.

Just one of the group’s founder directors, Ory Weihs, has a meaningful stake, with 8.14m shares, 3.10% of the equity.

Today’s Interim Trading Update

For the six months to end June the group expects to report a 38% jump in revenues to $44.5m ($32.2m), while its EBITDA could leap 59% to $10.5m ($6.6m).

Following a quite significant reorganisation of the group and boosted by its newest vertical, US Sports, it has traded very well in the first half year.

US Sports accounted for a substantial 68% of revenue, some $30.2m.

The Group’s European Sports vertical was solid, with a revenue of $3.8m.

While the restructured gaming and bingo vertical saw revenues drop to just $8.4m ($12.5m), at which level it is now stabilising on its reduced cost base, but still continuing to generate cash,

The group’s personal finance vertical saw a severe fall in revenues to $0.8m ($6.6m). This side of the business is now being reorganised to improve performance and revenues.

Analysts View

Simon Strong, analysts at the company’s broker Cenkos Securities, has rated the group’s shares as a Buy.

He stated that the first half results were substantially ahead of expectations, with the strength of the sports betting revenues more than offsetting weaknes elsewhere within the Group.

For the current year to end December his estimates are out there for $69.8m ($66.5m) revenues, with a $16.7m ($11.0m) adjusted pre-tax profits, that would generate 5.6c (5.0c) of earnings per share.

For the coming year he sees a good lift-upwards in revenues to $78.4m, with $19.5m profits and 5.7c per share in earnings.

Conclusion – DCF model shows a 98p ‘fair value’

There has been a great deal of mergers and acquisitions activity in the US sports betting sector over the last couple of years.

As sports makes up 68% of the group’s revenues it should do extremely well from the growth potential as more States legalise sports betting.

The group, which now operates in 21 US States and one in Canada, will spread its net even wider.

Ohio, which is the seventh most populated state, is now expected to permit sports betting from January next year.

That just has to be good news for XLMedia.

That is when this group’s scalability will really start to show through, as the Cenkos estimates for the coming year clearly indicate.

The group’s earnings are expected to grow significantly over the next three years.

Certain discounted cash flow models indicate that the group’s shares are 68.4% undervalued, suggesting a 98p ‘fair value’, which is impressive.

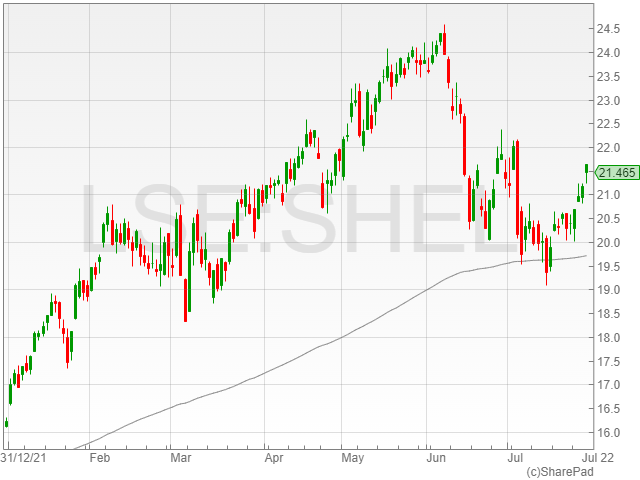

Less than a year ago the group’s shares were trading at 66.5p, they have since dipped to a low in early March of 24.3p.

At last night’s 29.5p they are looking ready to show an upward price push, especially after this morning’s Trading Update.