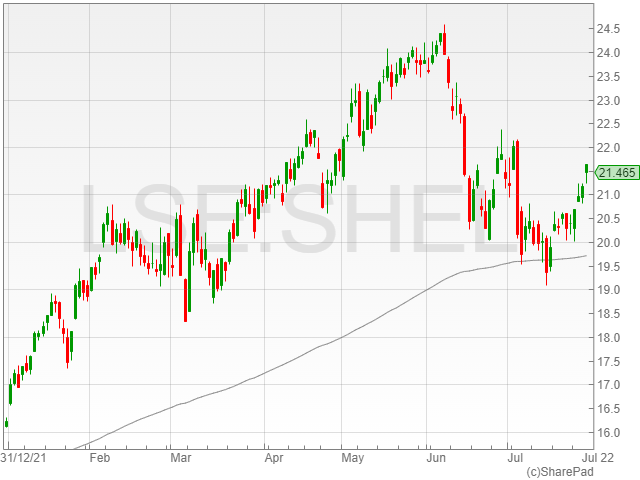

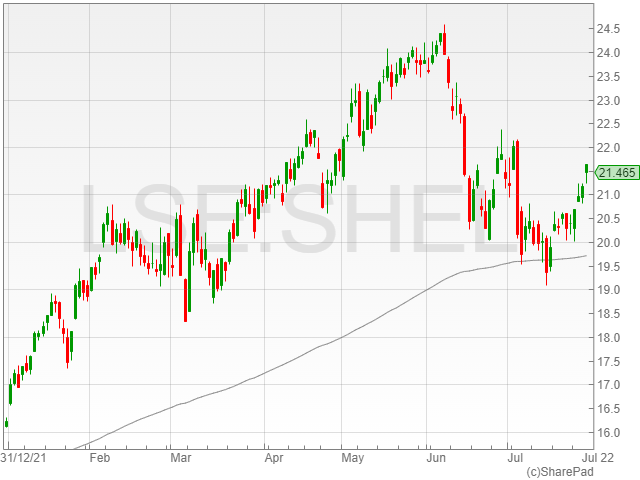

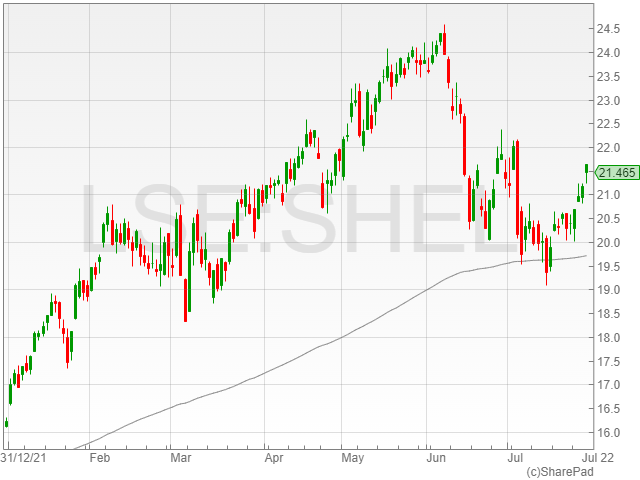

Shell shares rose 1.8% to 2,156.5p in early morning trading on Thursday after the oil giant announced a bumper $11.5 billion profit in Q2 2022, representing a 26% rise against its shattering $9.1 billion intake in Q1 2022.

Shell reported an adjusted EBITDA of $23.1 billion, marking a 22% leap over its $19 billion figure in the prior quarter.

The company attributed its surging income to higher realised prices, higher refining margins and climbing gas and power trading and optimisation results.

However, its skyrocketing intake was partially offset by lower LNG trading and optimisation results.

The energy group’s operating expenses remained almost flat at $9.5 billion compared to $9.4 billion from the last financial term.

Meanwhile, cashflow from operating activities grew 26% to $18.6 billion against $14.8 billion quarter-on-quarter.

The energy firm linked its cashflow to working capital outflow of $4.2 billion, $3.2 billion in tax payments and net derivative outflows of $700 million.

Its working capital outflow was driven by a climb in inventory due to price and volume increases of $6.8 billion, alongside a rise in current receivables, partially offset by an increase in current payables.

Additionally, Shell’s basic EPS shot up to $2.40 against 94c, along with an adjusted EPS of $1.54 compared to $1.20.

Share buyback programme and dividend

Shell confirmed its $8.5 billion share buyback scheme for HY1 2022 was closed on 5 July 2022.

However, the oil and gas firm announced the launch of a $6 billion share buyback programme which is scheduled for completion by Q3 2022.

Shell added that shareholder distributions were expected to remain in excess of 30% of cashflow from operating activities, pending board approval and the current energy sector outlook.

“Shell’s accelerating its share buybacks after another quarter of bumper profit growth as the energy sector continues to ride high on the supply and demand imbalance caused by the crisis in Ukraine,” said Hargreaves Lansdown equity analyst Laura Hoy.

“Strong oil prices are driving Shell’s bumper performance and the group’s pledged to share more than 30% of the windfall with investors.”

The company announced a Q2 dividend of 25c per share.