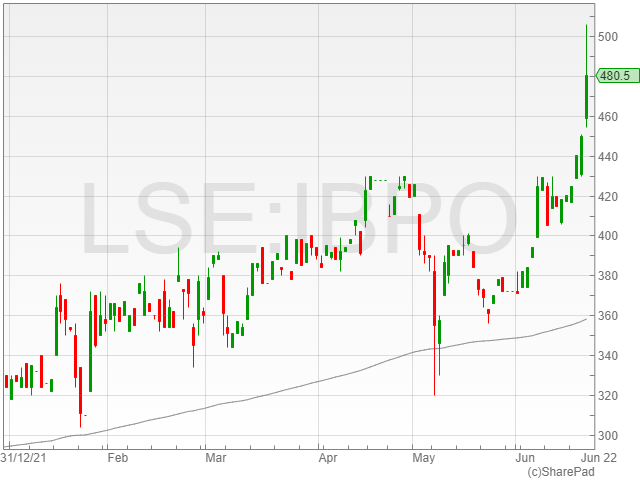

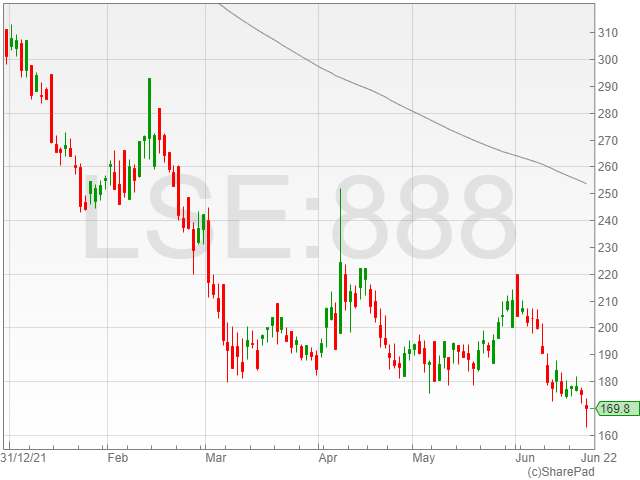

Volex shares slid 4% to 230.8p in late afternoon trading on Thursday after the group announced a rise in net debt to $95.3 million compared to $27.3 million in FY 2022.

Volex reported a revenue growth of 38.6% to $614.6 million from $443.3 million as a result of strong organic growth and acquisitions, with revenue momentum driven by efficiencies and vertical integration in growth sectors.

“Our intention, when we set about the transformation of Volex, was to create a resilient and dynamic business capable of delivering strong margins and revenue growth,” said Nat Rothschild.

“Our record performance and revenue progression, demonstrated against the backdrop of a challenging manufacturing environment, is testament to what we have achieved.”

The firm completed four acquisitions and strengthened its engineering and sales team to support further growth going forward.

“We continue to see significant opportunities across our market. The infrastructure and acquisition investments we have made in FY2022 are focused on our pursuit of further growth, capitalising on the leading position we have in attractive sectors. With an exciting acquisition pipeline and access to funding, we will continue this successful strategy,” said Rothschild.

The group maintained an operating margin of 9.1% despite inflationary challenges as it passed through cost increases.

Volex also mentioned a statutory operating profit increase of 33.6% to $41 million against $30.7 million, along with a statutory pre-tax profit climb of 23.6% to $36.2 million compared to $29.4 million year-on-year.

The firm added that it had launched a five-year plan to deliver $1.2 billion in revenue by the end of FY 2027 with an underlying profit margin in the range of 9-10%.

“With our financial performance significantly ahead of our existing strategic plan, we are today setting out a new, ambitious plan to increase our revenues to $1.2 billion by the end of FY2027, with underlying operating margins in the range of 9-10%,” said Rothschild.

“This underlines the confidence we have in the clear growth opportunities created by our combination of excellent customer relationships, exceptional assets and an agile operating model.”

The company highlighted a final dividend per share growth of 9.1% to 2.4p against 2.2p the last year.