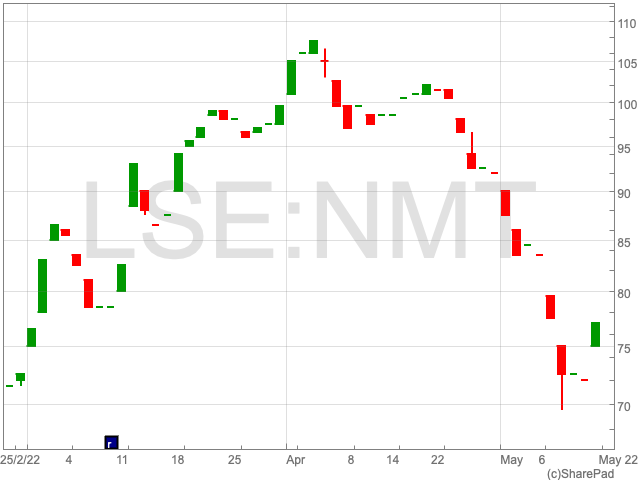

Nostra Terra shares were up 11.5% to 0.7p in early morning trading on Monday, following an update that the company’s Fouke 2 well production rates had exceeded management expectations with a rate of 145 barrels of oil per day (bodp).

The oil and gas firm said the production was 77% higher than its Fouke 1 current production rate, with 100% oil and no water in its extraction.

Nostra Terra commented that Fouke 1 was restricted by field rules to 82 bopd per well, which the operation had maintained for over one year without decline and without the production of any water.

The operator is reportedly set to request a substantial increase in the field allowable rate to raise production at both projects to a higher and more efficient scale, with a decision expected later in 2022.

The group said it intended to operate both projects at a 140 bopd rate of production, above the allowable cap, in a bid to obtain sufficient technical information to support the updated field allowable.

Nostra Terra confirmed that oil sales from Fouke 2 had kicked off, with both operations set to produce at increased levels with an estimated 40% rise in net production based on the company’s Q4 2022 average bodp, while the company searched for permanent allowable increase.

The energy group added that higher rates of production alongside rising oil prices had provided an increase in the company’s free cashflow, with Nostra Terra adding that it expected a free cash flow over the remainder of the year in excess of its original budget forecasts.

“We are very pleased with the results of the Fouke 2 test and the plans by the operator to seek a substantial increase in the field production allowable,” said Nostra Terra CEO Matt Lofgran.”

“The Fouke 2 production will have a very positive impact on our cash flow.”

“Given the performance of these wells we anticipate that a substantial allowable increase will be approved which will result in a further step change increase in our cash flow performance.”

Nostra Terra also said it was in the process of completing its Grant East #1 well in West Texas, and confirmed fracture stimulation last week, which is reportedly scheduled for completion this week.

The company confirmed that work was in progress on its production facilities, with completion scheduled in the near term.

“Finally, I am looking forward to the results of the Grant East 1 completion and simulation activity concurrent with the completion of the field facilities,” said Lofgran.

“It’s been an active period for the company recently and I look forward to reporting additional results of our efforts in due course.”