The FTSE 100 was broadly flat on Wednesday as investors accessed the possible impact of soaring prices after petrol sent UK inflation to a 30-year high.

“This is now the sixth consecutive month of rising inflation, and the data tells a story of what millions are currently living – steeper bills on everything from petrol to food and fuel, and less left over at the end of each month to put towards their future,” said Colin Dyer, Client Director at abrdn.

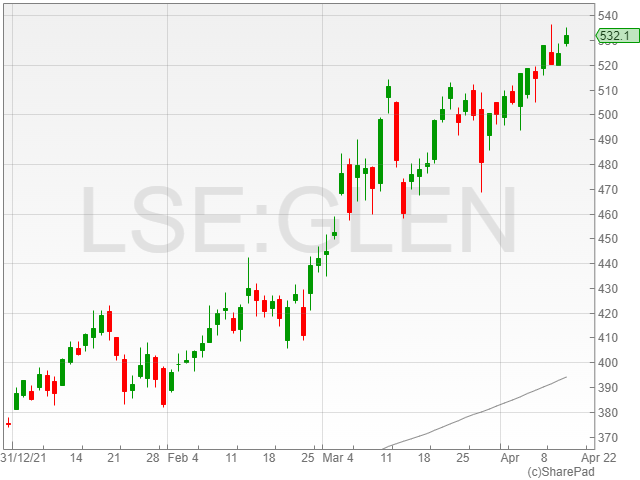

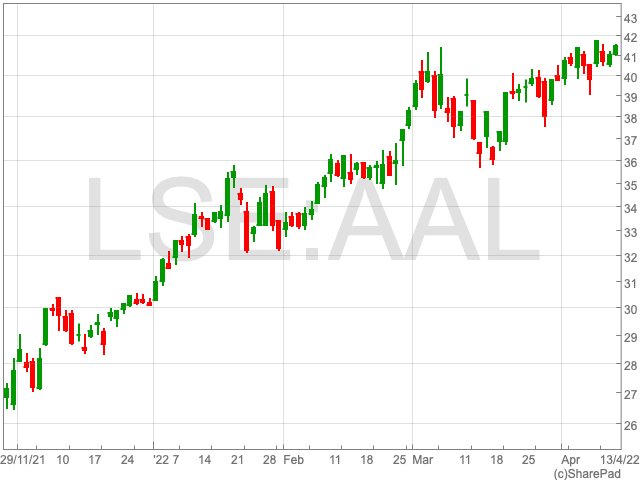

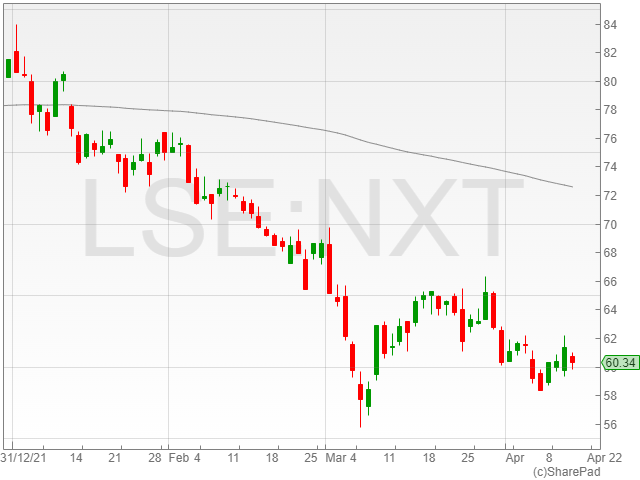

Miners have enjoyed a rise as investors prepared for higher commodity prices, while fashion companies including JD Sports and Next saw their shares fall as the market no doubt eyed the coming decline in more frivolous consumer spending.

Miners such as Glencore, Fresnillo, Anglo American and Antofagasta shares gained 1.7% to 534p, 1.3% to 810p, 1% to 4,139p and 1.4% to 1,702p as investors flocked to the stocks which “thrive in an inflationary environment,” according to Danni Hewson, Financial Analyst at AJ Bell.

Anglo American shares also benefitted from its rough diamond sale valued at $565m through De Beers earlier today.

Retailers such as JD Sports and Next saw its shares fall 2.5% to 144p and 1.7% 6,034p as investors assume consumer spending will take a hit with the rising inflationary pressure.

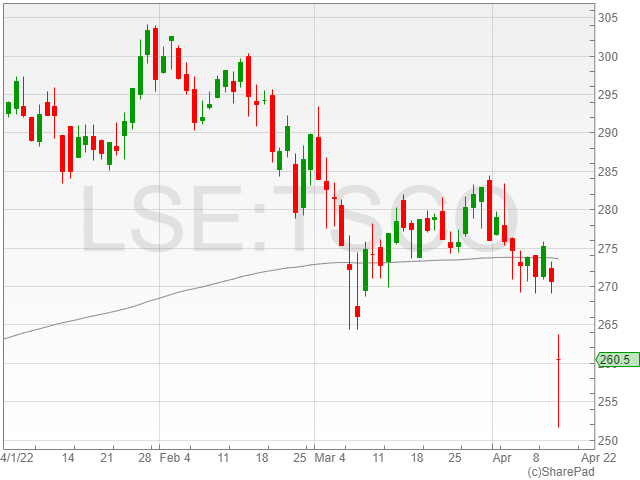

Tesco’s annual results served as an indicator for possible upcoming trends, with the Big 4 grocer warning that looming inflationary pressure could potentially eat into its shining profits in the next year.

“Inflation is an issue for the business, nonetheless. The coming months will be challenging for Tesco as it faces higher cost inflation and a potential shift in how consumers spend their money,” said Hewson.

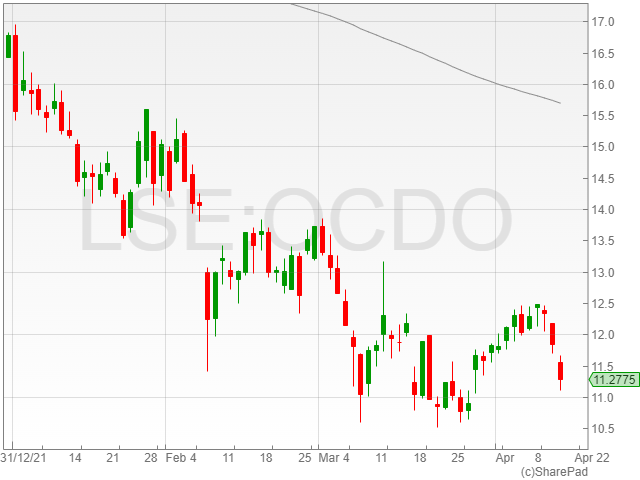

“That explains why its share price has fallen nearly 5% on the results, and why Ocado and Sainsbury’s shares are also weak.”

Tesco’s shares lost 4% to 260p as challenging months ahead pushed investors away from the stock. The company plans to invest in the company to meet competitive prices offered by its competitors and has seen a change in consumer behaviour in the past financial year.

The supermarket reported a 2.5% rise in group sales to £54.7bn compared to £53.4bn in its last annual report and saw 58% rise in profits.

Peer food retailers Sainsbury and Ocado shares lost 3.1% and 4.6% to 237p and 1,129p, respectively.

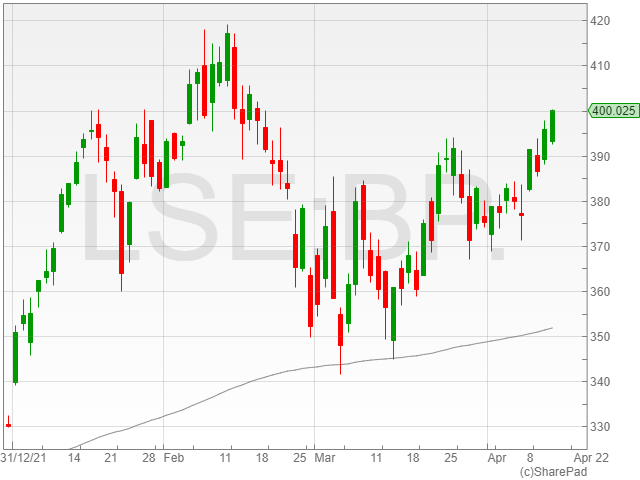

The price of oil also enjoyed a slight uptick in price, with Brent Crude futures changing hands at $106 per barrel. Despite the far cry from the mid-March heights of $120 per barrel, the update was no doubt welcome news for oil companies, with Shell shares increasing 1.6% to 22,017p and BP stock rising 1% to 399.8p.

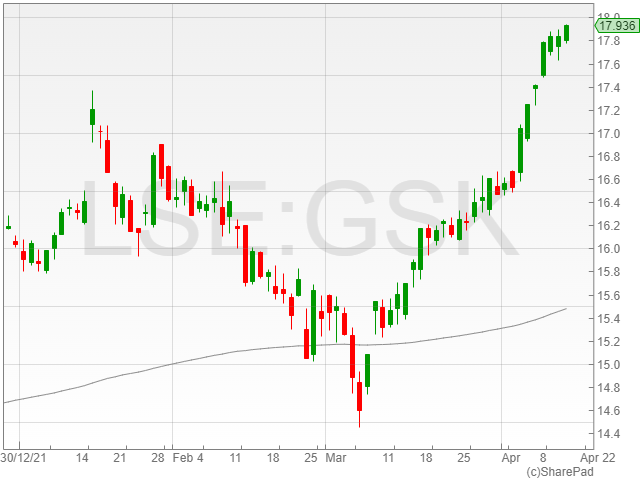

GlaxoSmithKline shares rose 0.7% to 1,796p as the company has entered into an agreement to acquire Sierra Oncology for £1.5bn through $55 per share of common stock in cash.

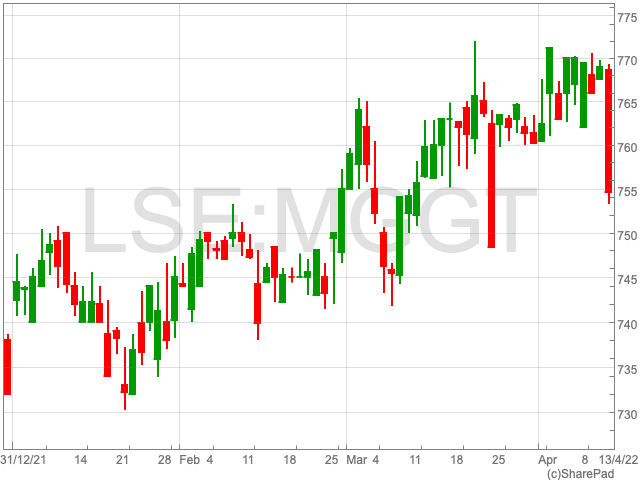

Meggitt gained 0.08% to 769p after the company announced the disposal of Meggitt A/S to CTS Ceramics Denmark A/S for £59m.