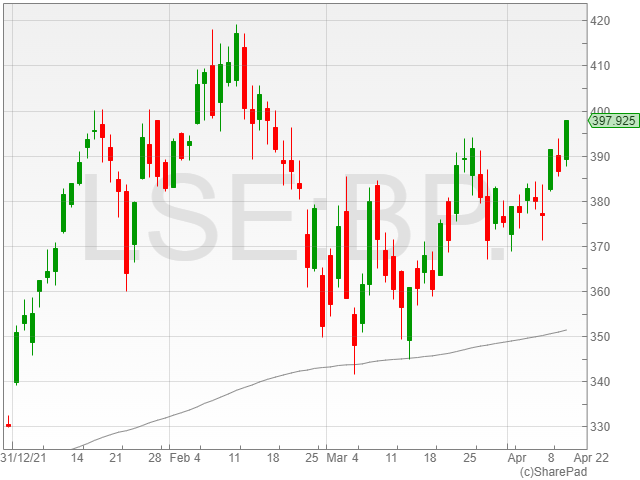

Pennon Group shares decreased 0.6% to 1,045p in late afternoon trading on Tuesday, after the company reported that it was on target to deliver financial results in line with management expectations ahead of its financial results for 2021.

The water firm noted its largest environmental investment programme in 15 years worth £1.4 billion across South West Water and Bristol Water, along with its scheduled acceleration and additional spend of £150 million over the current regulatory period, which was funded by re-investment of RORE outperformance to date.

The programme is set to include wastewater investments of £330 million as part of the company’s WaterFit plans for 2022 to 2025 in a move to improve the quality of rivers and seas across the South West waters region.

“Pennon, and other water companies, have come under fire for pollution incidents linked to their sewage operations so news of a £330m investment into their waste water operations will be welcomed by many,” said Hargreaves Lansdown select fund manager Steve Clayton.

The company highlighted its CMA clearance for its Bristol Water and South West Water merger, with the integration process in motion and synergies targeting £20 million per year identified across the company by 2024 to 2025.

Pennon also announced that it had delivered £200 million of its share buyback programme, with fresh phases scheduled to commence subject to its review of potential growth opportunities.

The Group also drew attention to its bill cut for 2022 to 2023, and said that bills were currently lower than they were 10 years ago for South West Water customers.

“Pennon are performing well, with good plans to drive growth in the years ahead,” said Clayton.

“All in all it is a robust performance. With cost pressures emerging, Pennon will be glad to have the opportunity to create offsetting synergies from the Bristol Water integration which should allow them to have a more resilient financial performance than many UK companies will manage in the next few years.”

“Critically, Pennon are targeting real terms increases in their dividends to shareholders.”