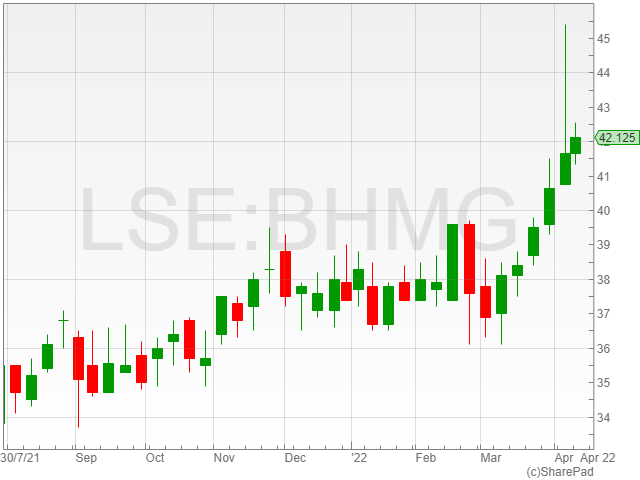

This sub-£100m group has very big ambitions and its experienced management is moving at an impressive pace with its corporate strategy.

The Likewise Group is a UK distributor of both domestic and commercial floor coverings and matting.

Upon floating last August, the group’s directors stated that they believed that they had an opportunity to build a business of national scale and over time become a strong alternative to the current larger industry competitors within the sector.

A very big and growing market

Excluding ceramics, the UK floorcoverings market, which is made up of manufacturers, distributors, retailers and installers, is worth some £2bn and is growing at around 3% per annum.

Some 30% of this market is made up by a number of larger players.

The 70% balance is covered by the national multiples and the regional independent retailers and flooring contractors.

Homes and offices creating demand

The residential sector of the market is expected to increase as new homes are added to meet the ongoing structural demand for housing at around 150,000 new residential dwellings a year.

Additionally, home improvements, changing consumer tastes and trends along with repair works is expected to create further demand. There is also a very strong replacement requirement.

It is believed that demand in the commercial sector will remain robust over the medium term, especially as new office developments continue to be constructed.

The group’s supplies and sales

Its suppliers are sourced from Holland (25% of sales), Belgium (24%), other countries in Europe (16%), the UK (15%), the Far East (11%), Turkey (6%), India (2.5%) and even Ukraine (just 0.5% previously).

Some 36% of the group sales is made up by carpets, commercial 20%, laminates 14%, mats and runners 10%, domestic vinyl 6%, artificial grass 6%, underlay 4%, luxury vinyl tiles 4% and other such products 1%.

Scale generates opportunity

It is the strategy of this group to consolidate the distribution and retail sections of the market to gain national scale and provide a channel for UK and overseas manufacturers.

To deliver on this strategy, Likewise has declared that it intends to utilise its expertise and industry knowledge to deliver organic growth, operational leverage and execute strategic acquisitions.

Expansion strategy and setting a price marker

But just look at this group’s expansion over the last few years.

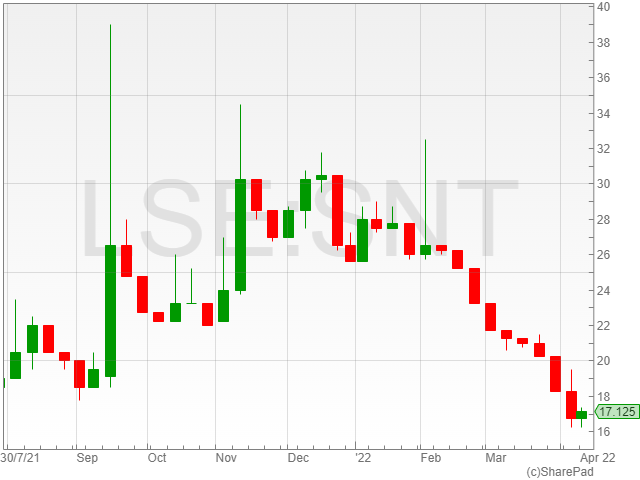

From 2019 to the summer of 2021 it had made and integrated some seven acquisitions, that was ahead of going public last August.

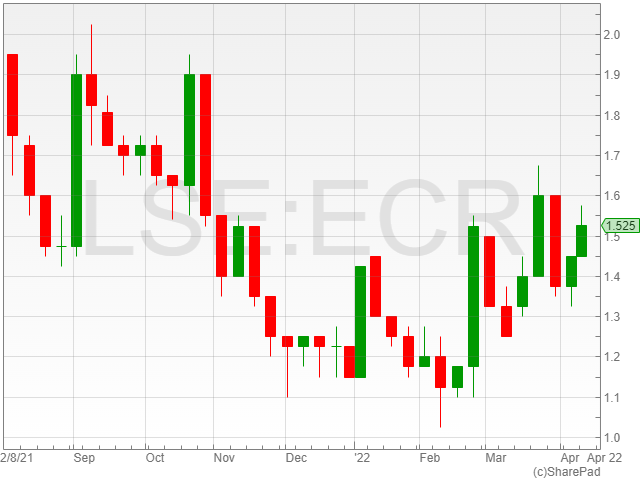

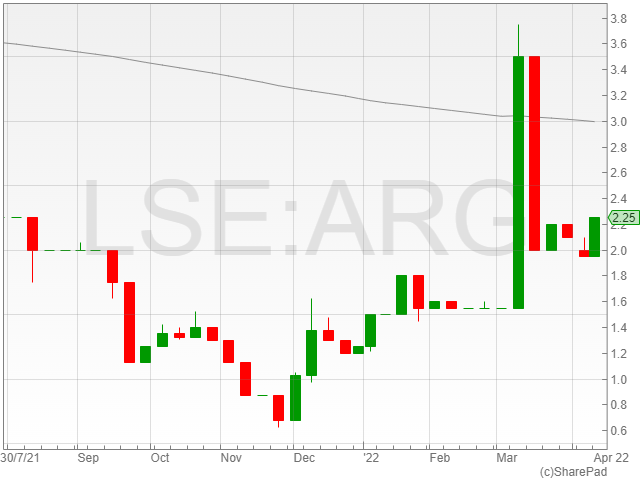

The valuation then was £48.1m, when it raised £10m before float expenses, with its shares priced at 25p each.

In mid-December last year, it made a £30m acquisition of Valley Wholesale Carpets – settled by paying £24m cash, £1m deferred cash and the issue of 5m shares.

If investors took any real notice that last part of the payment put down quite a marker.

The condition stated with the 5m new shares, was that if the 5m are valued at less than £5m on the second anniversary of the Acquisition Completion, then the shortfall will be settled in cash.

I take that as quite a strong pointer that the group’s management and its financial advisers are happy with setting a two-year target for the shares at 100p or better.

At the time of this deal the group raised £14m by way of issuing new shares to existing investors and institutions at 35p each, which was a 24% discount to the 46p share price on the day before it was announced.

A month later the group declared that the acquisition had been approved and completed. So, could the aim now be 100p a share by mid-January 2024?

Acquisitions continue

Continuing the group’s expansion programme saw it announce another acquisition at the start of this month.

For £3m it has added the Leeds-based Delta Carpets. Again it was completed with the issue of 0.5m new shares, at the underpinned 100p value upon the second anniversary of completion.

This really is a quite inventive and attractive form of financing through the issue of equity. The balance of the earnings enhancing deal price was in cash.

Delta distributes to independent retailers in the Midlands, South Wales and the North of England. It boosted the group’s geographical and operational spread.

Number Two player in the marketplace

Its various purchases over the last four years have now helped it to build itself up to be the number two player in the UK flooring market.

In the year to end December 2020 it had sales of £47.3m.

To the end of 2021 that revenue figure had risen 31% to £62.0m.

Current broker’s estimates suggest £115m this year, £137m next year and £161m in 2024.

But those estimates, obviously, do not take account for any future deals that the Likewise corporate team may put together.

Geographic expansion widens its coverage

At the current rate of expansion, I believe that the group will fill in its blank coverage areas of the UK by taking over other distribution companies.

So the management’s target of creating a national distribution business, with revenues in excess of £200m could well be beaten within a very short time frame.

From its centres across the country – Leeds, Sudbury, Birmingham, Manchester, Glasgow, Newcastle, and Peckham in the UK, while also having a centre in Meulebeke in Belgium – it can already offer an impressive one-day delivery service.

More sales ability brings added margins

As the expansion happens the pure strategic logistics will really start to fall into place.

Far bigger dealing power when negotiating with its global suppliers, which in turn strengthens operational and financial efficiency, its margins will increase and it will boost its cash flow, while also helping to reduce company debt.

It will also outperform other players in the sector.

The group management aim is to generate operating margins in excess of 5%, while also implementing a progressive dividend policy.

That is just what a quoted company should do, especially in these current markets.

Growth adds to profits

The current year is already looking promising.

Alongside details of its latest acquisition, the company reported that it was trading ahead of internal budgets for the first three months of this current year.

It also mentioned that it will be looking to help to cover general supply price rises by introducing a new price list as from the beginning of next month.

For this year its management believes that the group will meet market expectations.

The group’s brokers, Zeus Capital, are bullish about the company. They are not at all concerned by the current high price-to-earnings ratio at some 51 times 2021’s estimated results. They amplify the scalability of the group.

Their estimate for the 2021 figures look for a turn around from £3.6m of losses to £1.6m profit.

For the current year they go for £4.2m profits, worth 1.3p per share in earnings.

Next year the expansion shows through with £6.2m profits, generating 1.8p per share.

For the 2024 trading year the brokers go for £9.1m which would pump in 3p in earnings.

The group should be reporting its 2021 results next month, at which time we should expect a further trading update,

This real growth deserves a higher price

This really is a growth story – a classic ‘buy to build’ – and it has only been on the market for nine months.

There is a lot more to come from this very expansive group, its shares at just 35p warrant a much higher rating to reflect its growth prospects.