Shell posted an updated outlook for Q1 trading highlighting a write-down between $4bn and $5bn as a result of its losses associated with Russia on Thursday.

Following Moscow’s invasion of Ukraine, Western corporations such as Shell quickly withdrew from Russia, dissolving trading connections and winding down joint ventures leading to a rough start to 2022 for the oil and gas company.

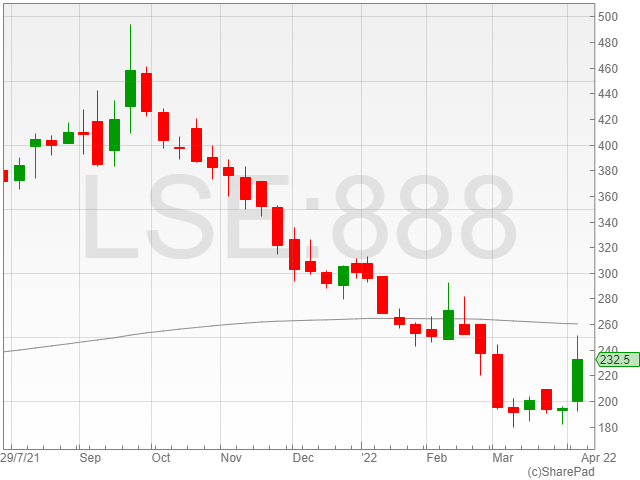

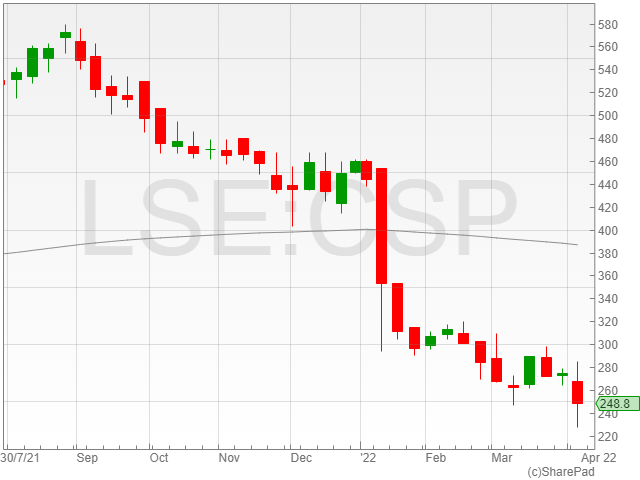

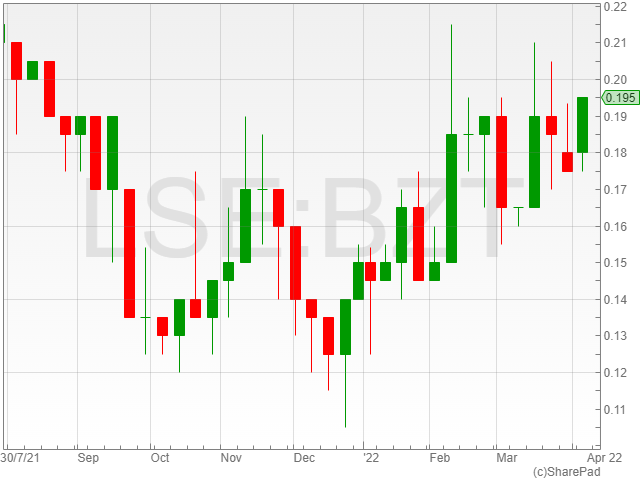

Shell shares have been bouncing with Russian oil bans, however, the rise in oil prices has cushioned the blow.

In the quarter, average oil prices rose to just above $100 a barrel, the highest since 2014, while European gas prices set a new high.

Shell had previously estimated the write-down to amount to $3.4bn on its exit from Russia due to contractual obligations, credit losses and receivable write-downs.

The post-tax impact from impairment of non-current assets and extra costs connected to Shell’s Russian activities is expected to be $4bn to $5bn for the first quarter of 2022 according to the results.

Shell has a market cap of approximately $210bn and it explained that the write-down will not impact the company’s earnings.

Shell has not renewed Russian oil contracts and will only do so if directed by the government, however it is legally obligated to take delivery of crude purchased under contracts made before the invasion.

Shell’s Results

Integrated Gas including Renewables and Energy Solutions

The company’s maintenance activities, including the planned reversal of one of the trains at Pearl GTL, are estimated to drive production between 860 and 910 thousand barrels of oil equivalent per day (kboe/d). The Canadian Shales assets are expected to produce around 50 kboe/d, according to the forecast.

Shell’s LNG liquefaction volumes are projected to be between 7.7 million tonnes (mt) and 8.3mt.

In comparison to the fourth quarter of 2021, trading and optimization results for Integrated Gas are estimated to be better, and the underlying Opex is estimated to be between $1.7bn and $1.9bn for the oil and gas company in Q1 2022.

The company’s depreciation before taxes is projected to be between $1.2bn and $1.4bn. The tax bill is likely to be in the range of $700m to $1.1bn for Shell.

Shell’s renewables and energy solutions are estimated to contribute between $100m and $600m of the overall Integrated Gas adjusted earnings.

Upstream

Between 1,900 and 2,050 kboe/d are predicted to be produced by Shell. The projection includes a 50 kboe/d drop as a result of the transfer of Canada Shales assets to Integrated Gas.

The company’s underlying Opex is estimated to be in the range of $2.3bn to $2.7bn with pre-tax depreciation projected to be between $2.8bn and $3.1bn and the tax bill is expected to range between $2.8bn to $3.3bn.

Oil Products

The marketing results for Shell are estimated to be in line with Q4 2021, with the underlying Opex estimated to be in the range of $1.8bn to $2.0bn and daily sales volume estimated to range between 2.2m and 2.6m barrels.

In terms of the product results of the company, trading and optimisation results are predicted to be much higher than Q4 2021.

The group’s estimated refining profit is around $10.23 per barrel, up from $6.55 per barrel in the fourth quarter of 2021.

Due to fewer turnaround events, refinery utilisation for Shell is predicted to be between 70% and 74%, higher than Q4 2021.

The underlying Opex is estimated to be in the range of $1.6bn to $2bn for Shell, with daily sales volume estimated to range between 1.5m and 2.3m barrels.

The company’s pre-tax depreciation is estimated to range between $700m and $900m, with around half of that going to marketing and the other half to refining and trading.

The tax bill is projected to be between $400m and $700m, with marketing accounting for 20%-30% and refining and trading accounting for 70%-80%.

The pipeline business will be shifted from marketing to the refining and trading sub-segment in the first quarter of 2022 as part of the continuing re-segmentation initiatives.

Chemicals

Shell’s chemicals margins are likely to be flat compared to Q4 2021, owing to lower unit margins due to higher feedstock and utility costs, which will be compensated by higher utilisation.

The volume of chemicals sold is projected to range between 3.1mt and 3.6mt in Q1 2022.

Due to fewer turnaround events, chemical manufacturing plant utilisation is predicted to be between 78% and 82% in Q4 2022, which is higher compared to 2021 for Shell.

The underlying Opex for Shell is projected to be in the range of $800m to $1bn and depreciation is projected to cost between $250m and $300m before taxes.

The company expects credit of up to $100m from the taxation charge and due to higher feedstock and utility costs offset by improved utilisation, adjusted earnings are estimated to be in line with the fourth quarter of 2021.

Shell shares have dropped 1.6% to 2,098p following the announcement of the $4bn write-downs caused by the exit from Russia.