Seeing Machines (LON: SEE) is making good progress and car manufacturers are installing its driver monitoring systems in more models. Interim revenues are 19% ahead at A$21.7m.

Seeing Machines develops artificial intelligence-based computer vision technologies. There are many potential uses, but the focus is the automotive market. Driver monitoring systems (DMS) are becoming a mass market due to regulatory changes.

Up until now, the main revenues were coming from Guardian fleet system monitors – annualised recurring revenues are running at A$18.8m. This is changing as the car manufacturers fit...

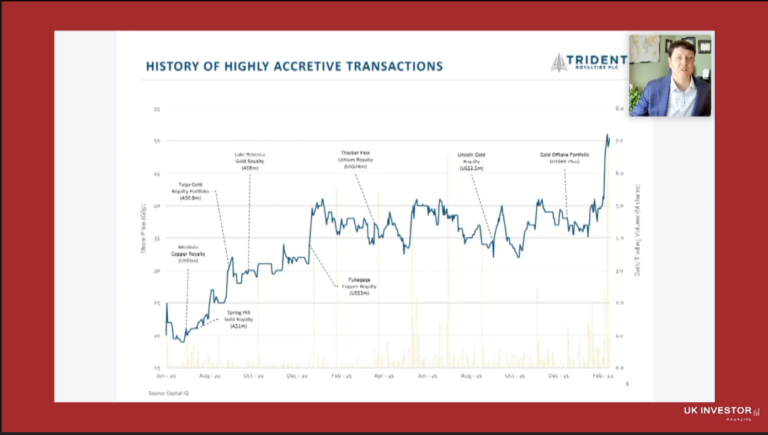

Trident Royalties Investor Presentation February 2022

Trident Royalties presents at the UK Investor Magazine Metals & Mining Investor Conference.

Trident believes that the acquisition and aggregation of individual royalties and streams has the potential to deliver strong returns for shareholders as assets are acquired on terms reflective of single asset risk compared with the lower risk profile of a diversified, larger scale portfolio, including diversity as to geography (lowering geopolitical risks) and commodity exposure.

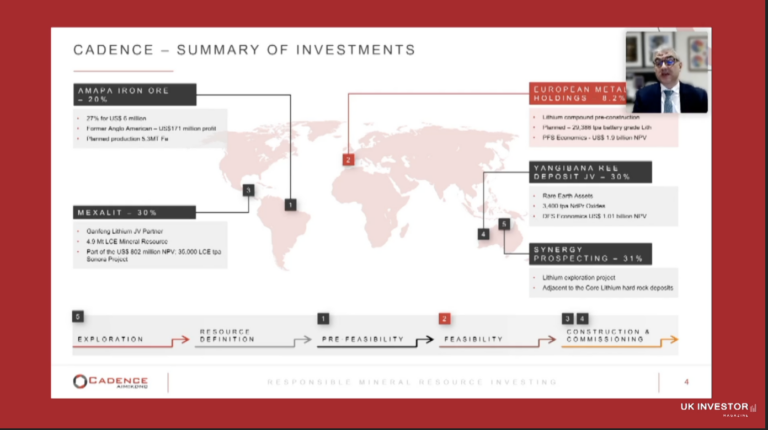

Cadence Minerals Investor Presentation February 2022

Cadence Minerals is an early stage investment and development company within the mineral resource sector and is listed as an investment company on the London Stock Exchange AIM market and the Aquis Stock Exchange, also based in London.

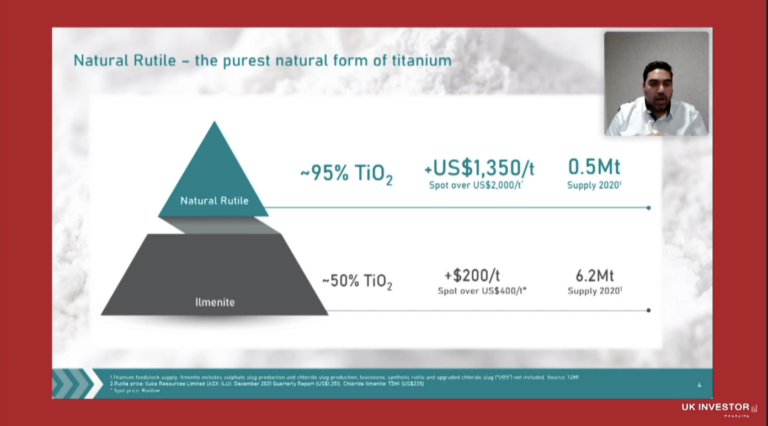

Sovereign Metals Investor Presentation February 2022

Sovereign Metals presents at the UK Investor Magazine Metals & Mining Conference February 2022.

Sovereign controls a globally significant, strategic rutile province across its large ground holding in Malawi, with its flagship project Kasiya, one of the world’s largest rutile deposits.

FTSE 100 grinds out gains as markets digest Russia sanctions

The FTSE 100 gained on Wednesday as markets shrugged of concerns around the latest developments in Russia’s movement in Ukraine.

Markets across Europe chose to look past the threats of conflict in Ukraine on Wednesday and traded within a tight range as investors awaited further news.

After trading as high as 7,549, the FTSE 100 closed just 3 points higher at 7,497.

“The FTSE 100 managed a move higher on Wednesday despite the simmering tensions in Ukraine,” said AJ Bell investment director Russ Mould.

“The US seems to have ruled out any talks with the Russians until they pull back from the separatist regions in the Donbas region they occupied yesterday so the ball now appears to be in Vladimir Putin’s court.

“So far the sanctions imposed by the West aren’t as heavy as might have been expected and the market is apparently taking this a win amid hints Putin might be open to a diplomatic solution.

“However, predicting the Russian premier’s next move is a mug’s game and unfortunately until the situation is resolved the markets are likely to remain firmly on the edge.”

Evraz was FTSE 100 top faller, with the steel manufacturing and mining company’s stock dropping 10.8% to 250.7p as Russia tension again hit the company.

The bulk of Evraz’s output comes from Russia, sparking questions about how the producer intends to export its wares if conflict erupts.

Kingfisher has also taken a significant hit, dropping 4.69% to 298.6p. Kingfisher has been under pressure recently over concerns rising households bills would dent spending on DIY.

CRH fell 3,472.5p, wiping 2.66% off the stock value of the building materials producer.

Barclays rose 3% at 196p after reporting an increase in their annual net profits before tax. The group’s net profit before tax amounted to £8.4bn with a rise of 174% from £3.2bn net profits before tax in 2021.

Barclay’s Corporate and Investment Banking division also recorded an increase in net profits at £5.8bn.

Dividend payouts increased with Barclay’s paying their shareholders 6.0p per share.

Antofagasta continues rally

Antofagasta was riding wave of positivity following as strong update yesterday. Anto’s share price gained 3.2% to 1450p on Wednesday.

Antofagasta yesterday reported a 46% increase in revenues from $5.1bn to $7.4bn. Profits before tax was reported as $3.4bn which is 146% higher than last year.

“Antofagasta is riding this price strength as in 2021 it has generated its highest profits in over a decade, based on the company’s preferred metric of earnings before interest, taxes, depreciation and amortisation (EBITDA), after a 77% jump to $4.8 billion,” said Russ Mould, AJ Bell Investment Director.

Hikma Pharmaceuticals shares rose 3.4% and were the FTSE 100 top rise ahead of their results tomorrow.

UK calls for windfall tax on big oil companies as prices spike

The UK government is calling for a windfall tax on big oil companies including Shell and BP as the commodity spikes to seven-year highs of almost $100 per barrel.

Shell and BP have seen their share prices surge this year due to tensions between Russia and Ukraine fuelling scarcity fears and sending the cost of the commodity soaring.

The oil majors have recently reported bumper earnings which are now being targeted for a potential windfall tax to help households deal with the impact of rising energy prices.

The Labour party proposed the one-off windfall tax following surging growth from the major oil producers as a means to counteract the rising oil price cap, which is set to cost consumers an estimated £693 per year in energy bills.

The price of rising energy is set to squeeze household budgets and analysts predict that UK consumers will suffer greatly without government intervention.

“The outlook is so bleak for cash strapped consumers, even the International Monetary Fund has now waded into the political waters surrounding high energy bills, urging the UK government to bring in targeted help for poorer households,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown

“Any increase to the warm homes grants would still be paid for by other energy bill payers, which is why there is increasing clamour for a windfall tax on the big North Sea oil and gas producers like Shell and BP.”

The proposal has been met with a negative response from the oil companies, with the argument against the tax rooted in lost dividends for reliant shareholders, alongside purported green energy transitioning taking a hit in a crucial stage of development.

BP recently announced in its financial year results for 2021 that its schedule for transitioning to green energy includes a complete shift to net-zero across its entire operational portfolio by 2050.

“We are accelerating the greening of BP,” said BP CEO Bernard Looney.

“Our confidence is growing in the opportunities that the energy transition offers. This allows us to raise our low carbon ambitions, and we are now aiming to be net zero across operations, production and sales by 2050 or sooner.”

Credit Suisse faces money laundering scrutiny following leak of client’s financial details

Credit Suisse is tied in a new scandal revolving around criminals and illicit funds following the leak of customer data.

Credit Suisse has faced scrutiny following the leak of information which showed the bank has provided services to criminals, raising questions about their internal procedures.

The Guardian reported the leak of 30,000 clients details highlighted Credit Suisse had been involved in managing the wealth of individuals involved torture, drug trafficking and money laundering.

Credit Suisse is yet again being accused of allegedly allowing clients with criminal records to maintain an account with the Swiss Bank after accusations they facilitated money laundering for cocaine dealers.

The Credit Suisse chairman recently left his post after he was found to break Covid regulations and faced backlash from ex-employees revealing money laundering practices.

As a response to these allegations, Credit Suisse issued a press release which stated, “Credit Suisse strongly rejects the allegations and insinuations about the bank’s purported business practices. The matters presented are predominantly historical, in some cases dating back as far as the 1940s, and the accounts of these matters are based on partial, inaccurate, or selective information taken out of context, resulting in tendentious interpretations of the bank’s business conduct. While as a matter of law Credit Suisse cannot comment on potential client relationships, we can confirm that actions have been taken in line with applicable policies and regulatory requirements at the relevant times, and that related issues have already been addressed.”

“Following numerous inquiries by the consortium over the last three weeks, Credit Suisse has reviewed a large volume of accounts potentially associated with the matters raised. Approximately 90% of the reviewed accounts are today closed or were in the process of closure prior to receipt of the press inquiries, of which over 60% were closed before 2015. Of the remaining active accounts, we are comfortable that appropriate due diligence, reviews and other control related steps were taken in line with our current framework. We will continue to analyze the matters and take additional steps if necessary.”

Past these allegations, talks of assessing Switzerland as a high risk country are about.

In an interview with The Guardian, Jonás Fernández, an S&D MEP and spokesperson for economic and monetary affairs said, “these latest revelations show that too many of the world’s largest banks have still not learned their lesson. Banks are only too willing to accept dirty money, as long as they can pocket the fees.”