Cineworld share were rocked on Wednesday by the news of a court ruling ordering the cinema group to pay Cineplex C$1.23 billion, equivalent to £720 million at current exchange rates.

The legal proceedings relate to the termination of a takeover approach by Cineworld of Cineplex in June 2020.

Cineplex alleged Cineworld broke their obligations under the agreement and Cineplex set about claiming damages.

Cineworld filed counter claims that were rejected by the court.

The ruling will be a hammer blow to Cineworld and their investors who have faced dire trading conditions during the pandemic.

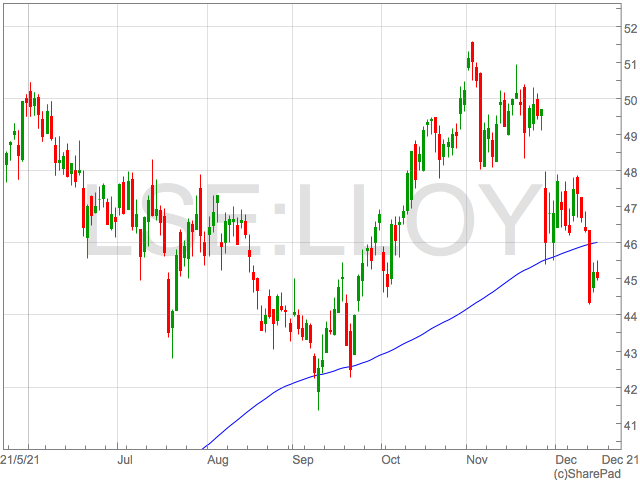

Cineworld shares were down 30% on Wednesday as investors questions the ongoing viability of the company with such a large penalty hanging over them.

“Cineworld’s hunger for growth has come back to haunt it,” said AJ Bell investment director Russ Mould.

“Pre-pandemic the company had expanded through acquisitions including taking on considerable debt to plant a flag in the US via the purchase of Regal Entertainment.

“Despite having borrowings up to its eyeballs, Cineworld then chased more growth by striking a deal in December 2019 to buy Canada’s Cineplex. That was a bold move, and many people suggested its eyes were bigger than its belly.

“The timing couldn’t have been any worse. The pandemic struck and it looked like Cineworld’s only way to survive this crisis was to bail out of the Cineplex deal, given that it had massive debt repayments and suddenly no income.”

The latest court ruling came shortly after another legal case that saw Cineworld pay out to prior shareholders of Regal which Cineworld took over in 2018.

“Ironically the ruling comes three months after an agreement by Cineworld to pay $214 million to disgruntled Regal shareholders who argued that the £2.7 billion acquisition of the US cinema chain in 2018 wasn’t done at a fair price,” Mould said.

“Cineworld is losing credibility fast with investors, having taken too many risks with expansion and paid the price for unscrupulous tactics.”