The FTSE 100 rose gingerly on Monday morning as investors pondered the possibility of a fresh COVID wave and looked forward to key central bank meetings.

This Thursday, the Bank of England will release their interest rate decision and Wednesday will see the Federal Reserve release the minutes of their meeting.

Before the discovery of Omicron, both central banks look set to begin the tightening of monetary policy, however, the economic uncertainties around the new variant have cast doubt on these plans. Particularly for the Bank of England.

This was evident in the pound with sterling dropping as traders positioned for no change in rates. The inverse relationship between the pound and the FTSE 100 provided support for Londons leading index on Monday as it traded above 7,300, before falling back to trade at 7,295 at the time of writing.

“The FTSE 100 was off to a solid start on Monday despite Prime Minister Boris Johnson’s warning of a ‘tidal wave’ of Omicron in a televised address last night,” says AJ Bell investment director Russ Mould.

“However, this is less a case of investors shrugging off the news as it is the index responding as it usually does to weakness in the pound.”

“Sterling’s performance against other currencies reflects traders’ view on the immediate prospects for the economy and interest rates in the UK and its weakness flatters the overseas earnings which dominate the FTSE.”

“The pound bouncing around year lows suggests there is little expectation the Bank of England will raise rates at its meeting later this week. The BoE is one of several central banks to have meetings in the coming days, including the Federal Reserve which may begin tapering its stimulus for the US economy.”

“The question on the lips of British hospitality, leisure and travel businesses in particular will be: can the souped-up booster campaign really deliver one million jabs a day to cover all over 18s by the end of December and prevent the need for more onerous restrictions?”

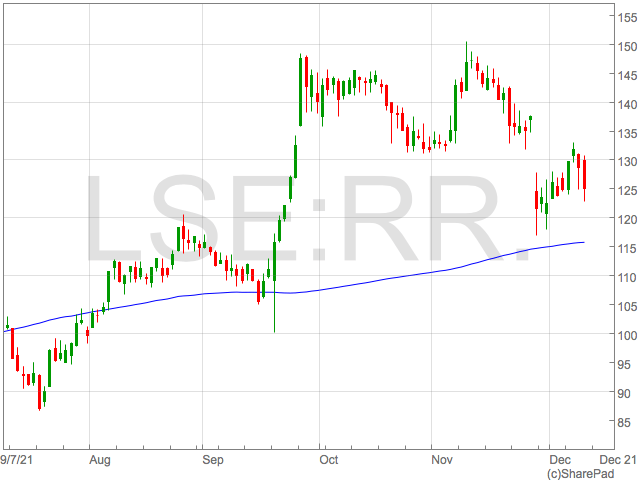

IAG and Rolls Royce were unsurprisingly the biggest fallers on Monday morning as investors left travel stocks in the face of further disruption. IAG shares are now down 16% YTD and are approaching the lowest levels of the year.