Eneraqua Technologies is well positioned to take advantage of the increasing focus on energy and water efficiency and the associated incentives for investment in these areas.

The annual social housing heating system renewal market is valued at £2.77bn and Eneraqua Technologies has a tiny market share. The UK market for the water flow technology is around £100m and there are opportunities overseas. Generally, competition is in different in each market.

The cash raised is being used to grow the market position in the energy market and build up a stronger position in the water sector. Ther...

FTSE 100 bounces off 4-week low before giving up gains

The FTSE 100 bounced back from last week’s selling in early Monday as a raft of positive corporate stories took attention away from concerns over inflation, the associated potential monetary policy tightening and lockdowns in Europe.

However, the index wasn’t able to hold onto gains and sank into the afternoon session.

The FTSE 100 was 0.4% stronger at 7,255 in mid morning trade on Monday having closed at the lowest since 25th October on Friday.

“The FTSE 100 rose 0.4% to 7,255 thanks to strength among banks, miners and telecoms stocks, the latter sector helped by a private equity takeover approach for Milan-listed Telecom Italia,” said Russ Mould, investment director at AJ Bell.

By lunchtime the FTSE 100 retraced all its gains and traded negatively.

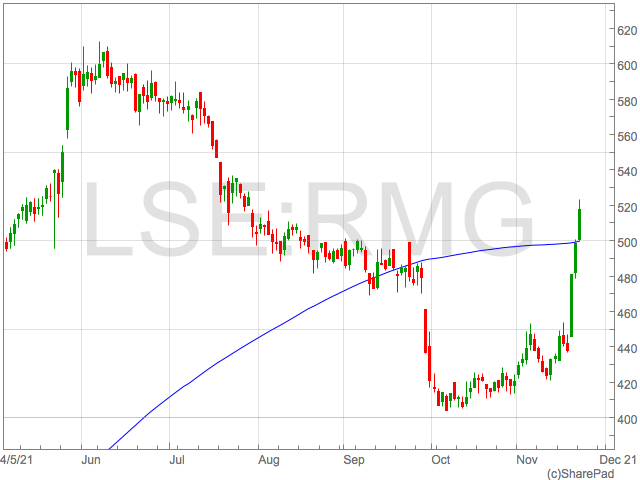

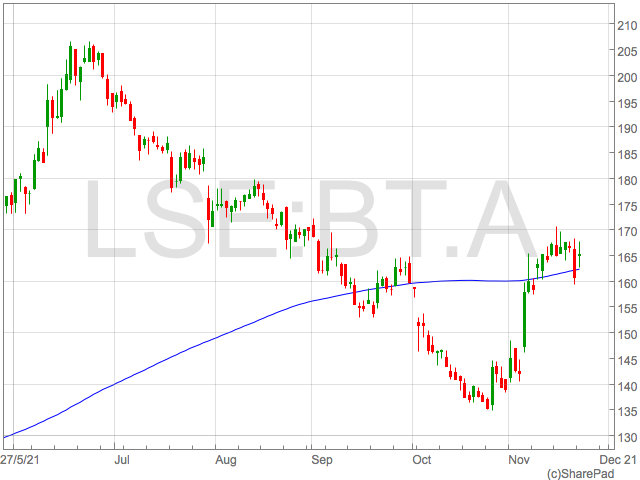

Royal Mail was again the FTSE 100’s top riser as investors continued to pick up shares following a strong set of results last week and the promise of shareholder distributions.

BT also kept hopes of an ongoing recover alive as it benefitted from M&A activity in the sector. Telecom Italia received an approach from US-based private equity group KKR, sending shares in the Italian Telecoms provider soaring.

Travel shares were also among the top risers as they bounced back from heavy selling at the end of last week sparked by fresh lockdowns and restriction in Europe due to a rise in Coronavirus cases.

IAG and Rolls Royce were both up over 2%, albeit off the highest levels of the session.

Precious metals miner Polymetal was the FTSE 100 biggest loser, falling inline with gold as the risk aversion evident last week diminished.

Castillo Copper provides Picasso Lithium Project update

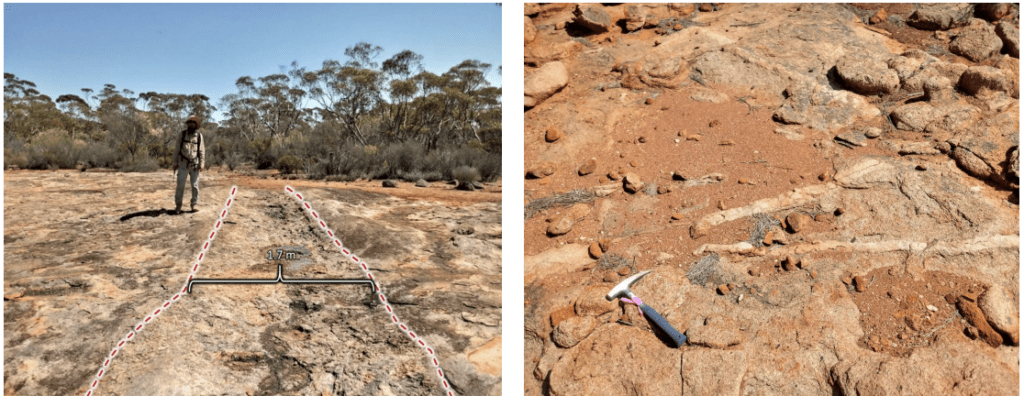

Castillo Copper has provided an update on their Picasso Lithium Project following the visit of a geology team.

The visit found pegmatite 10km in size that was significantly larger than prior government findings which are though to potentially be linked to lithium mineralisation.

The Picasso Lithium Project is located near Norseman in Western Australia and is diversifying Castillo’s asset base outside of their core copper projects.

There will be further investigations into the outcropping in the north-eastern quadrant of the prospect where the high-density pegmatite corridor is located.

“The geology team’s visit to the Picasso Lithium Project delivered encouraging news, confirming that a 10km zone of pegmatites is apparent in the tenure’s north-east quadrant,” said Simon Paull, Managing Director of Castillo Copper

“The Board’s preliminary conclusion, based on due diligence undertaken to date, is the Picasso Lithium Project is prospective for lithium mineralisation and delivers significant incremental exploration potential.”

Everyman Media Group cinema admissions ahead of expectations

Cinema operator, Everyman Media Group, has released a trading update for the 2021 FY year to 30th December 2021 and said they saw admissions ahead of expectations.

Assuming there are no more COVID restrictions in 2021, Everyman expects revenue to be no less than £46.3m producing EBITDA of no less than £7m.

This would be a dramatic increase from the £24.2m revenue recorded in 2020 FY but well below the £64.9m recorded in 2019 FY.

Everyman shares rose to 145p in early trade on Monday.

“Everyman’s shares jumped 8% after it said more people have been visiting its posh cinemas than expected, giving a nice boost to earnings. Cinema demand is highly dependent on the quality of the film slate and there have been quite a few popular titles released in recent months to help put bums on seats,” said Russ Mould, investment director at AJ Bell.

FTSE 100 sinks as COVID fears spread across Europe rocking European shares

The FTSE 100 dropped on Friday as fears over another wave of COVID spread across Europe as threatened another economic downturn.

Austria, with a population of 9 million, announced they were going into a full lockdown as cases and hospitalisations rose. Germany said they were not ruling out a full lockdown but were monitoring the situation.

“We are now in a situation – even if this produces a news alert – where we can’t rule anything out,” said acting health minister Jens Spahn in news conference.

The prospect of Europe’s largest economy going into another lockdown rocked major European indices. The German DAX was down over 0.5% whilst the Italian FTSE MIB shed 1.5%. The French CAC 40 dropped by 0.7%.

The FTSE 100 was unable to hold onto early gains driven by optimism around upbeat retail sales figures and stronger miners, falling by 0.6% in mid afternoon trade on Friday.

Unsurprisingly, travel shares were the hardest hit with airline IAG crashing 5.8% to 145p. Engine maker Rolls Royce wasn’t far behind giving up 5.65% of their value.

Kingfisher was another faller hurt by news the DIY boom was slowing driving a 6% drop in their reported revenue in the last quarter.

“Lockdown winners were always going to face tough year-on-year comparatives in 2021 and no more so than Kingfisher. The DIY boom that kicked off in 2020 has had considerable legs and still shows positive momentum. Unfortunately, it’s very hard to grow by a very large amount two years in a row, and so Kingfisher is now lamenting a drop in third quarter like-for-like sales,” said AJ Bell investment director Russ Mould.

Ryanair

Ryanair were weaker as they announced their departure from the London Stock Exchange. Ryanair will shortly only be listed in Dublin as it seeks to reduce costs and the burden of Brexit.

“For a business with a razor sharp focus on costs it seems the expense of maintaining a UK listing just doesn’t stack up any more given a decline in trading volumes and so Ryanair is planning a pre-Christmas getaway,” said Russ Mould.

“If Shell’s decision to pivot to London was chalked up as a Brexit win, this is likely to be characterised as a Brexit loss in some quarters, coming after restrictions were introduced on UK investors buying its shares at the start of the year.”

“Ryanair is desperate to be majority EU-owned in order to retain full licensing and flight rights in the bloc following the UK’s exit from the EU.”

The future of activist investing with Tulipshare

For those pushing for corporate change, activist investing is a movement gaining greater control and here to stay.

As a means to encourage companies to rethink investor strategies, buying and pooling shares together allow individuals to gain influence, lobby for change and pressure leadership to create positive change.

Socially responsible investing is the new wave of activist investing. Whilst activist investors traditionally target companies that are poorly managed or have inefficient operations, there is a growing movement of investors who are focusing on issues like sustainability and diversity.

Launching earlier this year, Tulipshare is a new activist investing platform that empowers people and shareholders to make sustainable changes within the world’s biggest investment companies. By investing and owning shares, individuals can lobby greener changes that promote ethical changes.

The platform allows investors to own global companies such as Coca-Cola, Amazon and JP Morgan. However, rather than focusing on short-term gains, investors can collectively call for improved working rights, plastic consumption and an end to fossil-fuel investment.

The platform’s first campaign is calling on Apple to open up its repaid policies to enable third-party technicians to fix your iPhone. At the time of writing, it has raised over $33,000 worth of investments and after a year of owning shares, Tulipshare can submit an activist shareholder proposal at the tech giant’s next AGM.

Kingfisher sales soften as pandemic DIY boom slows

Kingfisher has experienced a slowdown in sales in the three months to 31st October when compared to the same period last year.

Group LFL sales were 6.3% weaker on a reported basis and 2.4% down on a constant currency basis.

The drop in sales from a year ago shows the jump in DIY activity was starting to wane but sales this year were still 15% higher than two years ago, before the pandemic.

“Lockdown winners were always going to face tough year-on-year comparatives in 2021 and no more so than Kingfisher. The DIY boom that kicked off in 2020 has had considerable legs and still shows positive momentum. Unfortunately, it’s very hard to grow by a very large amount two years in a row, and so Kingfisher is now lamenting a drop in third quarter like-for-like sales,” said AJ Bell investment director Russ Mould.

“Most companies are comparing their latest takings to those of two years earlier, to see progress from a pre-Covid world to now. On that basis, Kingfisher is still doing very well. Furthermore, the company’s fourth quarter has got off to a bang and it is guiding for full year profit to be at the higher end of previously guide ranges.”

Despite the drop in sales compared to a year ago, CEO Thierry Garnier was confident long term changes in consumer behaviour would support demand.

“Kingfisher has delivered another successful quarter, with 2-year LFL sales growth of 15% and strong growth across both retail and trade channels, and across all categories. These are even stronger sales trends given the backdrop of an increasingly ‘normalised’ consumerspending environment. Demand remains supported by what we believe are enduring new industry trends, including more working from home,” said Thierry Garnier, Chief Executive Officer.

“We continue to grow our market share, driven by strong execution of our new strategy. We are pushing forward with investments in key areas of the business to drive long-term growth, including further enhancements to our e-commerce proposition and Screwfix’s launch inFrance. And we are progressing with our clear plans to deliver on our carbon reduction targets, aligned to 1.5°C to 2025, and to become ‘forest positive’ by the same year.

“Since the start of this year we have maintained, and in many cases improved, our product availability, which is amongst the best in our industry. This has supported our market share gains and allowed us to upweight promotional initiatives in the quarter. We have also continued to manage inflation pressures effectively, while retaining highly competitive pricing.