The flotation of Tungsten West (LON: TUN) is good news for Hargreaves Services (LON: HSP), which has connections with the Hemerdon mine in Devon dating back to the time it was owned by Wolf Minerals. This will generate significant revenues for Hargreaves Services.

Tungsten West bought the mine from Hargreaves Services in 2019, after the latter had taken ownership of the main assets from the administrators in lieu of the money it was owed by Wolf Minerals. This is the fourth largest tungsten resource in the world.

Tungsten West believes that it needs to invest £44.6m to improve the Hemerdon min...

Inflation could rise to over 5%

The Bank of England’s new chief economist has said that UK inflation could go above 5% next year.

Huw Pill told The Financial Times: “I would not be shocked — let’s put it that way — if we see an inflation print close to or above 5%. And that’s a very uncomfortable place for a central bank with an inflation target of 2% to be.”

This September saw inflation dip to 3.1% – down from 3.2% in August. According to the Office for National Statistics, the rise in petrol prices and transport were the biggest contributors.

Mike Hardie, head of prices at the ONS, commented: “However, this was partially offset by most other categories, including price rises for furniture and household goods and food prices falling more slowly than this time last year.”

“The costs of goods produced by factories rose again, with metals and machinery showing a notable price rise. Road freight costs for UK businesses also continued to rise across the summer.”

Intercontinental Hotels Group posts rise in Q3 revenues

The increased demand for domestic holidays has meant Intercontinental Hotels Group is seeing an increase in bookings.

The owner of The Crown Plaza and Holiday Inn reported a 66% increase in revenues for Q3, which is 21% behind pre-pandemic levels.

“Domestic leisure demand was particularly strong in a number of markets over the summer, where occupancy and rate climbed back to 2019 levels,” said chief executive, Keith Barr.

Commenting on the results, AJ Bell financial analyst Danni Hewson, said: “The pandemic had an outsized impact on the hotels sector and InterContinental Hotels was no exception. Today’s update confirms a recovering picture with the company gradually clawing its way back to its pre-pandemic levels of trading.

“Its various franchises, including Holiday Inn and Crowne Plaza, have been boosted of late by domestic leisure travel, as people holidayed at home rather than jetted off overseas. This trend was particularly notable in the US where the gap between pre-Covid and post-Covid trading is narrowest.

“The group’s commitment to growth is notable but it is taking a refined approach, rather than chasing growth blindly, with the business also exiting a large number of hotels and committing to the improvement of others.”

On the news, shares dipped 2% to 4,883p.

The best trusts to protect your portfolio against inflation

With prices rising sharply it is essential to safeguard the real value of your wealth

For the first time in a generation we are seeing a meaningful increase in inflation. In the UK, the consumer prices index including owner occupiers’ housing costs rose by three percent in the 12 months to the end of August, with the Bank of England forecasting that it will hit four percent by the end of the year.

This may not sound much, but every £10,000 you have invested would lose £400 of spending power unless you can keep up with the increase in prices. Unfortunately there is no risk free way to do this, but the best option would be to use investment trusts to give you exposure to real assets that should appreciate in value.

These sorts of holdings often generate inflation-linked revenues that will pass any cost increases on to their customers without it impacting the bottom line. The one caveat is that they might be negatively affected if interest rates have to rise, as the discounted present value of the future cash flows would be expected to fall.

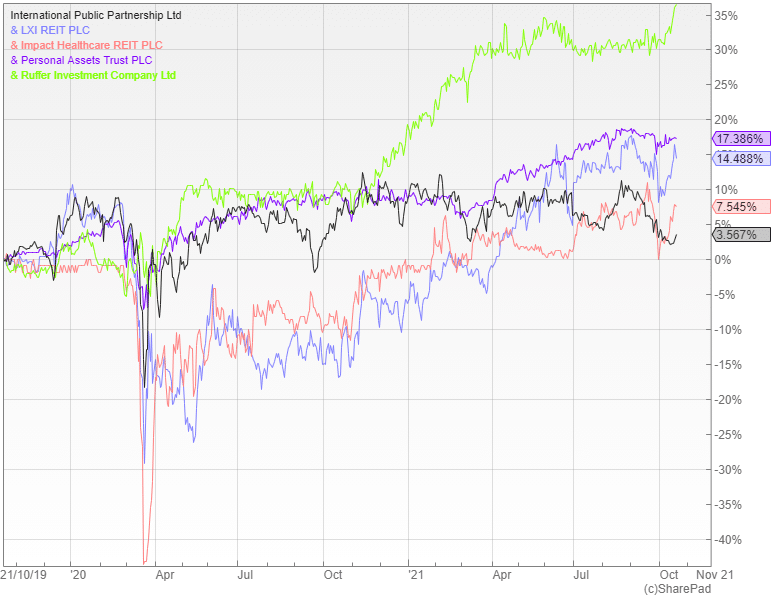

Infrastructure trusts such as International Public Partnerships (LON: INPP)are a good example. It invests in around 130 infrastructure assets, mostly in the UK, in areas such as energy transmission, transport and education.

INPP has the highest inflation linkage in the sector of 0.75%, which means that a one percent rise in inflation will produce a 0.75% increase in returns. The shares are yielding 4.6%, although they are trading on a 12% premium to NAV.

Real Estate Investment Trusts (REITs) are another option. One worth considering is the LXI REIT (LON: LXI)that holds a diversified portfolio of UK property that benefits from long-term index-linked leases with institutional-grade tenants. It is currently yielding 3.8% and trading on a nine percent premium.

Alternatively there is the Impact Healthcare REIT (LON: IHR), which owns a high-quality portfolio of UK care homes that pays an attractive yield of 5.3% and is trading on a seven percent premium. Its revenue is underpinned by the long-term, inflation-linked leases that are fully repairing and insuring with no break clauses.

The safest option would be to use one of the defensive multi-asset trusts like Personal Assets (LON: PNL)or the Ruffer Investment Company (LON: RICA). These aim to grow your investment ahead of inflation, but are based on a mentality of capital preservation.

Retail sales fall 0.2% in September

Retail sales were down by 0.2% in September, according to the latest numbers from the Office of National Statistics.

Despite the ending of almost all lockdown restrictions, retail sales volumes have fallen every month since April. Clothing and department stores saw a slight increase but it was Household goods stores that reported a 10% fall in sales. Sales at chemists and toy stores also fell.

“An unexpected fall in retail sales, which came despite a boost from rising fuel prices, demonstrating that things are getting tougher out there,” said AJ Bell financial analyst Danni Hewson.

Helen Dickinson, the chief executive of the British Retail Consortium, commented: “For the sake of the UK’s economic recovery, it is vital that retail sales bounce back as we near the festive season.”

“Labour shortages across the supply chains, on farms, factories, warehouses and lorry drivers, all threaten to derail this recovery and it is vital that government finds a long-term solution to this problem,” she added.

The tech trust positioned for further growth

Investors seeking robust capital growth should look no further than technology

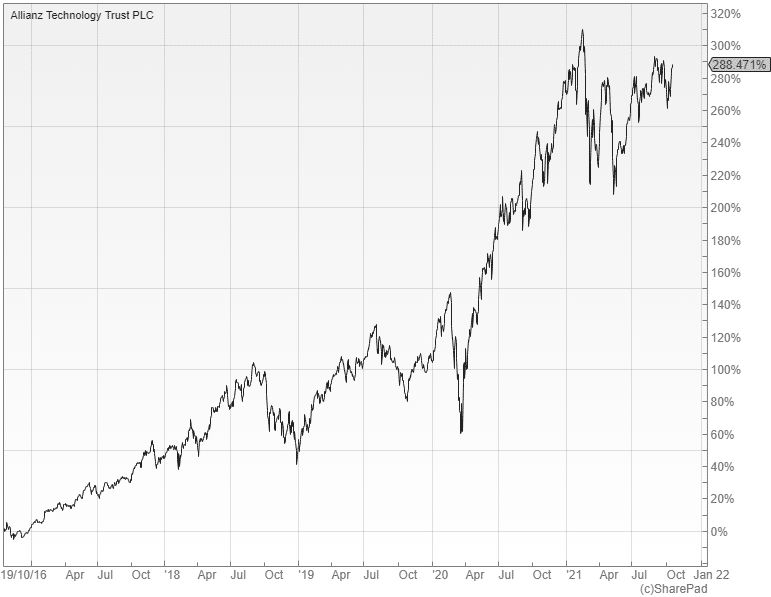

The best performing sector of the market over the last decade is technology and there is every chance that the innovative companies that operate in this area will continue to thrive as we move towards a more automated and digital future. There are various ways to profit from this with one of the best options being the £1.4bn Allianz Technology Trust (LON: ATT), which has a buy rating from the Winterflood investment trust team.

Manager Walter Price and his associates are based in Silicon Valley at the heart of the action and have ready access to the world-beating tech businesses that are located in the region. He employs an active and unconstrained approach that has enabled him to deliver a five year return of 280%, yet the shares are currently available on an eight percent discount to NAV.

Price believes that there are opportunities to create whole new sub-industries within the technology space. He aims to capitalise on this by identifying the major growth trends and then investing in attractive companies that are set to benefit.

The sort of stocks he targets are typically market leaders that can enjoy sustained earnings growth, have high quality management, strong balance sheets and barriers to entry, but are available at a reasonable valuation relative to growth rates and industry peers.

Most of these types of companies are based in the US with the trust’s largest holdings comprising well-known names like Alphabet, Microsoft, Amazon and Apple, alongside less familiar businesses such as CrowdStrike, Zscaler and Seagate Technology.

Price believes that the pandemic will spur the use of technology and change how we live and work in the future. He also points out that many businesses are struggling to find workers to meet customer demand and need technology solutions to improve the productivity of their limited workforces.

“As companies need to reduce costs and improve productivity, we expect to see accelerating demand for innovative and more productive solutions such as cloud, software-as-a-service, artificial intelligence and cyber security. We continue to believe the technology sector can provide some of the best absolute and relative return opportunities in the equity markets.”