Bens Creek Group has acquired coking coal mining assets in West Virginia, and it believes it can restart production before the end of 2021. There are surface and underground resources, and the coal can be used for steelmaking. While thermal coal is out of favour, coking coal demand is booming.

The Pond Creek mine is expected to recommence production in the fourth quarter of 2021, followed by a second mine site in the first quarter of 2022. Bens Creek intends to engage a contract miner to produce the coal, so this will reduce the investment it is required to make, while the deferred acquisition...

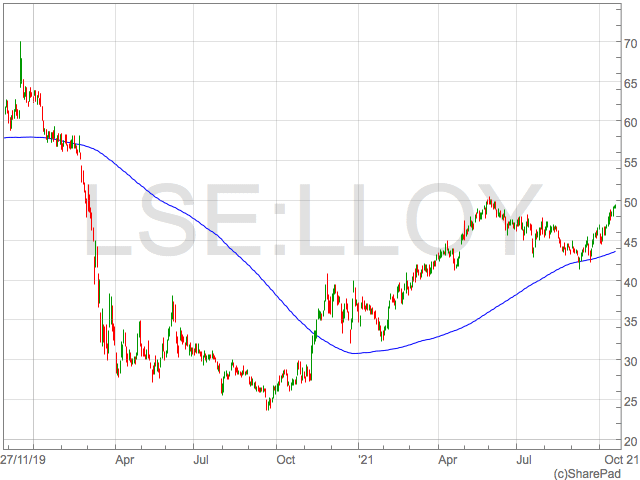

Lloyds share price will struggle to reach pre-pandemic levels

Lloyds share price (LON:LLOY) has provided investors with reason to be optimistic in 2021 having rallied 35% through the year.

The rally was sparked by strong results early in 2021 which unleashed a wave of bargain hunters picking up the beaten up stock.

“The market has been pricing in a brighter outlook for Lloyds and the bank has certainly delivered some impressive numbers in its first quarter update,” says Russ Mould, investment director at AJ Bell following first quarter results in April.

“Net interest margin is better than expected, being the difference between what it earns from interest charged on loans and interest paid on savings deposits. Costs are also better than expected, which might come as a surprise given how difficult it is to streamline a business the size and complexity as Lloyds.”

However, fast forward barely six months and long holding investors in Lloyds shares will be keen for the price to break significantly above the 50p level and return to pre-pandemic highs. Lloyds shares were trading at 64p in December 2019.

There are a number of factors at play that will dictate Lloyds shares in the short term and unfortunately Lloyds investors may be disappointed with how shares react.

Central Bank Action

The biggest influence on Lloyds shares through the rest of 2021 will be the action of central banks, in particular the Bank of England.

Rising prices driven by higher food and fuel prices are forcing the Bank of England’s hand and expectations of a rate hike have been brought forward in a dramatic shift in monetary policy narrative.

In many scenarios, rising rates would be seen as a positive for UK banks, however if we see a rate hike this year, it would be a hike into a backdrop of global stagflation fears and concerns over the resilience of the UK economy.

This increases the chances of a disorderly policy mistake that kills investor sentiment and therefore Lloyds shares.

Indeed, Pimco CEO Emmanuel Roman recently said ‘central banks are now running the markets’, which ultimately means central banks are in the control of the returns of Lloyds shares.

Bellway profits more than double

Bellway profits more than doubled to £479m for the year to July 31.

Revenues also jumped 40.3% to £3.12bn on the back of the strong housing market this past year.

The housebuilder has warned of supply chain issues, which are holding back the construction sector. Disruption in supply chains is increasing the price of steel and timber.

“In addition, the national shortage of heavy goods vehicle drivers and recent disruption to fuel supplies has had some impact on the availability of materials.”

“In general, these constraints are manageable by adopting good procurement disciplines and forward planning. They will, however, mean that construction output in the first half of financial year 2022 is likely to remain similar to that achieved in the first half of financial year 2021,” said the group in a trading statement.

Asda announces recruitment drive ahead of Christmas

Asda has announced plans to hire an additional 15,000 workers over the festive season.

The roles will be across stores, depots and in delivery. This week will also see the first Christmas delivery slots up for grabs, with the first available on Tuesday for Delivery Pass customers.

“We will do all we can to make sure customers have a fantastic Christmas and recruiting an extra 15,000 colleagues across our stores, depots and home delivery service will help us to provide them with great products and excellent service when they shop with us during the festive season,” said Hayley Tatum, chief people officer of the group.

Sainsbury’s is also taking part in a big hiring drive ahead of Christmas. The supermarket said it would hire 22,000 members of staff.

“The Government is protecting, supporting and creating jobs across the UK through our plan for jobs and it’s great to see Sainsbury’s launching its biggest ever Christmas recruitment drive,” said Business minister Paul Scully.

“These 22,000 jobs being created across the country mean more opportunities for workers and even better service for customers – enough to give Father Christmas some serious competition.”

888 Holdings posts jump in revenue

888 Holdings has posted a jump in revenues to $229.9m.

The betting firm’s revenue was up in the three months to September 30 by 7%, rising from $215.6m (£156.53m).

The group is expanding and in the last quarter, 888 Holdings announced plans to takeover William Hill.

Commenting on the recent results, chief executive Itai Pazner said the group had “continued positive trading, particularly as we lap very tough comparative periods.”

“This performance reflects the continued success of our data-driven investments and execution against our product-leadership plan that delivers ongoing improvements in the usability, quality and safety of our sports betting and gaming products.”

Investing in Your Future: Why Planning Your Pension Matters

Everyone likes to think of the here and now when it comes to investing. Which stocks are hot? Where is the S&P 500 heading? What’s the word on cryptocurrencies? Even though they all eventually have a long-term focus because you want an asset to appreciate in value, the initial focus is on the present. That’s not a bad thing. In fact, being on trend or, preferably just ahead of the curve, is important when it comes to investing.

However, there are also times when it pays to look beyond the present and towards those significant long-term life events, such as retirement. According to a 2020 survey by Unbiased, 17% of Brits aged 55+ said they didn’t have any retirement plans beyond a state pension. This is a potential problem and one of the main reasons why investments shouldn’t always be about the here and now.

Don’t Let Your Future Pass Your By

As of 2021, the UK state pension was £137.60 per week. That’s not a meagre amount, but it’s probably not enough for most people to live on. According to Retirement Living Standards, the minimum amount a single person needs to cover their basic living costs and have “some left over for fun” is £10,300 per year. If you want a moderate quality of life, the cost is £20,200 per year. Given that the state pension was worth £9,399 per year (2021/2022), you can see that there’s a shortfall.

That’s why it’s important to plan ahead and make future investments now. Indeed, when you’re assessing how much money you need for retirement, there are a variety of factors to consider. Firstly, there’s age. By 2028 the state pensionable age will be 67. Secondly, you need to think about expenses. Will you still have a mortgage and debts? Thirdly, how long is it until you retire? The less time you have, the more you may need to focus on saving and investing.

Finally, how much are you earning now and is a percentage of that enough for you to live on in retirement? These factors have to be taken into account when you’re planning for retirement. A solid starting point for calculating how much you need to retire with is the 4% rule. In other words, you shouldn’t use more than 4% of your savings to live on in a given year. From this, you can multiply the amount you currently spend on living expenses by 25.

That number is the amount of cash you should have when you retire. Of course, this is just a guide. However, it’s a good rule to have in place when you’re planning for retirement. Once you’ve set a target, achieving it is the next objective. A workplace pension is one way of getting there. But what if the projected returns aren’t great? What if you’re self-employed?

Take Control of Your Pension

This is where investments can help. A self-invested personal pension (SIPP) is a financial product that allows you to create your own retirement pot. In simple terms, you’re doing the same thing as the company running a workplace pension. With a SIPP, you’re able to invest in stocks and shares. The government will also add an additional 20% to any amount you invest. The crucial point here is that a SIPP allows you to invest in various financial instruments in a tax efficient way.

Moreover, you’ll have more control over your retirement funds. This means it pays to have a long-term focus when you’re investing. Yes, jumping on the bandwagon and buying the hottest asset right now is great if you’re investing outside of a SIPP. However, if the money you’re aiming to make is for retirement, it’s better to look at established performers such as the S&P 500 or the Fidelity World Index Fund. Being on-trend is important in the investment world. But there are also times when you have to think about the past, present, and, in turn, the future when you’re playing the financial markets.

How to buy US stocks in the UK

UK investors can easily buy US stocks from within the UK but it can be a little confusing when starting out – this helpful guide explains how it works and clears up any misunderstandings.

Can I invest in US stocks from the UK?

Yes, it is entirely possible to buy US stocks from the UK. Non-US citizens are entitled to buy US stocks. While the laws that govern US stock markets are American, you do not need to be an American to invest in them. For example, you can be British and invest in America by buying US stocks. The same applies to other investments like US government bonds or corporate bonds, as well as US property.

The US stock market is the largest in the world and potentially offers some of the most popular stocks to trade. For foreigners, investing in the US also has the benefit of diversification, giving you ‘global market exposure’ to your investment portfolio,although bear in mind that trading is risky and may not be appropriate for everyone.

Can I buy US stocks in the UK?

You don’t need to open a US brokerage account to buy US stocks. UK banks and brokers offer accounts in which British residents can buy US stocks and other financial instruments.

LCG offers trading in thousands of US stocks and ETFs listed on the New York Stock Exchange, Nasdaq and BATS with a low commission of just 2-4 cents per share.This can all be done from the ease of the LCG app or desktop trading platform.

Some of the most popular stocks to buy on the New York Stock Exchange and Nasdaq tend to be the largest.

Here are the top 10 US stocks by market cap:

| Rank | Name | Ticker | Market Cap | Price(on 9/9/2021) |

| 1 | Apple | AAPL | $2.574 T | $155.73 |

| 2 | Microsoft | MSFT | $2.262 T | $301.03 |

| 3 | Alphabet (Google) | GOOG | $1.921 T | $2,895 |

| 4 | Amazon | AMZN | $1.793 T | $3,542 |

| 5 | FB | $1.065 T | $377.74 | |

| 6 | Tesla | TSLA | $760.58 B | $759.24 |

| 7 | Berkshire Hathaway | BRK-A | $631.16 B | $419,810 |

| 8 | NVIDIA | NVDA | $559.75 B | $224.62 |

| 9 | Visa | V | $501.48 B | $228.53 |

| 10 | JPMorgan Chase | JPM | $476.28 B | $159.39 |

Source: Companiesmarketcap.com

An alternative for Brits to buy US equities is to invest in an index like the S&P 500 or Dow Jones Industrial Average. This can be done by buying a US index fund, index ETF or indices CFDs.

NOTE: Pink sheets and US small cap stocks tend to have very low liquidity, potentially can be volatile and considered as high-risk investments and are not suitable investments for most investors and tend not to be available through large UK Brokers. Additionally when buying stocks denominated in currencies other than your home/base currency, you will be exposed to exchange rate risk.

Can I buy US stocks in pound or euros?

Yes, all modern trading platforms and investing apps will offer the ability to deposit in one currency and convert it into foreign currency like US dollars to buy foreign stocks. Once the trade is closed, the US dollars can then be converted back into GBP directly through the investing app. This of course also means you are exposed to exchange rate risk.

Investing in US stocks therefore offers the opportunity and risk for investors to be exposed to currency fluctuations. If you are long a US stock, and the US dollar depreciates against the pound, your US stock will be worth even less to you, even if the share price did not go down. Also be aware that there is a physical currency conversion charge to be paid when investing in physical shares, and following and converting currencies can become confusing.

On an LCG spread betting account all trades on all markets, including US shares, are denominated in GBP, keeping it simple for the user.

Watch this video to see the ease at which a trade is made in the LCG app.

Can I invest directly in US stocks?

You might be wondering How can I buy US stocks from oversea’s? Remember that in the digital age, shareholders will typically not have a physical copy of their share certificates. You can own the stocks, while the bank or broker takes custody of the certificates, either physically or digitally, and charges you a nominal quarterly fee for doing so (this process is called dematerialisation).

There are two options to consider when investing in stocks fromthe US. Taking ownership of the stocks directly – or using CFDs for speculation and avoiding direct ownership.

Read this blog on CFDs vs stocks to understand more about the differences between the two and which might be right for your investing journey.

Do Residents of the UK pay tax on US stock trading?

Always one of the biggest considerations for investing is what tax will be owed on any earnings. Naturally a concern for Brits investing in the US is the possibility of double taxation. Thankfully this is not the case.

As a so-called ‘non-resident alien’ i.e. a non-US citizen who doesn’t live in the United States, you would not be obligated to pay US capital gains tax – this would be paid in your home country of the UK. And if you open a spread betting account, there is not even any UK capital gains tax on your returns (subject to you being a UK resident for tax purposes).

However, even as a non-US citizen, Brits will be obliged to pay dividend tax – just like Americans. But don’t worry, this happens automatically. Every time a company pays you a dividend for owning their stock, the UK bank or broker will withhold the necessary tax and pay you the rest.

*** Note: LCG do not offer tax advice, taxes are subject to individual circumstances and are subject to change. Please consult your tax professional. Additionally, LCG are not investment advisers, therefore if you need an opinion on whether our products are appropriate, or suitable for your existing investment strategy, then you will need to speak to an independent advisory investment broker.

US stock market trading hours in BST (British Summer Time)

If you are investing in US stocks in the UK, one consideration will be the time difference and Stock Exchange opening/closing hours. When investing while residing in the UK time zone (GMT), you will not be able to buy or sell US stocks in the morning, only in the afternoon and evening due to the time difference…. Why watch TV when you can invest!

9:30 AM to 4 PM Eastern time (ET) on weekdays (except stock market holidays)

When do US stock markets open and close in UK time?

3:30 PM to 10 PM British Summer Time (Opens at 14:30 GMT+1 and closes at 21:00 GMT+1)

(GMT – Greenwich Mean Time) during winter (November to April) and (BST – British Summer Time) when its ‘Daylight Saving’ Time (May to October)

How to open a trading account to trade in the NYSE & Nasdaq

How to start trading? There are some simple steps you can take to trade in US stocks from the UK:

- Go to LCG.com

- Open a trading account (all LCG accounts have access to US stocks)

- Fund the account

- Research US stocks to buy (using the analysis section)

- Place the trade

Spread betting and CFD trading carry a high level of risk to your capital and can result in loss of your deposits. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 69% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

The information provided within this communication has been prepared by London Capital Group Limited (LCG) and is intended for informative purposes only. It is not intended for investment, or commercial advice or an offer or solicitation for the purchase or sale of any financial instrument. Any opinions, news, research, analysis, prices, other information or links to third-party contained within this communication is provided as general market commentary and does not constitute investment advice and is not intended for any form of commercial use. LCG shall not accept liability for any loss, damager including, but without limitation, to any loss or profit which may arise directly or indirectly from use of or reliance on such information.

The information in this article is not directed at residents of EU as well as Australia, Belgium, Canada, New Zealand, Singapore or the United States, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

London Capital Group (LCG) is a company registered in England and Wales under registered number: 3218125. LCG is authorised and regulated by the Financial Conduct Authority (FCA) under the firm reference number of: 182110. The registered address for LCG is: 80 Cheapside, London EC2V 6EE.

FTSE 100 rattled by poor Chinese data

The FTSE 100 fell on Monday following a disappointing set of economic data from China.

Chinese GDP growth fell to 4.9% year-on-year in the third quarter whilst Industrial Production fell to 3.1%, well below the 4.5% estimated by analysts.

“The FTSE 100 dipped on Monday, losing some of its recent momentum as China’s GDP figures for the third quarter disappointed,” says AJ Bell investment director Russ Mould.

Mould also highlighted the factors driving the weaker economy in China in supply chain problems and power issues similar to those be experienced in many other economies around the world.

“The problems facing the Chinese economy are familiar ones of supply chain issues and power shortages,” said Mould.

Miners managed to surprisingly shrug off the poor Chinese data and the top FTSE 100 faller was International Consolidated Airlines, down 3.5%, as investor continued to fret over the strength of post-pandemic travel.

Despite the FTSE 100 giving up ground on Monday, the declines in London were not as damaging as those observed in Europe.

The German DAX and French CAC were both down over 0.5%.

UK FinTech, PropTech and EIS with Love Ventures’ Marcus Love

The UK Investor Magazine Podcast has the pleasure of presenting Marcus Love, a Partner at VC Love Ventures.

Love Ventures operate an EIS Fund that focuses on UK PropTech and FinTech companies.

We start by exploring the history of the fund and the founders who have a strong background in Angel Investing having backed some of the UK’s most successful FinTech companies of recent years including Revolut, which is now the UK’s highest valued private company.

Their early success led to the establishment of Love Ventures and a portfolio of UK FinTech and PropTech companies for their Love Ventures EIS Fund I.

There is consideration paid to the key themes they see opportunity in and the tax benefits available to High Net Worth Individuals and Sophisticated Investors.

For more information, please visit Kemeny Capital or Love Ventures.