Poolbeg Pharma is a spin-out of non-core pharma assets from Open Orphan (LON: ORPH). These are all early-stage assets and Open Orphan did not want to spend money on them.

Poolbeg’s strategy is to reposition products with existing positive clinical safety data. It will undertake trials so that sufficient data is collected to make the treatments attractive to larger pharma companies with more cash to invest.

There will be multiple treatments developed so that they are ready for phase II trials, that will then attract licensing or partnering. POLB 001 is already phase II ready and further investm...

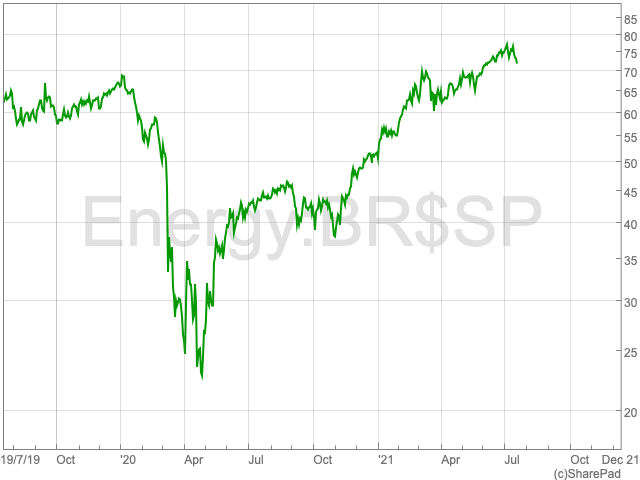

OPEC+ reaches agreement over deal to increase oil supply

Brent crude oil is down by 2.26% to $71.64 per barrel

OPEC and its allies have reached an agreement to increase oil supply in an effort to keep soaring crude oil prices under control.

The group will now pump an additional 400,000 barrels per day each month during August, increasing output by 2m barrels per day by the end of 2021.

The monthly increases will rise next year, as OPEC+ confirmed it has extended the deal from April next year to December 2022.

During the pandemic, OPEC and its allies slashed production by 10m barrels a day as the downturn saw a collapse in demand for oil and prices.

However, as economies are reopening, the price of oil is surging again, which is leading to inflationary pressures and brining the recovery of the world economy into doubt.

Brent crude oil is down by 2.26% to $71.64 per barrel, while West Texas Intermediate also slipped by 2.24% to $69.85.

Saudi Arabia’s energy minister Prince Abdulaziz bin Salman said the deal proves that the group is able to strike agreements and gives more certainty over the future.

“This agreement should give market participants comfort that the group is not headed for a messy break-up and will not be opening up the production floodgates any time soon,” Helima Croft at RBC Capital Markets told The Times.

UK house prices rise again as homebuyers seek outdoor space

The average price of a UK home now stands at more than £338,000

The average price of UK homes coming to the market increased by 0.7% between the middle of June and early July, compared to the month before.

It is the biggest rise in UK house prices for the time of year since 2007, despite the stamp duty holiday being scaled back, according to data from Rightmove.

The average price of a UK home now stands at more than £338,000, an increase of more than £21,000 over the past six months.

The price surge has come about thanks to a number of factors. First, people are demanding larger properties with outdoor space as they are spending more and more time at home. There is also a narrowing of supply on properties following an extended hot-run thanks in part to the government’s stamp duty holiday.

While the housing boom has supported the UK economy during a downturn, it has also exacerbated wealth inequality between those who own homes and those who don’t.

Properties with four bedrooms and above are seeing the biggest imbalance in supply and demand, while homes with two bedrooms and fewer had an unchanged number of new sellers.

John Eastgate, Managing Director of Property Finance at Shawbrook Bank, commented: “The exceptional times in which we find ourselves makes any analysis of short term movements in house prices more than challenging. Extreme demand, extreme stimulus and a dearth of supply have created a unique scenario.”

“But if we look longer term, history shows us that the housing market has a long-term pattern of strength and resilience. While the ending of lockdown and the Stamp Duty Holiday will naturally lead to a slowdown in activity levels, a supply/demand imbalance and continued commitment to move from buyers will help to ride out any significant drop-off in activity.”

Freedom Day gives no cause for celebration for the FTSE 100

Freedom Day, 19 July, is finally here, but the UK stock market is not in a celebratory mood. The FTSE 100 is down by 1.94% during the morning session 6,872.38, well below the 7,000 mark it worked so hard to get above earlier this year.

“There is no ticker tape parade, cheers from the rooftops or people dancing in the streets as Freedom Day finally comes,” says Russ Mould, investment director at AJ Bell.

“Many of the stocks leading the UK stock market downwards are related to travel and leisure, suggesting that investors are extremely worried that we’ve lifted restrictions too soon and that another lockdown could be a month or two round the corner,” Mould added.

Covid is on the rise again and air travel firms, restaurants and other leisure companies may not get the positive summer period they have been crossing their fingers for. “The fact Cineworld is down 8%, Carnival falling 7% and Restaurant Group 4% implies that investors think the reopening trade is now a dud,” said Mould.

While many have been vaccinated, they are also finding out that the jab does not make them invincible, as cases begin to rise, or people are getting told to go into isolation.

“Pictures from UK airports would suggest some increase in flying but certainly nowhere near the levels one might have expected a few months ago. Then, everyone was talking about their big plans to celebrate once Freedom Day came around, and now it’s proved to be a damp squib.”

“The big concern for the market is whether we going to see a slowdown in the global economic recovery, and this could be the overriding force which results in a bad period for equities in the weeks ahead.”

FTSE 100 Top Movers

It’s never good news when only a handful for of companies are in the green. Today, on a dismal day for the FTSE 100, 3i Group, up 0.19%, is the only riser.

At the bottom end of the index out of the other 99 companies, Rolls-Royce (-4.25%), St James’s Place (-3.97%) and Glencore (-3.75%) are the top fallers on the FTSE 100.

Edison Group confirms senior appointments to drive technology and ESG expansion

Edison Group continues its expansion following a successful year

Edison Group, the international research and investor relations consultancy, confirmed on Monday that it has hired Paul Miller as CTO and Kelly Perry as head of ESG Client Services.

Paul Miller specialises in technology solutions, data management, e-commerce, and business process improvements, as well as founding a selling a number of companies. Miller has also consulted for and advised various companies undergoing technology transformations.

Miller’s role will involve overseeing the technology side of the company as it undergoes its own digital transformation, Edison said in a statement today.

Paul Miller, CTO, Edison Group, commented: “In today’s market, technology is at the cornerstone of any business. For a company like Edison, it is critical to ensure clients, readers, and other stakeholders are able to access the valuable market information they need in a timely manner, all the while making all the internal processes as efficient and smooth as possible.”

Kelly Perry joined Edison from the London Stock Exchange, where she focused on privates markets fundraising, in addition to being a member of WIN (Women inspired Network).

Before her time at the London Stock Exchange, Perry worked at Cowen and Company, leading Corporate Access across the US and Europe. She is also actively engaged with the CFA Institute ‘ESG Investing’ programme.

The appointment of Kelly Perry to head of ESG Client Services falls closely with Edison Group’s continued expansion and focus on its ESG offering.

In her role, Kelly will lead the firm’s efforts to commercialise ESG solutions and integrate them across existing Research and Investor Relations, Edison said in a statement on Monday.

Kelly Perry, Head of ESG Client Services, Edison Group said: “ESG is the fastest growing area of Capital Markets, with ESG funds on track to hold more assets under management than their non-ESG counterparts by 2025. Rapidly becoming one of the most important factors for companies when engaging with investors.”

“As scrutiny around ESG shows no sign of slowing, financial market participants will continue to hold sustainability at the centre of their decision making,” Perry added.