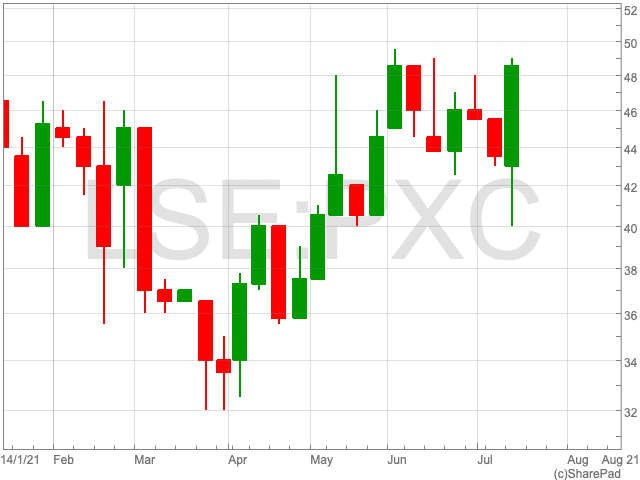

Phoenix Copper Share Price

The Phoenix Copper share price (LON:PXC) increased by 16% on Wednesday as the miner made an announcement regarding its Deep Sulphide core drilling programme. The move follows what has been a volatile past six months for the copper miner, which has added 6.55% over the time period. Unlike most companies in the UK, Phoenix Copper saw its share price surge when the pandemic came into effect, in line with the value of the red metal that it mines, as its name suggests.

Sulphide-Rich Mineralisation

Phoenix Copper confirmed via an update on Thursday that sulphide-rich mineralisation had been intercepted below the copper oxide open pit at the Empire mine in Idaho.

The ‘Empire Mine’ was historically mined until the early 1940s at head grades of up to 8% copper. The first drill hole of around 20 has been completed of the 4,500-metre 2021 Deep Sulphide drilling programme.

“These are exceptional results from the first drill hole, suggesting potentially elevated grades of copper, as well as the presence of gold, silver, zinc, lead and perhaps molybdenum by-products. It reinforces our geological model that the deeper Empire underground deposit represents a major ore system, which we are only just beginning to evaluate and understand,” said Ryan McDermott, chief executive of Phoenix Copper.

Phoenix Copper said said further drilling was required to define true thickness, while samples were being logged and prepared for shipping to assay laboratories.

Copper

While the price of copper soared when the pandemic took a stranglehold of the world economy, it has been underperforming over recent weeks. The price of copper reached an all-time-high in May, getting above $10,802 per tonne, before its recent retreat. Investors in the red metal and companies that produce complementary goods will be wondering if and when it is going to see a reversal in its fortunes.

A number of analysts are estimating that the price of copper will rise significantly this year and during Q1 of 2022. Specifically, Michael Widmer, Bank of America commodity strategist, believes that copper could rise to $13,000 per tonne. Widmer added that copper could hit $20,000 per tonne by 2025.

“The world risks running out of copper” amid widening supply and demand deficits, according to Bank of America.

“If our expectation of increased supply in secondary material, a non-transparent market, did not materialize, inventories could deplete within the next three years, giving rise to even more violent price swings that could take the red metal above $20,000/t ($9.07/lb).”