Deliveroo said its riders are self-employed and therefore not entitled to the rights of “workers”

Deliveroo came out victorious following a legal battle over the employment status of its riders as judges dismissed a trade union’s appeal.

The London-listed food delivery company made the case that the riders are self-employed and therefore not entitled to the rights of “workers”.

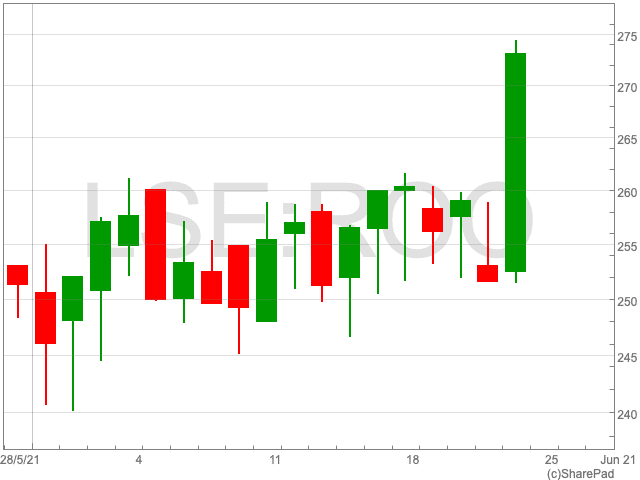

The fact that Deliveroo successfully defended its business model also cheered investors with the Deliveroo share price climbing rapidly, up by 8.5% in afternoon trading.

The legal case dates back to 2017, and was brought by the Independent Workers Union of Great Britain (IWGB), which represents gig economy workers.

However, a number of rulings, held up by a trio of Court of Appeal judges, have found that they cannot be considered “workers” under trade union law.

“Deliveroo has consistently argued in court that the way it engages with its riders means that they are self-employed and so should not be classed as workers,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. “Now the company has won the latest skirmish in its legal fight with judges dismissing an appeal, ruling that because riders are not in an employment relationship with the company, they could not form a collective bargaining unit.”

“The company’s success appeared to hinge on the fact riders are able to ask another person to take on a job for them. This was the crunch factor which led to the UK Supreme court ruling that because of the lack of substitution rights, Uber drivers should be classed as workers.”

“Concern about the company’s reliance on the gig economy model was one of the factors which contributed to its disastrous IPO in March,” Streeter added.

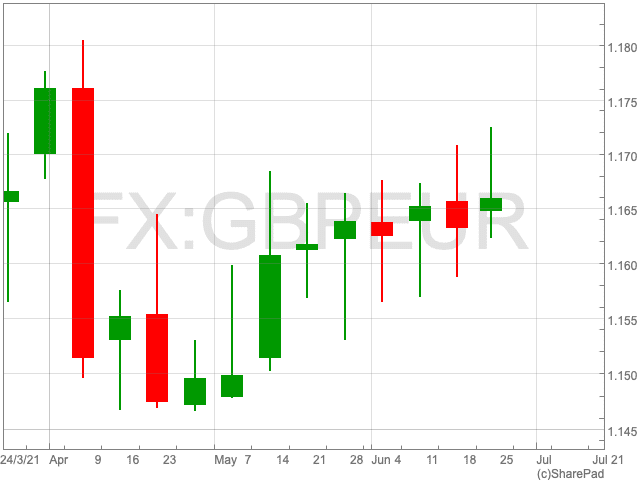

Since the end of March, the Deliveroo share price is down by over 5%, following a disastrous IPO.

The battle for improved working rights being fought by contractors is far from over with a European Commission review of how the gig economy operates still underway.