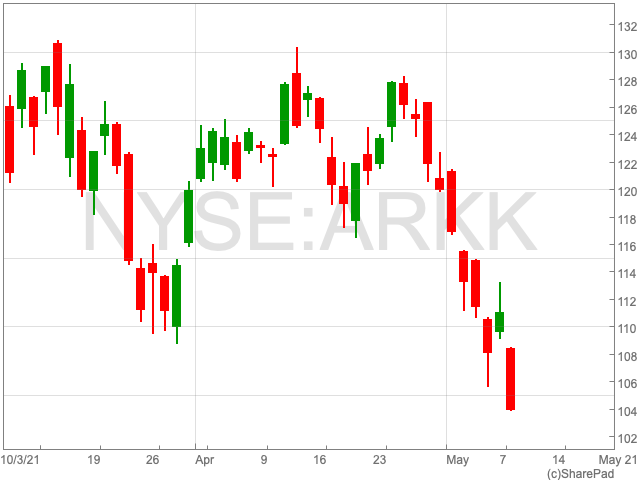

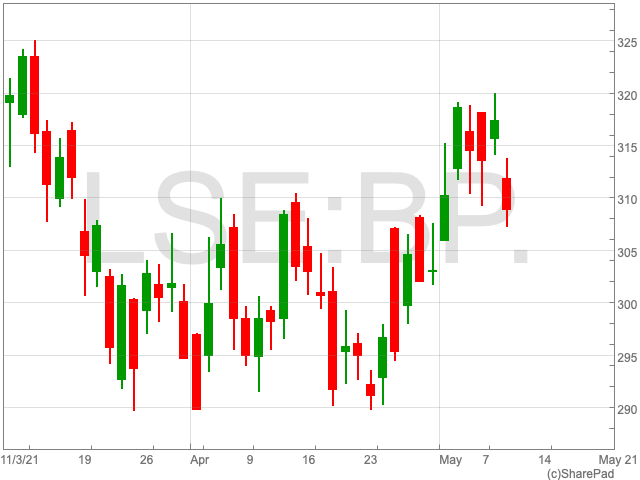

BP Share Price

The BP share price (LON:BP) is down by 2.09% on Tuesday following a period of solid gains in April when it reached as high as 318.5p. The FTSE 100 oil giant’s upwards movement came alongside increases in the price of Brent crude oil and West Texas Intermediate. Over a longer period BP’s share performance holds up well. Since the beginning of the year its stock value is up by 21.4%. With the company’s much anticipated annual general meeting tomorrow, and its recent announcement of its intention to buy back shares, investors will be paying close attention.

Annual General Meeting

BP’s annual meeting is scheduled for tomorrow, Wednesday 12 May, when there will be calls for the oil giant to redo its carbon emissions plan to make more significant reductions which more closely follow the Paris Climate Accord. While BP’s aim is to slash its production by 40% by 2030 in line with its net-zero target, along with increasing its renewable capacity, its emissions are expected to rise over the same period of time.

There is controversy heading into the meeting as prominent investor group, Calpers, decided to vote against BP’s climate resolution.

BP has previously said that its plan is in keeping with the goals of the Paris Climate Accord, saying it “consistent with the Paris goals” and was a drastic shift from the past. It added: “Going back to the drawing board on strategy, targets and aims would disrupt our business plans” as it rallied its shareholders to vote against the resolution.

While redrawing its plans could negatively impact its financial future, not going further put off investors who want to see a commitment to action in emissions. Whatever the outcome it will be interesting to see the response from investors.

Reduced Debt and Share Buybacks

In an effort to impress investors, BP stated its commitment to buying back shares this year as the company reduced its debt levels quicker than anticipated. The news came as BP announced earlier this month that it expects to reach its $35bn net debt target in Q1 of 2021.

The estimate is a result of earlier-than-expected proceeds from disposals and a “very strong quarter”, the oil company said last week. At the end of 2020, BP had a debt pile of $39bn. The company previously expected to reduce its debt to $35bn by as late as 2022.

“With the acceleration of divestment proceeds, together with strong business performance and the recovery in the price environment, we generated strong cash flow and delivered on our net debt target around a year early,” said Bernard Looney, chief executive.