Dignity (LON: DTY) is reporting its first quarter figures on Monday. They should show some growth, but the significant information is likely to be about management / director changes and the strategy of the funeral services provider and crematoria owner.

Lower prices are partly offsetting the effect of the greater number of deaths in the first quarter of 2021. There should still be growth in revenues of around 10%. However, in the second quarter the prices will still be under pressure, not least from continued restrictions, but the number of deaths will be lower – particularly on a year-on-yea...

Nonfarm payroll way off forecasts for April

March’s nonfarm payroll revised down to 770,000 from 916,000

Nonfarm payroll figures came in well below expectations, rising by 266,000 on Friday, as the unemployment rate rose to 6.1%.

Dow Jones estimates had been for 1m new jobs to be added, in addition to an unemployment rate of 5.8%.

A number of economists had been expecting a higher jobs figure as there were signs that the US economy was getting back on track.

Markets gave a slightly negative reaction to the announcement, in a signal that investors expect the Fed is a long way from tightening its policy.

“It certainly takes the pressure off the Fed and takes an imminent rate increase off the table,” said JJ Kinahan, chief market strategist at TD Ameritrade. “We’re not going to see inflation in wages, and we don’t have as many people employed as we thought, so we have to keep the party going.”

In further bad news, March’s original figure was revised down to 770,000 from 916,000.

“I think this is just as much about a shortage in labor supply as it is about a shortage of labor demand,” said Jason Furman, an economist at Harvard University and a former Obama administration advisor. “If you look at April, it appears that there were about 1.1 unemployed workers for every job opening. So there are a lot of jobs out there, there is just still not a lot of labor supply.”

The beaten up leisure and hospitality industry saw thee most significant hiring gains, with 311,000 extra workers added, although thee sector still has 2.9m fewer people employed than pre-pandemic.

The Bureau of Labor Statistics also confirmed that among the major worker groups, the unemployment rates for adult men (6.1%), adult women (5.6%), teenagers (12.3%), Whites (5.3%), Blacks (9.7%), Asians (5.7%), and Hispanics (7.9%) showed little or no change in April.

The report comes amid robust growth that saw gross domestic product rise at a 6.4% annualized pace in the first quarter, and as many economists see a burst of 10% or more in the second quarter.

Robert Alster, CIO at Close Brothers Asset Management commented: “Every piece of the economic puzzle was building a picture of strong recovery and thriving growth in the US, but the employment data has proved a shocking outlier. With both nonfarm payrolls and unemployment coming in much worse than expected, the combination of a rapid vaccine rollout, hefty fiscal stimulus and ultra-easy monetary policy has not yet pushed the US economy into the clear.

“What’s more, the devil is in the detail. The Fed is keen to monitor inclusive employment, to ensure that the US doesn’t fall into the ‘K-shaped’ recovery trap. By using the ‘Powell dashboard’, the Fed has made it clear that true recovery means an improvement in Black employment, wage growth for low-income workers, and labour market participation for Americans without a college education – indicators that tend to lag the broader data. For those trying to read whether Yellen’s comments on a possible rate hike are predictions or hypotheses, it is these more nuanced metrics which require a watching brief.”

Baillie Gifford Positive Change Fund: a long-term option with high social impact

Investment in companies that integrate environmental, social and governance (ESG) factors continues to gain momentum on both public and private markets. ESG concerns underpin the majority of discussions around the future of the investment industry. Baille Gifford’s Positive Change Fund, launched in 2017, represents an option with a solid track record for those seeking to invest for the long term while also paying attention to the fund’s social impact

The Baillie Gifford Positive Change Fund seeks to outperform the MSCI AC World Index, by at least 2% per year over rolling periods of five years. In addition, it seeks to “contribute to a more sustainable and inclusive world”. The managers seek out companies that can deliver positive change in one of four areas: social inclusion and education, environment and resource needs, healthcare and quality of life.

Performance

Throughout the pandemic, the Baillie Gifford Positive Change Fund far outperformed its target benchmark with gains of 79.3%. Its impressive returns are a continuation of its form over the past four years, when it has far exceeded its index, target benchmark and the sector average in all but one year.

| 31/03/2016 31/03/2017 | 31/03/2017 31/03/2018 | 31/03/2018 31/03/2019 | 31/03/2019 31/03/2020 | 31/03/2020 31/03/2021 | |

| Class B-Acc | n/a | 29.3% | 11.0% | 15.9% | 79.3% |

| Index* | n/a | 2.9% | 11.1% | -6.2% | 39.6% |

| Target Benchmark** | n/a | 5.0% | 13.3% | -4.3% | 42.4% |

| Sector Average*** | n/a | 2.7% | 9.0% | -6.0% | 40.6% |

**MSCI AC World Index +2%.

***IA Global Sector.

Holdings

Tesla (7.96%), ASML Holding (6.78%) and Taiwan Semiconductor Manufacturing (6.55%) are the three companies that the fund is most invested in and have supported its impressive growth over the past 12 months.

With only 35 stocks, the fund is highly concentrated and therefore more susceptible to volatility, however, as seen over the past 12 months, it is also gives investors the opportunity to make outstanding returns.

Costs

The fund has an ongoing fee of 0.53%, which is pricier than other Baillie Gifford funds, but more affordable than many others which focus on sustainability. The managers are able to draw on the fund firm’s extensive research capabilities, and they conduct a separate positive change analysis for each stock before making decisions to invest.

Liontrust to launch ESG fund with a £150m IPO

Liontrust to reinvest fees to develop financial instruments covering UN Sustainable Development Goals

Liontrust, the specialist fund management company, is launching its debut investment trust, an ESG set for a £150m IPO.

Liontrust ESG, as the trust is named, will invest in mostly developed markets across the world, with holdings in 25 to 35 sustainable companies.

The Financial Times has reported that investment managers would be free to invest in smaller cap stocks due to the fund’s closed-ended nature, meaning there is less concern over short-term volatility.

Peter Michaelis, Chris Foster and Simon Clements, whom represent Liontrust’s sustainable investment team, will actively manage the trust’s portfolio.

According to research by Research in Finance, carried at at the end of last year, 78% of wealth managers and 71% of financial advisers have witnessed a growing number of clients looking for sustainable investments.

The trust managers will use a ‘sustainable future’ investment process, which according to the firm selects companies “helping to create a cleaner, safer and healthier world”.

Michaelis said: “We are excited by the opportunities that ESGT offers in being able to construct a high conviction portfolio with companies from across the market cap spectrum and our sustainable investment themes.”

“Key attractions include the wide opportunity set it provides as it is unconstrained by market capitalisation, a concentrated portfolio focused on the highest sustainability companies and the chance to invest a portion of the portfolio in small cap companies that we do not hold in our open-ended funds.”

“These stocks fit perfectly with our focus on the long-term drivers of the sustainable economy of the future.”

Michaelis also said that up to 10% of the management fee his company receives from ESGT would be used to fund research to identify and develop financial instruments covering those UN Sustainable Development Goals that are currently uninvestable.

John Ions, chief executive of Liontrust, added: “The intention to launch ESGT recognises the growing demand for sustainable investment as an increasing number of people want their investments to make positive contributions to society, the environment and the economy.”

Liontrust launched in 1995 and was listed on the London Stock Exchange in 1999.

IAG calls on UK government to take action on international travel

IAG calls on government action through four key measures

IAG, the owner of British Airways, has announced that it is “ready to fly” and is calling upon the government to implement action to resume international travel.

The airline company has called for “travel corridors without restrictions” between specific countries to respond to substantial pent-up demand among Brits.

It is thought that some holidays abroad could be allowed as England continues to come out of lockdown. The much anticipated “green list” of countries with the least travel rules is expected to be announced soon.

IAG, owner of a number of airlines including BA, said it is “doing everything in our power to emerge in a stronger competitive position.”

“We’re absolutely confident that a safe re-start to travel can happen as shown by the scientific data,” said Luis Gallego, IAG chief executive.

The entire industry is eagerly anticipating further information of the government’s traffic light system. Gallego has called on the government to take action via four key measures.

The measures IAG demanded are as follows:

- Travel corridors without restrictions between countries with successful vaccination rollouts and effective testing such us the UK and the US

- Affordable, simple and proportionate testing to replace quarantine and multi-layered testing

- Well-staffed borders using contactless technology including e-gates to ensure a safe, smooth flow of people and frictionless travel

- Digital passes for testing and vaccination documentation to facilitate international travel

In the meantime, IAG has increased its cargo-only flights over the last quarter to 1,306, up from 969 during thee three months before.

“Cargo has enabled us to operate a more extensive passenger long-haul network,” said Mr Gallego. “It generated €350m in revenue, a record for quarter one.”

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said that cargo offered “relief” to the airline, but the “pain of lost passenger bookings is severe”.

“British Airways owner IAG is still in emergency mode, battening down the hatches as global travel remains in limbo pushing bookings to a fraction of usual levels,” she said.

The IAG share price has rallied recently as passengers await further announcements by the government.

FTSE 100 hits fresh pandemic high on mining gains

On a hugely important nonfarm Friday, the European markets found themselves heading towards a basket of new highs.

As was the case earlier in the week, the FTSE 100’s mining stocks “did the UK index a solid”, according to Connor Campbell, financial analyst at Spreadex, propelling it to a pandemic peak thanks to all-time highs from iron ore and copper.

Adding another 35 points, the FTSE 100 is trading at 7,100, a price it last saw in late-February 2020. It is a sign of just how stark that month’s losses were, however, that the index still has 300-plus points to go before it has recovered all of its initial pandemic-plunge.

“The FTSE could’ve been even higher if the pound wasn’t also rebounding after yesterday’s Bank of England rollercoaster, adding 0.3% against the dollar and 0.1% against the euro,” said Campbell.

Over in the Eurozone the situation was similarly celebratory. The CAC continued to push beyond 6,330 as it added 0.3%, while the DAX was back above 15,300 for the first time in over a week following a 0.9% surge.

FTSE Top Movers

Melrose Industries (2.47%), Rolls-Royce (2.54%) and Anglo American (2.21%) were the top risers on the FTSE 100 at mid-morning.

While Antofagasta (-1.58%), BT Group (-1.24%) and Just Eat (-1.23%) are the biggest fallers on the index on Friday.

Copper

Copper hit a record high on Thursday as demand for the commodity soared on the back of a five-day holiday in China.

The copper composite nearly made it to $4.6, while copper for delivery in July was up 1.71% yesterday, with futures at $4.6 per pound ($10,123 a tonne) on the Comex market in New York.

Iron Ore

Iron ore reached its highest ever point on Thursday thanks to strong demand for steel in China. On Thursday, the benchmark S&P Global Platts IODEX, the spot price of 62% iron-fines delivered to China, was assessed at a record high of $202.65 per dry metric ton.

It trades up by about 27% from the price at the end of 2020, according to data from S&P Global Platts. “Appetite for steel has been far beyond expectations as China returned to work, helping iron ore fly past this historic milestone,” said Julien Hall, director of Asia metals price reporting at S&P Global Platts.

China sees huge growth in imports and exports during April

Chines exports rose sharply by 32.3% in April

China further improved its trade levels in April, as exports grew and imports hit their highest point in ten years.

The American economy recovered while other nations saw their factory production stall, resulting in increased demand for Chinese made goods.

Exports from the second largest economy in the world rose sharply by 32.3%, to $263.92bn, from the year before, according to China’s General Administration of Customs, surpassing analysts’ estimates of 24.1% and the 30.6% growth seen in March.

“China’s export growth again surprised on the upside,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management, adding that two factors – the booming U.S. economy and the COVID-19 crisis in India, causing some orders to shift to China – likely contributed to the strong export growth.

“We expect China’s export growth will stay strong into the second half of this year, as the two factors above will likely continue to favour Chinese manufacturers. Exports will be a key pillar for growth in China this year.”

The figures have helped to push the yuan and equities in China and nearby Asian markets up.

Imports also performed well, jumping by 43.1% from the year before, the most significant gain since January 2011 and up from the 38.1% growth seen in March. It also slightly exceeded the 42.5% rise tipped by a Reuters poll.

But Zhang Yi, chief economist at Zhonghai Shengrong Capital Management, said it is unclear if strong import growth, mainly a result of price inflation, will be sustained as China brings its fiscal policy support to a close.

“It must be noted that the fast year-on-year growth today was largely due to the negative growth a year ago. The two-year average growth was only about 10%, which is not that strong.”

Indeed, import volumes for some products are starting to level off. China’s iron ore imports fell 3.5% in April from a month earlier, while copper imports dropped 12.2% on the month.

Tui to offer £20 Covid PCR tests for travellers

UK government set to publish its much-anticipated traffic light system

Coronavirus tests for holiday goers could be as low as £20 under plans revealed today that are designed to encourage bookings.

Tui, the UK-based tour operator, said it would cut the price of PCR tests by more than 50% as concerns were raised over the cost of tests stopping people from booking vacations abroad.

The company will manufacture a number of packages to be distributed to passengers as of Monday, including one for £20 for people returning to the UK from “green” listed countries.

The package will consist of a rapid lateral flow test to be taken prior to boarding a UK-bound flight, in addition to a PCR test to be used within two days of getting back into the country.

Previous PCR tests for travellers have been priced at £45 or more.

The UK government is set to publish its much-anticipated traffic light system for overseas travel, as well as lifting the ban on foreign holidays.

As of May 17, holidaymakers will be able to visit a select group of “green” countries without needing to quarantine for up to ten days when they return to England.

Taylor Wimpey Share Price: will demand for homes remain if stamp duty holiday goes?

Taylor Wimpey Share Price

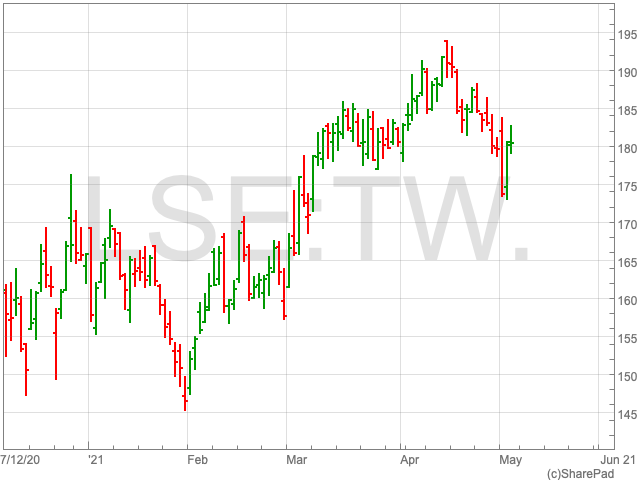

The Taylor Wimpey share price (LON:TW) went on a bit of a bull-run from the beginning of February, getting from 152p to 191.7p in mid-April. Since then it has dipped back down, although Taylor Wimpey shares are still up by 9.94% since the turn of the year. The FTSE 100 homebuilder remains some way of its pre-pandemic high of 232.4p.

Demand for Homes

According to Pete Redfern, chief executive of Taylor Wimpey, demand for homes is set to soar and not stop anytime soon. “I have more confidence than at any time in the last 20 years about underlying demand,” Redfern has said.

The Taylor Wimpey boss’s comments came as the company revealed its Q1 results at the end of April. The group revealed a “strong” pipeline, with the the value of its order book reaching £2.8bn, up by £140m from the year before, as at 18 April 2021.

However, concerns remain over the sustainability of these levels as the government is expected to remove some of the favourable policies geared towards the housing market during the pandemic.

Redfern sought to reassure investors who may be concerned about the possible end of the government’s stamp duty holiday, by playing down its influence on the high levels of demand in the housing market.

“I’m still of the view that the stamp duty holiday isn’t a big part of what we’re seeing,” he said. “What we’re seeing is driven by underlying demand.”

Outlook

Taylor Wimpey is expecting its volumes during 2021 to reach 85% to 90%, in comparison to 2019, while it is seeking to bring its operating margins up to 21%-22% over the course of the next two to three years. For this year the homebuilder is seeking a return to between 18.5% and 19%, which is significantly higher than its current margins of 10.8%.