Accsys Technologies (LON: AXS) is raising up to €37m to finance a new Accoya wood plant in the US. The achievable market in the US is at least 15 times the current level of international sales, which are constrained by a lack of capacity. Accsys has been quoted for more than 15 years and it is finally on the brink of making a significant profit.

A placing has raised €33m at €1.65 (140p) a share and the one-for-70 open offer could raise up €4m at the same price. The current share price is 150.75p.

Accoya &n...

Bank of England to hold interest rates as it anticipates quicker UK recovery

Bank of England has set its new growth target at 7.25% for 2021

The Bank of England confirmed on Thursday that it has upgraded its growth forecast for the UK while suggesting it will not increase interest rates in the near future.

This is despite the possibility of inflation rearing its head.

The most recent meeting of the central bank’s Monetary Policy Committee left interest rates unchanged at their coronavirus pandemic low of 0.1% in line with analysts’ expectations.

The Bank of England also kept its quantitative easing programme on hold at £895bn.

Its Monetary Policy Report stated that thanks to the vaccine roll-out, the UK is recovering from the biggest drop in economic output in over 300 years quicker than initial expectations.

The central bank has set its new growth target at 7.25% for 2021, up by 2.25% from its previous expectations, while output is down by 1.5% during the first quarter.

The report said: “GDP (gross domestic product) is expected to rise sharply in 2021 second quarter, although activity in that quarter is likely to remain on average around 5% below its level in the fourth quarter of 2019.

“GDP is expected to recover strongly to pre-COVID levels over the remainder of this year in the absence of most restrictions on domestic economic activity.”

Giles Coghlan, Chief Currency Analyst at HYCM, said: “On the face of it, today’s MPC meeting was unremarkable. Interest rates and asset purchases both remain the same, and these were the key headlines that investors and traders will have been watching.”

“However, looking at the minutes, it is important to note that the BoE has adopted a more optimistic outlook for the UK economy. They are expecting the country’s GDP to fall by less than forecast back in February, with the low Covid case numbers and success of the vaccine rollout clearly playing a big part in this. Crucially, there is an expectation that the estimated £150 billion of savings that consumers have accumulated over the past 14 months or so will steadily be released into the economy in the months ahead.”

“Uncertainty is dissipating, and we are seeing the GBP and FTSE 100 go on initial mild bullish runs immediately after the decision. In the medium-term, as lockdown measures ease, we could expect this trend to continue. Of course, the positive performance of GBP will be welcomed by holidaymakers; as many Britons prepare to travel abroad again later this year, the improved strength of sterling against the likes of the USD and euro will certainly help consumers,” Coghlan added.

Could Ethereum become the most popular cryptocurrency?

Survey says 68% of people would be most likely to invest in Ethereum

Ethereum, the decentralized, open-source blockchain developed by Vitalik Buterin in 2013, is becoming more and more popular. That is according to a recent survey, which said that 68% of people would be most likely to invest in the second largest cryptocurrency, behind bitcoin.

The survey also said that 18% of people would opt to invest in bitcoin, while 14% remain undecided. In addition, there are other indicators that Ethereum is becoming the most popular cryptocurrency in the eyes of investors.

Over the past seven days, data shows that there were 23,241 negative tweets about bitcoin, while there were 95,521 tweets with positive connotations. On Google, analytics show that “buy Ethereum” is currently outperforming “buy bitcoin” in terms of search volume.

Bitcoin remains a more prominent holding in more people’s portfolios. 37% of eToro customers own bitcoin, while 29% own Ethereum. Bitcoin’s market cap still far exceeds Ethereum’s too, although it is shrinking.

“For a long time, media coverage of cryptocurrencies was dominated by Bitcoin, dubbed ‘digital gold'”, Kryptoszene analyst Raphael Lulay observes. “The topics of decentralised finance and decentralised applications are currently gaining in importance, which seems to be working in Ethereum’s favour.”

Ether, the digital coin linked to the Ethereum blockchain, rose to an all-time-high of $3,456.57 on Tuesday, as the crypto continued a rally which has seen its value increase by over 350% in 2021.

Sergey Nazarov, co-founder of smart contract network Chainlink, commented on Ehtereum’s rise and influence.

“Thousands of developers are building applications that recreate traditional financial products in decentralized ways on top of Ethereum, and as more and more users pour in to interact with these apps, they require ETH (ether) to conduct any transaction,” he said.

“Second, there seems to be growing institutional interest in the public Ethereum blockchain, as stakeholders play around with ways to leverage the public network.”

Mast Energy Developments price target upgraded following operational update

Clear Capital Markets give a fresh near-term target price for the stock of 26p

Mast Energy Developments (LON:MAST), the UK-based developer of natural gas power plants, which featured in February’s UK Investor Magazine conference, today gave an operational update on its site development pipeline.

Upgraded Output Expectations

When Mast was set to IPO in mid-April, it said that its expected power output would be around 20MW within 6 months, while it was likely to increase as acquisitions were completed and visibility improved. On Thursday, Mast confirmed that its power output expectations are now between 54-58 MW.

MW 300 Power Capacity a Step Closer

Mast previously set a power generation target of 300 MW, which now looks achievable, according to Clear Capital Markets, the London-based wealth manager. Mast’s near-term probable capacity has risen sharply, while the company is in talks with additional developers with site capacities totalling a further 166 MWs.

Valuation and Recommendation

Clear Capital Markets believes that MED is “well positioned” to benefit from the changing UK power generation landscape while today’s announcement “further strengthens this position”. MED’s negotiation of an off take agreement for all the power it can supply for the next 15 years, reinforces this view according to the wealth management company.

MED listed on 14 April 2021 at 12.5p per share with a near term power generation expectation of 20MW. MED’s expectations have now risen to 54-58MW, along with a further potential 166MW coming down the track.

This is indicative of the management team’s industry expertise in Clear Capital Market’s view. Given all of the above, Clear Capital Markets gave a fresh near-term target price for the stock of 26p and reiterated its Buy recommendation.

Louis Coetzee, Non-Executive Chairman shared her delight that the company’s successful IPO and its ability to deliver on targets set out in the company’s prospectus. “We are, in particular, pleased with the fact that we remain confident that all the projects identified in the company’s working capital budget, as stated in the Company Prospectus, can be delivered within the said budget,” Coetzee said.

While Paul Venter, chief executive of Mast Energy Developments, analysed the company’s outlook.

“MED’s executive management and project team on the ground are experienced operators with a track record capable to deliver tangible outcomes based on experience in multiple jurisdictions. The building blocks of the platform and launching pad to achieve MED’s operational and commercial success in future are in place and MED’s team can now get on with the task in hand.”

“Having raised and received £5.54 million with key institutions and retail investors who have recognised the opportunity, we now look forward towards successful delivery of the projects in our project pipeline and imminent revenue generation.”

Outperformance of commodity shares will drive portfolio returns

Alan Green discussed the commodities super cycle on the UK Investor Magazine Podcast as it began at the beginning of 2021. Since then, major commodities indices have increased dramatically with copper touching 10 year highs and Oil breaching $70.

Demand for commodities is increasing as economies reopen after the pandemic and under investment in commodity exploration and development has caught supply off guard leading to higher prices. This is particularly evident in Lumber markets which has seen $25,000 added to the cost of constructing the average US home.

With the Federal Reserve hinting QE tapering is some way off, meaning interest rate increases won’t be happening for some time, the path is clear for further commodity price rises. We explore what this means for equity markets and how commodities shares could outperform over the next decade.

We discuss Mast Energy Developments (LON:MAST), Advance Energy (LON:ADV) and Caerus Mineral Resources (LON:CMRS).

View Clear Capital Market’s Research Note on Mast Energy Developments.

FTSE cautious of tapering talk ahead of Bank of England forecasts

Following Wednesday’s super-surge the European markets entered Thursday’s trading at a light jog. The FTSE 100 could only add 0.1% after the bell, though its reticence was understandable. For today brings May’s Bank of England meeting, one that comes complete with a fresh set of economic forecasts for the UK.

“From expectations of 5% growth in 2021 back in February, Andrew Bailey and the rest of the MPC are set to announce that the country will instead see GDP at 7% this year,” said Connor Campbell, financial analyst at Spreadex.

“However, those revised forecasts come with a potential catch. Much like in the US, the increasing strength of the UK economy’s rebound will cause the central bank to mull over tapering its current stimulus support.”

“Any hawkish signals could well send the FTSE 100 back below 7,000 – it’s currently at 7,060 – while leaving the pound primed to build beyond $1.39 against the dollar.”

FTSE 100 Top Movers

Next (2.9%), Pearson (2.55%) and Rolls-Royce (2.33%) are the biggest risers on the FTSE 100 at mid-morning trading.

At the bottom end, Admiral Group (-3.63%), Mondy (-2.75%) and Polymetal International (-2.10%) have seen the biggest falls.

Next

Next, the UK fashion outlet, increased its full-year profit guidance as it announced better than anticipated Q1 trading.

The FSTE 100 group, which has around 500 shops, in addition to an online presence, confirmed its central guidance for profit before tax in the 2021/2022 fiscal year is now at £720m, £20m more than what was forecast in April.

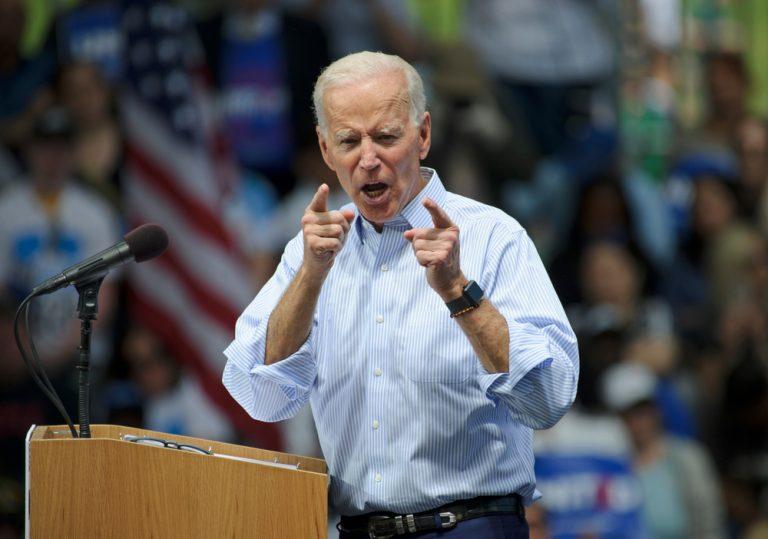

Biden backs waiving patents for Covid-19 vaccinations

Shares in leading western drugmakers down as Biden administration speaks out

Joe Biden has given support to an effort to temporarily waive intellectual property rights for vaccinations as a means of supporting the supply of vaccines to developing countries.

The President and his administration got behind calls for a temporary suspension of current rules as pressure to do so mounted. The Times has reported that Biden’s chief trade negotiator made the case for extra action as the nature of the pandemic so required.

Shares in a number of manufacturers of coronavirus treatments fell as the news emerged.

Katherine Tai, the US trade representative, said it would be in favour pf proposals to allow nations to override patent rights of medical products while the pandemic is ongoing.

The measure has now been backed by dozens of countries, as well as campaign groups and former world leaders, after it was first proposed by South Africa and India at the World Trade Organisation (WTO) last autumn.

Yesterday’s remarks by Tai represent a significant move towards the campaign coming to fruition after western economies, many of which are home to leading drugmakers, have not put their support behind it.

“The extraordinary circumstances of the Covid-19 pandemic call for extraordinary measures,” Tai said. “The administration believes strongly in intellectual property protections but, in service of ending this pandemic, supports the waiver of those protections for Covid-19 vaccines.”

Biden, whose campaign for the presidency last year featured support for a waiver, said he endorsed the move. Asked whether he backed the suspension, he told reporters: “Yes, I’m going to talk about that later today, yes.”

Shortly afterwards, Tai issued her statement. “As our vaccine supply is secured, the administration will continue to ramp up its efforts — working with the private sector and all possible partners — to expand vaccine manufacturing and distribution,” she said.

Next raises its profit guidance for second time

Next expects pre-tax profit for current financial year to hit £720m

Next (LON:NXT), the UK fashion outlet, increased its full-year profit guidance as it announced better than anticipated Q1 trading.

The FSTE 100 group, which has around 500 shops, in addition to an online presence, confirmed its central guidance for profit before tax in the 2021/2022 fiscal year is now at £720m, £20m more than what was forecast in April.

The news comes despite full price sales in the quarter to May 1 dropped by 1.5% compared to a year prior, before the coronavirus pandemic impacted its trading levels.

Next’s previous guidance anticipated Q1 sales falling by 10% for the same period in the 2019/20 financial year, however, it beat the forecast by £75m.

The group did show strength during the pandemic, thanks to its online sales, while some of its rivals, including Primark, have fared less well.

Next said first quarter retail sales from its stores were down 76% on two years ago, reflecting COVID-19 lockdowns, while online sales increased 65%.

Total full price sales in the last three weeks were up 19%, reflecting the recent easing of pandemic restrictions.

“Evidence from last year suggests that this post lockdown surge will be short lived, and we expect sales to settle back down to our guidance levels within the next few weeks,” it said.

Trainline confirms £100m operating loss as sales dive

Trainline’s volume of UK passengers fell to 5% at outset of pandemic

Trainline (LON:TRN) announced on Thursday that it made a £100m loss as lockdown restrictions across the UK caused its passenger numbers to dive.

Having made a £2m profit the year before, Trainline posted an operating loss of £100m, as net ticket sales dropped by 79% to £783m.

The FTSE 250 company saw its revenue fall by 74%, down from £261m to £67m at the end of February.

At the outset of the pandemic, Trainline’s volume of UK passengers fell to 5%, in what was the beginning of a very challenging year for the company.

It is possible that consumer demand for train travel remains low as companies are often sticking with their hybrid working approaches.

Russell Pointon, Director, Consumer & Media at Edison Group commented: “Lockdowns, social distancing and a year of working from home impacted domestic train travel exponentially over the last year. It is, therefore, not surprising to see Trainline posting a poor set of full-year results today.”

However, Pointon suggests that the measures the train company took during the pandemic could allow it to bounce back strongly.

“As the pandemic hit, the company put in steps to reduce cash flow, halting marketing efforts and utilised the government furlough scheme for its teams. This resulted in its average cash burn being reduced to £5 million per month, outperforming its initial guidance of £8-9 million. With all furloughed teams back at work and marketing programmes beginning to be ramped up again, the Trainline is looking to bounce back strongly.”

While chief executive Jody Ford gave his thoughts on how Trainline is adapting itself to the future.

“Our continued investment in product and tech through COVID-19 means, despite the ongoing COVID-19 uncertainty, we are well positioned to support the wider industry recovery and continue driving the market shift to online and mobile tickets,” chief executive Jody Ford said.

“Looking ahead I feel very confident about Trainline’s prospects for the future. We remain committed to championing rail as a greener mode of travel for millions of customers around Europe, and to driving the significant long-term growth opportunity for this business.”

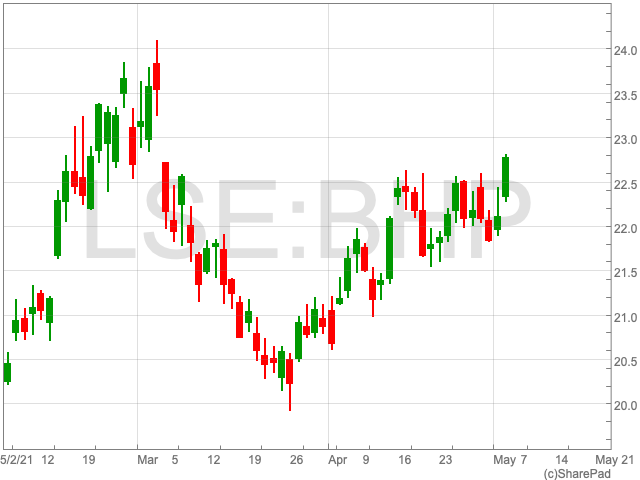

BHP Share Price: iron ore price to continue rising

The BHP share price (LON:BHP) performed relatively well during the pandemic, making a swift recovery and then getting far beyond its pre-pandemic level during 2021. Since the turn of the year the FTSE 100 mining giant is up by 18.6% to 2,302p.

Iron Ore

UK Investor Magazine outlined earlier this year that BHP’s performance would be dependent on the price of iron ore during 2021. While there was a possibility that the Chinese government could move to suppress the price of iron ore, so far, the commodity is close to an all-time-high. Iron ore has been getting near a record $200 per tonne, over double its price 12 months ago.

The price of iron ore is high because of soaring Chinese steal prices, as reported by S&P Global Platts, in addition to output reductions for environmental reasons boosting an already overheated sentiment.

The question now is whether or not iron ore has much further to go? China’s steel output grew by 16% year-on-year during Q1, which suggests demand for iron ore is likely to rise. Another potential cause of a fall in the price of iron ore is a global increase of supply. However, S&P Global Platts has suggested that both outcomes are unlikely and that “the market expects steel prices to continue rising, supported by falling steel inventories and robust orders”.

Analysts’ Views

Stockopedia has reported that out of 16 analysts covering BHP, three have given ‘buy’ recommendations, 12 have said to ‘hold’ and one gave the stock a ‘sell’.