Concurrent Technology (LON:CNC) 95p Mkt Cap: £71m

Yesterday, CNC reported its Finals to December 2020. At the operating level these finals seemed little effected by Covid although a reduced profit to £2.7m from £4.1m was report but its £5m EBITDA was about the same as last year, despite a 9% fall in revenue to £21.1m. Its EPS at 3.75p was down from 4.4pm which gives an historic P/E of 25x and as a show of financial strength the dividend was increased to 2.55p for a 2.7% yield. The gross margins are a healthy enough 53% and net cash increased at the year-end to £11.8m.

CNC is a...

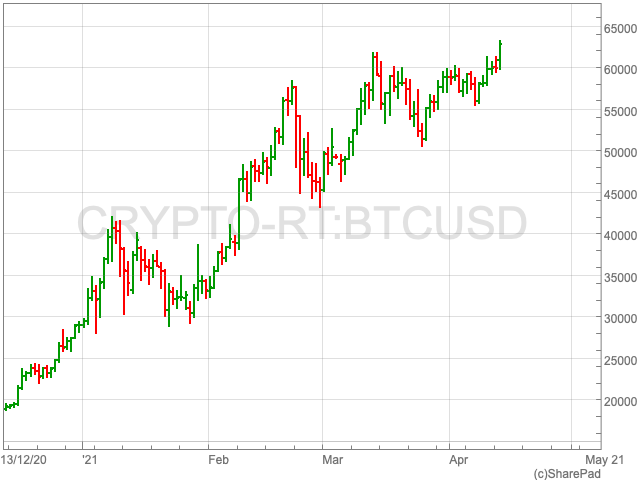

Bitcoin climbs above $63,00 to all-time high

Bitcoin record comes one day before Coinbase IPO

Bitcoin has set a new all-time high on Tuesday, surging above $63,000, before retreating slightly.

The pre-eminent cryptocurrency has been pushing up in recent weeks, and is up by over 7% in the last seven days.

The record has come just one day before crypto exchange Coinbase is set for its public listing on the Nasdaq. The company, which may have a valuation north of $100 billion, will begin trading on the Nasdaq under the ticker symbol COIN.

Circle Squared Alternative Investments founder Jeff Sica told FOX Business that Coinbase may be the most important IPO of 2021.

“I see this as a bridge between the disruptive decentralized cryptocurrency market and the traditional market,” Sica said. “This IPO will bring cryptocurrency to the forefront, take away some of the obscurity, and allow people to invest in what I believe is gonna be a very, very significant presence as an alternative currency in the future.”

Jason Deane, Bitcoin analyst at Quantum Economics said the price increase was inevitable.

“Bitcoin has been testing the resistance levels for some weeks now, each time bouncing off but immediately coming back undeterred.”

Today’s all time high was therefore all but inevitable as sheer market momentum, investor sentiment and accelerating rate of development act as primary drivers,” Deane added.

Just under a month ago, bitcoin broke the $60,000 mark, which brought its market capitalisation to $1trn. While in November 2020, the cryptocurrency surged to a three-year high of $17,891 – then its highest level since December 2017.

In further news regarding institutional adoption, the board at MicroStrategy is now being paid in bitcoin.

Per a company announcement, the Board of Directors “modified the compensation arrangements” for directors that were classified as non-employees. Such directors will receive “all fees” for their services in bitcoin instead of cash.

UK economy in ‘early stages of an economic recovery’ after growing 0.4% in February

UK exports to the EU surged by 47% during February, up to £11.6bn

The UK economy grew in February as businesses managed to cope with lockdown restrictions better as exports to the European Union recovered as well.

GDP increased by 0.4% following a 2.2% fall in January, according to figures from the Office for National Statistics (ONS).

A representative from the ONS commented: “Wholesalers and retailers both saw sales pick up a little, while manufacturing improved with car producers experiencing a partial recovery from a poor January. Construction grew strongly.”

Exports to the EU surged by 47% during February, up to £11.6bn, after a 40% drop at the beginning of the year as the Brexit transition unfolded to the detriment of trading levels. Goods coming in from the EU rose by 7.3% having fallen by 29.7% in January.

However, exports are expected to remain below 2020 levels while the economy is nearly 8% below its level prior to the pandemic.

The country took a beating from the coronavirus pandemic as the economy shrank by 9.8%, the biggest fall in more than three centuries and one of the most severe in Europe.

Commenting on UK GDP rising 0.4%, Douglas Grant, director of Conister, part of AIM-listed Manx Financial Group, said:

“The modest rise in GDP is a positive step towards showing signs of the early stages of an economic recovery. While the unemployment rate remains low, much of the country is reopened and vaccinations are administered extensively across the land, the economy has been like a coiled spring as lenders flush with liquidity in a low-yield environment prepare to deploy capital to support resilient business sectors.”

“Lenders and agile, resilient companies alike have been awaiting a directive on which sectors remain a Government priority and the introduction of a new recovery loan scheme (RLS) will provide the necessary catalyst many sectors need to living off an ever-increasing debt pile.”

The UK’s recovery is set to be quicker than anticipated over the next two years as the global economy rebounds from its worst recession since World War 2.

The International Monetary Fund (IMF) is forecasting that the UK economy would grow by 5.3% in 2021 and 5.1% the following year, which would be its fastest rate of growth since 1988. A year ago the UK economy shrank by 9.8%, the most severe recession since 1709.

FTSE 100 off to quiet start ahead of crucial US inflation reading this afternoon

With sterling nudging higher, rising 0.1% against the dollar and 0.2% against the euro, the FTSE 100 fell a further 0.3% to hit 6,880.

“Though the GDP reading for February missed estimates, at 0.4% the country’s economy still grew despite lockdown. Industrial and manufacturing production both exceeded expectations, while construction output also outstripped forecasts,” said Connor Campbell, financial analyst at Spreadex.

A game of tug of war ensued on the FTSE 100 according to Russ Mould, investment director at AJ Bell “as one team consisting of miners, financial and real estate couldn’t make any ground against the other team of energy, healthcare and consumer non-cyclicals”.

Next up is this afternoon’s CPI data. Analysts are expecting the standard figure to rise from 0.4% to 0.5% month-on-month, with the core reading up from 0.1% to 0.2%. “Anything higher than those estimates will likely set alarm bells ringing; anything lower will act as reassurance about the pace of building inflationary pressures,” said Campbell.

FTSE 100 Top Movers

Just Eat (2.72%), B&M European Value Retail (2.43%) and JD Sports (2.39%) are the day’s top risers so far midway through the morning session.

The biggest fallers so far on the FTSE are Experian (-1.36%), Rentokil Initial (-1.17%) and British American Tobacco (-1%).

Just Eat Takeaway

Just Eat confirmed today that it received 200m orders in Q1 of 2021, an increase of 79% compared to the same period the year before. UK customers placed the highest number of orders at just under 64m.

The FTSE 100 company suggested in March in its full-year earnings report that it would see Q1 order growth of over 42%.

JD Sports

JD Sports is expecting its profit for the coming year to surpass its level before the pandemic in its end of year report as the company announced it will be resuming its dividend payments. For the financial year ahead, ending in January 2022, JD Sports is expecting to make a profit before tax in the range of £475m to £500m, a rise from its previous forecast of £440m-£450m.

The FTSE 100 firm will pay out a final dividend of 1.44p per share, the same as in 2019, however it has not offered to return any of the government’s assistance even though JD Sports is ending the year with £800m in net cash.

Sosandar upside potential 48p says N+1 Singer

Sosandar sets record for revenue in March

Sosandar (LON:SOS), the online women’s fashion brand, has this morning announced that its Q4 revenue is at £3.94m, up 63% from the year before, as part of its trading update for the financial year ended 31 March 2021.

Customer activity rose each month during the fourth quarter with record revenue recorded in March, a 66% increase compared to January, and a 163% rise compared to the previous year when lockdowns made an impact.

The AIM-listed company put its performance down to “increasing level of consumer optimism as lockdown restrictions start to lift”.

The Company expects to report revenue of £12.2m, up 35% year on year, with the EBITDA loss reduced by over 60%.

N+1 Singer evaluated the company’s performance and put forward a fair value estimate:

“With net cash and a market cap of only £39m, we find the investment case compelling, especially with a clear path to profitability now in sight. It currently trades on 1.6x EV/Sales to Mar’22 on conservative estimates (vs. 2 year average of 2.2x).”

“Herein lies the opportunity as EBITDA margin expands. Our fair value estimate of 32p is derived using a regression based EV/Sales multiple of 2.6x. We see scope for this to increase to 48p in the event strong top line growth is sustained, which seems plausible, and to c50-85p over 3 years in our bull case,” the note said.

Ali Hall and Julie Lavington, Co-CEOs Sosandar added their thoughts:

“In what has been a year that no one could have possibly predicted, we are delighted to have shown resilience and our entrepreneurial spirit, overcoming challenges to deliver a significant improvement in revenue and reduction in EBITDA losses, together with the further diversification of our product range.”

“The progress we are making reflects the scale of our opportunity and growing demand for our unique offering in the market. The recent purchasing trends that we have seen from our customers point to a period of increased activity and we believe that our extensive product range can cater to their needs.”

JD Sports expects to beat pre-pandemic profit levels in coming year

JD Sports to reinstate dividend to same level as 2019

JD Sports (LON:JD) is expecting its profit for the coming year to surpass its level before the pandemic in its end of year report as the company announced it will be resuming its dividend payments.

For the financial year ahead, ending in January 2022, JD Sports is expecting to make a profit before tax in the range of £475m to £500m, a rise from its previous forecast of £440m-£450m.

The revised estimate has taken into account a number of recent acquisitions by the sports fashion brand.

For the year ended in January 2021, its sales came in at £6.17bn, slightly up from the previous year, While its profit before tax was £421m, in line with its estimates, and just shy of the £438m announced prior to the pandemic.

The FTSE 100 firm will pay out a final dividend of 1.44p per share, the same as in 2019, however it has not offered to return any of the government’s assistance even though JD Sports is ending the year with £800m in net cash.

Harry Barnick, senior analyst at Third Bridge commented on the strength of the results in the midst of the crisis:

“2020 has been a dire year for UK retail, with an unprecedented double-digit decline across in-store sales,” said Barnick.

“Against this backdrop, JD Sports has performed remarkably, reflecting some of the retailer’s key strengths. JD Sports has a relatively high share of online sales as well as a tight inventory management system and these factors softened the blow of 2020’s pandemic. It allowed sales to continue as stores were closed and supported gross margins, allowing the group to retain its high profitability from the prior year.”

“The next few months will be crucial for JD Sports as it seeks to capitalise on the forecasted pent up demand for retail.”

“Global apparel brands such as Nike and Adidas have been decluttering their distribution network, reducing the number of small and underperforming stockists they rely on. At the same time, they have been clear that they will partner more closely with large omnichannel retailers and JD Sports is likely to benefit from this trend.”

Just Eat says Q1 orders up 79% to 200m

Just Eat secures new partnerships with major brands in first quarter

Just Eat (LON:JET), the food takeaway service, confirmed today that it received 200m orders in Q1 of 2021, an increase of 79% compared to the same period the year before.

UK customers placed the highest number of orders at just under 64m.

The FTSE 100 company suggested in March in its full-year earnings report that it would see Q1 order growth of over 42%.

In European markets, where Just Eat competes with Uber, including in Germany, where orders rose by 77% to 39.2m, and the Netherlands, where orders were up by 53% to 15.3m.

Following Takeaway’s £6.2bn merger with Just Eat last year, the company has profited as a result of lockdown restrictions as people have remained confined to their homes.

Just Eat grew for the fourth quarter in a row having secured partnerships with a host of major brands including Leon, Starbucks and Costa.

Jitse Groen, chief executive of Just Eat Takeaway.com:

“The first quarter of 2021 marks our fourth consecutive quarter of order growth acceleration. Our fastest growing segment was the United Kingdom, and we are especially pleased with the roll-out of our UK Delivery network, which has reached an impressive 695% order growth rate year-on-year,” Groen said.

“We are also very proud of the acceleration in two of our highly profitable markets, with 77% order growth in Germany and 53% in the Netherlands. Just Eat Takeaway.com is in excellent shape and the start of 2021 has been very strong.”

London Stock Exchange sees best quarter for IPOs since 2007

12 IPOs raised £5.2bn on the main market, while on the AIM, eight listings earned £441m

The London Stock Exchange posted its best start to the year for IPOs in over a decade, despite a weak debut for Deliveroo.

Included in the list of stock floats alongside the food delivery company is Trustpilot, the consumer reviews site, in addition to a number of smaller-sized firms listed on the AIM. This is according to research by EY.

EY said that 12 IPOs raised £5.2bn on the main market, while on the AIM, eight listings earned £441m, in the most lucrative quarter since 2007.

The financial services company claimed that London is still the optimal place in Europe for companies to go public, despite Deliveroo’s poor start to trading. The food delivery company is down to 248p per share on Monday morning following its listing at 390p.

Scott McCubbin, an EY partner, commented: “The UK has had the strongest opening quarter for IPOs for 14 years, with the markets successfully weathering the effects of Brexit and bouncing back from the stall in activity caused by the onset of the pandemic a year ago. With an effective vaccine rollout under way, momentum and confidence in the UK IPO market should continue to build, but future growth may vary depending on the sector.”

Compared to the same period a year ago there is a sharp difference in the performance of IPOs. In Q1 of 2021 there were only three IPOs on the main market and only two on the AIM, raising a total of £615m.

Rishi Sunak recently paved the way for sweeping reforms of the stock market to attract more fast-growing companies to list in the UK. However, EY’s McCubbin warned that further action would be required in order to compete with America.

“Such a positive performance in the first quarter shows confidence in the strong fundamentals of the UK IPO market. While some believe there is a risk of compromising on current strengths if the UK seeks to adapt to bolster its tech status, the UK would likely have to make some significant changes if it were to rival the US in this area,” he said.

Shoppers flock to high streets as restrictions are lifted

Pubs, cafes and restaurants in England also able open for customers seated outdoors

Shoppers have rushed back to high streets across the country as a range of non-essential retail outlets have reopened their doors for the first time in over three months.

According to analysts at Springboard, the number of people out by 10am had more than tripled in comparison to the Monday before and was only 15% less than 2019 levels.

Despite snow falling and cold temperatures throughout, shopping centres reported the most significant increase in footfall, followed by the high streets.

Customers waited in queues on London’s Oxford Street early on Monday, outside stores such as Primark, John Lewis and Selfridges.

Pubs, cafes and restaurants in England are also able to open for customers seated outdoors.

Restrictions have been amended since the last time pubs were open, as people are no longer required to order a substantial meal with alcoholic beverages. Also, there is no 10pm curfew.

Commenting on the reopening of the food service industry, Mark Lynch, Partner at corporate finance house, Oghma Partners, said:

“The food service industry will be relieved that we have come through a tough shuttered winter and have now reached the start of the unlocking process. Whilst it is likely that only half of UK pubs will open due to lack of outside space, and restaurants perhaps an even lower percentage, the 12th April should, we hope, mark the first steps in the return of the industry to business as normal and the start of a painful rebuild of industry activity, cashflow and eventually balance sheets,” Lynch said.

“Undoubtedly we will see consolidation in the sector as the winners and losers from the recovery emerge. At this next phase of the crisis however, the focus is likely to be very much on supplying the customer and getting back to ‘normal’. What may surprise is the number of lessons learnt around cost and the positive implications that this could have for profitability which will, no doubt, emerge in due course.”