Ebiquity (LON: EBQ) non-executive chairman Rob Woodward is the latest director to buy shares in the media consultancy following the publication of its 2020 results at the end of March. He has invested nearly £15,000 in 41,759 shares at 35.9p each. That takes his stake to 147,280 shares. Woodward is a former boss of STV.

Chief executive Nick Waters, who joined last July from Dentsu Aegis, bought 50,000 shares at 32p each, which was his first purchase, while non-executive director Richard Nichols doubled the number of shares owned by him by buying 100,000 shares at 30.729p each.

Business

Ebiquit...

FTSE 250 recovers to pre-pandemic levels

The FTSE 250 has now recovered to its level prior to the coronavirus pandemic as the index jumped up today following the Easter break.

The index, which includes Royal Mail and Domino’s Pizza Group, is up 1.2%, or 261.81 points, to 21,994.48 on market closing.

Prior to when the stock market crashed in February 2020, the FTSE 250 peaked at just below 21,900.

The FTSE 100 also crept upwards, by 1.36%, getting above 6,800 on early Tuesday trading to 6,829.09, marking a four-month high.

Markets across the continent put in strong performances, albeit not as strong. The DAX was back above 14,500 following a 0.4% increase, while the CAC is nearing 6,050 once again after adding 10 or so points.

Optimism around a worldwide recover is ever-growing as employment numbers in the US, still the world’s largest economy, far exceeded expectations.

Closer to home, confidence is on the rise as prime minister Boris Johnson confirmed that the reopening of non-essential shops and pub gardens on schedule. Johnson added that there was no reason to to think that there would be any reason to delay the UK’s current roadmap out of lockdown.

UK to record fastest growth since 1988 according to IMF

UK recovery set to surpass expectations

The UK’s recovery is set to be quicker than anticipated over the next two years as the global economy rebounds from its worst recession since World War 2.

The International Monetary Fund (IMF) is forecasting that the UK economy would grow by 5.3% in 2021 and 5.1% the following year, which would be its fastest rate of growth since 1988. A year ago the UK economy shrank by 9.8%, the most severe recession since 1709.

The revised growth target means places the UK as the third fastest growing economy in the G7 behind the US and France, after it performed the worst in 2020. The global growth forecast has been raised to 6% this year and 4.4% in 2022, increases of 0.8% and 0.5% respectively.

The IMF said that its updated forecasts were a result of “additional fiscal support in a few large economies and the anticipated vaccine-powered recovery in the second half of the year”.

The world economy contracted by 3.3% in 2020, the deepest recession since the Second World War. This figure was minimised thanks to government support which amounted to $16trn across the world, in addition to interest rate cuts, quantitative easing and loans, the report by the IMF said.

The IMF said that the collapse during 2020 could have been three times worse without the aforementioned support by governments.

Out of the develop world, America will see the fastest recovery primarily as a result of the $1.9trn stimulus package by President Biden. The US is the only nation expected to surpass its pre-pandemic levels of GDP.

Other advanced economies will recover more slowly, with the eurozone and Britain expected to return to pre-crisis levels of GDP next year but remaining short of where they would have been under pre-crisis projections.

Unemployment is expected to increase to 6.1%, up from 5%, meaning 400,000 Brits would be out of work this year.

Nonfarm payroll figures far exceed expectations in March

Nonfarm payrolls rose by 916,000 last month

Job numbers soared in March at the fastest rate since last summer, as the vaccine roll-out continued apace along with robust economic growth.

The US Labor Department reported a surge in new jobs in hospitality and construction on Friday.

During March nonfarm payrolls rose by 916,000 while the unemployment rate fell to 6%.

A Dow Jones survey of economists anticipated a rise of 675,000 along with an unemployment rate of 6%. The figure for March was the highest since the 1.58m added in August 2020.

“It shows that the economy is healing, that those who lost their jobs are coming back into the workforce as the recovery continues and restrictions are lifted,” Quincy Krosby, chief market strategist at Prudential Financial told CNBC. “The only concern here is if we have another wave of Covid that leads to another round of closures.”

While the jobs added were spread across the US economy, they were particularly strong in areas impacted the most by the pandemic.

Nearly 7.9m fewer Americans are counted as employed in February 2021 compared to the year before, and the labour market is down by 3.9m people.

Leisure and hospitality, a sector critical to restoring the jobs market to its former strength, showed the strongest gains for the month with 280,000 new hires. Bars and restaurants added 176,000, while arts, entertainment and recreation contributed 64,000 to the total.

Despite its continued gains, the leisure and hospitality sector remains 3.1m below its total before the pandemic in February 2020.

Economists have outlined what the data could mean for monetary policy in the USA if the results show consistency.

“While the gaudy hiring numbers for March won’t lead to an immediate policy shift, if the economy puts together a string of months like what we’ve seen in March, it will only be a matter of time before expectations on the start of Fed tapering will move up to late 2021, also pulling forward market expectations for the first interest-rate hike into the latter part of 2023,” wrote Joseph Brusuelas, chief economist at RSM.

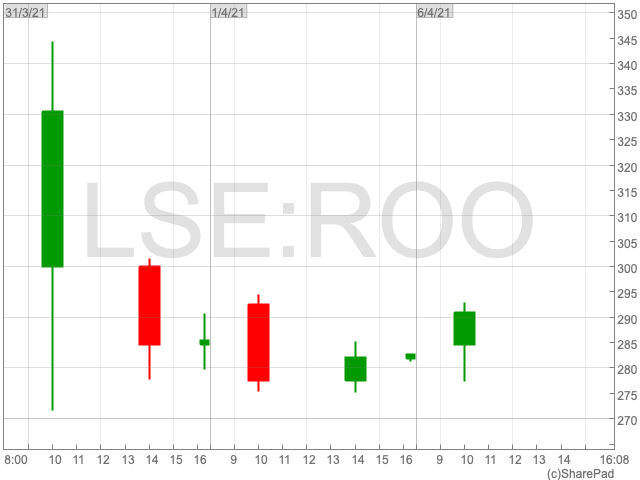

Deliveroo Share Price: what now after poor London debut?

Deliveroo Share Price

The Deliveroo (LON:ROO) IPO turned out to be a huge disappointment as shares plunged 26% in the company’s debut on the final day of March. It has since recovered somewhat although investors who got in early are still well down. The question now is whether the fall represents an opportunity for investors to get value by buying shares in the food delivery company.

Why did the Deliveroo share price perform poorly on its London debut?

There was a number of factors at play according to analyst Neil Wilson of Markets.com.

“In addition to the failure to bring several large funds on board, the dual-class share structure, regulatory uncertainty, general profitability concerns and a miscalculation by the bankers on the pricing in relation to wider demand in the market, it also looks like some hedge funds shorted the stock aggressively from day one.”

The dual-class structure, whereby founders could retain control via enhanced voting rights, particularly appears to have put investors off.

Sacha Sadan, director of investment stewardship at Legal & General Investment Management (LGIM), said that while the ruling is appealing to founders, it alienates investors. “If a client puts £1 in, why should they not get a £1 economic interest? Seems fair.

“It is important to protect minority and end-investors against potential poor management behaviour that could lead to value destruction and avoidable investor loss.”

Looking ahead

Deliveroo is not the first company to experience a rocky start. “Uber stocks fell more than 7% on its debut but, if you’d kept your nerve, you’d be up 20% today,” said Danni Hewson, financial analyst at AJ Bell.

“Facebook had a torrid year or so as a listed business but if you’d hung on from those initial lows your investment would be up by more than 10-fold today,” Hewson added.

Investors saw an opportunity in Deliveroo and the company hasn’t disappeared. It is still a rapidly growing company with ambitions to be a market leader. Now it has a point to prove. Will Shu, who founded the company in 2013 and remains as CEO, needs to show the country’s credentials quickly and publicly.

No decision made to restrict AstraZeneca vaccine

AstraZeneca share price down as Holland halts jab

Following reports that the UK’s medicines regulatory body is considering restricting use of the vaccine in younger people, it has now said no decision has been made on a regulatory action relating to the Oxford/AstraZeneca vaccine.

Channel 4 News said yesterday that the Medicines and Healthcare products Regulatory Agency (MHRA) was weighing up the possibility of imposing restrictions following concerns around blood clots.

“Two senior sources have told this programme that while the data is still unclear, there are growing arguments to justify offering younger people – below the age of 30 at the very least – a different vaccine,” the report said.

The two sources did however put their support behind the Oxford jab and said that restricting the roll-out could harm public confidence in it.

The MHRA’s chief executive Dr June Raine yesterday said that no decision had been reached and urged people to keep getting vaccinated.

“Our thorough and detailed review is ongoing into reports of very rare and specific types of blood clots with low platelets following the Covid-19 vaccine AstraZeneca. No decision has yet been made on any regulatory action.”

Professor Neil Ferguson of Imperial College London told BBC Radio 4’s Today programme on Monday that the clots raised questions over whether young people should get the jab.

“There is increasing evidence that there is a rare risk associated particularly with the AstraZeneca vaccine, but it may be associated at a lower level with other vaccines, of these unusual blood clots with low platelet counts,” he said.

“And so the older you are, the less the risk is and also the higher the risk is of Covid, so the risk-benefit equation really points very much towards being vaccinated. I think it becomes slightly more complicated when you get to younger age groups, where the risk-benefit equation is more complicated.”

The AstraZeneca share price is down 0.57% since market opening on Tuesday as the Netherlands became the latest country to stop rolling out the vaccine.

FTSE 100 catches up to US and China after Easter break

The FTSE 100 crept above 6,800 on early Tuesday trading to 6,829.09, up 1.36%.

“The FTSE 100 was playing catch up after the Easter break, enjoying strong gains after global stocks rallied hard on Monday, supported by strong US and Chinese economic data,” says AJ Bell financial analyst Danni Hewson.

Also helping the index was news from index heavyweight BP that it expects to hit its net debt target ahead of schedule – raising the prospect of more generous returns to shareholders.

“Travel stocks moved higher despite tourism chiefs voicing some disappointment with the plans announced for international travel from the UK yesterday,” Hewson added.

The rest of the week could see markets struggle for direction with relatively few big corporate announcements on the horizon.

FTSE 100 Top Movers

SSE (4.02%), Rolls-Royce (3.69%) and mining giant, Glencore (3.61%), led up the FTSE 100 at the beginning of the week.

At the bottom of the index, Ocado (-1.63%), Just Eat (-1.35%) and Rentoki (-0.98%) are the day’s biggest fallers so far.

BP

BP (LON:BP) announced on Tuesday that it expects to reach its $35bn net debt target in Q1 of 2021. The estimate is a result of earlier-than-expected proceeds from disposals and a “very strong quarter”, the oil company said today.

At the end of 2020, BP had a debt pile of $39bn. The FTSE 100 company previously expected to reduce its debt to $35bn by as late as 2022. The company plans to begin buying back shares once it reaches its debt target, and will provide an additional update upon releasing its Q1 results on 27 April.

Tesla

Away from the FTSE 100, Tesla shares (NASDAQ:TSLA) opened 7% higher on Monday as news emerged that the electric vehicle manufacturer exceeded expectations of its production and delivery figures.

At the end of last week Tesla confirmed it had delivered and produced 184,800 and 180,338 cars respectively in the first quarter of 2021. Analysts expectations were at around 168,00 vehicles for the period, according to data collected by FactSet. It was a record-setting quarter, exceeding the 180,570 deliveries completed in Q1 of 2020.

Tesla shares jump as Q1 results exceed expectations

Tesla could deliver 900,000 cars in 2021

Tesla shares (NASDAQ:TSLA) opened 7% higher on Monday as news emerged that the electric vehicle manufacturer exceeded expectations of its production and delivery figures.

At the end of last week Tesla confirmed it had delivered and produced 184,800 and 180,338 cars respectively in the first quarter of 2021. Analysts expectations were at around 168,00 vehicles for the period, according to data collected by FactSet.

It was a record-setting quarter, exceeding the 180,570 deliveries completed in Q1 of 2020.

Over the weekend, Daniel Ives, analyst at Wedbush, upgraded Tesla shares to outperform and increased its 12-month price target to $1,000, up from $950.

“In our opinion, the 1Q delivery numbers released on Friday was a paradigm changer and shows that the pent-up demand globally for Tesla’s Model 3/Y is hitting its next stage of growth as part of a global green tidal wave underway,” Ives wrote.

“We now believe Tesla could exceed 850k deliveries for the year with 900k a stretch goal, despite the chip shortage and various supply chain issues lingering across the auto sector.”

A February filing also revealed that Tesla’s saes in China more than doubled last year in the midst of the coronavirus pandemic.

The electric car maker’s sales in China came in at $6.66 billion — around a fifth of the company’s $31.54 billion revenues.

Tesla’s share price remains down by 5% since the turn of the year as the company has had a tough 2021 so far.

88 Energy releases “encouraging” operations update from Alaska

88 Energy uncovers various prospective zones

88 Energy (LON:88E) announced that the results from the Merlin-1 well were “very encouraging” for the potential at Project Peregrine, in the NPR-A region of the North Slope of Alaska.

Various prospective zones were uncovered, matching the shows and logs found while drilling, as part of the first go of the wireline programme.

The explorer said one of these zones is considered to be a new prospective horizon within the Nanushuk Formation that may be wholly within the Project Peregrine acreage and was not one of the pre-drill targets.

The other zone is interpreted to be shared with one of the zones in the Harrier prospect, to the north of Merlin.

The AIM-listed company said its initial observations indicated the presence of an oil signature in the fluid, which was followed by slugging of hydrocarbon and water. 88 Energy’s statement said this is often a precursor to hydrocarbon flow from the reservoir.

However, the company had to pull out of the hole for repairs before obtaining samples due to equipment failure.

After repairs were completed, the run back in hole encountered several sticky sections, but the sampling tool did not re-establish good communication.

A decision was made to move to the next shallowest prospective zone, which had exhibited good oil shows and petrophysical characteristics, but wellbore condition issues prevented a test as the tool became stuck.

The tool was freed but the risk of returning to that zone was deemed too high.

Not being able to sample these two most prospective zones does not preclude a discovery, 88 Energy noted, but analysis of sidewall cores and potentially further drilling may be required for confirmation.

Several samples were taken in zones interpreted to be less prospective on the way out of the hole, all of which contained low saturations of hydrocarbons, which will now be sent to a laboratory for testing.

The presence of hydrocarbons in these zones is considered encouraging for regional prospectivity but does not constitute a discovery due to the low saturation levels.

Managing director of 88 Energy David Wall commented on the company’s findings:

“We appreciate that these early results may be difficult to interpret. That is because we do not yet have all the data required to allow interpretation,” said managing director David Wall in a release.”

“This means some uncertainty remains; however, it is already clear that Merlin-1 has delivered by far the best outcome of any of the five wells drilled by 88 Energy in Alaska over the last six years.”

“The company is extremely proud to have been able to achieve this result from a wildcat exploration well drilled on sparse 2D seismic, 60kms from the nearest control well, in the middle of the Arctic winter.”