Nickel shares are set to enjoy the benefits of increased demand for their metals as the world moves to increase the adoption of Electric Vehicles (EVs).

The anticipated exponential growth in demand for EVs in the coming years will require a significant ramping up in the production of the metals essential for their manufacture.

Electric vehicles require huge amounts of cobalt, copper, lithium and nickel and demand for these metals has ticked higher inline with EV manufacturing.

Minerals used in EV, according to the International Energy Agency:

-Copper: 53.2kg

-Lithium: 8.9kg

-Nickel: 39.kg

-Manganese: 24.5kg

-Cobalt: 13.3kg

-Graphite: 66.3kg

The surging demand for these metals is most recently evident in the nickel price, which has recently hit the highest level since 2011 on the London Metal Exchange.

Nickel prices traded above $22,000 per tonne on the London Metals Exchange this week, having sunk to lows around $11,000 in March 2020.

The increasing nickel price is of course good news for nickel mining shares and could make them one of the foremost beneficiaries of the EV boom.

Nickel shares

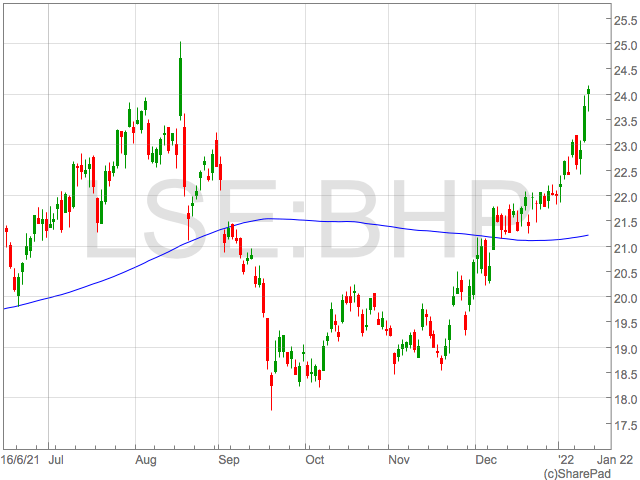

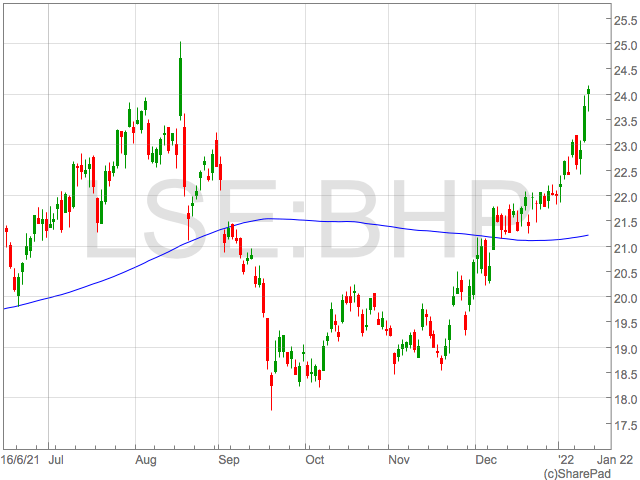

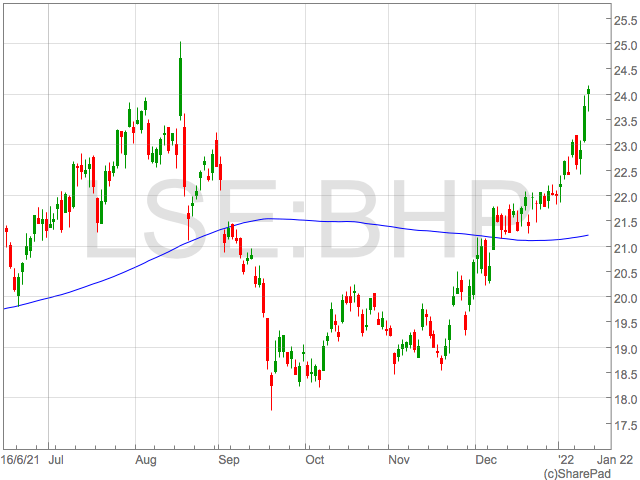

BHP Group (LON:BHP)

BHP is a highly diversified miner with global operations that produce copper, iron ore, potash and nickel.

BHP posted a 69% increase in underlying EBITDA to $37.4bn in 2021 on revenue of $60.8bn.

Nickel accounted for £1.5bn of this revenue in the period from their Nickel West asset in Australia.

Although BHP provides a relatively small exposure to nickel compared to their diversified production of base metals and fossil fuels, they have included nickel – along with copper and potash – as commodities they want to increase their exposure to.

In their 2021 results, BHP outlined forecasts of metal demand over the next 30 years as the world decarbonises to reach climate change targets.

BHP’s forecasts predict nickel demand will increase nearly 400% in a scenario where 1.5 degree targets are met.

Highlighting the importance the group places on nickel, BHP have recently announced a $100m investment into Tanzanian UK private entity, Kabanga Nickel.

Although BHP offers a marginal exposure to nickel currently, it has plans to ramp their nickel exposure up, and the FTSE 100 stock provides safety through their diversified portfolio of assets and attractive dividend yield.

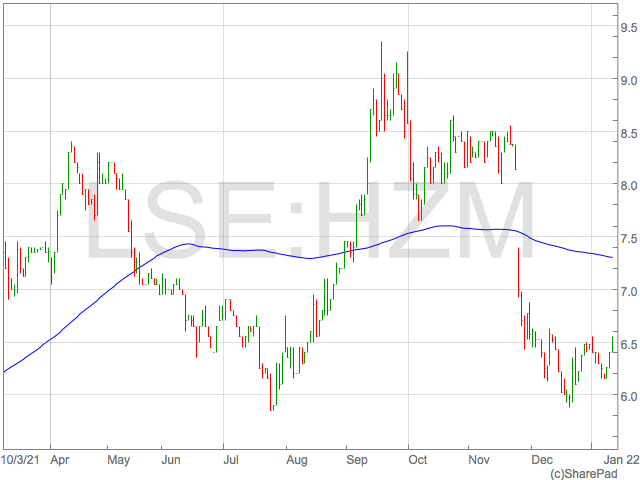

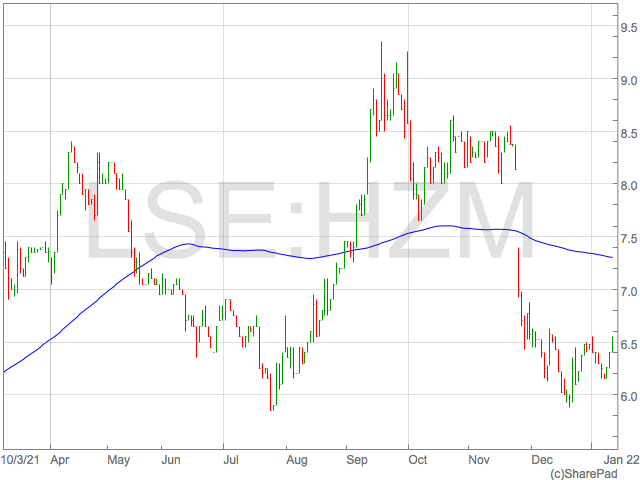

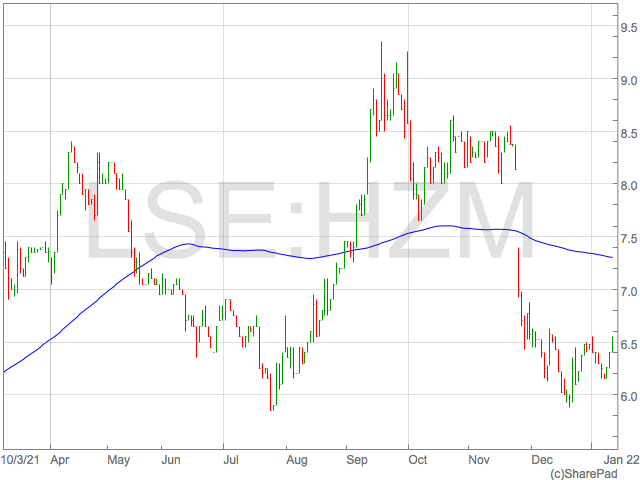

Horizonte Minerals (LON:HZM)

Horizonte Minerals is dual-listed on the TSX and London’s AIM and operates the Araguaia and Vermelho nickel projects in Brazil.

The company has conducted feasibility studies on the Araguaia projects and is working towards construction of a mine that could produce up to 29,000 of nickel per annum.

Horizonte’s Vermelho nickel cobalt project is being developed specifically to service the needs of the electric vehicle market and is currently undergoing feasibility studies.

In a tweet from the Horizonte Minerals account on 13th January, they said “At US$22,000/t #nickel Araguaia’s Stage 1 + Stage 2 NPV is US$2.23 billion.”

Their lack of revenues means investors are at risk of dilution should the company need to raise further funds in addition to funding packages already outlined by Horizonte. However, adventurous investors may stomach this risk given the firm has recently completed a £147m fundraise and the NPVs of their projects dwarf the current £245m market cap.

Horizonte Minerals is the purest play on nickel of the three nickel shares we have included.

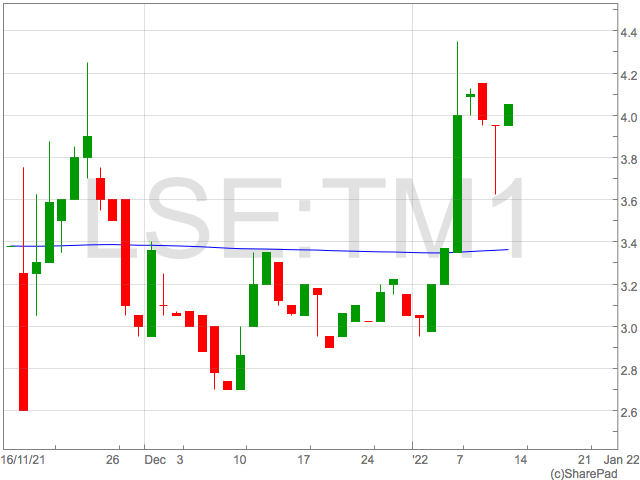

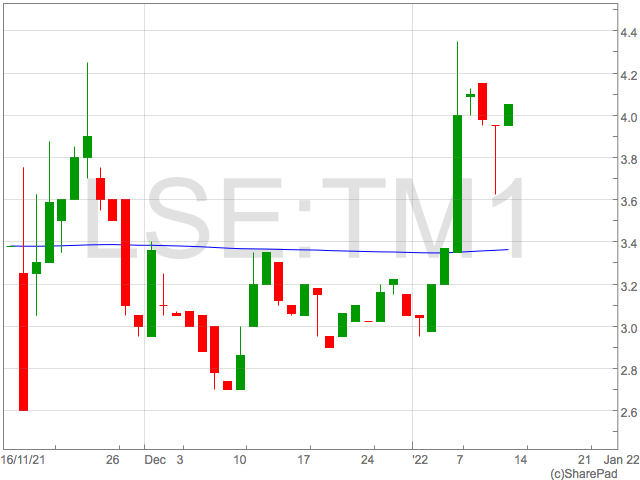

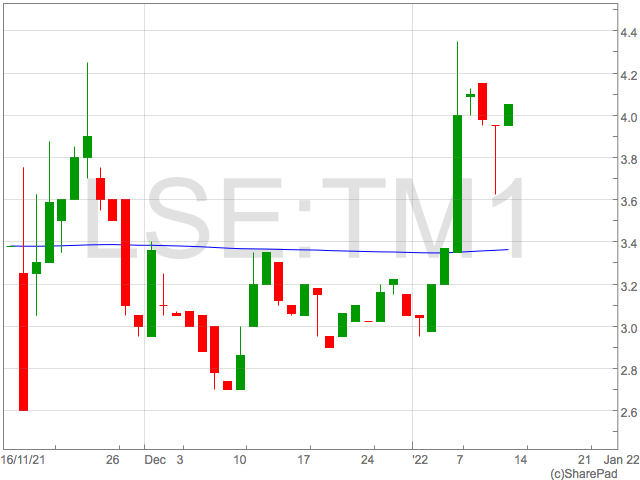

Technology Minerals (LON:TM1)

Technology Minerals have recently floated on the London Stock Exchange and provide exposure to all battery metals, including nickel.

Having raised approximately £5 million through their IPO, Technology Minerals plan to create a circular economy for battery metals in one group. This will involve the mining of battery metals through multiple projects and recycling of the metals through Recyclus Group. Technology Minerals has a 49% stake in Recyclus Group.

Technology Minerals is at the very early stages of establishing their operations but has commissioned a Competent Persons Report (CPR) for their project in Cameroon and has applied for exploration permits.

The CPR found three of five permits are considered prospective for nickel-cobalt-manganese mineralization.

The report makes similarities to the Nkamouna in southeastern Cameroon operated by Geovic Mining Corp where 120.6 Mt @ 0.65% Ni, 0.23% Co and 1.35% Mn has been identified.

Technology Minerals’ nickel journey is just beginning and may face bumps in the road, however, the overall business model will interest those looking for exposure to the EV and clean energy market, when compared to other nickel shares.