Growth Expected in 2021

China was the only major global economy to post gains during 2020, as it recovered quicker than the rest from the pandemic-induced slowdown. China recorded a growth rate of 2.3% last year, albeit its weakest performance in 44 years. Having scrapped its target for 2020, the country is aiming for a growth rate in excess of 6% for 2021.

With China set to overtake America as the largest economy in the world, foreign investors are increasingly keen to get a share of the pie.

Will Hobbs, chief investment officer at Barclays Wealth Management & Investments said Chinese equities are an important part of diversified multi asset class funds and portfolios.

“At the most basic level, in investing in a diversified mix of assets investors are trying to harvest the gains from future innovative breakthroughs,” Hobbs said.

“The lesson from history is that there is no requirement for such breakthroughs, or indeed their primary beneficiaries, to come from a particular country or political creed.”

“In this context, exposure to Asian companies is a vital part of the design of this net – focusing all your efforts on one particular country or other means you risk missing important parts of the catch.”

Fidelity China Special Situations PLC and Matthews China Small Companies are newly established funds with exposure to the Chinese economy. Both performed well during 2020 and could be of interest to investors seeking to gain from the inexorable rise of the Chinese economy.

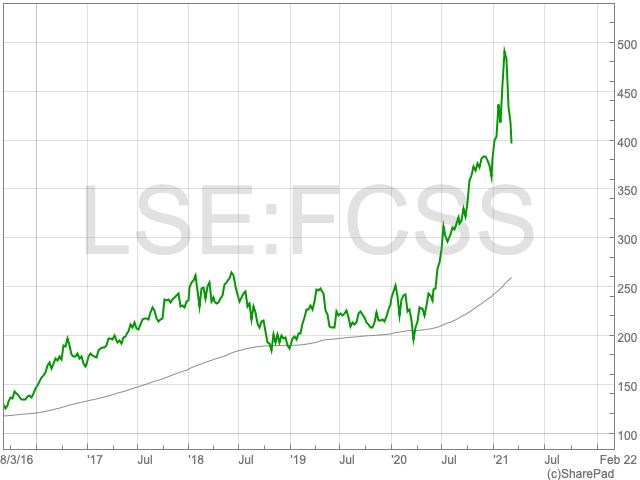

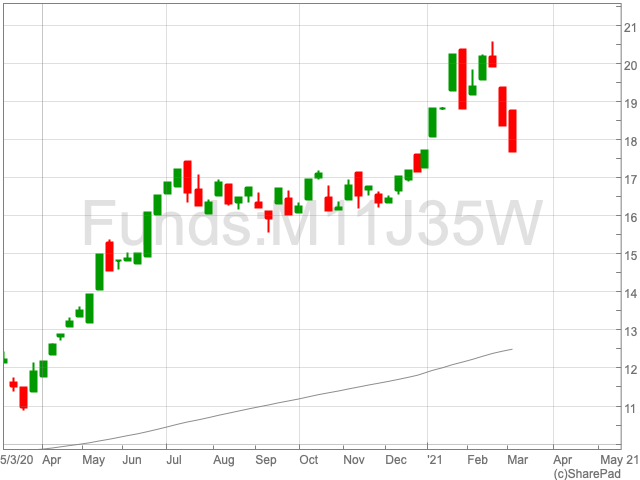

Fidelity China Special Situations PLC

Fidelity China Special Situations PLC consists of an actively managed portfolio made up primarily of securities issued by companies listed in China and Chinese companies listed elsewhere. Over the 12 months to 31st January 2021, the trust’s NAV recorded a 75.9% return, outperforming its reference index, MSCI China Index, which delivered 40.2%. The trust’s share price rose by 92.7% over the same period. Over a five-year period the trust’s share price is up by 270.6%.

The top 10 asset holdings make up 46.07% of the fund’s total, with Alibaba (8.09%), Tencent (8.09%) and Hang Seng China Enterprises Index Future (4.72%) forming the top three. However, one of the trust’s key aims is to seek out companies which are not well understood by the market, and are therefore undervalued. 25.3% of the trust’s holdings are in the consumer cyclical sector while 16.93% and 11.51% are in communications services and industrials respectively. The Fidelity China Special Situations PLC paid out a dividend of 4.3p for 2020, up slightly from 4.25p the year before.

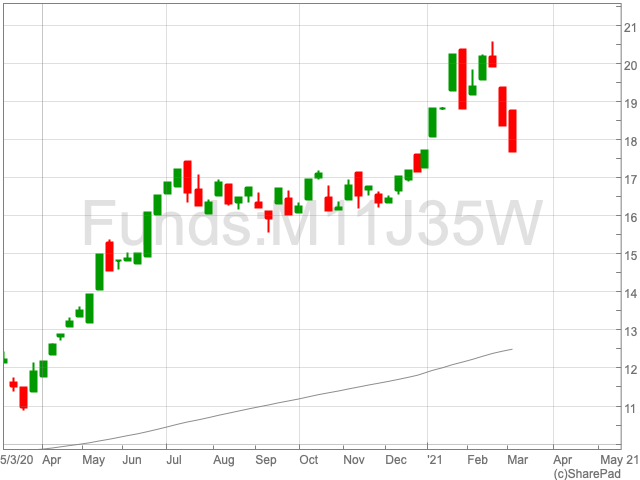

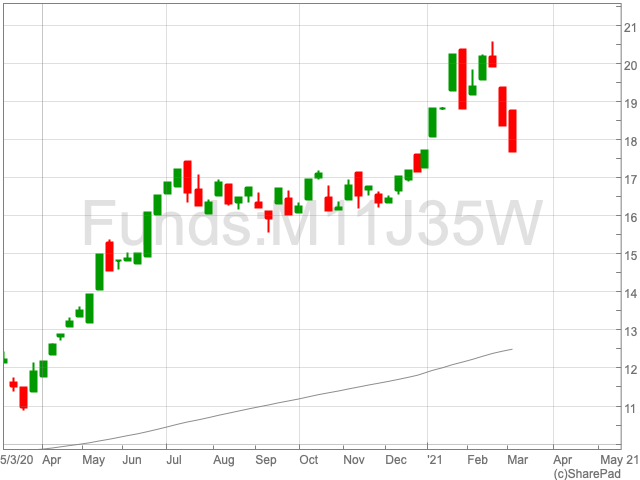

Matthews China Small Companies

The fund seeks to achieve its investment objective by actively investing, directly or indirectly, at least 65% of its total net assets, in equities of small companies located in China. Over the past 12 months, the Matthews China Small Companies Fund (GBP) has seen a 53.11% gain, outperforming the MSCI China Small Cap Index (GBP), its benchmark index, which grew by 43.39%. The fund began operating on 30 January 2020, just over a year ago. Since then it is up by 45.65%.

The fund’s top three holdings are KWG Group (real estate), Weimob (IT) and Alchip Technologies (IT) at 3.3%, 3.2% and 3% respectively. The Matthews China Small Companies is most heavily weighted to IT (27.9%), industrials (21.6%) and healthcare (12.1%). In fact it is more heavily weighted in each of these sectors than the benchmark MSCI China Small Cap Index by 5.3%, 10.1% and 3.1% respectively. Finally, money is reinvested into the fund rather than paying a dividend.