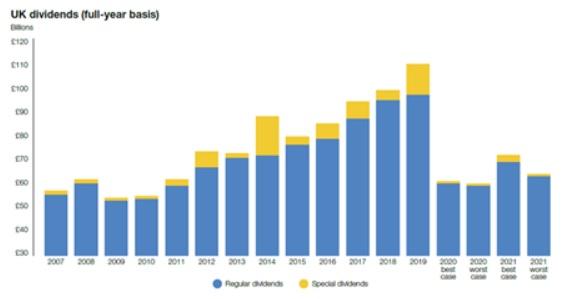

With bank pay-outs on ice, Q3 dividends hit their lowest level since the financial crash aftermath in 2010 – down by 49.1% on a headline basis, to £18.0 billion.

Of the estimated £14.7 billion of cuts during the third quarter, some two fifths of this number came from bank dividend reductions, due to Bank of England restrictions. Similarly, chopped oil and mining dividends accounted for one fifth and one eighth of cuts respectively.

While two-thirds of companies cutting or cancelling their dividend sounds drastic, these figures are certainly more modest than the second quarter, where dividends dropped by 57.2% and 75% of companies cut or cancelled their coveted investor income.

According to Link Group, the hardest-hit areas were airline, travel, leisure, general retail, media and housebuilding. Within travel and retail in particular, pay-outs fell year-on-year by 96%, while dropping by approximately two-thirds in the remaining sectors. Meanwhile, food and basic consumer goods retailers increased their pay-outs, and BAE and IMI caught up on all the dividends they missed during the year-to-date.

The question is: following the Bank of England’s recent decision, was it right to remove the ban on banking sector dividends?

On the one hand, reinstating payments will likely provide lenders and savers with additional cash. On the lender side (banks), dividends returning will likely encourage investors to look towards the biggest financial stocks on the FTSE for reliable, long-term investment. This may in turn drive up banks’ share prices, and give banks the capital flexibility to be more generous with products such as mortgages or business loans (whether this comes to fruition is another story).

On the saver side, those with financial equities in their pension pots will benefit from the extra income which will be compounded and used to build up their retirement funds.

Now, on the other hand, while encouraging investors capital to flow into banks, reinstating dividends also – inevitably – come at a cash cost. As stated by Positive Money Executive Director, Fran Boait: “It is deeply concerning that the Bank of England is pandering to commercial banks and allowing them to prioritise shareholder payouts instead of supporting the Covid-19 recovery.”

“The Bank rightly suspended dividend payouts in March to make sure lenders were preserving capital to support struggling households and businesses across the economy. Private banks have been lobbying to overturn this intervention ever since, proving once again that they cannot be trusted to work in the public interest, even during a global pandemic.”

“The Bank is now also considering watering down its guidance on limiting executive bonuses. With considerable economic uncertainty and unemployment set to rise sharply, this would be premature and irresponsible.”