On Wednesday, Chancellor Rishi Sunak set out his spending review detailing how much will be spent on public services, lamenting the “economic emergency” that the UK government faces as the coronavirus pandemic rages on. He explained the measures the government is putting in place to “protect people’s jobs and incomes”, with a £280 billion pledge to see the UK through this year alone.

What are the main points to take away from the spending review?

Among the new commitments, Mr Sunak confirmed that public sector workers – excluding some NHS staff and those earning less than £24,000 – will have their pay frozen next year, saying that he could not promise an across-the-board pay rise while many private sector employees have seen their hours and pay cut during the crisis. The pay freeze was first proposed last week in unconfirmed news reports, but was met with hostility from unions.

Kevin Courtney, Joint General Secretary of the National Education Union, stated that public sector employees were owed a pay rise by the government for their service during the coronavirus crisis:

“This is a predictable attempt at divide and rule in the middle of a pandemic. Police officers, prison officers, school support staff, teachers, head teachers, DWP workers, hospital ancillary staff, have all put their lives on the line this year and they all deserve a pay rise. So should the delivery drivers for big supermarkets. We are supposed to be all in this together as working people”.

Mr Sunak did, however, guarantee that 2.1 million public sector workers earning below the median wage of £24,000 will receive a £250 pay rise – although this is well former Labour leader Jeremy Corbyn’s proposition of a 10% pay rise for public servants, to “begin to make up the ground they’ve lost over the last ten years”.

More than 1 million NHS staff will reportedly be eligible for a raise.

In addition, the minimum wage – now rebranded as the National Living Wage – will see a 2.2% (19p) increase to £8.91 per hour for those aged 23 and over.

While Mr Sunak did not comment on the much-anticipated tax hike to accommodate extra government spending, the threat has by no means disappeared. Research by the Interactive Investor shows that most think it is still firmly on the cards.

What do investors make of a potential tax rise?

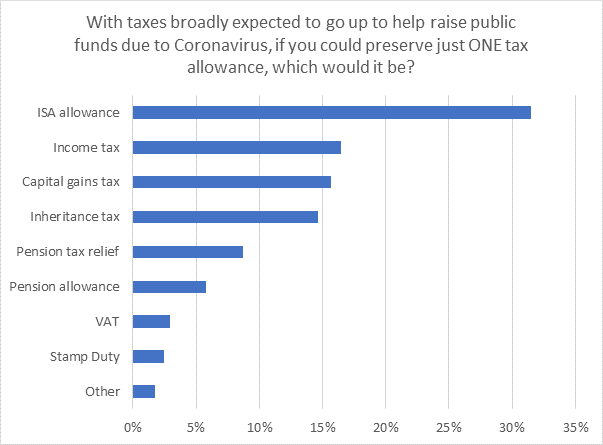

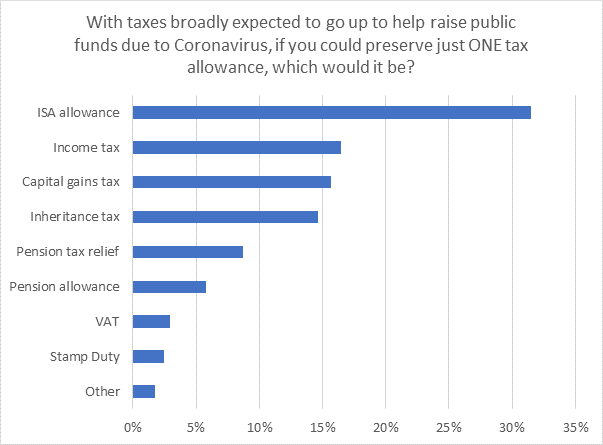

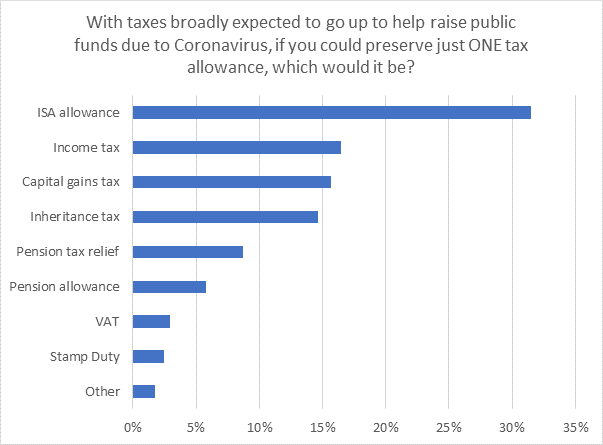

A snap poll orchestrated by the Interactive Investor – the UK’s leading flat-fee investment platform – ahead of the spending review’s release found that just under a third (31%) said that if they could preserve just one tax allowance, it would be the ISA allowance. Income and capital gains taxes settled in joint second place (16%), and inheritance tax (15%) in third.

Only 9% of investors said that they would prioritise pension tax relief from efforts to help raise public funds, 6% the pension tax allowance, 3% VAT, 2% Stamp Duty, while another 2% of respondents cited other forms of taxation.

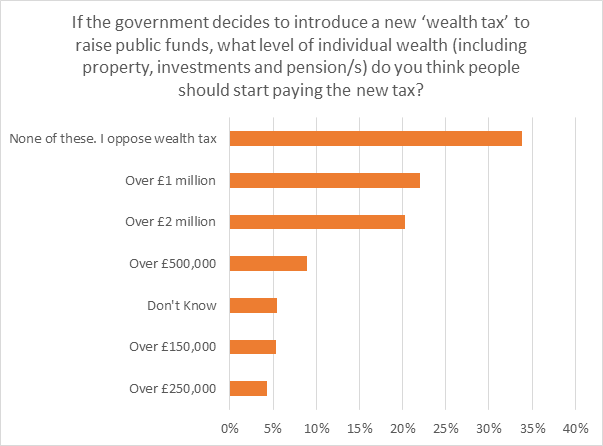

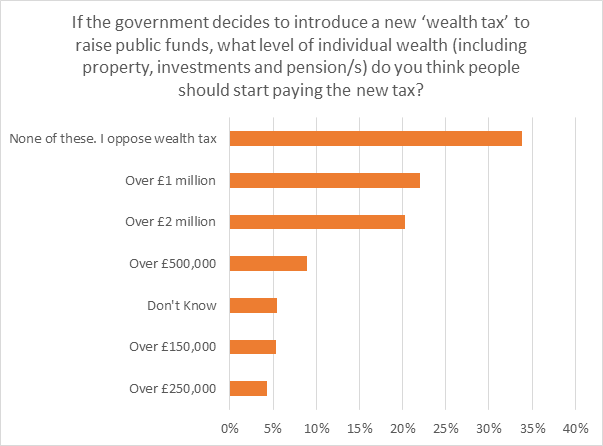

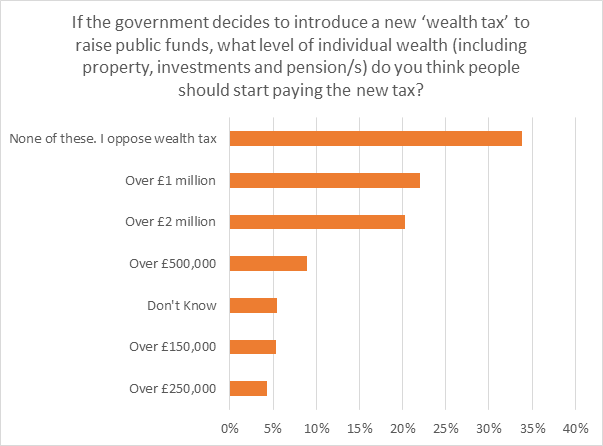

When asked who should pay for any new wealth taxes to raise public funds, just over two-fifths (22%) said “those with assets worth £1 million or more”, while 20% believe the starting threshold should be £2 million, and 9% said “over £500,000”. Only 5% said that the new tax should apply to “those with assets worth £150,000”, and fewer (4%) prefer the £250,000 threshold.

However, the largest percentage of respondents (34%) said that they were opposed to “any form” of wealth tax. The remainder (5%) said that they didn’t know.

Becky O’Connor, Head of Pensions and Savings at Interactive Investor, commented on the findings:

“With so many question marks around where the money will come from for this gigantic multi-billion pandemic bailout, investors will be waiting with bated breath for next year’s Spring Budget to see where the axe will fall.

“This could be a good time to make sure investments are as tax-efficient as possible, using ISAs and SIPPs and maximising any allowances if that’s possible – and with unemployment set to soar further, it’s time to start shoring up your finances if you haven’t yet started. If you can’t save more, it’s worth looking at areas where you can save money, by shopping around for better deals in all aspects of your life”.

Myron Jobson, Personal Finance Campaigner for Interactive Investor, added that the government’s ambitious measures will inevitably trickle down into the public pocket:

“Savers and investors will be breathing a sigh of relief as the much-mooted ‘wealth tax’ failed to materialise in the Spending Review. However, it is surely a question of when, not if a tax hike will be announced as part of efforts to address the Government’s WW2-sized public borrowing bill for its Covid-19 economic support packages.

“The extent of the economic uncertainty means that the Chancellor focused on the direction of public spending for the next 12 months. A cocktail of spending cuts and tax rises to get the UK economy back on an even keel from the damage done by the coronavirus crisis remains on the cards. The announced public sector pay freezes is a tell-tale sign of the difficult measures to come”.