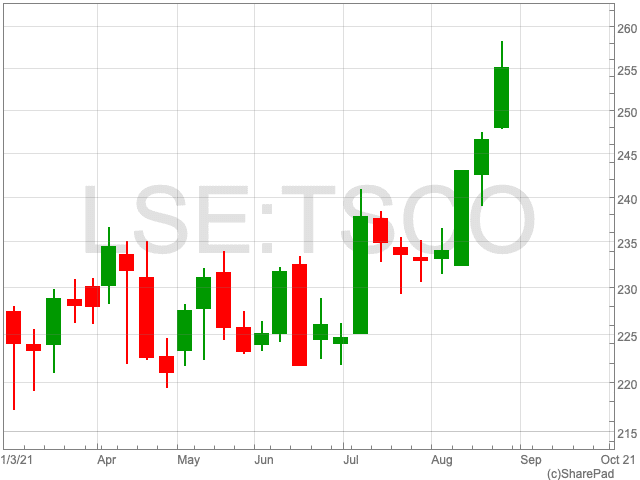

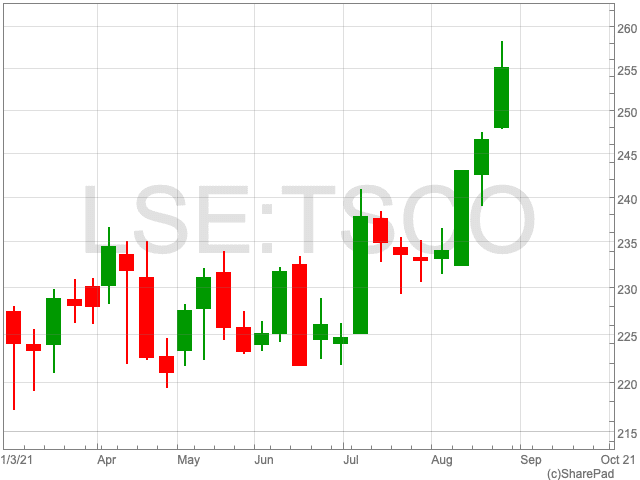

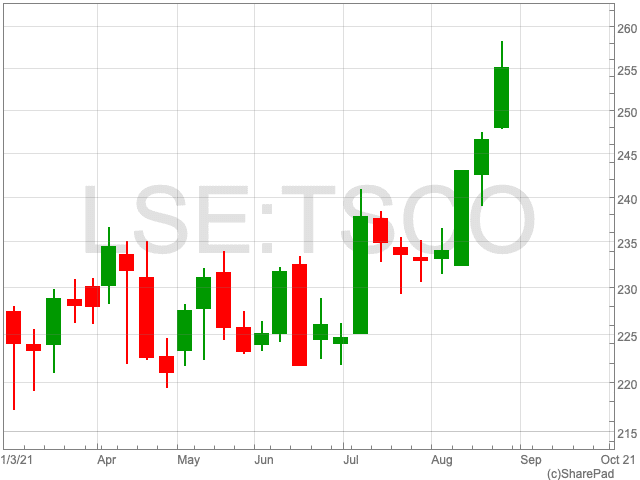

Tesco Share Price

The Tesco share price (LON:TSCO), up by 0.79% on Friday, is set to close out its fourth consecutive week in the green. The supermarket chain has now added 8.79% in the past month. However, it remains some way off its level in February, when Tesco paid out £5bn to shareholders via a special dividend with the proceeds of the sale of its business arms in Malaysia and Thailand. On 12 February, the Tesco share price was at 304.76p, while today it stands at 255p per share. With close attention being paid to UK supermarkets by American private equity firms, investors will be keeping a close eye on the Tesco share price.

Takeover Talk

The Morrisons buyout has brought eyes to the sector, with both Tesco and Sainsbury’s seeing their stock values rise in recent weeks. However, while US private equity firms are keen on Morrisons, Tesco is a different proposition entirely. Over the past two years, Morrisons has been underperforming vs Tesco, meaning it represents better value for Clayton, Dubilier & Rice et al.

Analysts

A range of analysts, as reported by Stockopedia, have a positive outlook on the FTSE 100 company. Among seven analysts currently covering Tesco, seven have given a ‘buy’ recommendation, three a ‘hold’ and zero a ‘sell’. This may come as encouraging news to those holding the stock, although it must be noted that analysts are susceptible to fallibility just like investors.