KEFI Minerals plc (LON: KEFI) have seen their shares surge on Thursday, administration problems with regard to Ethiopian operations were resolved.

The specialist gold and copper miner saw their shares rise 55.11% during Thursday trading to 1.15p. 7/11/19 14:05BST.

KEFI Minerals confirmed that it has now resolved outstanding internal administrative arrangements with respect to the Tulu Kapi gold project.

In late October, the company had to wait for the Ethopian Government to resolve “certain internal administrative matters”.

This will come at a pleasing time for KEFI Minerals, as competitors report strong profit gains in their relevant updates.

Big time competitor Hochschild Mining (LON: HOC) have issued a strong statement for future mining projects in their most recent update. Additionally, Serabi Gold (LON: SRB) reported strong production gains in their update.

The gold exploration and development company said these outstanding government administrative arrangements had held up the closing of project financing past the originally set date of October 31.

The issues related to how the government manages its shareholding in Tulu Kapi Gold Mines Share Co, KEFI said back in October.

“The community, contractors and other stakeholders will now also be asked to prepare for the commencement of project development and the site and district security arrangements will continue to be checked and refined with all the authorities,” the company said.

KEFI gave shareholders a strong outlook as they forecasted 140,000 ounces of gold per year for the first seven years from the open pit at Tulu Kapi.

The Tulu Kapi Gold Mines Share Company is a high-profile public-private partnership in Ethiopia which KEFI said “has the potential to be the largest single export-generator” for the country.

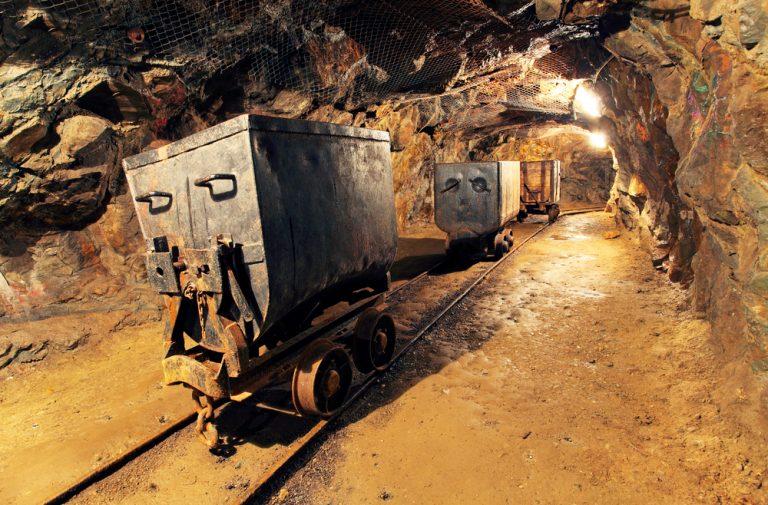

With this conflict being resolved, this will allow KEFI to use the untapped potential of the Tulu Kapi Gold Mine.

If these operations live up to their potential, shareholder of KEFI could be very excited about future gains as productions of gold and copper rise in the long term.