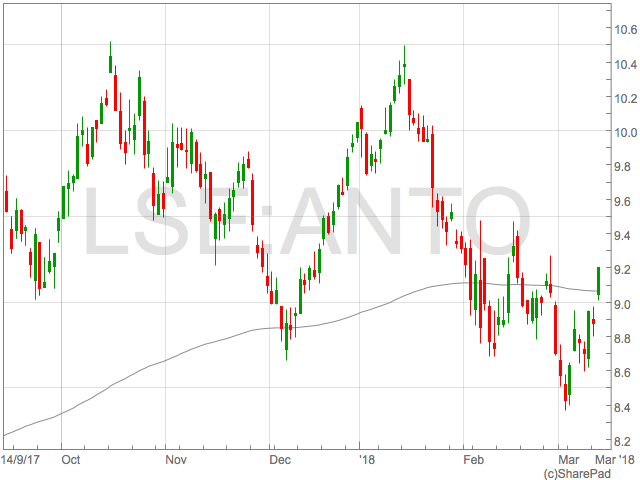

Copper miner Antofagasta (LON:ANTO) reported preliminary results on Tuesday which pointed to a year of recovery, helped by rising copper prices.

The miner with operations predominantly in Chile enjoyed a 59% increase in EBITDA to $2,586. A 31% rise in copper prices helped boost earnings as production for the period was mildly down 0.7% on the previous year.

The higher copper price also assisted stronger cashflow which allowed the group to reduce net debt to just $42 million.

Copper prices have increased dramatically over the past year helped the mining sector to recoup much of the losses suffered during fears of a Chinese hard landing.

Antofagasta CEO commented on the results:

Antofagasta CEO commented on the results:

“We have continued to invest through the cycle while maintaining our focus on cost discipline and operating performance. As a result, as copper prices rose in 2017 Antofagasta had another successful year completing the development of Encuentro Oxides, meeting our safety target of zero fatalities and achieving both our production and cost guidance.

“EBITDA increased by 59% to $2.6 billion with operating cash flow rising to $2.5 billion. Testament to the improved copper market and our continuing cost management programme, our EBITDA margin rose to 54% – the highest level since 2012 when the copper price was 30% higher. As a result of this performance the Board has recommended a final dividend of 40.6 cents per share which, combined with the interim dividend, brings the total dividend for the year to 50.9 cents per share, an increase of 177% on 2016, and represents a cash payout of 67% of earnings.

“Our priorities for 2018 are continued capital discipline and the next phase of our growth – notably the review and expected approval of the Los Pelambres Incremental Expansion project and progressing expansion plans at Centinela.”