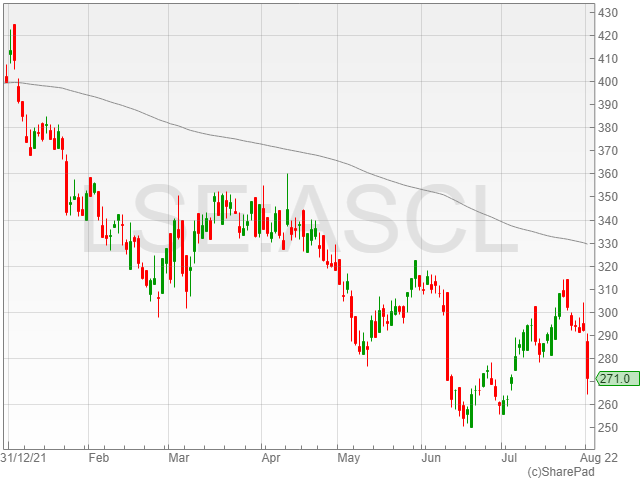

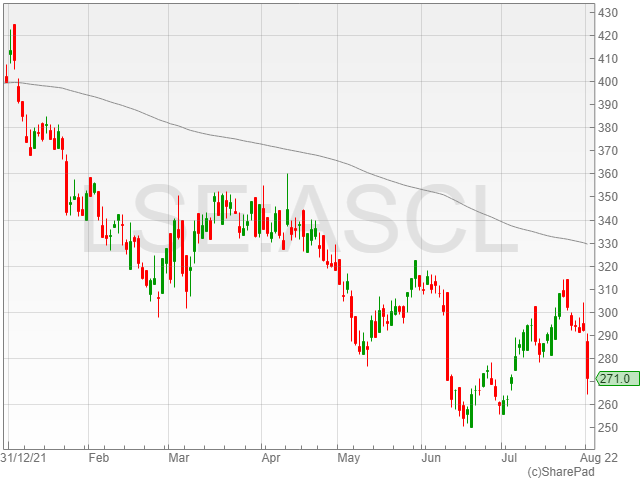

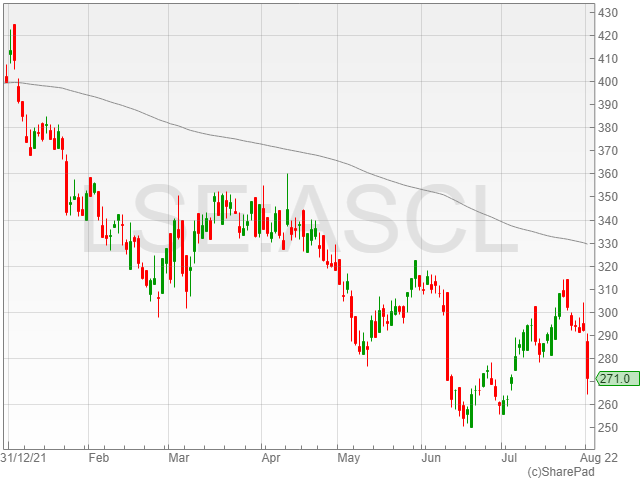

Ascential shares decreased 6.4% to 273.2p in late morning trading on Monday after a widened reported operating loss of £35.2 million in HY1 2022 compared to £2.4 million in HY1 2021.

Ascential attributed the loss to the amortisation of acquired intangibles at £17.5 million and share-based payments at £7.6 million, alongside non-trading items for acquisition earnouts, transaction and integration costs, and the expensing of build costs for its new ERP and Salesforce systems at £33.2 million.

The firm also noted a non-cash charge of £31.4 million for the impairment of the Edge Digital Shelf intangibles, along with the expenses of its strategic shift to refocus its foundational services on the leading global marketplaces.

Acential confirmed its results were in line with market expectations, with an adjusted EBITDA of £67.2 million against £42.8 million the last year, and a margin of 25.8% compared to 27.8%.

The company announced a revenue climb across all four sectors of £260.7 million against £154.3 million, reflecting continued structural growth in end markets, assisted by a bounce-back from major events.

The group highlighted an adjusted EPS profit from continuing operations of 8p against 5.7p the last year.

“Ascential has had an excellent first half of the year, with strong growth in group revenue and profit in line with expectations. Each of our segments delivered double digit revenue growth: all the more pleasing given the challenging macro backdrop,” said Ascential CEO Duncan Painter.

“We are making good progress with our mission to make Digital Commerce the number one, global real-time platform that powers eCommerce by enhancing our capabilities, expanding our partnerships with leading eCommerce marketplaces and increasing our addressable market through complementary acquisitions.”

Ascential commented its outlook included strong results for its Digital Commerce and Product Design businesses in FY 2022, with continued recovery anticipated for its Marketing and Retail and Finance sectors.

“Despite the current macro-economic uncertainty, all our businesses are well positioned to drive the success of Ascential now and in the long term, as we continue to invest to extend our market leadership and maximise our future profitable growth,” said Painter.