The M&G Global Emerging Markets Fund is increasing exposure to China and sees the world’s second largest economy as a potential source of outperformance in the coming year.

As we start the Chinese New Year – the Year of the Rabbit – China is dominating headlines and gaining the attention of investors.

The end of Zero COVID policies promises to boost the Chinese economy and provide support for mainland and Hong Kong equities. Indeed, the leading Hong Kong indices have rebounded some 40% from last year’s lows.

Having been called ‘uninvestable’ by investment bankers and fund managers through 2021 and 2022, China is beginning to shake off stigma attached to the policies of China Communist Party and the woes of their domestic property market.

The dramatic shift in the approach to COVID highlights the Chinese leadership’s desire to pursue growth. Their willingness to roll back COVID policies they had previously been steadfast in delivering has demonstrated economic health is still the CCP’s main priority.

Having scrapped lockdowns and restrictions at the end of last year, the Chinese New Year may mark a new chapter in the Chinese economy and returns for investors in Chinese equites.

Increasing China Exposure

Speaking at an M&G event held in London last week, Fund Manager Michael Bourke alluded to a rotation towards China in their portfolio as a result of the Chinese reopening and valuation of Chinese equities.

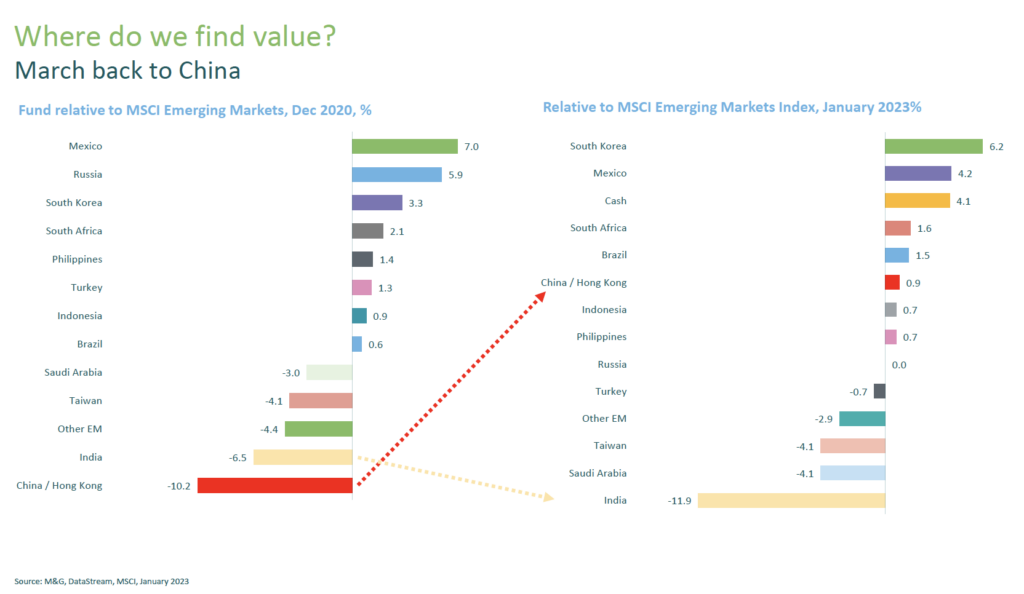

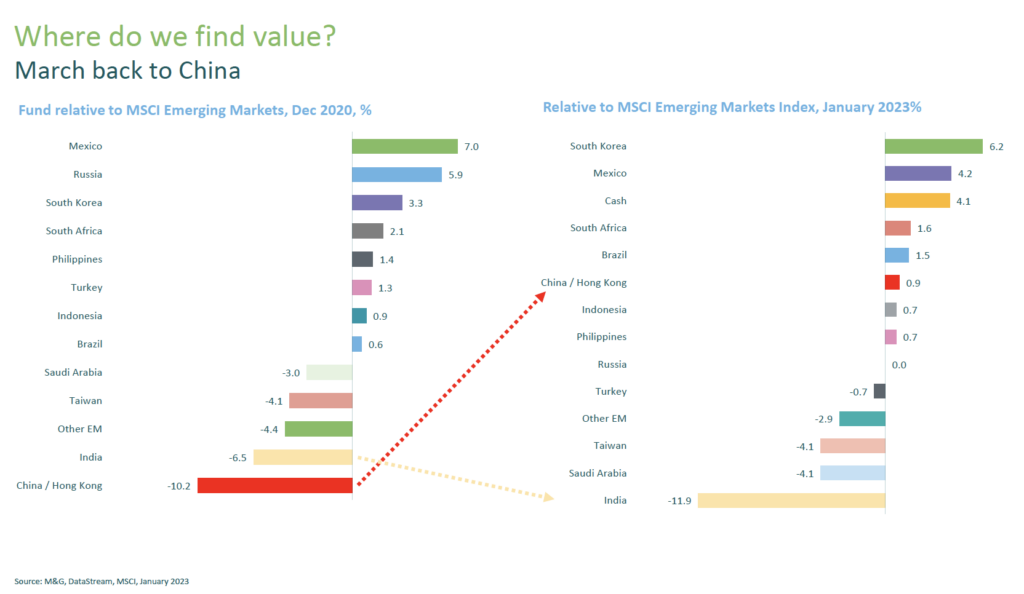

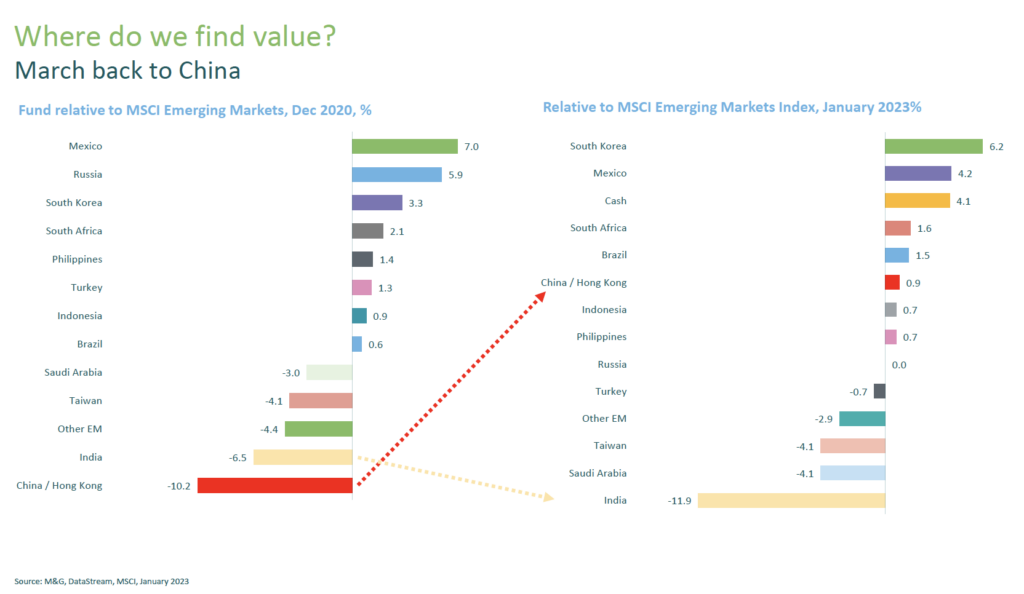

The extent to which managers of the M&G Global Emerging Markets Fund have increased their exposure to China is illustrated below. From being underweight China compared to the MSCI EM benchmark by 10.9% in December 2020, the fund is now overweight China by 0.9%.

Being significantly underweight China through 2021 and early 2022 meant the M&G Emerging Markets Fund significantly outperformed the benchmark. Sharp losses in Chinese tech names were a major drag on Emerging Markets over the past 18 months and avoiding the sector helped produce M&G’s outperformance compared to the benchmark.

However, the losses in Chinese stocks are now being seen as major opportunity – and a sustained recover in Chinese equity may provide the M&G team with third consecutive year of outperformance.

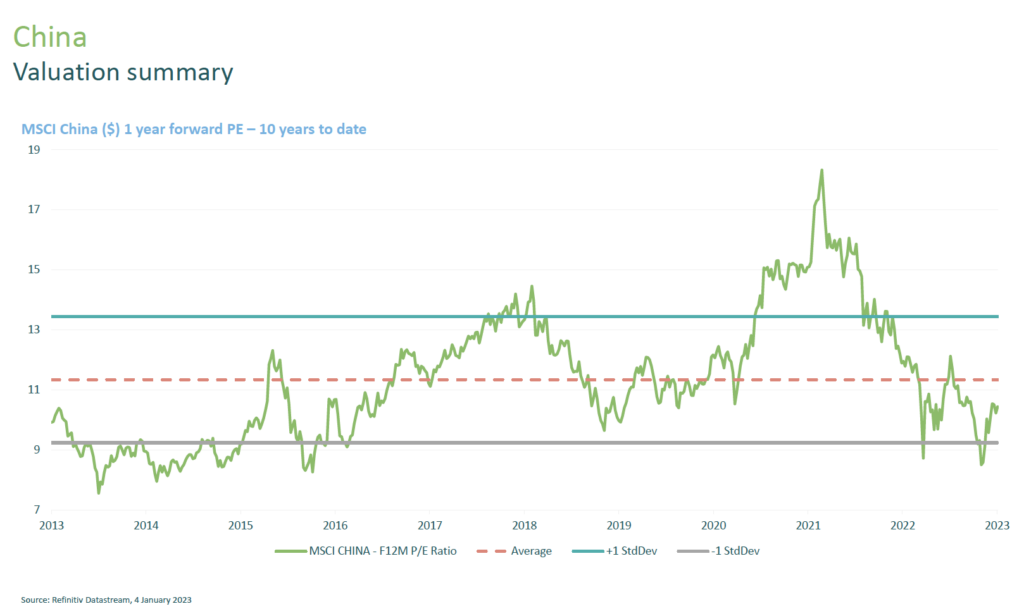

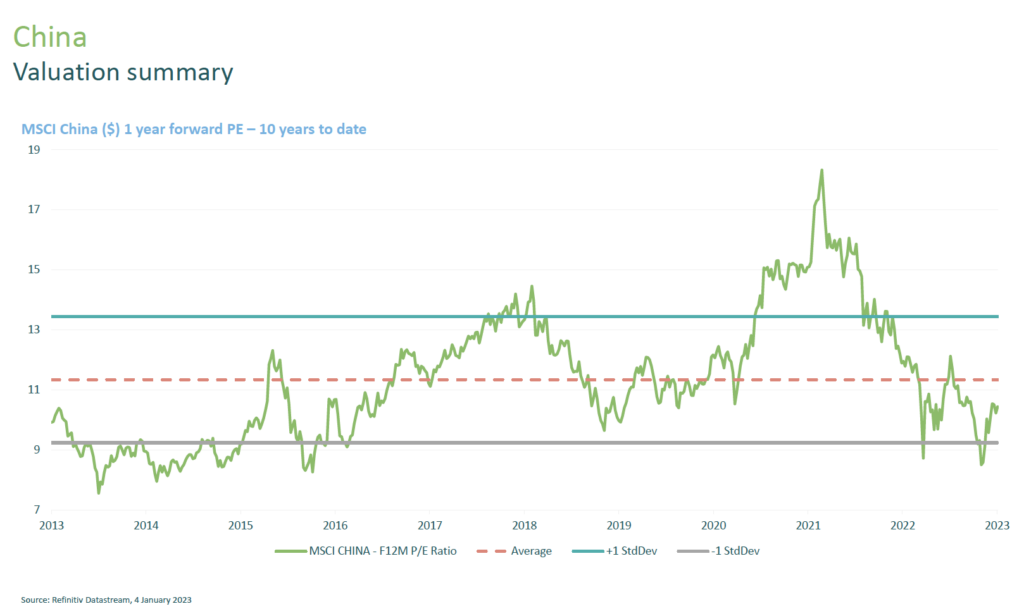

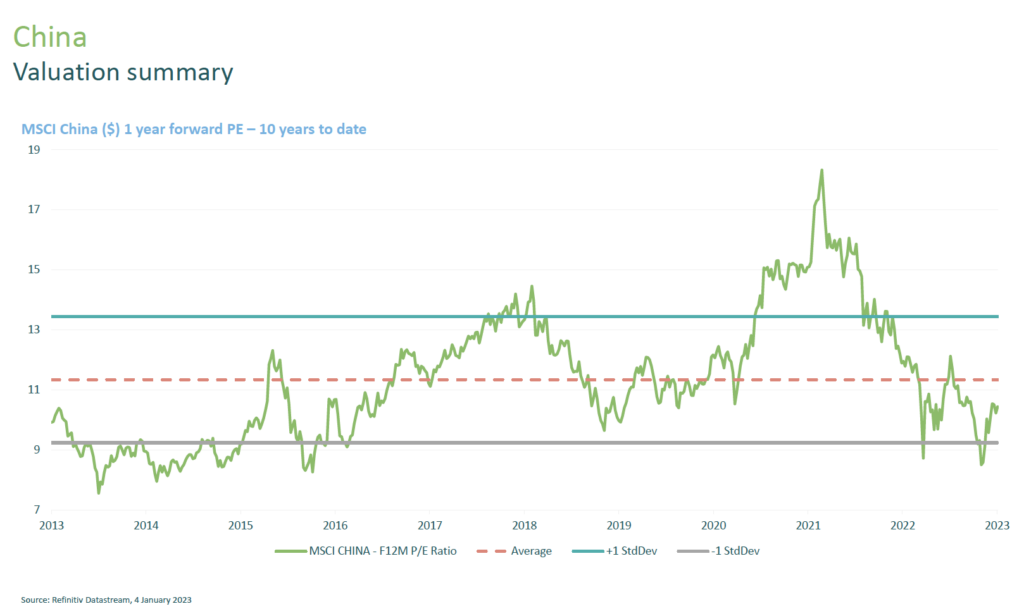

The valuation argument is compelling. Bourke explained that Chinese equity valuations have spent a considerable period trading one standard deviation away from the average price-to-earning ratios, and are ripe for a rebound.

Alibaba accounts for 3.9% of the M&G portfolio while Chinese finance conglomerate Ping AN Insurance Group earns a 3% weighting.

In addition to China, Bourke detailed their interest in Mexico and South Korea, while saying they saw little value in India currently.

Mexico’s proximity to the US and manufacturing capabilities has driven a 4.2% higher weighting in the M&G EM portfolio compared to the benchmark.

South Korea’s traditional tech names and semi conductor companies have been swept up in the global tech sell off are also providing fairly attractive valuations.

Samsung and Taiwan Semiconductor were the top two holdings as of 31st December.