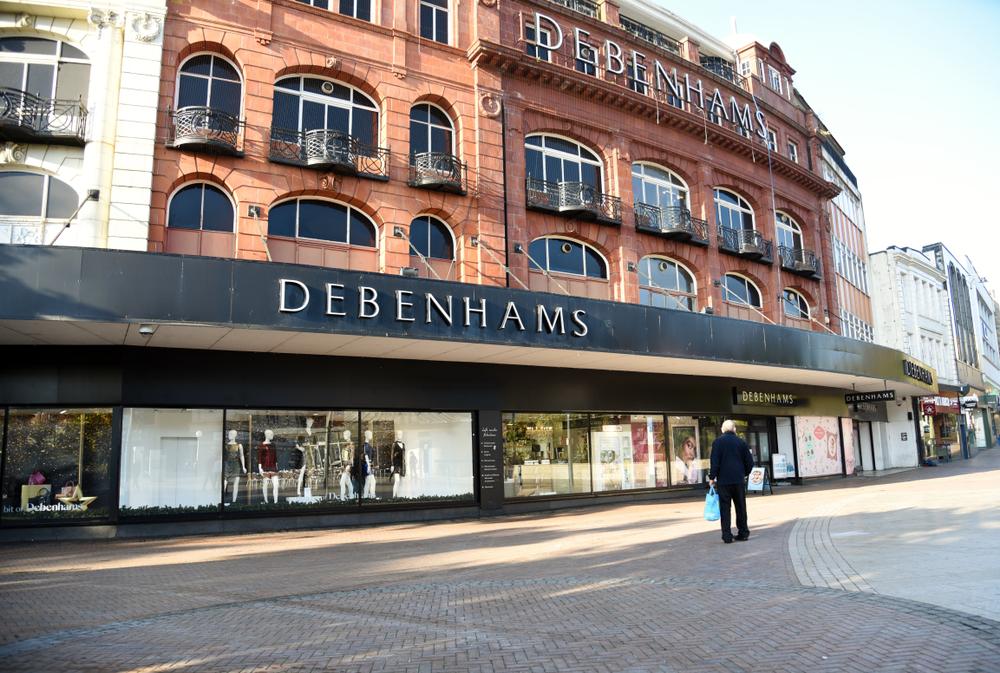

Department store chain Debenhams announced on Tuesday that it has agreed to extend its credit facilities and a sourcing partnership with Li & Fung. Shares in the company soared 39% during trading on Tuesday morning.

It has agreed to an additional 12-month senior secured credit facility. The additional facility provides £40 million on increased liquidity headroom, which will be available to draw as required.

Additionally, the new facility agreement will be a bridge to facilitate a broader refinancing and recapitalisation. Against this backdrop, the company has said it will continue to engage constructively with with its stakeholders. It intends to conclude a “comprehensive refinancing” by the end of the period.

Earlier this January, Moody’s Investors Service downgraded Debenhams’ outlook from stable to negative.

Debenhams has also entered into an agreement with Li & Fung. Li & Fung is a Hong Kong based leading supply chain solutions partner for consumer brands and retailers. The agreement aims to develop a strategic sourcing partnership and is expected to eventually cover a material part of its own-brand sourcing, delivering benefits for both of its customers and stakeholders.

CEO of Debenhams, Sergio Bucher, commented on the announcement:

“Today’s announcement represents the first step in our refinancing process. The support of our lenders for our turnaround plan is important to underpin a comprehensive solution that will take account of the interests of all stakeholders, and deliver a sustainable and profitable future for Debenhams.”

“In addition, the partnership agreement we are announcing today with Li & Fung will be a key part of our turnaround plan. It gives us access to state-of-the-art technology in the LF Digital platform, providing end-to-end visibility across our supply chain. This will help us anticipate and respond more quickly to trends and our customers’ preferences, as well as delivering better quality product.”

Debenhams recently announced that it is planning to close 90 stores. Likewise, it may axe 10,000 jobs as it battles against plummeting profit and sales.

Shares in Debenhams plc (LON:DEB) were trading at +39.35% as of 10:13 GMT on Tuesday.