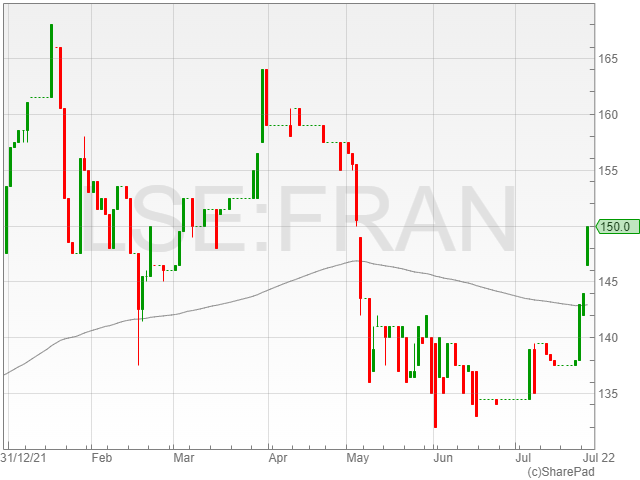

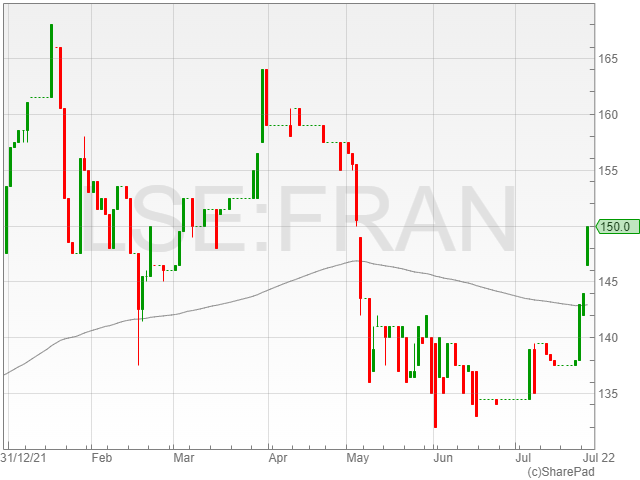

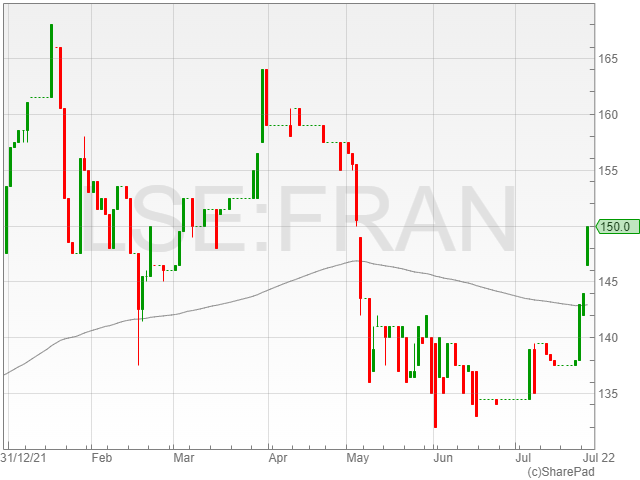

Franchise Brands shares rose 3.1% to 148.4p in late afternoon trading on Tuesday following a reported 60% surge in revenue to £44.5 million in HY1 2022 against £27.8 million in HY1 2021.

The multi-brand franchise business highlighted an adjusted EBITDA growth of 74% to £7.3 million from £4.2 million the last year, alongside a statutory pre-tax profit spike of 83% to £4.8 million compared to £2.6 million.

The firm’s Metro Rod and Metro Plumb system sales grew 20% to £28.5 million, with its results exceeding management expectations in part linked to its recent acquisition of Filta, which served to expand the company’s international footprint.

Franchise Brands confirmed an adjusted EPS climb of 51% to 4p from 2.7p and a basic EPS growth of 89% to 3p compared to 1.6p.

The group mentioned net cash of £4.7 million at 30 June 2022 against £6.5 million year-on-year, after £1.3 million of costs associated with its Filta acquisition and its £1.7 million Willow Pumps contingent consideration payment.

“The Group has had a highly productive and successful first half, with record organic growth primarily driven by Metro Rod and the transformational acquisition of Filta bringing highly complementary services, an international footprint and considerably enhanced scale,” said Franchise Brands executive chairman Stephen Hemsley.

“Beyond the near term, we are confident our largest businesses, Metro Rod and Filta, are well positioned to capture the clear opportunities to grow from their current small share of large, fragmented markets where scale is becoming still more of a competitive advantage, including through the implementation of efficiency-enhancing technology.”

Franchise Brands announced a 50% interim dividend climb following its strong interim performance to 0.9p per share against 0.6p per share.

“As a highly profitable and cash generative business, with a strong ungeared balance sheet, we are in a robust financial position to weather uncertain economic conditions, take advantage of future organic growth and acquisition opportunities, and deliver growing returns to shareholders, as we have today through a 50% increase in our interim dividend,” said Hemsley.