Markets moved into the red as the UK awaited confirmation of the details for Liz Truss’ £130 billion energy relief plan, which would reportedly see the energy price cap frozen or reduced instead of its scheduled 80% rise to £3,548 in October.

The FTSE 100 dropped 0.4% to 7,266.3 in lunchtime trading on Wednesday.

“Action on energy bills continues to be widely trailed as new prime minister, Liz Truss, prepares for an official announcement on her policy,” said AJ Bell investment director Russ Mould.

“Given the big package that is expected, anything short could spark renewed selling in consumer-facing stocks.”

The Pound weakened against the dollar after the US currency strengthened, with the dollar index reaching a 20-year high of 110.69 earlier on Wednesday.

“Sterling remains weak and that is leaving UK stocks vulnerable to approaches from overseas predators – cybersecurity GB Group the latest on the block as it is targeted by a US private equity firm,” said Mould.

“An already shrinking UK tech sector on the London market can ill-afford another departure, GB’s peer NCC is also pulled higher by the news.”

Chinese economy

Investment bank Noruma cut its Chinese GDP forecast to 2.7% from 2.8% in August, after the country’s recent lockdown in Sichuan Province capital Chengdu and tightened Covid restrictions in tech hub Shenzhen dealt a blow to analyst estimates.

Noruma reported approximately 12% of China’s GDP was impacted by Covid measures at current time, marking a steep growth from 5.3% last week.

“Back [on Aug. 17], when we cut our Q3 and Q4 GDP growth forecasts, we did not expect growth to worsen at such a pace,” said Nomura chief China economist Ting Lu.

“What is becoming increasingly concerning is that Covid hotspots are continuing to shift away from several remote regions and cities – with seemingly less economic significance to the country – to provinces that matter much more to China’s national economy,” said Nomura analysts.

The Hang Seng dropped 0.8% to 19,044.3 and Chinese-facing stocks dipped on the FTSE 100, with Scottish Mortgage Investment Trust sliding 0.4% to 787.2p and Asia-focused insurer Prudential falling 1.1% to 922.1p.

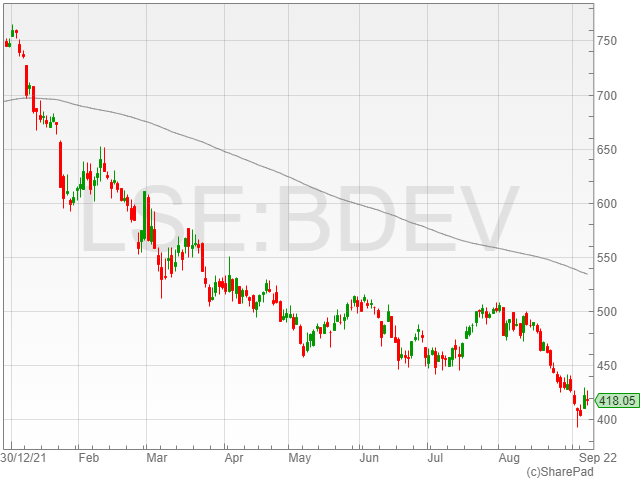

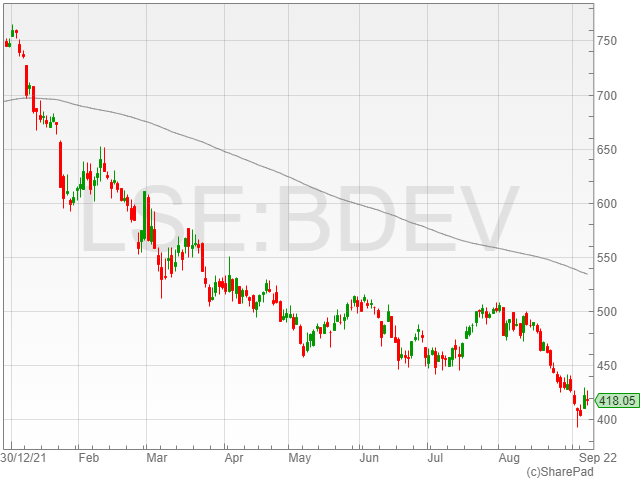

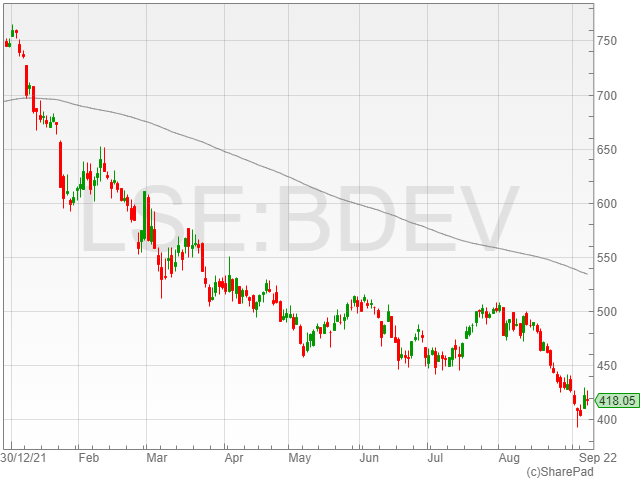

Barratt Developments

Housing giant Barratt Developments dropped 1% to 417.9p despite rising revenues and a return to pre-Covid completion levels.

The group announced a £5.2 billion revenue in FY 2022 compared to £4.8 billion the year before, alongside 17,908 properties completed against 17,243 in 2021.

However, the positive results were marred by signs of a housing market slowdown, with the latest report from Halifax signalling a decline in housing demand on the horizon as the cost of living crisis bites.

House prices reached a new record of £294,260 per average UK property in August, however analysts warned of cooler prices for the red-hot market in the coming months.

“Now the cost-of-living crisis has hit home, and while we may not be forced to face the full impact of rises in energy prices, we’re still having to cope with rampant inflation across the board. At a time of rising rates and higher house prices, this is going to push property out of reach for desperate buyers,” said Hargreaves Lansdown finance analyst Sarah Coles.

“However, we won’t see annual house price rises fall in a straight line. This is partly because of the echoes of the stamp duty holiday last year which created really lumpy price changes a year ago.”

“However, it’s also because the property market is driven to a huge extent by sentiment, and right now, that’s a bit of a rollercoaster ride.”