Stryker Corporation (NYSE: SYK) are set to purchase rival Wright Medical (NASDAQ: WMGI) in a $4 billion cash deal, to gain access to the fast-growing upper-body joint implants business.

Wright Medical, one of the small competitors to titan Stryker recorded strong trading figures in 2018, showing why Stryker were keen on the deal.

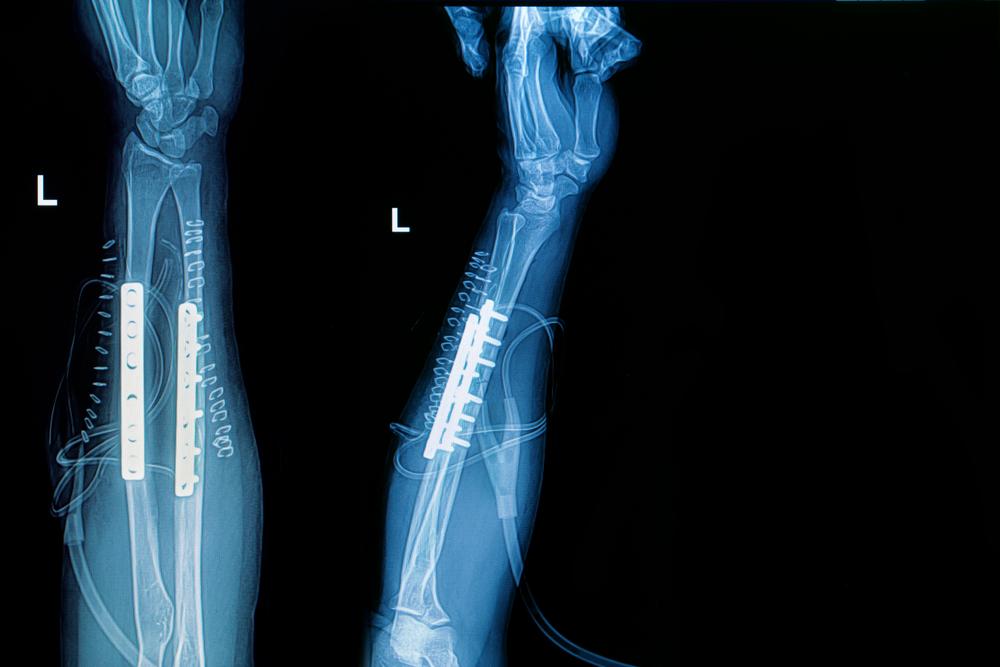

Wright reported sales of $836 million last year, and are among the top makers of implants to treat upper-body joint injuries such as shoulder or wrist, as well as lower body including foot and ankle.

Wells Fargo (NYSE: WFC) analyst Larry Biegelsen said “the deal would give Stryker a leading position in the shoulder market, which has been a major gap in the device maker’s orthopaedic portfolio”

Stryker may have to make further divestments in its ankle implant to avoid clashes with Wright medical, as as Wright have a near 70% share of the total ankle replacement market.

“Stryker will meaningfully bolster its ability to compete and innovate in the nearly $2 billion global shoulder market,” Chief Executive Officer Kevin Lobo said in a conference call with analysts.

The move comes at no surprise after rival firm Boston Scientific Corporation (NYSE: BSX) acquired British drugmaker BTG Plc last year in a $4.2 billion buyout.

Stryker’s offer for $30.75 per Wright share represents a premium of 39.7% which will feed the appetite for shareholders.

Stryker will also gain access to Wright Medical’s biologics portfolio including its Augment drug-and-device combination product used for bone repair, and its Cartiva implant for foot and ankle.

Including debt, the deal values Wright at about $5.4 billion and is expected to close in the second half of 2020.

Interestingly, Stryker have said that their business could be far from done as expansion into the orthopaedics market.

Seniority commented that a search for new acquisitions will continue to take place, but only on a small scale.

Shares in Stryker are currently trading at $203 per share, whilst Wright Medical shares have climbed 29.67% to trade at $28.