Sponsored and written by Red Ribbon Asset Management

Leading Analysts, including Nomura, are forecasting India will be leading the way out of the COVID downturn, and History is on their side.

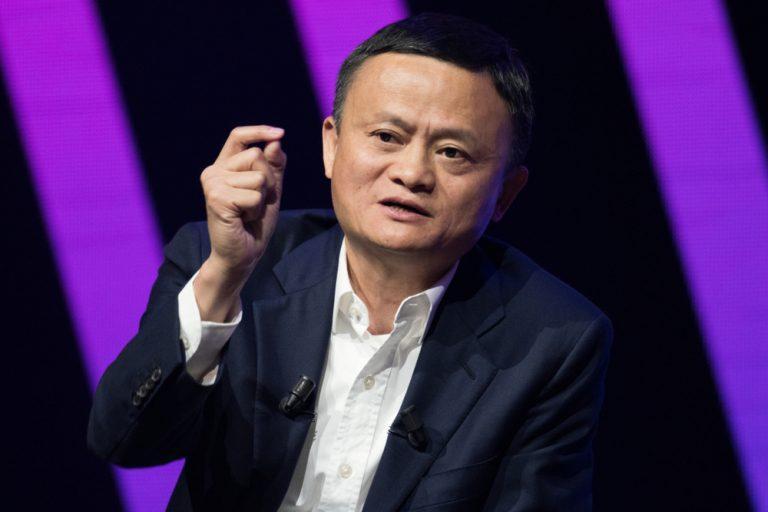

We’ll be taking a look at the underlying issues in this article by Suchit Punnose, CEO and Founder at Red Ribbon Asset Management

In last month’s Asia 2021 Outlook, Nomura forecast a 9.9% growth in Indian GDP by the end of 2021: that’s more than China (9%), and waymore than the UK (5.5%) and the United States (4.7%), all of which are running off historically low recovery platforms as a result of the Pandemic. The UK’s forecast, for example, may be the highest since the 1980’s, but according to the Office of Budget Responsibility (“OBR”) the economy will not return to pre-Pandemic levels until the last quarter of 2022. Investors would do well to remember that even a dead cat bounces…On the other hand, India is expected to go on to deliver GDP growth of 11.9% by the first quarter of 2022, far higher than pre-Pandemic levels.

None of which should come as any surprise.

Before COVID gripped its chill hand on economies across the planet, GDP on the subcontinent was growing at a rate of 5.02% annually, barely half of the figure now being forecast by Nomura for the coming year. So unlike the UK there’s certainly something more than bouncing back at work here. Just look at the underlying data…in the second quarter alone, Nomura expects Indian GDP to grow by 32.4%, which means the so-called “base effect” of COVID will be completely eliminated on the subcontinent within six months (as opposed to two years in the UK).

Ten years ago the comparable (World Bank) figure for growth on the subcontinent was 8.5%, and in 2016 it was 8.26% (www.worldbank.org). So the latest Nomura forecast is well within the parameters of an already established, upwards growth trajectory. In fact, at 9.9%, it even foreshadows a sharp(ish) upwards tick over the near term.

And once again, that can be usefully contrasted with comparable trends for the UK economy over the same period. In 2010 GDP grew in the UK by 1.95%, but by 2016 it had fallen back to 1.92%. And before COVID struck, it had fallen back again to 1.41%. That’s why even on the basis of the latest OBR data, any UK recovery will still be two years behind India, heading for a downturnon what are already historically low figures. There’s no sign of an upward tick any time soon in the UK, sharp(ish) or otherwise.

So what’s the reason for those stark differences, and what does COVID have to do with it?

Well, there are three key indicators.

First of all, the UK has built up a staggering Budget Deficit of £394 Billion for the year to March 2021: struggling to balance massive recovery spending with dwindling tax receipts. As a whole, UK national debt currently exceeds £2 Trillion, which is more than 100% of GDP, and its expected to stay that way for at least the next five years. Putting it mildly, none of this is a healthy foundation for future economic growth. But even allowing for COVID recovery programmes on the subcontinent and an unprecedented level of public infrastructure spending, India’s deficit is only 17.9% of projected GDP (less than a fifth of the UK figure), so it has vastly more headroom for growth.

And then, secondly, there’s that tried and trusted bellwether of growth: Inflation. As Keynes once said, there’s no inflation in a junkyard: upward pressure on prices is usually a reliable indicator of healthy levels of consumer demand, and demand is a significant driver for growth. In 2020 the UK inflation rate slumped to 0.3%, which is the lowest level on record. And there’s a double whammy too: as the economic strictures of COVID are eased, inflation is likely to rise with a parallel increase in interest rates: so its not a good time to be holding £2 Trillion in debt (see above). On the other hand, inflation on the subcontinent is currently 4.95%, which is slightly higher (but not disturbingly so) than the midpoint 4% target maintained by the Reserve Bank of India since 2016, and in turn that reflects a robust level of consumer demand as a result of a burgeoning, increasingly wealthy and product hungry population.

And then, finally, there’s Housing: an Englishman’s home isn’t just his castle, over the years it’s been a pretty good investment too. Despite the shocks of COVID and the worst recession for three hundred years, house prices in the UK rose to a six-year high at the end of 2020, which speaks to a certain confidence in the future…or does it? Across the board, analysts in the UK are now predicting a sharp decline in house prices. Halifax (the country’s biggest mortgage lender) expects a fall of between 2% and 5% over the coming year, and the OBR is even more of a Cassandra: forecasting an 8% drop in prices during 2021. That’s certainly not a trend reflected on the subcontinent…house prices are going through the roof from Mumbai to Chennai.

So with strong fundamentals in Housing, Monetary and Macro Economic policy, India seems all set for further growth; and despite the fact that the traumatic impact of COVID must induce a necessary caution into any forward looking analysis, there’s little reason to doubt Nomura’s figures. After all, history has given us the compelling lesson of Spanish Flu: a hundred years ago we were also socially distancing, wearing masks and watching fearfully as old certainties crumbled away. But within two years global economies had bounced back with a vengeance… there’s no reason to doubt that they can (and will) do it again.

Expect India to be at the head of the pack when they do.

Red Ribbon Asset Management has more than a decade’s experience of successfully investing in the subcontinent’s markets: delivering above market rate returns for investors whilst at the same time staying loyal and committed to its core values of Planet, People and Profit.

Executive Overview

The World has come a long way since March 2020, and we’ve learned a lot of lessons along the way: but with effective vaccines now on the horizon, and signs of economic recovery emerging across the Planet, its time to look to the future. All of the data now suggests India will be playing a leading part.