Ofgem reveals £25bn green investment plan

United Airlines set to furlough 36,000 staff

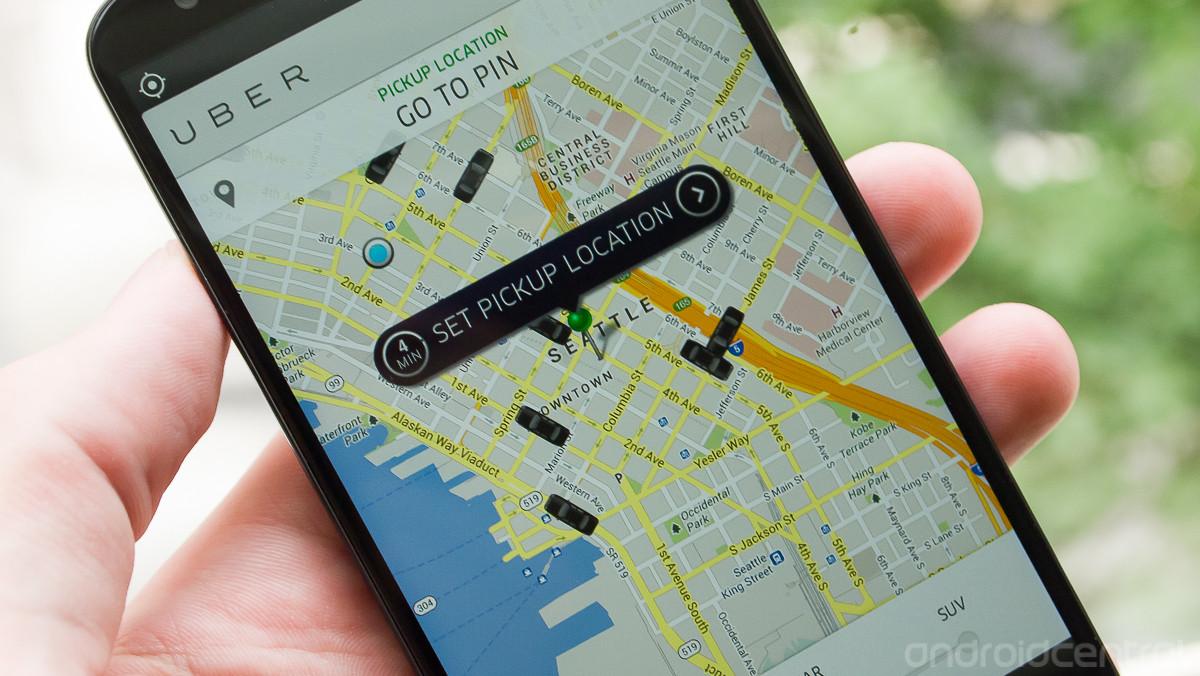

Uber launches commuter boat service on the Thames

Green Homes Grant: £2bn insulation scheme could support over 100k jobs

Sunak mini budget means additional 73% of homes exempt from stamp duty

Response to the Sunak stamp duty holiday

Speaking on the mini budget, Zoopla’s Research and Insight Director, Richard Donnell, commented: “The immediate increase in the Stamp Duty threshold will help sustain the rebound in housing market activity across England. The benefits will be immediate; nine of ten transactions in England will no longer be subject to the tax and in London and the South East, home to more expensive properties, homebuyers can save up to £14,999 overnight.” “The Government will expect the change to stimulate more housing sales over the second half of the year and that savings made by buyers will be reinvested in home improvements, white goods and furniture, rather than bidding up the cost of housing.” Head of Residential at Cheffins, Mark Peck, concurred with our previous analysis that the stamp duty holiday will intensify demand. While having the potential to help current first-time buyers, buyers of tomorrow will be faced with further price inflation. He added that: “Reports have shown price falls across the property market, however these are somewhat misleading. In reality, values haven’t actually reduced in most cases, rather buyers renegotiated on purchases during lockdown or sales fell through, and this will be quickly addressed now that lockdown is easing and the market is seeing almost normal levels of activity. In fact, in some geographic areas, June has been one of the busiest months on record as prices have managed to hold firm as bottle-necks of supply have led to competition between buyers.” Chairman of Jackson-Stops, Nick Leening, added that his company’s research had indicated that some 40% of under-55s would consider a move in the next two years, while 41% of their clients thought there should be a wholesale reduction in stamp duty, and a quarter wanted the government to scrap the duty on all homes under £500k altogether.First Group books £150m loss as Coronavirus hampers transport sector

First Group response

In a cautious but overall hopeful outlook, company Chief Executive Matthew Gregory commented: “There is no way of predicting with any certainty how the coronavirus pandemic will continue to affect the public transportation sector and the impact it may have on customer trends longer-term. However, as leading operators in each of our markets we are strongly positioned for a recovery in passenger demand and for the opportunities that may emerge from this exceptional period.” “Despite the near-term uncertainty, the long-term fundamentals of our businesses remain sound. We are resolutely committed to delivering our strategy to unlock material value for all shareholders through the sale of our North American divisions at the earliest appropriate opportunity. The importance of public transport to society has never been more clearly demonstrated, and we will continue to take all necessary measures to enable the Group to emerge from this unprecedented situation in a robust position.”Investor insights

Following the update, First Group shares plummeted over 17%, before recovering slightly, down 15.82% or 7.78p, to 41.40p per share 08/07/20. This is comfortably below the company’s median target price of 75.00p, and over 60% down on where it was a year ago. The Group’s p/e ratio currently stands at 3.42.AirAsia shares drop 18% with future in ‘significant doubt’

“This is by far the biggest challenge we have faced since we began in 2001,”“Every crisis is an obstacle to overcome, and we have restructured the group into a leaner and tighter ship.” “We are positive in the strides we have made in bringing cash expenses down by at least 50% this year, and this will make us even stronger as the leading low-cost carrier in the region,” he added. Following the news, AirAsia shares dipped 17.54% or 0.15 ringgit, to 0.70 ringgit per share 08/07/20 17:00 GMT+8.

Jaguar Land Rover: over 2,000 agency jobs lost

Global equities stung by US COVID cases and potential second lockdown

“A second round of fresh 5-year highs for the Chinese stock market failed to produce the same boost it did on Monday, with the threat of returning lockdown measures in various spots around the globe casting doubt on Europe’s recent rally.”

“Melbourne has been placed under a new 6-week lockdown after a 191 case spike in new cases were confirmed in state of Victoria. Elsewhere South Africa’s total number of cases has passed 200,000, the highest figure in Africa.”

“Of course then there’s the US, the gold standard of coronavirus mismanagement. Between Friday and Sunday alone the country saw 200,000 fresh infections, with the number of cases in Florida alone doubling from 100,000 to 200,000 in less than a fortnight. All this before considering the impact the weekend’s 4th July celebrations will have on the infection rate.”

For anyone who remembers the old adage of ‘when the US sneezes, the whole world catches a cold’, today’s global equities pessimism seems to be history repeating itself. The only difference is, the US is the sick man making everyone else sick, but now chooses to be ignorant of its own ailment.