COVID-19: retail sales plunge as high streets remain empty

Retail sales in the UK took a hit in March as measures to contain the spread of COVID-19 were introduced by the British government.

UK Head of Retail at KPMG, Paul Martin, said that the illness has changed the consumer landscape “significantly”.

Data from the British Retail Consortium revealed that, on a total basis, sales decreased by 4.3% in March, compared to a decrease of 1.8% in March 2019.

In the last two weeks of the period, sales crashed by 27%.

The British government introduced stricter lockdown rules at the end of March in order to help stop the illness from spreading.

People have been encouraged to stay at home and practice social distancing, with all non-essential shops being made to close.

“Lockdown has prompted a fundamental rethink of what is deemed essential,” Paul Martin continued.

“The UK’s closure of non-essential stores only started at the backend of the month, so it’s likely worse data is yet to emerge,” Paul Martin said.

Many have been hit financially by the economic implications of the illness.

Paul Martin added that staying at home has seen a rise in sales of food and drink, computing equipment, children’s toys and health-related goods.

“Yet our high streets are completely void of footfall, and non-food categories like fashion have been forced into hibernation,” Paul Martin said.

The Chief Executive of the British Retail Consortium, Helen Dickinson OBE, described the March data as “the worst decline in retail sales on record”.

Helen Dickinson OBE said: “The crisis continues; the retail industry is at the epicentre and the tremors will be felt for a long while yet. Many physical non-food retailers have been forced to shut down entirely or to limit themselves to online only to protect customers and staff. Consequently, hundreds of thousands of jobs at are risk within these companies and their supply chains.”

“At the same time, supermarkets brace themselves for lower sales, while still spending huge sums on protective measures, donating to food banks and hiring tens of thousands of temporary staff. We welcome the Government’s actions to date, yet millions of livelihoods rely on their continued support.”

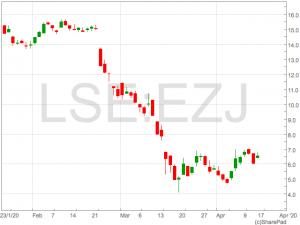

easyJet share price gains in broad travel sector rally

The easyJet share price (LON:EZJ) rose over 9% in early trade on Thursday in a broad travel sector rally that also saw Carnival and IAG up over 6% and 4% respectively.

The jump in easyJet shares came as the airline released their trading update for the six months ending 31st March. easyJet said it saw a loss of between £185m to £205m for the winter trading period. This is a material improvement on 2019 when the company posted a loss of £275m.

The company said swift cost cutting measures in the last few weeks of the period when coronavirus began to ground flights has helped to minimise losses in the first half.

easyJet share price

The rally in the easyJet share price also came a day after European countries announced plans to begin the reopening of their economies. Germany said it was to reopen schools and small shops in early May whilst President Trump said the US was past the peak.

This is ultimately the first step towards passengers being able to take flights again and has caused optimism among investors.

easyJet shares rose as highs 659p on Thursday morning before the initial rally faded.

Despite the sharp rise today, the easyJet share price is still down 54% year to date.

easyJet share price

The rally in the easyJet share price also came a day after European countries announced plans to begin the reopening of their economies. Germany said it was to reopen schools and small shops in early May whilst President Trump said the US was past the peak.

This is ultimately the first step towards passengers being able to take flights again and has caused optimism among investors.

easyJet shares rose as highs 659p on Thursday morning before the initial rally faded.

Despite the sharp rise today, the easyJet share price is still down 54% year to date.

“Our first half trading performance was very strong prior to the impact of coronavirus, which shows the strength of easyJet’s business model,” said Johan Lundgren, easyJet CEO.

Airlines typically post losses across the Autumn and Winter months and make up for it in the Summer months. However, this year’s Summer trading period is going to be severely disrupted by the coronavirus lockdown. Much of the period is likely to be blighted by grounded flights or a severely reduced schedule. To combat these measures easyJet brought forward the release of winter 2020/2021 tickets and have enjoyed a significant increases in sales as passengers plan trips for when coronavirus lockdowns may have eased. The airline also said it had deferred the delivery of 24 aircraft and raised finance to ensure to financial strength of the group through the grounding of flights. easyJet share price

The rally in the easyJet share price also came a day after European countries announced plans to begin the reopening of their economies. Germany said it was to reopen schools and small shops in early May whilst President Trump said the US was past the peak.

This is ultimately the first step towards passengers being able to take flights again and has caused optimism among investors.

easyJet shares rose as highs 659p on Thursday morning before the initial rally faded.

Despite the sharp rise today, the easyJet share price is still down 54% year to date.

easyJet share price

The rally in the easyJet share price also came a day after European countries announced plans to begin the reopening of their economies. Germany said it was to reopen schools and small shops in early May whilst President Trump said the US was past the peak.

This is ultimately the first step towards passengers being able to take flights again and has caused optimism among investors.

easyJet shares rose as highs 659p on Thursday morning before the initial rally faded.

Despite the sharp rise today, the easyJet share price is still down 54% year to date. Bitcoin – Investing in the 4th Industrial Revolution

Bitcoin is one of today’s most misunderstood technologies. While Bitcoin is commonly touted as a speculative asset, its monetary token is the least exciting aspect of the technology. Far more promising is Bitcoin’s potential to serve as infrastructure for the Fourth Industrial Revolution: a data-based economy.

An Immutable and Transparent Infrastructure

Right now, the data we emit becomes the property of dubious organisations (e.g. Cambridge Analytica data scandal), and there’s no way to ensure the integrity of the data we record intentionally (e.g. Novartis data manipulation scandal).

The Bitcoin blockchain solves the issues of data ownership and data integrity, making it the ideal infrastructure for a data-based economy.

Bitcoin has the potential to transform existing business applications and infrastructure like EDI, accounting, banking, supply chain management, healthcare and many more. But, beyond these improvements lies a massive explosion of entirely novel business applications and enterprise models.

Interested to learn more? Pre-order your (free) copy of our new eBook, What is Bitcoin?

Webinar: Before Investing, Educate Yourself

The first step to identifying Bitcoin and blockchain investment opportunities should be to educate yourself thoroughly.

Bitstocks was established in 2014 as the City of London’s first Bitcoin Market Advisory and Cryptocurrency Investment firm. While we served as an investment house for retail bitcoin investors, our core purpose and focus was always, first and foremost, to be an education house that demystifies the complex nature of blockchain technology and offers insight into the financial and philosophical value held within its blueprint.

Ready to start your educational journey? Sign up for our free webinaron Wednesday 22nd April, 11am GMT.

Bitstocks Advisory Services

Keen to explore Bitcoin as an investment but not quite ready to do it on your own? Bitstocks’ global advisory service (minimum investment: £25k) might be the right option for you. By signing up for this bespoke service, you’ll benefit from the expertise of our in-house analysts, years of extensive Bitcoin knowledge, and our highly secure custody service. Our analysts will build your portfolio from the appropriate digital assets and manage your investment throughout.

As there are different levels of investment and services available, we recommend that you book a meeting with one of our expert Relationship Managers, or join our webinarto find the most suitable option for you.

Bitstocks was established in 2014 as the City of London’s first Bitcoin Market Advisory and Cryptocurrency Investment firm. While we served as an investment house for retail bitcoin investors, our core purpose and focus was always, first and foremost, to be an education house that demystifies the complex nature of blockchain technology and offers insight into the financial and philosophical value held within its blueprint.

Ready to start your educational journey? Sign up for our free webinaron Wednesday 22nd April, 11am GMT.

Bitstocks Advisory Services

Keen to explore Bitcoin as an investment but not quite ready to do it on your own? Bitstocks’ global advisory service (minimum investment: £25k) might be the right option for you. By signing up for this bespoke service, you’ll benefit from the expertise of our in-house analysts, years of extensive Bitcoin knowledge, and our highly secure custody service. Our analysts will build your portfolio from the appropriate digital assets and manage your investment throughout.

As there are different levels of investment and services available, we recommend that you book a meeting with one of our expert Relationship Managers, or join our webinarto find the most suitable option for you.

Bitstocks was established in 2014 as the City of London’s first Bitcoin Market Advisory and Cryptocurrency Investment firm. While we served as an investment house for retail bitcoin investors, our core purpose and focus was always, first and foremost, to be an education house that demystifies the complex nature of blockchain technology and offers insight into the financial and philosophical value held within its blueprint.

Ready to start your educational journey? Sign up for our free webinaron Wednesday 22nd April, 11am GMT.

Bitstocks Advisory Services

Keen to explore Bitcoin as an investment but not quite ready to do it on your own? Bitstocks’ global advisory service (minimum investment: £25k) might be the right option for you. By signing up for this bespoke service, you’ll benefit from the expertise of our in-house analysts, years of extensive Bitcoin knowledge, and our highly secure custody service. Our analysts will build your portfolio from the appropriate digital assets and manage your investment throughout.

As there are different levels of investment and services available, we recommend that you book a meeting with one of our expert Relationship Managers, or join our webinarto find the most suitable option for you.

Bitstocks was established in 2014 as the City of London’s first Bitcoin Market Advisory and Cryptocurrency Investment firm. While we served as an investment house for retail bitcoin investors, our core purpose and focus was always, first and foremost, to be an education house that demystifies the complex nature of blockchain technology and offers insight into the financial and philosophical value held within its blueprint.

Ready to start your educational journey? Sign up for our free webinaron Wednesday 22nd April, 11am GMT.

Bitstocks Advisory Services

Keen to explore Bitcoin as an investment but not quite ready to do it on your own? Bitstocks’ global advisory service (minimum investment: £25k) might be the right option for you. By signing up for this bespoke service, you’ll benefit from the expertise of our in-house analysts, years of extensive Bitcoin knowledge, and our highly secure custody service. Our analysts will build your portfolio from the appropriate digital assets and manage your investment throughout.

As there are different levels of investment and services available, we recommend that you book a meeting with one of our expert Relationship Managers, or join our webinarto find the most suitable option for you. Aquis Exchange revenue jumps as trading activity increases

Aquis Exchange (LON:AQX) has reported a 73% increase in revenue for the year ended 31st December as trading activity picked up among its members.

Revenue grew by 73% to £6.9m, up from 4m in the same period a year prior.

Aquis Exchange has three main revenue channels in Subscription Fees, License Fees and Market Data.

The most significant of these channels the Subscription Fees business which relates to the trading activities of its members and accounted for £5.3m, up 71% in 2019.

The introduction of new order types including the ‘Market at Close’ or ‘MaC’ order attracted higher trading volumes on the Aquis Platform.

The ‘Market at Close’ order allows traders to take the price at the close of the a market based on a broad range of trading facilities including dark pools.

In addition to strong growth in its trading facilities business, Aquis made the exciting acquisition of the NEX Exchange, a junior London exchange which has 90 companies listed on it with a combined market capitalisation of over $2 billion.

Aquis entered the primary market with the acquisition of the NEX Exchange with the aim of turning the exchange around. The NEX Exchange made a loss of £2.1 million in the year to 31st March 2019 but has huge potential to facilitate the IPOs of companies that may not be ready for the London’s main exchanges.

Alasdair Haynes, Chief Executive Officer of Aquis, commented on the results:

“Against a challenging market backdrop, Aquis delivered substantial operational and financial progress during 2019. It is very pleasing to see our adjusted EBITDA figure reaching near break-even, as revenues continue to grow across all business divisions and the MaC leads the field among closing auction alternatives in the market.

“Last month we were delighted to complete our acquisition of NEX Exchange, now renamed the Aquis Stock Exchange, and to list our first company on to it a few weeks later. Developing this market into a future-facing, disruptive home for quality growth businesses will be a key focus for us during the year ahead.

“Notwithstanding the impact of the COVID-19 pandemic, our aim is to take the Group to the next level of operational, financial and strategic success in 2020. We look forward to continuing to build value for all our stakeholders.”

COVID-19: 66% of businesses have furloughed staff

New data revealed on Wednesday that 66% of businesses have furloughed a proportion of their staff under the British government’s coronavirus Job Retention Scheme.

As the illness continues to spread, many are struggling to overcome the financial challenges caused by the measures to contain the virus.

Indeed, stricter lockdown measures in the UK have caused many non-essential shops to close, such as restaurants, pubs and bars.

Data from the British Chambers of Commerce’s Coronavirus Business Impact Tracker shows that 31% of businesses have furloughed between 75 to 100% of their workforce.

Meanwhile, very few firms have been able to successfully access government support schemes.

Indeed, the British Chambers of Commerce said that only 2% have been able to access the Coronavirus Business Interruption Loan Scheme this week, whilst 9% of survey respondents were unsuccessful.

For those who were unsuccessful, slow or no response from lenders has been cited as the main reason.

“Businesses on the frontline need cash to start flowing from support schemes fast.With April’s payday coming up, we are fast approaching a crunch point, and both the furlough scheme and CBILS facilities need to be accelerated,” British Chambers of Commerce Director General Dr Adam Marshall said in a statement.

“While we’ve seen a high number of firms furloughing staff in anticipation of the Job Retention Scheme coming online, it is still unclear whether they will start receiving funds before their payroll date, which could exacerbate the cash crisis many businesses are facing.”

“It is essential that the Job Retention Scheme makes payments to businesses as soon as possible. Any delay could mean more livelihoods under threat, more business failures, and more hardship in our communities.”

BP share price sinks on IEA demand outlook concern

The BP share price (LON:BP) fell sharply after a warning from the IEA the recent OPEC cuts will not be enough to reduce the over supply of oil.

The International Energy Agency said they saw oil demand falling 9% in 2020 due to the spread of coronavirus.

In the market reaction, the price of WTI oil fell beneath $20 to the lowest levels for 18 years, erasing the gains made due to the OPEC production cut.

OPEC confirmed 10 million in production cuts over the over the weekend in a historic move to reduce global oil supply.

However, the IEA has just poured cold water on the bullish impact of the OPEC supply cuts on the price of oil. Investors have seen the price of oil surpass the recent lows and take oil shares such as BP down with it.

The IEA see oil demand falling 9% in 2020 before recovering. Although the OPEC will remove some supply from the market it doesn’t go far enough to mitigate the declining demand.

The danger to the oil price is the over supply is quickly filling up storage facilities – something the IEA says could happen within weeks.

BP share price

The downbeat IEA outlook will cause concern for investors who enjoyed a sharp rally in the BP share price in the run up to the OPEC meeting. Not only does the low price of oil put pressure on on BP’s margins, the potential reduction in demand means overall volumes of oil sold will be lower. This will likely have a significant impact on BP’s earnings in 2020 as the lockdown to contain coronavirus destroys economic activity. However, investors will look to the IMF’s economic outlook and should take note of the strong recovery forecast for 2021. With the BP share price trading just above 300p, it would appear the reduction in earnings for 2020 is largely priced in and could provide upside if earnings return in 2021.COVID-19: over £1.1 billion lent to SMEs

News emerged on Wednesday that the UK banking and finance sector has lent more than £1.1 billion to small and medium-sized businesses in order to help them survive during the COVID-19 crisis.

Support has been provided through the Coronavirus Business Interruption Loan Scheme (CBILS).

UK Finance said that total lending has increased by 150% to £700 million in the last week.

As the virus continues to spread, many have been financially hit by the economic implications of the illness.

UK Finance said on Wednesday that lenders have received 28,460 applications to the scheme from businesses. More than 6,000 of these have been approved so far and more are expected to be processed and approved over the next few days.

Total lending under the scheme has jumped from £453 million on 6 April to £1.115 billion just a week later, and the average value of a loan has increased to more than £185,000.

“The banking and finance sector recognises the challenging conditions faced by many businesses and the critical role we must play in helping the country get through this crisis,” Stephen Jones, Chief Executive of UK Finance, said in a statement.

“Frontline staff in local branches and call centres are working incredibly hard to help firms access finance as quickly as possible amid unprecedented demand. Like all businesses they are working at reduced capacity as many staff are self-isolating or looking after family,” the Chief Executive continued.

Meanwhile, the Chancellor of the Exchequer, Rishi Sunak, said: “Getting finance to businesses is a key part of our plan to support jobs and the economy during this crisis – and we’re working with lenders to ensure support reaches those in need as soon as physically possible.”

“Loan approvals have doubled in a week with more than 6,000 businesses benefiting from over £1.1 billion of loans – and it’s vital we continue this upward trajectory,” Rishi Sunak added.

FTSE 100 falls as attention shifts to earnings and warnings of sharp recession

The FTSE 100 fell on Wednesday as investors shifted their attention to upcoming earnings season and the damage coronavirus may have had on corporate earnings.

In addition, investors digested warnings from the IMF that the global economy was heading towards the worst recession since the Great Depression.

The IMF have predicted the global economy will shrink by 3% in 2020, with Europe particularly heavily hit contracting by 7.5%.

The projections did, however, limit the economic downturn to 2020 before sharp rebounds next year.

The UK’s economy is expected to shrink by 6.5% in 2020 before rebounding 4% in 2021.

Coming into the coronavirus crisis many investors and analysts had predicted a V-shaped recovery. This would have involved a sharp increase in activity as the economic opened up as quickly as it shutdown. This now looks very unlikely with Germany announcing measures would remain in place until early May. The UK is set to make an announcement on Thursday which is widely expected to detail an extension of current social distancing practises. Even Donald Trump, who previously said the economy would be back to normal by Easter, has conceded the reopening of the economy will be protracted with the release of a draft ‘phased reopening plan’.The #IMF says the “Great Lockdown” recession will likely be the worst since the Great Depression. Global economy projected to shrink by 3% in 2020. By contrast, in January, the IMF had forecast a global GDP expansion of 3.3% for this year. Details in chart below. Table: @IMFNews pic.twitter.com/Kg6oXUvJ4c

— 🚶🏻Curtis S. Chin (@CurtisSChin) April 14, 2020

Corporate earnings

The market received the first instalment of earning from US companies in JP Morgan and Wells Fargo who didn’t release spectacularly bad earnings figures but did miss estimates and caused concern with preparations for an economic downturn. JP Morgan CEO, Jamie Dimon said “in the first quarter, the underlying results of the company were extremely good, however given the likelihood of a fairly severe recession, it was necessary to build credit reserves of $6.8B, resulting in total credit costs of $8.3B for the quarter.” Bank of America reported on Wednesday and also bumped up provisions for bad debts in preparation of consumer defaults.Burger King “vegan” adverts banned

Burger King adverts promoting the fast food chain’s vegan burger were banned on Wednesday for misleading consumers.

Adverts for the Rebel Whopper were seen in January as part of the Veganuary campaign, which encourages consumers to follow a vegan diet for a month.

These advertisements described the product as a “plant-based burger” and “100% Whopper No Beef”.

However, the Advertising Standards Authority said on Tuesday that these adverts were “misleading”.

Though the patty itself was plant-based, it was cooked on the same grill as meat products.

Burger King’s complete burger also contained egg-based mayonnaise, which means the burger as-sold was not actually suitable for vegans.

Adverts included the “Vegetarian Butcher” logo and a green colour palette.

Burger King’s adverts were also timed to coincide with the Veganuary campaign, which further contributed to the impression that the product was suitable for vegans and vegetarians.

“Because the overall impression of the ads was that the burger was suitable for vegans and vegetarians when in fact it was not, we concluded that the ads were misleading,” the Advertising Standards Authority said in a statement on Wednesday.

Veganuary is a particularly popular campaign which occurs at the beginning of the year. Many decide to try following a vegan diet for reasons linked to health and environmentalism.

A growing number of restaurants in the UK have begun to cater for vegans as there is profit to be made, especially in the month of January.

Greggs (LON:GRG) offers vegan versions of its classic sausage roll and steak bake.