Heineken withdraws 2020 guidance amid COVID-19 uncertainty

Heineken N.V. (AMS:HEIA) shares dropped on Wednesday after the company announced that it has withdrawn all guidance for 2020 as the COVID-19 outbreak continues to evolve.

Shares in the Dutch brewing company were down by almost 3% during trading on Wednesday.

Given the uncertainty surrounding the duration of the pandemic and its impact on the economy, the company has withdrawn its guidance for the 2020 year.

Heineken said that total consolidated volume is expected to decrease by 4% in the first quarter of 2020, with beer volume declining by 2%. The impact is expected to get worse in the second quarter.

As the illness continues to spread, several nations have been placed on lockdown to restrict the unnecessary movement of people, with only essential stores and outlets open.

“With the spread of the Covid-19 crisis to all geographies, multiple countries have taken far-reaching containment measures such as restrictions of movement for populations and outlet closures, sometimes combined with the mandatory lockdown of production facilities,” Heineken said in a statement.

“This constitutes a major negative macro-economic development and as such it is having a significant impact on Heineken’s markets and on its business in 2020,” the Dutch brewing company continued.

“In these very trying times, Heineken’s priority is to ensure the health and welfare of its employees, customers, and business partners. All Heineken teams are mobilised to enable the company to face this unprecedented crisis in the best possible way, and to protect the long-term potential of its brands and businesses.”

Shares in Heineken N.V. (AMS:HEIA) were down on Wednesday, trading at -2.36% as of 14:33 CEST.

UK insurers Aviva, RSA, Hiscox, Direct Lend scrap their dividends

UK insurance companies have suspended their dividends following pressure from the Bank of England’s Prudential Regulatory Authority.

Aviva said in a release “the Board has taken this decision in the wake of the unprecedented challenges COVID-19 presents for businesses, households and customers, and the adverse and highly uncertain impact on the global economy.”

The Prudential Regulatory Authority wrote to both UK insurers and banks at the end of March advising them to cease payouts to help ensure financial stability during a coronavirus-induced recession.

RSA were due to pay a dividend 14th May which will now be cancelled.

Martin Scicluna, Chairman of RSA, said:

“This is a difficult decision, not least in terms of the initial impact it will have on shareholders. The Company has a strong capital base, but we think it is right and prudent, for the many businesses and people that we support as well as wider stakeholders, to take these steps now, and ensure that RSA is well placed to continue doing what we can to help through this crisis.

“No company exists in a vacuum and at this time we judge it to be in the best long term interests of RSA to show forbearance on dividends and maximise our capability to support customers under the terms of their respective policies and play our part in industry initiatives to support relief efforts.”

Legal & General decided against Bank of England warnings and said they were going to proceed with a £750 million dividend payment which saw their shares soar.

The news insurers were to cut dividends came as Tesco confirmed they were going to maintain their dividends despite rising costs.

Investors have suffered a raft of dividend suspensions since the spread of coronavirus caused an economically damaging lockdown.

However, many of these suspensions were precautionary and are likely to be reinstated when the economy begins the recovery.

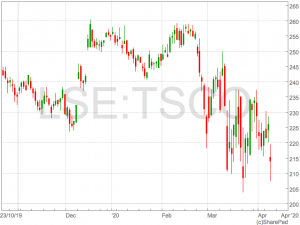

Tesco to maintain dividend despite higher costs

Tesco (LON:TSCO) are to continue to pay their dividend after it experienced a jump in sales due to coronavirus panic buying. However, this uplift may be short-lived as the group expects to suffer up to £925 million in additional costs through the pandemic.

In a trading update and preliminary results for 2020 the retailer said it had seen a circa 30% increase in sales during the onset of the coronavirus pandemic which had cleared the supply chain of certain lines. This is now said to be stabilising and they see stores well stocked.

The group said they had been on a hiring spree to meet demand, leading to higher overall costs as it supported employees unable to work due to illness or isolation.

Despite the expectation of higher costs, Tesco said they plan to pay their full year dividend of 9.15p.

The full year dividend would be in addition to a proposed special dividend from the sale of the Thai and Malaysian business.

In early March, Tesco announced it was selling the Thai and Malaysian business unit for a consideration of £8.2 billion, to help focus the business.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

Shares is Tesco were down over 4% following the announcement.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

Shares is Tesco were down over 4% following the announcement.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

Shares is Tesco were down over 4% following the announcement.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

Shares is Tesco were down over 4% following the announcement. ASOS shares jump after placing, coronavirus hits sales

ASOS (LON:ASC) has raised £247 million through a placing to help strengthen the groups balance sheet in the midst of the coronavirus crisis.

ASOS shares rose over 30% following the announcement of the successful placing conducted by JP Morgan as the market rewarded the company’s nimbleness.

ASOS are the first company to conduct a significant share sale in the coronavirus crisis.

The rise in ASOS shares also comes after the online retail company released first half results demonstrating strong sales, before the onset of the coronavirus lockdown.

ASOS revenue grew by 21% to £1.59 billion from £1.34 billion the year prior, in the six months to 28th February.

The strong sales were a result of a push into social media driving higher customer retention and acquisition.

However, the company said it has been adversely impacted by the spread of coronavirus and saw sales down in the region of 20-25% in the period since the end of the half year.

Nick Beighton, CEO of ASOS, commented:

“ASOS had a strong start to the year, making significant progress against the priorities we set out and delivering a better than anticipated first-half performance, driven by the operational improvements we are making to the business.

“Along with other businesses, we have been significantly impacted by the COVID-19 outbreak. Our first priority was to quickly put in place the necessary measures to ensure the health and wellbeing of our people. I have been extremely impressed with the pace of change and the flexibility our teams have shown in adopting these new ways of working. I’d like to thank them all for the way they have responded.”

“Since then, we have been focused on keeping our business delivering for customers whilst implementing a series of actions to mitigate the sales impact we have been experiencing. At the same time we have been working to strengthen our financial position, including reaching agreement with our lenders to provide us with additional short-term financial flexibility.”

Mr Beighton continued to explain how customer loyalty will provide ASOS with a steady demand through coronavirus, albeit reduced.

“The ASOS business model provides us with significant resilience and we are encouraged to have seen, across our markets, that where consumers are in lockdown, ASOS continues to be an important part of their lives. We have a global platform with the capacity and capability to drive our future growth as demand returns and against that backdrop we are looking to raise incremental equity capital to ensure we have sufficient resources to capitalise on the future whatever it may hold,” he said.

“The COVID crisis is clearly going to continue to be tough for everyone and the short-term outlook remains highly uncertain, but the measures we have taken ensure we are able to be clearly focussed on making sure that ASOS emerges as a stronger and better business.”

ASOS shares were up 33% to 2,085p in early trade on Wednesday.

Nick Beighton, CEO of ASOS, commented:

“ASOS had a strong start to the year, making significant progress against the priorities we set out and delivering a better than anticipated first-half performance, driven by the operational improvements we are making to the business.

“Along with other businesses, we have been significantly impacted by the COVID-19 outbreak. Our first priority was to quickly put in place the necessary measures to ensure the health and wellbeing of our people. I have been extremely impressed with the pace of change and the flexibility our teams have shown in adopting these new ways of working. I’d like to thank them all for the way they have responded.”

“Since then, we have been focused on keeping our business delivering for customers whilst implementing a series of actions to mitigate the sales impact we have been experiencing. At the same time we have been working to strengthen our financial position, including reaching agreement with our lenders to provide us with additional short-term financial flexibility.”

Mr Beighton continued to explain how customer loyalty will provide ASOS with a steady demand through coronavirus, albeit reduced.

“The ASOS business model provides us with significant resilience and we are encouraged to have seen, across our markets, that where consumers are in lockdown, ASOS continues to be an important part of their lives. We have a global platform with the capacity and capability to drive our future growth as demand returns and against that backdrop we are looking to raise incremental equity capital to ensure we have sufficient resources to capitalise on the future whatever it may hold,” he said.

“The COVID crisis is clearly going to continue to be tough for everyone and the short-term outlook remains highly uncertain, but the measures we have taken ensure we are able to be clearly focussed on making sure that ASOS emerges as a stronger and better business.”

ASOS shares were up 33% to 2,085p in early trade on Wednesday.

Nick Beighton, CEO of ASOS, commented:

“ASOS had a strong start to the year, making significant progress against the priorities we set out and delivering a better than anticipated first-half performance, driven by the operational improvements we are making to the business.

“Along with other businesses, we have been significantly impacted by the COVID-19 outbreak. Our first priority was to quickly put in place the necessary measures to ensure the health and wellbeing of our people. I have been extremely impressed with the pace of change and the flexibility our teams have shown in adopting these new ways of working. I’d like to thank them all for the way they have responded.”

“Since then, we have been focused on keeping our business delivering for customers whilst implementing a series of actions to mitigate the sales impact we have been experiencing. At the same time we have been working to strengthen our financial position, including reaching agreement with our lenders to provide us with additional short-term financial flexibility.”

Mr Beighton continued to explain how customer loyalty will provide ASOS with a steady demand through coronavirus, albeit reduced.

“The ASOS business model provides us with significant resilience and we are encouraged to have seen, across our markets, that where consumers are in lockdown, ASOS continues to be an important part of their lives. We have a global platform with the capacity and capability to drive our future growth as demand returns and against that backdrop we are looking to raise incremental equity capital to ensure we have sufficient resources to capitalise on the future whatever it may hold,” he said.

“The COVID crisis is clearly going to continue to be tough for everyone and the short-term outlook remains highly uncertain, but the measures we have taken ensure we are able to be clearly focussed on making sure that ASOS emerges as a stronger and better business.”

ASOS shares were up 33% to 2,085p in early trade on Wednesday.

Nick Beighton, CEO of ASOS, commented:

“ASOS had a strong start to the year, making significant progress against the priorities we set out and delivering a better than anticipated first-half performance, driven by the operational improvements we are making to the business.

“Along with other businesses, we have been significantly impacted by the COVID-19 outbreak. Our first priority was to quickly put in place the necessary measures to ensure the health and wellbeing of our people. I have been extremely impressed with the pace of change and the flexibility our teams have shown in adopting these new ways of working. I’d like to thank them all for the way they have responded.”

“Since then, we have been focused on keeping our business delivering for customers whilst implementing a series of actions to mitigate the sales impact we have been experiencing. At the same time we have been working to strengthen our financial position, including reaching agreement with our lenders to provide us with additional short-term financial flexibility.”

Mr Beighton continued to explain how customer loyalty will provide ASOS with a steady demand through coronavirus, albeit reduced.

“The ASOS business model provides us with significant resilience and we are encouraged to have seen, across our markets, that where consumers are in lockdown, ASOS continues to be an important part of their lives. We have a global platform with the capacity and capability to drive our future growth as demand returns and against that backdrop we are looking to raise incremental equity capital to ensure we have sufficient resources to capitalise on the future whatever it may hold,” he said.

“The COVID crisis is clearly going to continue to be tough for everyone and the short-term outlook remains highly uncertain, but the measures we have taken ensure we are able to be clearly focussed on making sure that ASOS emerges as a stronger and better business.”

ASOS shares were up 33% to 2,085p in early trade on Wednesday. Halifax: UK house prices stable before COVID-19

New data revealed on Tuesday that house prices in the UK were stable last month before the measures to contain COVID-19 were put in place.

According to the latest Halifax House Price Index, UK house prices in March were 3% higher than the same month a year earlier.

Meanwhile, house prices in Britain were flat on a monthly basis.

Last month was a turning point for the UK in its battle to contain the spread of COVID-19, as the government introduced stricter social distancing measures.

“The UK housing market began March with similar trends to previous months, as key market indicators showed a sustained level of buyer and seller activity,” Russell Galley, Managing Director at Halifax, commented on the data.

“Overall average house prices in the month were little changed from February’s record high, while annual growth nudged up to 3%,” Russell Galley continued.

“These factors all underlined a positive trajectory and increased momentum in the early part of the year, with confidence rising as political and economic uncertainty eased. However, it’s clear we ended the month in very different territory as a result of the country’s response to the coronavirus pandemic,” Russell Galley said.

The Managing Director added that most market activity “has been paused” as people are following government guidelines to stay at home.

Meanwhile, estate agencies, surveyors and conveyancers have been temporarily closed.

“With viewings cancelled and movers being encouraged to put transactions on hold, activity will inevitably fall sharply in the coming months. It should be noted that with less data available, calculating average house prices is likely to become more challenging in the short-term,” Russell Galley said.

“However, it’s still too early to properly assess what potential long-term impacts the current lockdown might have on the UK housing market. While there is very significant uncertainty at the moment, much will depend on the length of time it takes for restrictions to be lifted, the pressure that has been exerted on the economy in the meantime and the effect this has on consumer sentiment.”

All Cineworld cinemas closed amid COVID-19

Cineworld (LON:CINE) updated the market on Tuesday on its current position amid the evolving COVID-19 crisis.

Shares in the cinema chain soared above 40% during trading on Tuesday.

The company said that all 787 of its cinemas in 10 countries have been closed as a result of the virus outbreak.

Many governments have closed non-essential shops and outlets in an attempt to contain the spread of the illness.

Cineworld stressed the importance of conserving cash where possible and decided to suspend payment of its fourth quarter dividend, as well as upcoming 2020 quarterly dividends.

Additionally, the executive directors have voluntarily agreed to defer payment of their full salaries and any bonuses which they are entitled to, Cineworld added.

“Every effort is being made to mitigate the effect of the closures, to assist our employees and to preserve cash,” the cinema chain said in a statement.

“These efforts include discussions with our landlords, the film studios and major suppliers, as well as curtailing all currently unnecessary capital expenditure,” Cineworld continued.

“This is a painful but necessary process as before the onslaught of the COVID-19 virus, we were excited and confident about the Group’s future prospects. We are also discussing the Group’s ongoing liquidity requirements with our RCF banks.”

The COVID-19 outbreak continues to develop in the UK, and people are being encouraged to stay indoors in order to help contain the spread of the illness.

With most of the country coming to a standstill, these are difficult times for many businesses.

Shares in Cineworld Group plc (LON:CINE) were up on Tuesday, trading at +40.12% as of 10:57 BST.

FTSE 100 travel shares surge as German DAX enters bull market

The FTSE 100 and European shares rallied for a second day on Tuesday after Asian shares continued a risk-on rally over night.

A rally in global stocks has been sparked by optimism the number of coronavirus cases were falling in European epicentres.

Both Spain and Italy have recorded a consistent drop in new coronavirus cases over the past five days.

“The market is front running what it believes is a peak in the virus case count with Europe leading the way,” said Chris Weston, head of research at Pepperstone.

The German DAX has today entered a technical bull market from the 18th March low as its moved above 10,400.

A technical bull market is a market move higher of 20% or more.

The drop in cases has led to European governments laying out plans for a return to normal life. Austria has said it expected business to open again a1st May whilst Italy was working on a programme to start manufacturing again.

However, the rally in shares came as JP Morgan boss, Jamie Dimon, warned over the up coming recession and implications for the financial system.

“We don’t know exactly what the future will hold — but at a minimum, we assume that it will include a bad recession combined with some kind of financial stress similar to the global financial crisis of 2008,” Dimon said.

Travel shares surge

The FTSE 100 was buoyed by travel shares who have been destroyed during the spread of coronavirus. Carnival shares were up over 24% to 890p building on yesterdays gains following the news the Saudi Arabian Public Investment Fund had taken a 8.2% stake in the cruise liner. Carnival also announced it had successfully raised $1.95 billion through the issuance of convertible senior notes. easyJet shares also cheered the apparent peak in coronavirus cases, rallying over 16%. Intercontinental Hotels and International Consolidated Airlines were both up over 10%.GVC optimistic amid COVID-19 crisis

GVC (LON:GVC) shares rose on Monday after it provided an optimistic update concerning the outbreak of COVID-19.

Shares in the British sports betting company were up by 19% during trading on Monday.

The owner of Ladbrokes had previously warned that COVID-19 would impact its EBITDA by a reduction of roughly £100 million each month.

However, the company provided investors with hope on Monday, announcing that this damage has been reduced.

“Following the initiation of a number of mitigating actions the Group now expects to reduce this EBITDA impact to approximately £50m per month,” GVC said in a statement.

Many fear the economic impacts of the COVID-19 outbreak, as shops have been made to close in order to adhere to government guidelines.

“While our global and product diversification is standing us in good stead during the current uncertainty, the COVID-19 pandemic is posing an unprecedented challenge to our business and our industry,” Kenneth Alexander, GVC’s CEO, said in a statement.

“We are responding decisively, and have put in place a range of measures to keep our people safe, strengthen our financial position, limit cash outflow, preserve jobs and maintain a compelling customer offer,” the CEO continued.

“I am confident that we will emerge from this period in a position of strength, and we will be well placed to take advantage of a range of attractive growth opportunities which we believe will be available to us.”

The CEO said: “We are also sensitive to the fact that at this time of economic stress and isolation, it is vital that we ensure a safe, responsible and enjoyable gaming environment for our customers and do everything that we can to minimise the potential for harm.”

Shares in GVC Holdings plc (LON:GVC) were up on Monday, trading at +18.88% as of 12:21 BST.

UK new car registrations plunge 44%

Data revealed on Monday that UK new car registrations plunged in March as the evolving COVID-19 outbreak caused showrooms to close.

The Society of Motor Manufacturers & Traders (SMMT) said that UK new car registrations fell by 44% in March, which is a steeper decline than during the financial crisis.

Last month was the worst March since the late nineties, the SMMT added, with 203,370 fewer sold across the month.

Following government advice to contain the spread of the illness, showrooms have been closed.

Additionally, the SMMT downgraded its 2020 outlook to 1.73 million registrations. This is a 23% drop compared to the earlier outlook made in January, and 25% less than the 2.31 million registrations in 2019.

“With the country locked down in crisis mode for a large part of March, this decline will come as no surprise,” Mike Hawes, SMMT Chief Executive, commented on the data.

“Despite this being the lowest March since we moved to the bi-annual plate change system, it could have been worse had the significant advanced orders placed for the new 20 plate not been delivered in the early part of the month. We should not, however, draw long term conclusions from these figures other than this being a stark realisation of what happens when economies grind to a halt,” the Chief Executive continued.

The Chief Executive said: “How long the market remains stalled is uncertain, but it will reopen and the products will be there. In the meantime, we will continue to work with government to do all we can to ensure the thousands of people employed in this sector are ready for work and Britain gets back on the move.”

FTSE 100 rises inline with European shares as coronavirus cases dip

The FTSE 100 started higher on Monday after data over the weekend revealed a slowdown in cases in European epicentres such as Italy and Spain.

The FTSE 100 pushed up as high as 5,590 in early Monday trade, before the rally faded.

Europe indices such as the German DAX, French CAC, Spanish IBEX and Italian FTSE MIB were all stronger in a broad European rally.

The move to the upside was sparked by optimism European countries were past the current peak in coronavirus cases. Italy and Spain have registered the steepest incline in deaths globally but over the weekend the number of new cases and deaths fell in both European countries.

Italy registered 525 deaths on Sunday, the lowest number of deaths since March 19th. 15,887 people have now sadly died with coronavirus in Italy.

This fall in deaths suggests the lockdown measures had their desired effect more a month after they were implemented.

However, while Italy and Spain seemed to be moving past the peak, the United States were bracing for what experts predict will be their worst week. However, this didn’t have an impact on US equities as the Dow Jones and S&P 500 rose in the premarket.

Legal & General was the FTSE 100’s top risers after it said it was going to ignore Bank of England warnings and pay its dividend. UK banks scrapped their dividends last week on advice from the Prudential Regulatory Authority to cease all payouts including buybacks and senior staff bonuses. Shares in Legal & General were up more than 17% on Monday.

Coronavirus testing kit producer Novacyt shares were also stronger following an announcement on approval from France. Novacyt have recently supplied Public Health England with a test order and have FDA approval to distribute through the United States.

Oil shares were weaker as oil retreated from Friday’s sharp rally on the decision to push the OPEC + meeting to Thursday and reports of rifts opening up again between Russia and Saudi Arabia.