European shares staged a significant rally despite further concerns around US/China relations. China unveiled further measures that have been seen to increase instability in Hong Kong and threatens a reaction from the west.

“With varying degrees of tenacity, the markets continued to rally on Wednesday, ignoring further potential red flags for the US-China relationship,” said Connor Campbell, analyst at Spreadex.

“As Beijing add a bill banning mockery of the Chinese national anthem, while preparing to rubber stamp a new set of national security laws, armed policed flooded the streets of Hong Kong in an attempt deter and disperse pro-democracy protests.”

“Beyond the terrifying implications for Hong Kong itself, it is also adding fuel to the fire of US-China tensions. Trump has said he is ‘displeased’ with China, and that he will take action against the superpower this week if the national security laws are imposed.”

“And yet, despite all this, investors were insistent on focusing on the lockdown-easing measures from around the globe, extending yesterday’s substantial gains,” said Campbell.

European shares staged a significant rally despite further concerns around US/China relations. China unveiled further measures that have been seen to increase instability in Hong Kong and threatens a reaction from the west.

“With varying degrees of tenacity, the markets continued to rally on Wednesday, ignoring further potential red flags for the US-China relationship,” said Connor Campbell, analyst at Spreadex.

“As Beijing add a bill banning mockery of the Chinese national anthem, while preparing to rubber stamp a new set of national security laws, armed policed flooded the streets of Hong Kong in an attempt deter and disperse pro-democracy protests.”

“Beyond the terrifying implications for Hong Kong itself, it is also adding fuel to the fire of US-China tensions. Trump has said he is ‘displeased’ with China, and that he will take action against the superpower this week if the national security laws are imposed.”

“And yet, despite all this, investors were insistent on focusing on the lockdown-easing measures from around the globe, extending yesterday’s substantial gains,” said Campbell. FTSE 100 boosted by travel shares for second day

The FTSE 100 continued its rally into a second day on Wednesday, driven by a recovery in travel shares.

The FTSE 100 rose 1.32% to 6,147 in early trade on Wednesday and approached the highest intraday levels seen since the March sell off.

The FTSE 100 top riser was Carnival, up over 5% as it built on a 12% rally yesterday. easyJet and International Consolidated Airlines were both stronger, with the later posting gains in excess of 5%.

Optimism over the reopening of European economies to holiday makers has driven investors back into beaten down travel shares that now look like they are set to reignite cash flows within the next month and avert a much feared collapse.

In addition to strength in the travel sector, potential plans for more EU stimulus raised the mood across the market as Chinese industrial data showed signs of improvement.

European shares staged a significant rally despite further concerns around US/China relations. China unveiled further measures that have been seen to increase instability in Hong Kong and threatens a reaction from the west.

“With varying degrees of tenacity, the markets continued to rally on Wednesday, ignoring further potential red flags for the US-China relationship,” said Connor Campbell, analyst at Spreadex.

“As Beijing add a bill banning mockery of the Chinese national anthem, while preparing to rubber stamp a new set of national security laws, armed policed flooded the streets of Hong Kong in an attempt deter and disperse pro-democracy protests.”

“Beyond the terrifying implications for Hong Kong itself, it is also adding fuel to the fire of US-China tensions. Trump has said he is ‘displeased’ with China, and that he will take action against the superpower this week if the national security laws are imposed.”

“And yet, despite all this, investors were insistent on focusing on the lockdown-easing measures from around the globe, extending yesterday’s substantial gains,” said Campbell.

European shares staged a significant rally despite further concerns around US/China relations. China unveiled further measures that have been seen to increase instability in Hong Kong and threatens a reaction from the west.

“With varying degrees of tenacity, the markets continued to rally on Wednesday, ignoring further potential red flags for the US-China relationship,” said Connor Campbell, analyst at Spreadex.

“As Beijing add a bill banning mockery of the Chinese national anthem, while preparing to rubber stamp a new set of national security laws, armed policed flooded the streets of Hong Kong in an attempt deter and disperse pro-democracy protests.”

“Beyond the terrifying implications for Hong Kong itself, it is also adding fuel to the fire of US-China tensions. Trump has said he is ‘displeased’ with China, and that he will take action against the superpower this week if the national security laws are imposed.”

“And yet, despite all this, investors were insistent on focusing on the lockdown-easing measures from around the globe, extending yesterday’s substantial gains,” said Campbell.

European shares staged a significant rally despite further concerns around US/China relations. China unveiled further measures that have been seen to increase instability in Hong Kong and threatens a reaction from the west.

“With varying degrees of tenacity, the markets continued to rally on Wednesday, ignoring further potential red flags for the US-China relationship,” said Connor Campbell, analyst at Spreadex.

“As Beijing add a bill banning mockery of the Chinese national anthem, while preparing to rubber stamp a new set of national security laws, armed policed flooded the streets of Hong Kong in an attempt deter and disperse pro-democracy protests.”

“Beyond the terrifying implications for Hong Kong itself, it is also adding fuel to the fire of US-China tensions. Trump has said he is ‘displeased’ with China, and that he will take action against the superpower this week if the national security laws are imposed.”

“And yet, despite all this, investors were insistent on focusing on the lockdown-easing measures from around the globe, extending yesterday’s substantial gains,” said Campbell.

European shares staged a significant rally despite further concerns around US/China relations. China unveiled further measures that have been seen to increase instability in Hong Kong and threatens a reaction from the west.

“With varying degrees of tenacity, the markets continued to rally on Wednesday, ignoring further potential red flags for the US-China relationship,” said Connor Campbell, analyst at Spreadex.

“As Beijing add a bill banning mockery of the Chinese national anthem, while preparing to rubber stamp a new set of national security laws, armed policed flooded the streets of Hong Kong in an attempt deter and disperse pro-democracy protests.”

“Beyond the terrifying implications for Hong Kong itself, it is also adding fuel to the fire of US-China tensions. Trump has said he is ‘displeased’ with China, and that he will take action against the superpower this week if the national security laws are imposed.”

“And yet, despite all this, investors were insistent on focusing on the lockdown-easing measures from around the globe, extending yesterday’s substantial gains,” said Campbell. Graphite miner Blencowe set to shine in 2020

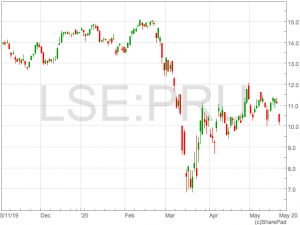

The latest resource company to list on LSE – Blencowe Resources (LON: BRES) – has enjoyed a strong few weeks of trading since relisting on April 28th, moving up nearly 50% from 6p towards 9p in a weak market where many of its peers are heading in the opposite direction. What makes Blencowe and its Orom-Cross Graphite Project in Uganda stand out as special?

Graphite is not particularly high profile as a mining commodity, but it is a naturally occurring form of crystalline carbon. It has many uses today, but key to its importance is that graphite makes up approximately half the weight of a lithium-ion battery, used extensively for powering electric vehicles (EV) and storing renewable energy around the globe.

Every EV currently contains between 30-50kgs of graphite within its lithium-ion battery, and like all batteries, from time to time they need replacing. Most auto manufacturers around the world have thrown down markers and timelines to replace current diesel and petrol vehicles with electric versions, and although the pace of change around the EV revolution hasn’t swept all before it as dramatically as was initially predicted, the burgeoning levels of investment into battery production and EV production suggests that demand for the core minerals is set to extrapolate over the next decade and beyond.

Enter Blencowe Resources and its Orom-Cross Project, which is one of the largest graphite deposits in the world, estimated to contain over three billion

tonnes. Furthermore, most of its graphite is near to surface, which means it can be mined easily and at very low cost.

Add to this the high quality of the graphite, its ability to upgrade to a highly sought-after concentrate and a recently awarded 21- year mining license and it is clear that Blencowe has all the attributes to develop into a world class graphite play. Another important factor is the project’s location in Uganda. The English-speaking nation is universally viewed as one of the most stable African countries, with all the requisite qualities in which to develop a world class resource project.

With over 50% of the world’s graphite currently forecast to come out of much higher risk Southern African countries such as Mozambique, Madagascar and Tanzania, lithium-ion battery producers and auto manufacturers are rightly concerned that one of their key source products may be at risk of a supply bottleneck, all of which makes the case for Blencowe’s Orom-Cross project even more compelling.

And at a paltry £8m market cap, Blencowe may be one junior resource company worth following closely over the next few years as it develops this extraordinary asset into production. Covid-19 restrictions notwithstanding, Blencowe has plenty lined up in 2020, with a maiden JORC resource number and strategic partnerships announcements expected. One thing is already clear – the Orom graphite project will be right on time for the anticipated explosion in demand for EV’s and battery technology.

And at a paltry £8m market cap, Blencowe may be one junior resource company worth following closely over the next few years as it develops this extraordinary asset into production. Covid-19 restrictions notwithstanding, Blencowe has plenty lined up in 2020, with a maiden JORC resource number and strategic partnerships announcements expected. One thing is already clear – the Orom graphite project will be right on time for the anticipated explosion in demand for EV’s and battery technology.

And at a paltry £8m market cap, Blencowe may be one junior resource company worth following closely over the next few years as it develops this extraordinary asset into production. Covid-19 restrictions notwithstanding, Blencowe has plenty lined up in 2020, with a maiden JORC resource number and strategic partnerships announcements expected. One thing is already clear – the Orom graphite project will be right on time for the anticipated explosion in demand for EV’s and battery technology.

And at a paltry £8m market cap, Blencowe may be one junior resource company worth following closely over the next few years as it develops this extraordinary asset into production. Covid-19 restrictions notwithstanding, Blencowe has plenty lined up in 2020, with a maiden JORC resource number and strategic partnerships announcements expected. One thing is already clear – the Orom graphite project will be right on time for the anticipated explosion in demand for EV’s and battery technology. FTSE 100 jumps on economic recovery hopes

The FTSE 100 rallied on Tuesday on market optimism global economies would soon reopen as governments outlined plans for the lifting of restrictions over the weekend.

The FTSE 100 was up 1.38% at 6070 in midmorning trade on Tuesday after a long bank holiday weekend that saw global stocks rally whilst the FTSE 100 was closed on Monday.

“Once again the markets embraced an optimistic outlook regarding the current coronavirus situation, setting aside fears over the long-term economic impact of the pandemic AND the ever-growing tensions between the US and China to instead focus on another round of global easing measures,” said Connor Campbell, analyst at Spreadex.

There was also hope the UK economy would soon bounce back as the Prime Minister announced plans for shops to reopen in the coming weeks.

“The FTSE led the charge on Tuesday, returning from the Bank Holiday weekend feeling refreshed and rejuvenated. That’s because Boris Johnson gave the public more details on how the UK is going to stagger out of lockdown.”

Oil majors BP and Shell added a significant number of points to London’s leading index after a rally in oil helped lift commodity shares.

BP and Shell were up 1.8% and 2.2% respectively whilst Brent oil rose through $36.

However, the top FTSE 100 risers were IAG and easyJet, both up around 20%. The jump in airlines shares came after an industry wide update on the resumption of flights and announcements from some European countries they would be scrapping quarantine measures.

Spain released a statement over the weekend that included plans to remove the current mandatory quarantine 1st July which would open the doors for holiday makers to take flights to one of the UK’s most popular holiday destinations.

Cruise operator Carnival was also stronger, up 12%.

Fresnillo was the FTSE 100’s biggest faller as demand for safe haven precious metals was sapped by a risk-on sentiment in markets.

UK and Coronavirus – reviewing a difficult week for Boris’s government

Running on a precarious combination of national solidarity and political incompetence, the UK’s Coronavirus outlook ended the week much the same as it began. There is a lack of clarity, a lack of optimism, and we still seem far behind our peers in dealing with the virus.

Any hope of enforcement?

On Friday, Home Secretary Priti Patel did offer some semblance of tangible policy, with the implementation of self-quarantine for arrivals into the UK. The new measure will mean those coming into the country will have to self-quarantine for 14 days, effective from the 8th of June, with failure to comply resulting in a £1,000 fine. The quarantine policy will not apply to those travelling from the Republic of Ireland, the Channel Islands and the Isle of Man and will exempt lorry drivers, seasonal farm workers and Coronavirus medics. Unfortunately, the system will be enforced by way of ‘random spot checks’, and will likely end up being as strictly implemented as the government’s consistently vague advice on going outdoors. Also, after a challenging week of backtracking on fees for overseas NHS workers, any hope of continued clarity in Ms Patel’s announcement was dashed as the Home Secretary was flustered by a question from The Independent, who asked whether the visa extensions offered to overseas doctors and nurses would also be afforded to hospital porters and cleaners.Flouting his own guidelines

The government’s bumpy end to the week was made worse, as allegations of Dominic Cummings flouting isolation rules were made public. A spokesman for Durham Constabulary said, “On Tuesday, March 31, our officers were made aware of reports that an individual had travelled from London to Durham and was present at an address in the city.” “Officers made contact with the owners of that address who confirmed that the individual in question was present and was self-isolating in part of the house.” “In line with national policing guidance, officers explained to the family the guidelines around self-isolation and reiterated the appropriate advice around essential travel.” At the time, Cummings had been reported as self-isolating with symptoms of Coronavirus, having made recent contact with both Matt Hancock and Boris Johnson, both of whom had tested positive for the virus. The allegations follow sightings of the Number 10 advisor outside of his parents’ house. They not only represent a contradiction of the advice issued by the government, but a replication of behaviour which has seen other high profile officials being forced to resign.Back to school, or not?

The party’s rocky end of the week was exacerbated again by continued resistance to primary school children returning to school. Despite popular desire for life as normal to resume, the Teachers’ Union disputed reports by the Sun newspaper, which framed findings from the SAGE scientific advisory group as clearly indicating the reduced risk factors of young children being exposed to Coronavirus. “It will quickly become clear to anybody reading the papers that the science is not definitive,” said Geoff Barton, leader of the ASCL heads teachers’ union. “The papers highlight the significant gaps in evidence, knowledge and understanding,” said Patrick Roach, leader of the Nasuwt teachers’ union. The mood of the general public seems to be equally ambiguous, with some saying it should be the parents’ prerogative to allow their children to return to school if they see fit, while others have argued that the benchmark for returning to normality should be set by MPs returning to Commons.Holyrood-Westminster divergence

Much like Wales, the Scottish government’s approach to the virus is becoming more diametrically opposed to that of Westminster as the days pass. After announcing an additional £50 million in social care support funding last Tuesday, on Thursday Nicola Sturgeon published plans to start relaxing the country’s quarantine from next week, having maintained its restrictions on outdoor activities and travel more than a week beyond their English counterparts. On Wednesday, the Scottish government also followed the example of Wales, Denmark and France, and said they too would not be offering financial support to companies based in tax havens. The proposals were initially tabled and then amended by the Scottish Green Party, before being backed by both the SNP and Scottish Conservatives. Speaking on the news, SGP co-leader Patrick Harvie commented, “Any company which avoids its responsibility to contribute to society should not be getting handouts when things go wrong. That’s why many European nations and Wales have already made this commitment.” “I’m delighted that ministers finally saw sense on this basic issue of fairness. This move isn’t the final word, but it marks the beginning of a new approach to tackling the companies which shamelessly avoid paying tax, and we will continue to build on what’s been achieved today.”Final thought

It has proven to be a difficult week for the Conservative party. On Friday we saw the likes of Ian Hislop take the PM to task on Have I Got News for You, as the Boris administration’s hesitance and negligence becomes accepted public discourse. As the founder of ‘Clap for Carers’ calls for the ritual to be ended – before it becomes an exclusively cynical, political device – Jacob Rees-Mogg encouraged MPs to return to Commons, and gee up the prime minister for next week’s PMQs. Unfortunately for the prime minister, the ‘turbo-charging’ and ‘ramping-up’ rhetoric appears increasingly hollow; his party lauds ‘NHS heroes’ one day and votes down NHS pay-rises the next. As we should see through his babbling veneer more and more with each passing day, Boris’s handling of Coronavirus should also see his hopes of a Churchill-esque legacy become a more and more distant dream.Investment grade artist – Richard Hambleton, proving real value to investor’s portfolios during turbulent times.

Sponsored by Woodbury House

We spoke with Woodbury House to find out more about the art investment market, in particular street art and an artist named Richard Hambleton. Here is an inside scoop about Woodbury House and their knowledge of Richard Hambleton and the art market.

We visited their studio and interviewed the brand’s co-founder Steven Sulley.

Woodbury House is a well-respected private art studio based in the heart of Soho, London. They specialise in contemporary art and have an extensive collection of artworks from emerging to established artists. Artists included in their collection are Richard Hambleton, Daze, Banksy, Futura, Retna, and many more. Click here to contact Woodbury House.

There are substantial plans for Woodbury House as they venture into becoming the link between the art and fashion world. Whilst still selling investment-grade art, later this year Woodbury House 2.0 is due to launch, this will commence the start of limited drops that they will continue to release with various emerging and established artists.

Coined ‘The Godfather of Street art’ by The New York Times, Richard Hambleton is regarded as a legend of the street art world as many late artists have used his artwork as inspiration. The 1980s New York scene was a popular exclusive scene to be a part of, Hambleton was not fazed by the limelight and rejected the attention he received.

However, his predecessors Jean-Michel Basquiat and Keith Haring were very savvy on their approach towards the press. They worked in collaboration with them agreeing to interviews and article features to remain in the public eye.

We’ve gathered data from past auctions, to show a price increase of one artwork for each of the three artists. We decided to compare past auction results, as this is impartial data out there for everybody to see.

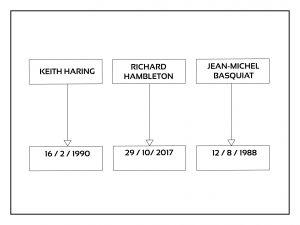

Below is a graph showing the dates of the three artists that have passed away, as you can see Hambleton’s friends, Basquiat and Haring passed away over thirty years ago.

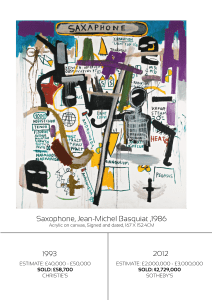

Jean-Michel Basquiat

Price increase of £2,670,300 in 19 years

Jean-Michel Basquiat

Price increase of £2,670,300 in 19 years

\

Richard Hambleton

Price increase of $312,600 in 12 years.

\

Richard Hambleton

Price increase of $312,600 in 12 years.

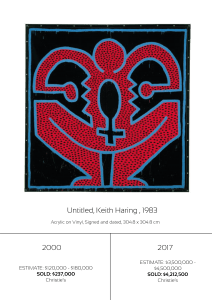

Keith Haring

Price increase of $3,975,500 in 17 years.

Keith Haring

Price increase of $3,975,500 in 17 years.

Once an artist passes their artwork becomes limited to an archive of artwork they created whilst they were alive. In this case, Hambleton’s artwork from the start of his career i.e. the 1980s is becoming much harder to source as investors are seeking these works to build up their collections.

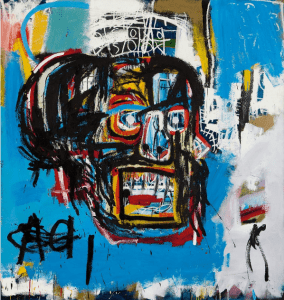

Below is Basquiat’s most memorable artwork originally sold for $19,000 in 1984 and progressed to sell for $110.5 million in the Sotheby’s auction in 2017.

Once an artist passes their artwork becomes limited to an archive of artwork they created whilst they were alive. In this case, Hambleton’s artwork from the start of his career i.e. the 1980s is becoming much harder to source as investors are seeking these works to build up their collections.

Below is Basquiat’s most memorable artwork originally sold for $19,000 in 1984 and progressed to sell for $110.5 million in the Sotheby’s auction in 2017.

To conclude, logic suggests that the Hambleton market will follow in the same footsteps as his predecessors Jean-Michel Basquiat and Keith Haring. Hambleton’s works have already seen some good capital growth since his death in 2017, the above artwork we showed is not a standalone example either. Investors and collectors worldwide are now stockpiling his work with a common-sense approach that it will rise in value in the coming years.

To conclude, logic suggests that the Hambleton market will follow in the same footsteps as his predecessors Jean-Michel Basquiat and Keith Haring. Hambleton’s works have already seen some good capital growth since his death in 2017, the above artwork we showed is not a standalone example either. Investors and collectors worldwide are now stockpiling his work with a common-sense approach that it will rise in value in the coming years.

Jean-Michel Basquiat

Price increase of £2,670,300 in 19 years

Jean-Michel Basquiat

Price increase of £2,670,300 in 19 years

\

Richard Hambleton

Price increase of $312,600 in 12 years.

\

Richard Hambleton

Price increase of $312,600 in 12 years.

Keith Haring

Price increase of $3,975,500 in 17 years.

Keith Haring

Price increase of $3,975,500 in 17 years.

Once an artist passes their artwork becomes limited to an archive of artwork they created whilst they were alive. In this case, Hambleton’s artwork from the start of his career i.e. the 1980s is becoming much harder to source as investors are seeking these works to build up their collections.

Below is Basquiat’s most memorable artwork originally sold for $19,000 in 1984 and progressed to sell for $110.5 million in the Sotheby’s auction in 2017.

Once an artist passes their artwork becomes limited to an archive of artwork they created whilst they were alive. In this case, Hambleton’s artwork from the start of his career i.e. the 1980s is becoming much harder to source as investors are seeking these works to build up their collections.

Below is Basquiat’s most memorable artwork originally sold for $19,000 in 1984 and progressed to sell for $110.5 million in the Sotheby’s auction in 2017.

To conclude, logic suggests that the Hambleton market will follow in the same footsteps as his predecessors Jean-Michel Basquiat and Keith Haring. Hambleton’s works have already seen some good capital growth since his death in 2017, the above artwork we showed is not a standalone example either. Investors and collectors worldwide are now stockpiling his work with a common-sense approach that it will rise in value in the coming years.

To conclude, logic suggests that the Hambleton market will follow in the same footsteps as his predecessors Jean-Michel Basquiat and Keith Haring. Hambleton’s works have already seen some good capital growth since his death in 2017, the above artwork we showed is not a standalone example either. Investors and collectors worldwide are now stockpiling his work with a common-sense approach that it will rise in value in the coming years. FTSE 100 led lower by financials with Hong Kong exposure

The FTSE 100 fell on Friday after China said it was going impose security law in Hong Kong, significantly increasing tensions that had diminished during the coronavirus outbreak.

Security law means it would be made illegal for people in Hong Kong to undermine the central Chinese government under lose offences of treason, sedition and subversion.

Mike Pompeo, US Secretary of State, called the move a ‘death knell’ for Hong Kong autonomy.

Whilst Hong Kong leaders said they would co-operate with the legislation, many voiced their concerns over the move which could see a return to social unrest that caused significant economic disruption before the COVID-19 pandemic.

The real risk is any unrest spills over into the relationship between the US and China who are locked into trade negotiations and a political stand off caused by Trump blaming China for the global coronavirus crisis.

The FTSE 100 had reached lows of 5,893 on Friday morning before recovering to 5,980 at 15:30 on Friday.

FTSE 100 shares with a substantial exposure to Hong Kong were among the most heavily hit as Prudential shed 8% and HSBC sank 4%. Asia focused Standard Chartered was down 2.8%.

Following the demerger of M&G Investments, Prudential is highly reliant on Asian earnings and disruption in Hong Kong could be highly damaging to 2020 earnings.

Burberry was one of the top risers after the luxury brand said it had seen a strong rebound in Asian sales as demand returns after lockdown measures are lifted. Whitbread was also stronger as the Premier Inn owner rebounded following the announcement of a rights issue.

Following the demerger of M&G Investments, Prudential is highly reliant on Asian earnings and disruption in Hong Kong could be highly damaging to 2020 earnings.

Burberry was one of the top risers after the luxury brand said it had seen a strong rebound in Asian sales as demand returns after lockdown measures are lifted. Whitbread was also stronger as the Premier Inn owner rebounded following the announcement of a rights issue.

Despite falling on Friday, the FTSE 100 is now down just 20% in 2020 having rallied 20% from the 23rd March low. However, there are concerns that the market hasn’t fully priced in the risk of coronavirus on the economy.

“After the shock of the COVID-19 lockdown, we have to go through a regular recession with high unemployment, low capex, low demand and that’s not what’s priced in at the moment,” said Andrea Cicione, head of strategy at TS Lombard.

Despite falling on Friday, the FTSE 100 is now down just 20% in 2020 having rallied 20% from the 23rd March low. However, there are concerns that the market hasn’t fully priced in the risk of coronavirus on the economy.

“After the shock of the COVID-19 lockdown, we have to go through a regular recession with high unemployment, low capex, low demand and that’s not what’s priced in at the moment,” said Andrea Cicione, head of strategy at TS Lombard.

Following the demerger of M&G Investments, Prudential is highly reliant on Asian earnings and disruption in Hong Kong could be highly damaging to 2020 earnings.

Burberry was one of the top risers after the luxury brand said it had seen a strong rebound in Asian sales as demand returns after lockdown measures are lifted. Whitbread was also stronger as the Premier Inn owner rebounded following the announcement of a rights issue.

Following the demerger of M&G Investments, Prudential is highly reliant on Asian earnings and disruption in Hong Kong could be highly damaging to 2020 earnings.

Burberry was one of the top risers after the luxury brand said it had seen a strong rebound in Asian sales as demand returns after lockdown measures are lifted. Whitbread was also stronger as the Premier Inn owner rebounded following the announcement of a rights issue.

Despite falling on Friday, the FTSE 100 is now down just 20% in 2020 having rallied 20% from the 23rd March low. However, there are concerns that the market hasn’t fully priced in the risk of coronavirus on the economy.

“After the shock of the COVID-19 lockdown, we have to go through a regular recession with high unemployment, low capex, low demand and that’s not what’s priced in at the moment,” said Andrea Cicione, head of strategy at TS Lombard.

Despite falling on Friday, the FTSE 100 is now down just 20% in 2020 having rallied 20% from the 23rd March low. However, there are concerns that the market hasn’t fully priced in the risk of coronavirus on the economy.

“After the shock of the COVID-19 lockdown, we have to go through a regular recession with high unemployment, low capex, low demand and that’s not what’s priced in at the moment,” said Andrea Cicione, head of strategy at TS Lombard. Burberry sees ‘strong rebound’ in Asia

Burberry shares (LON:BRBY) gained on Friday as the luxury brand said they were experiencing a bounce back in demand from key Asian markets.

“It will take time to heal but we are encouraged by our strong rebound in some parts of Asia and are well-prepared to navigate through this period. Now, more than ever, our strategy to secure our position in luxury fashion is key,” said Marco Gobbetti, Chief Executive Officer of Burberry.

Burberry shares were over 2% stronger in early Friday morning trade, one of the few shares up on the day as the FTSE 100 fell 1.76% to 5,909.

The comments from the CEO were released in the group’s preliminary 2020 results, in which pro forma revenue in the 52 weeks to 28th March fell 3% to £2,633m.

The 3% drop in revenue could be seen as a relatively positive result, given 60% of stores were closed at the end of March due to coronavirus with comparable Q4 sales falling 27%.

The drop in sales in Q4 offset what had been a strong year for Burberry having seen double digit growth in their new collections.

However, the uncertainty surrounding COVID-19 was enough to push the board in the direction of many other FTSE 100 companies and cut their dividend to help strengthen the balance sheet.

“With these results, it comes as no surprise that, hoping to ensure liquidity, the company has decided to pull its dividend and review future pay-outs at the end of its 2021 year,” said Russell Pointon, Director & Head of Consumer at Edison Investment Research.

“Prior to the pandemic, Burberry, began to focus on leather goods and accessories in a bid to diversify their brand towards more resilient and growing sectors in the market and that has helped them navigate the current landscape. Although, they´ve had to put a hold on their plan to revive sales with star designer Ricardo Tisci, the opening of stores mainly in Asia should provide some comfort and hope for the company.”

“With much of the world still in lockdown, and hence no open shops, turbulent times still lie ahead for Burberry. Nevertheless, given its strong online offering as well as diversification of products, it will be interesting to see if consumers will continue buying online or potentially holding off from luxury during the coming months.”

FTSE 100 retreats on China concerns and poor UK data

The FTSE 100 fell on Thursday as the market digested UK economic data that had been ravaged by COVID-19 and a risk-off tone was set by concerns over China rifts.

The FTSE 100 was trading at 6,055, down 0.19%, going into the close on Thursday.

“On one hand, it was a relatively good morning for UK data. The flash manufacturing PMI rose from 32.6 to 40.6, while the services reading bounced from a truly horrific 13.4 to 27.8. On the other hand, the manufacturing and services PMIs still came in at 40.6 and 27.8, the awfulness of those readings only slightly dulled by comparisons to the month previous,” said Connor Campbell, analyst at Spreadex.

“The situation was the same across the Eurozone, with the French, German and region-wide PMIs all improving month-on-month. In fact, all bar the German manufacturing reading also came in higher than forecast.”

“However, it was little comfort to investors. With Trump ploughing ahead with his daily twitter assaults on China, but this time combing it with a 20-page report detailing the superpower’s ‘malign activities’ in an attempt to take heat off his own mishandling of the coronavirus pandemic, investors are worried about the state of things between Washington and Beijing,” Campbell said.

Whitbread was the top faller on Thursday after the Premier Inn owner announced a rights issue.

Rolls Royce was the top riser as the engine maker said they were going to cut 9,000 jobs ,whilst easyJet rose on plans to start flights again in mid-June.

easyJet shares fly as flights set to resume in June

easyjet shares (LON:EZJ) rose sharply on Thursday as the budget airlines announced plans to commence flights from 15th June.

easyJet shares rose over 6% in midmorning trade on Thursday.

The service will be limited with flights revolving around a number of airports in the UK and France initially, with plan to expand the service as more European governments ease restrictions.

The COVID-19 lockdown has ravaged the European airline industry and governments are under pressure to step in and help prevent major airlines collapse.

The German government is exploring what would be a remarkable step to bailout of Lufthansa and take stake in the company whilst AirFrance has sought help from both the French and Dutch governments.

Government support has it’s critics and the Ryanair CEO said government bailouts would distort the market.

Nonetheless, the resumption of flights will be a lifeline for easyJet who will soon be facing the repercussions of a sophisticated cyber attack that compromised the personal details of 9 million people. However, easyJet said there hadn’t been any evidence of wrongdoing with the details.

Johan Lundgren, easyJet CEO commented on the resumption of flights:

“I am really pleased that we will be returning to flying in the middle of June. These are small and carefully planned steps that we are taking to gradually resume operations. We will continue to closely monitor the situation across Europe so that when more restrictions are lifted the schedule will continue to build over time to match demand, while also ensuring we are operating efficiently and on routes that our customers want.

“The safety and wellbeing of our customers remains our highest priority, which is why we are implementing a number of measures to enhance safety at each part of the journey, from disinfecting the aircraft to requiring customers and crew to wear masks. These measures will remain in place for as long as is needed to ensure customers and crew are able to fly safely as the world continues to recover from the impact of the coronavirus pandemic.”

Johan Lundgren, easyJet CEO commented on the resumption of flights:

“I am really pleased that we will be returning to flying in the middle of June. These are small and carefully planned steps that we are taking to gradually resume operations. We will continue to closely monitor the situation across Europe so that when more restrictions are lifted the schedule will continue to build over time to match demand, while also ensuring we are operating efficiently and on routes that our customers want.

“The safety and wellbeing of our customers remains our highest priority, which is why we are implementing a number of measures to enhance safety at each part of the journey, from disinfecting the aircraft to requiring customers and crew to wear masks. These measures will remain in place for as long as is needed to ensure customers and crew are able to fly safely as the world continues to recover from the impact of the coronavirus pandemic.”

Johan Lundgren, easyJet CEO commented on the resumption of flights:

“I am really pleased that we will be returning to flying in the middle of June. These are small and carefully planned steps that we are taking to gradually resume operations. We will continue to closely monitor the situation across Europe so that when more restrictions are lifted the schedule will continue to build over time to match demand, while also ensuring we are operating efficiently and on routes that our customers want.

“The safety and wellbeing of our customers remains our highest priority, which is why we are implementing a number of measures to enhance safety at each part of the journey, from disinfecting the aircraft to requiring customers and crew to wear masks. These measures will remain in place for as long as is needed to ensure customers and crew are able to fly safely as the world continues to recover from the impact of the coronavirus pandemic.”

Johan Lundgren, easyJet CEO commented on the resumption of flights:

“I am really pleased that we will be returning to flying in the middle of June. These are small and carefully planned steps that we are taking to gradually resume operations. We will continue to closely monitor the situation across Europe so that when more restrictions are lifted the schedule will continue to build over time to match demand, while also ensuring we are operating efficiently and on routes that our customers want.

“The safety and wellbeing of our customers remains our highest priority, which is why we are implementing a number of measures to enhance safety at each part of the journey, from disinfecting the aircraft to requiring customers and crew to wear masks. These measures will remain in place for as long as is needed to ensure customers and crew are able to fly safely as the world continues to recover from the impact of the coronavirus pandemic.”