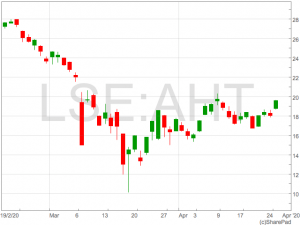

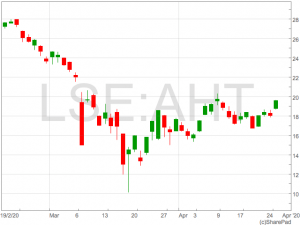

Ashtead share price builds on stable trading environment

Shares in plant-hire company Ashtead (LON:AHT) rose on Monday after the company said operations were relatively stable during the coronavirus crisis.

Although the US-focused business highlighted disruption due to coronavirus, the business has been classed as an essential business due to the work it does with emergency services. This means most of Ashtead’s locations have remained opened and providing Ashtead with a steady stream of business through the crisis.

The company also provided guidance on profit for 2020FY ending 30th April. Ashtead said it expects profit before tax to be in the region on £1.050m, this would be almost identical to 2019FY profit before tax of 1,059.5m.

Shares in Ashtead (LON:AHT) rose over 7% on Monday morning in reaction to the news.

The emerging new sector of FTSE 100 ‘lockdown’ shares

There is an emerging new sector of FTSE 100 shares whose products and services have become inextricably linked to the coronavirus lockdown.

The economy has changed beyond recognition due to the spread of coronavirus and the subsequent lockdown and social distancing measures.

The initial market reaction was of course a devastating selloff that saw major global equity indices lose around a third of their value.

Equity indices, including the FTSE 100, have since stabilised and even started to move higher, helped by a recovery in beaten down cyclical shares, but also by an emerging new sector of those shares that benefit from the lockdown.

There are two factors behind the link to the lockdown; firstly those shares that enjoy increased revenue from the lockdown and those shares that benefit from increased buying by investors seeking a safe haven through the volatility.

These shares have outperformed during the coronavirus lockdown and will likely continue to do so whilst measures remain in place, until such a point they are lifted, when these stocks could very well underperform the wider FTSE 100 benchmark.

Ocado

Ocado has probably earned the crown as the ultimate lockdown share after consistently breaking record highs and posting gains of 25% in 2020. Consumers have flocked to Ocado’s website to avoid going to the supermarket to the extent the site crashed and others were unable to get a delivery slot for weeks. However the problems are now subsiding and Ocado is likely to have gained thousands of new customers that will continue to use their service after lockdown measures lift.

Sainsbury

Supermarkets are likely to be a beneficiary of the lockdown due to lack of alternatives for consumers who don’t buy items online. While demand for food remains relative steady after the spike higher due to panic buying, supermarkets will benefit from consumers purchasing goods they would have bought elsewhere during their trip to the supermarket. Sainsbury is particularly well placed to benefits from this with their in-store Argos offering, something that makes in stand out among the FTSE 100’s supermarket, although the likes of Morrisons and Tesco could well be be included as lockdown shares. In addition to the sales associated to Argos, with consumers unable to take holidays or eat out, it is likely they will spend more on higher quality items from Sainsbury as well as increasing the number of meals consumed as a result of shopping in Sainsbury’s stores.Polymetal & Fresnillio

Gold and other precious metals provide investors with a safe have during times of volatility, as well as providing a hedge against inflation. The spread of coronavirus has provided plenty of market volatility and gold has reacted accordingly; the yellow metal is up 16% year-to-date. In addition, to market volatility lifting gold, the prospect of higher inflation will provide support for the gold price going forward. For the time being, an increase in the price of everyday goods will be largely offset by the drop in the price of oil but the unprecedented levels of monetary stimulus from central banks and fiscal cash injections will lead to higher level of inflations as economies begin to open up. FTSE 100 Polymental & Fresnillo have been on a tear since the beginning of lockdown measures and are set to remain elevated during the period of uncertainty.

Reckitt Benckiser

The FTSE 100 owner of Dettol, Cillit Bang and Air Wick will have experienced an uptick in demand during lockdown panic buying, and the home-oriented products are expected to experience steady demand throughout the lockdown. RB is also one of the traditionally defensive ‘bond-proxy shares’ which will become increasingly attractive to investors whilst government bond yields remain depressed.AstraZeneca

The entire world is attempting to move heaven and earth in order lift the coronavirus lockdown. The key to lifting the lockdown are effective measures prevent the spread of COVID-19 and reduce the death rate in those infected by the virus. A vaccine is many months away so effective treatment of severely ill patients will be the most immediate method of fighting COVID-19. AstraZeneca is currently trialing two drugs in Calquence and Farxiga. The drugs have already been approved for the treatment of leukaemia and diabetes so it is deemed safe to conduct broad trials. We await the early results for signs of efficacy in treating COVID-19IG Group sees a jump in new clients and higher trading revenue

Spread betting and online trading company IG Group (LON:IGG) has enjoyed a sharp rise in the number of new clients and a jump in trading activity due to the coronavirus crisis.

The company said they had generated £173 million in the first 36 trading days of their Q4 trading period. When taking consideration revenue for the rest of the year it means IG have earnt £562.7 million in revenue so far in 2020FY, already well ahead of 2019FY’s £488m.

With the country under lockdown, traders have jumped at the opportunity to harness the volatility in financial markets by trading IG’s products.

The increase in activity means IG are set to return to revenue levels not seen since new ESMA regulations were implemented to help protect inexperienced retail clients from the high leverage of many of IG’s products.

However, the higher levels of activity meant remuneration levels would increase accordingly and costs were expected to rise by £40m.

The strength in the underlying business means IG Group are one of the few companies confident enough to maintain dividend payments and the company is to maintain their 43.2p dividend.

“During such a prolonged period of volatility, we’ve seen high volumes of clients choosing to trade markets with IG, reflecting our business resilience, our robust systems and our commitment to delivering the best possible trading experience,” said IG CEO, June Felix.

Cynics may argue the IG CEO attempts to distract from the fact IG have profited from the coronavirus crisis by drawing attention to the IG Brighter Future Fund in a large part of the comment on the results.

June Felix continued; “we are encouraged with the resilience and performance of our employees in such challenging times for everyone. The IG Brighter Future Fund builds on our culture of supporting the local communities in which we operate, helping disadvantaged young people gain access to improved educational opportunities. We are thrilled to be able to build on our partnership with Teach First and forge ties with other new international partners to support the long‐term education needs of children living through such an unsettling period.”

Shares in IG Group (LON:IGG) were down 0.6% in mid-afternoon trade having reverse early gains.

The increase in activity means IG are set to return to revenue levels not seen since new ESMA regulations were implemented to help protect inexperienced retail clients from the high leverage of many of IG’s products.

However, the higher levels of activity meant remuneration levels would increase accordingly and costs were expected to rise by £40m.

The strength in the underlying business means IG Group are one of the few companies confident enough to maintain dividend payments and the company is to maintain their 43.2p dividend.

“During such a prolonged period of volatility, we’ve seen high volumes of clients choosing to trade markets with IG, reflecting our business resilience, our robust systems and our commitment to delivering the best possible trading experience,” said IG CEO, June Felix.

Cynics may argue the IG CEO attempts to distract from the fact IG have profited from the coronavirus crisis by drawing attention to the IG Brighter Future Fund in a large part of the comment on the results.

June Felix continued; “we are encouraged with the resilience and performance of our employees in such challenging times for everyone. The IG Brighter Future Fund builds on our culture of supporting the local communities in which we operate, helping disadvantaged young people gain access to improved educational opportunities. We are thrilled to be able to build on our partnership with Teach First and forge ties with other new international partners to support the long‐term education needs of children living through such an unsettling period.”

Shares in IG Group (LON:IGG) were down 0.6% in mid-afternoon trade having reverse early gains.

The increase in activity means IG are set to return to revenue levels not seen since new ESMA regulations were implemented to help protect inexperienced retail clients from the high leverage of many of IG’s products.

However, the higher levels of activity meant remuneration levels would increase accordingly and costs were expected to rise by £40m.

The strength in the underlying business means IG Group are one of the few companies confident enough to maintain dividend payments and the company is to maintain their 43.2p dividend.

“During such a prolonged period of volatility, we’ve seen high volumes of clients choosing to trade markets with IG, reflecting our business resilience, our robust systems and our commitment to delivering the best possible trading experience,” said IG CEO, June Felix.

Cynics may argue the IG CEO attempts to distract from the fact IG have profited from the coronavirus crisis by drawing attention to the IG Brighter Future Fund in a large part of the comment on the results.

June Felix continued; “we are encouraged with the resilience and performance of our employees in such challenging times for everyone. The IG Brighter Future Fund builds on our culture of supporting the local communities in which we operate, helping disadvantaged young people gain access to improved educational opportunities. We are thrilled to be able to build on our partnership with Teach First and forge ties with other new international partners to support the long‐term education needs of children living through such an unsettling period.”

Shares in IG Group (LON:IGG) were down 0.6% in mid-afternoon trade having reverse early gains.

The increase in activity means IG are set to return to revenue levels not seen since new ESMA regulations were implemented to help protect inexperienced retail clients from the high leverage of many of IG’s products.

However, the higher levels of activity meant remuneration levels would increase accordingly and costs were expected to rise by £40m.

The strength in the underlying business means IG Group are one of the few companies confident enough to maintain dividend payments and the company is to maintain their 43.2p dividend.

“During such a prolonged period of volatility, we’ve seen high volumes of clients choosing to trade markets with IG, reflecting our business resilience, our robust systems and our commitment to delivering the best possible trading experience,” said IG CEO, June Felix.

Cynics may argue the IG CEO attempts to distract from the fact IG have profited from the coronavirus crisis by drawing attention to the IG Brighter Future Fund in a large part of the comment on the results.

June Felix continued; “we are encouraged with the resilience and performance of our employees in such challenging times for everyone. The IG Brighter Future Fund builds on our culture of supporting the local communities in which we operate, helping disadvantaged young people gain access to improved educational opportunities. We are thrilled to be able to build on our partnership with Teach First and forge ties with other new international partners to support the long‐term education needs of children living through such an unsettling period.”

Shares in IG Group (LON:IGG) were down 0.6% in mid-afternoon trade having reverse early gains. FTSE 100 travel shares fall as early COVID-19 treatment trials disappoint

Shares in the FTSE 100’s travel shares fell on Friday after disappointing reports from a Chinese trial of the drug Remdesivir.

Many had hoped Remdesivir would provide an effective treatment for COVID-19 following positive findings in a US-based trial just last week.

The market’s disappointment was evident in the lower open for equities on Friday with travel shares particularly heavily hit.

easyJet and International Consolidated Airlines were down 5% and 4% respectively in early trade.

The two had rallied heavily on prior reports of positive results from Remdesivir and the latest study has ultimately changed perceptions on when the airlines will be able to begin ramping up the number of flights again.

Chinese Remdesivir study

The Chinese study involved 237 COVID-19 patients of which 158 were administered Remdesivir and 79 were given a placebo. The study found that the placebo group actually had better survival rates than the group who received Remdesivir. 13.9% if the group who were treated with Remdesivir sadly died where as just 12.8% of those in the placebo group died. However, the study has been met with much scepticism due to the nature it was released and the fact the study was carried out in China with a small sample size. The results of the study had been published by mistake by the WHO before it was quickly removed. Gilead Sciences, the company who owns Remdesivir, hit back at the findings saying the study had been completed early and pointed to the progress of on-going studies.Merdad Parsey, Chief Medical Officer at Gilead Sciences commented on the Chinese study: “Today, information from the first clinical study evaluating the investigational antiviral remdesivir in patients with severe COVID-19 disease in China was prematurely posted on the World Health Organization website. This information has since been removed, as the study investigators did not provide permission for the publication of the results. Furthermore, we believe the post included inappropriate characterizations of the study. The study was terminated early due to low enrollment and, as a result, it was underpowered to enable statistically meaningful conclusions. As such, the study results are inconclusive, though trends in the data suggest a potential benefit for remdesivir, particularly among patients treated early in disease. We understand the available data have been submitted for peer-reviewed publication, which will provide more detailed information from this study in the near future.” “The results of this trial in China, along with those of the compassionate use cohort of more critically ill patients published on April 10, add to a growing but still inconclusive body of evidence for remdesivir. Remdesivir is an unapproved investigational product, and the safety and efficacy of remdesivir for the treatment of COVID-19 are not yet known. There are multiple ongoing Phase 3 studies that are designed to provide the additional data needed to determine the potential for remdesivir as a treatment for COVID-19. These studies will help inform whom to treat, when to treat and how long to treat with remdesivir. The studies are either fully enrolled for the primary analysis or on track to fully enroll in the near future.”Gilead statement on data from study in patients with severe COVID-19 in China: https://t.co/pDsnSmVijG. pic.twitter.com/UpqR5EJqvQ

— Gilead Sciences (@GileadSciences) April 23, 2020

Avacta Group’s COVID-19 tests could hold the key to economic recovery

AIM-listed Avacta (LON:AVCT) is at the forefront of the drive to develop testing kits on a large enough scale to help track COVID-19 and prevent the spread of the virus, and ultimately reduce deaths.

The broad testing for COVID-19 is also the first step in allowing non-contagious people go back to work and aid the economic recovery.

COVID-19 mapping

The foremost measure governments can implement to help tackle the spread of coronavirus is the testing of individuals and mapping the potential spread of the virus. A vaccine, or even effective treatment, is the end goal to help global economies recover to some normality. But we are unfortunately many months away from such medicines being distributed to the extent to bring the virus under control. In the meantime, wide spread testing will be the most effective method of fighting coronavirus and reopening economies. Avacta are harnessing their Affimer® technology to use in testing kits that will produce and positive or negative results in minutes, in a similar manner to pregnancy tests. Avacta are preparing trials for the testing kits, which if successful, would be monumental for the fight against COVID-19. The market has already begun pricing in the significance of the testing kits to the Avacta share price; the company’s shares have more than tripled to 68p in April alone. Key to Avacta reaching their goals is ensuring enough cash to facilitate the development programme and complete clinical trials. However, after a recent placing the company should have enough cash on hand to complete trails “Based on anticipated burn for the COVID-19 test strip as detailed above and its existing programmes, TPI estimates Avacta should still hold cash c.£8.5m by its December year end. It will initiate the Phase I trial of its lead asset late in 2020 and initial data will be available within a few months, but the cash position means that Avacta is now fully-funded to complete this trial,” Barry Gibb, Research Aanalyst at Turner Pope wrote in a note to clients. “Beyond the obvious reputational and commercial, albeit presently unquantifiable, short and longer-term opportunities that could emerge from its new partnership with Cytiva, this development represents a major inflection point along with potential for creation of significant value for Avacta, while it also forwards its partnered programmes and licensing relationships for its diagnostics reagents.”Stronger house builders help lift FTSE 100

A strong housebuilding sector helped reverse early FTSE 100 losses on Thursday as investors looked forward to the resumption of construction by the UK’s leading house builders.

Taylor Wimpey announced in a trading statement they would be reopening their sites 4th May, sparking a wave of optimism in the housebuilding shares.

Taylor Wimpey had rallied by over 11% by early afternoon, with Barratt Developments and Persimmon not too far behind, both recording intraday gains just in excess of 10%.

The prospect of a resumption in construction brings forward the date house builders’ cash can once again start flowing. Investors will be anticipating further updates on dividends given the strong cash position of the house builders after they scrapped payouts in response to COVID-19.

“In the period while our sites have been closed, trading has inevitably been impacted. However, we are still seeing continued demand for our homes and our sales teams have been selling homes remotely, and digitally, week to week. Cancellations represent less than 1% of our current order book. We have a strong balance sheet and have managed the business conservatively and are as well positioned as we can be in the very difficult circumstances,” said Pete Redfern, Chief Executive of Taylor Wimpey.

Shares in Rightmove rose over 3% as the prospect of increased house building activity would ultimately lead to houses being listed on their site.

US jobs

The FTSE 100 recovered early losses to trade mildly positive on Thursday after the US released weekly initial jobless claims figures that showed the world’s largest economy had recorded 26 million people unemployed since the beginning of the lockdown. The US recorded 4.4 million initial jobless claims this week, down from 5.2 million last week. The United States are currently locked in a debate over the opening up of the economy with some states outlining plans to open some restaurants, shops and even bowling alleys to help support jobs. Critics say this may increase activity in the short term but could cause a potential second wave of coronavirus.Taylor Wimpey share price rises on plans to reopen sites

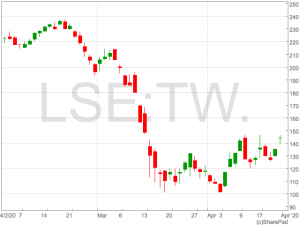

The Taylor Wimpey share price (LON:TW) rose on Thursday following the announcement of plans to reopen their sites in May.

Taylor Wimpey has closed its UK sites after the government announced lockdown measures, despite many other construction sites remaining open, albeit at a reduced capacity.

The Taylor Wimpey share price rose over 6% in a reaction to the announcement which came as part of a trading statement.

The update would have also bolstered investor confidence in Taylor Wimpey as they revealed a gross cash position of c.£836 million, as of 22 April 2020.

Taylor Wimpey have recently scrapped their full year and special dividend in order to conserve cash. Today’s announcement will be welcome news to investors as it highlights Taylor Wimpey’s balance sheet is suitably robust to resume dividends, when house sales commence.

However, whilst sites will reopen, sales offices will stay closed for the time being.

Pete Redfern, Chief Executive, commented:

“Our first priority is always the health and safety of our customers, employees, subcontractors and suppliers. We took an early decision at the end of March to close our sites while we assessed in detail how to build homes without compromising on health and safety or quality. We are now confident that we have clear plans and processes in place so we can safely start back on site in a phased way beginning on 4 May.”

“In the period while our sites have been closed, trading has inevitably been impacted. However, we are still seeing continued demand for our homes and our sales teams have been selling homes remotely, and digitally, week to week. Cancellations represent less than 1% of our current order book. We have a strong balance sheet and have managed the business conservatively and are as well positioned as we can be in the very difficult circumstances.”

The past few weeks have been unlike anything we have seen before, presenting huge challenges for businesses and individuals, and we support the measures put in place by the Government to reduce the spread of the virus and safeguard the NHS and public health. I would like to thank each and every one of our people for their outstanding efforts and commitment, and the way in which they have come together, working extremely hard not only to support the business and its performance, but to provide invaluable help to their local communities.”

The Taylor Wimpey share price traded at 144p, up 6.6%, just before 10am on Thursday.

Pete Redfern, Chief Executive, commented:

“Our first priority is always the health and safety of our customers, employees, subcontractors and suppliers. We took an early decision at the end of March to close our sites while we assessed in detail how to build homes without compromising on health and safety or quality. We are now confident that we have clear plans and processes in place so we can safely start back on site in a phased way beginning on 4 May.”

“In the period while our sites have been closed, trading has inevitably been impacted. However, we are still seeing continued demand for our homes and our sales teams have been selling homes remotely, and digitally, week to week. Cancellations represent less than 1% of our current order book. We have a strong balance sheet and have managed the business conservatively and are as well positioned as we can be in the very difficult circumstances.”

The past few weeks have been unlike anything we have seen before, presenting huge challenges for businesses and individuals, and we support the measures put in place by the Government to reduce the spread of the virus and safeguard the NHS and public health. I would like to thank each and every one of our people for their outstanding efforts and commitment, and the way in which they have come together, working extremely hard not only to support the business and its performance, but to provide invaluable help to their local communities.”

The Taylor Wimpey share price traded at 144p, up 6.6%, just before 10am on Thursday.

Pete Redfern, Chief Executive, commented:

“Our first priority is always the health and safety of our customers, employees, subcontractors and suppliers. We took an early decision at the end of March to close our sites while we assessed in detail how to build homes without compromising on health and safety or quality. We are now confident that we have clear plans and processes in place so we can safely start back on site in a phased way beginning on 4 May.”

“In the period while our sites have been closed, trading has inevitably been impacted. However, we are still seeing continued demand for our homes and our sales teams have been selling homes remotely, and digitally, week to week. Cancellations represent less than 1% of our current order book. We have a strong balance sheet and have managed the business conservatively and are as well positioned as we can be in the very difficult circumstances.”

The past few weeks have been unlike anything we have seen before, presenting huge challenges for businesses and individuals, and we support the measures put in place by the Government to reduce the spread of the virus and safeguard the NHS and public health. I would like to thank each and every one of our people for their outstanding efforts and commitment, and the way in which they have come together, working extremely hard not only to support the business and its performance, but to provide invaluable help to their local communities.”

The Taylor Wimpey share price traded at 144p, up 6.6%, just before 10am on Thursday.

Pete Redfern, Chief Executive, commented:

“Our first priority is always the health and safety of our customers, employees, subcontractors and suppliers. We took an early decision at the end of March to close our sites while we assessed in detail how to build homes without compromising on health and safety or quality. We are now confident that we have clear plans and processes in place so we can safely start back on site in a phased way beginning on 4 May.”

“In the period while our sites have been closed, trading has inevitably been impacted. However, we are still seeing continued demand for our homes and our sales teams have been selling homes remotely, and digitally, week to week. Cancellations represent less than 1% of our current order book. We have a strong balance sheet and have managed the business conservatively and are as well positioned as we can be in the very difficult circumstances.”

The past few weeks have been unlike anything we have seen before, presenting huge challenges for businesses and individuals, and we support the measures put in place by the Government to reduce the spread of the virus and safeguard the NHS and public health. I would like to thank each and every one of our people for their outstanding efforts and commitment, and the way in which they have come together, working extremely hard not only to support the business and its performance, but to provide invaluable help to their local communities.”

The Taylor Wimpey share price traded at 144p, up 6.6%, just before 10am on Thursday. FTSE 100 recoups recent losses amid strong corporate results

The FTSE 100 was rose on Wednesday, breaking a string of down days caused by uncertainty surrounding the price of oil.

Strong corporate results helped lift sentiment as the FTSE 100 rallied towards 5,800 on Wednesday afternoon.

Building material group CRH was one of the FTSE 100 top risers on Wednesday rising over 6% following the release of a trading statement that pointed to a strong first quarter.

The group also said they saw future benefits from government stimulus to help revive the economy.

“We have had a good start to the year, and although the global spread of COVID-19 brings challenges for us all, I have no doubt that with the financial strength of CRH and the experience of our leadership teams, we will endure through these unprecedented and uncertain times,” said Albert Manifold, Chief Executive of CRH.

“All necessary actions are being taken to protect our employees and businesses, and to ensure that we are well positioned for the recovery in our markets.”

US-focused Plant hire company Ashtead was also stronger on the day, rising over 7%.

UK house builder’s were among the top risers a day after a report from Zoopla revealed a 30% increase in rental activity, suggesting housing activity could bounce back following the easing of lockdown measures.

Oil giants Royal Dutch Shell and BP added a significant number of points to the FTSE 100 as the oil market calmed.

Fears over a lack of storage had caused WTI oil to trade negatively on Monday sending shock waves through markets. The two FTSE 100 majors have now reversed much of the losses inflicted on the equities in the wake of the oil turmoil, despite oil remaining weak today.

Centrica was the biggest faller on the FTSE 100 as it sank to 29p, the lowest price in the energy companies’ history.

In the US, the Dow Jones and S&P 500 also gained after the open with the Dow Jones rising to 23,413, up 1.71%.

Lloyds share price: key considerations before buying

The Lloyds share price (LON:LLOY) will ultimately be dictated by the strength of the UK economy and how fast it can recover from the coronavirus lockdown.

However, like many of other companies in the FTSE 100, Lloyds shares are currently down heavily from recent highs and investors will want to pre-empt any recovery and buy shares as cheaply as they can.

This means the big question is with Lloyds already looking good value at 30p after the recent crash, will we see a situation where Lloyds fall further and look even better value?

Another important consideration to access whether Lloyds shares have bottomed is the recent technical formations.

Since bottoming, Lloyds has made a series of higher highs which are typically signal the beginning of an uptrend.

If this uptrend is to take hold, any dips in the Lloyds share price would certainly present a buying opportunity.

It should be noted the market is yet to retest the recent lows around 27.7p to access whether it will hold as support for the price.

Another important consideration to access whether Lloyds shares have bottomed is the recent technical formations.

Since bottoming, Lloyds has made a series of higher highs which are typically signal the beginning of an uptrend.

If this uptrend is to take hold, any dips in the Lloyds share price would certainly present a buying opportunity.

It should be noted the market is yet to retest the recent lows around 27.7p to access whether it will hold as support for the price.

Lloyds share price valuation

With Lloyds shares trading at 30p, the company trades at just 7x historical earnings. This is significantly lower than their long term historical average and value investors would argue this is an ideal time to pick shares up. As with all markets, there would be a counter argument to this view, centred around Lloyds’ exposure to UK households and businesses; both are currently under extreme pressure from the coronavirus lockdown. It should be expected the number of bad loans jump and Lloyds suffer an increased volume of defaults during the period. This will have a negative impact on Lloyds profitability in the short term which will be compounded by a reduction in mortgages and new loans.Lloyds financial health

Nevertheless, the impact of any disruption is probably priced into the current Lloyds share price, as is the recent scrapping of their dividend. It would be more plausible for investors to start thinking an economic recovery when considering a purchase of Lloyds shares as this would be a truer reflection of Lloyds underlying earnings over the long-term. With a CET1 ratio of 13.8 per cent after dividends reported for 2019FY, Lloyds are in a much stronger financial position than in the financial crisis and are able to absorb the reduced profitability through 2020. This would mean in the short-term any influences on the timing of a recovery, such as the easing of the lockdown or successful trials of a vaccine, are going to be the biggest driver of Lloyds shares. If the country is forced into a an extended coronavirus lockdown to help save lives, this will negatively impact the economy, and the shares of Lloyds bank. Another important consideration to access whether Lloyds shares have bottomed is the recent technical formations.

Since bottoming, Lloyds has made a series of higher highs which are typically signal the beginning of an uptrend.

If this uptrend is to take hold, any dips in the Lloyds share price would certainly present a buying opportunity.

It should be noted the market is yet to retest the recent lows around 27.7p to access whether it will hold as support for the price.

Another important consideration to access whether Lloyds shares have bottomed is the recent technical formations.

Since bottoming, Lloyds has made a series of higher highs which are typically signal the beginning of an uptrend.

If this uptrend is to take hold, any dips in the Lloyds share price would certainly present a buying opportunity.

It should be noted the market is yet to retest the recent lows around 27.7p to access whether it will hold as support for the price. Netflix enjoy a jump in new subscribers during lockdown

US-listed streaming service Netflix (NASDAQ:NLFX) has announced a significant jump in the number of new subscribers in the first quarter as new users seek new forms of entertainment during imposed lockdowns.

Revenue in the first quarter grew to $5.7 billion up from $4.5 billion in the first quarter of 2019.

Hit new shows such as ‘Tiger King’ were instrumental in attracting the number of new subscribers. Tiger King was watched by 64 million households and caused a storm on social media likely driving people to sign up up to Netflix and watch it.

Netflix are one of the beneficiary companies of the coronavirus lockdown as home-orientated services become almost essential. Almost 16 million people signed up to Netflix in the first quarter globally.

Netflix touched on this in a letter to shareholders as well as the higher level of engagement levels of existing users.

“In our 20+ year history, we have never seen a future more uncertain or unsettling. The coronavirus has reached every corner of the world and, in the absence of a widespread treatment or vaccine, no one knows how or when this terrible crisis will end. What’s clear is the escalating human cost in terms of lost lives and lost jobs, with tens of millions of people now out of work.”

“At Netflix, we’re acutely aware that we are fortunate to have a service that is even more meaningful to people confined at home, and which we can operate remotely with minimal disruption in the short to medium term. Like other home entertainment services, we’re seeing temporarily higher viewing and increased membership growth. In our case, this is offset by a sharply stronger US dollar, depressing our international revenue, resulting in revenue-as-forecast. We expect viewing to decline and membership growth to decelerate as home confinement ends, which we hope is soon.”

Shares in Netflix initially spiked higher in the US premarket but eased off to trade at $435 as market approached the US cash open.