FTSE 100 rises as bargain hunters pick up beaten down shares

The FTSE 100 closed higher on Thursday as investors picked up bargains among the most heavily hit shares in the FTSE 100.

Earlier in the week, travel shares rallied sharply as news of a slowdown in the number of coronavirus cases caused some optimism among investors.

On Thursday it was the turn of the retailers and advertising companies to enjoy some attention from investors as Next, ITV and JD Sports all rose more than 7%.

Housebuilder shares were also higher with Taylor Wimpey up 7% and Barratt Developments rising 5%.

Just Eat was the top riser after its newly acquired takeaway.com reported a significant jump in revenue. Food delivery companies are one of the sectors that have seen steady demand through the spread of coronavirus and even enjoyed spikes in demand.

Hopes that the coronavirus crisis would soon peak have increased this week as epicentres in Italy and Spain had seen the number of new cases decline.

Later in the session markets received the latest instalment of stimulus from the United Sates in the form of a $2.3 trillion stimulus package from the the Federal Reserve.

The move was a surprise to investors who thought the Fed had spent its ammunition with previous rounds of stimulus.

“The Federal Reserve and the U.S. government are willing to go to extreme lengths to support the economy and that has been far beyond my expectations,” said Dev Kantesaria, founder of US hedge fund Valley Forge Capital Management.

The FTSE 100 closed the week at 5,842, up 2.9% on the day.

The Federal Reserve unleashes $2.3 trillion additional stimulus

The Federal Reserve has unleashed another round of stimulus on the US economy to help prop up the financial system as the coronavirus lockdown hits the economy.

Jereme Powell, Chair of the Federal Reserve, announced a $2.3 trillion package targeted at businesses ahead of the easter weekend.

The latest round of stimulus was a lot more broad in terms of the assets they were prepared to buy meaning their would be greater scope to purchases lower rated bonds.

The Fed also promised an increase to the Main Street Lending Program for businesses from $75 billion to $400 billion.

The announcement also came just after another huge rise in jobless claims in the United States.

6.6 million individual register as unemployed and applied for benefits in the last week meaning in the past three week 16 million workers in the United States have lost their jobs.

Connor Campbell, Financial Analyst at Core Spreads, highlighted the timing of the announcement which could be designed to stabilise market before market close for a long weekend.

“In an expertly timed intervention, not long after that jobs data the Federal Reserve revealed its latest stimulus package. With Jerome Powell stating that the central bank will ‘forcefully, proactively and aggressively’ protect and bolster the US economy, the Fed unveiled another $2.3 trillion in loans aimed at small and mid-size businesses,” Connor Campbell said.

“The move partially explains why the markets have somewhat taken the jobs data in their stride in these last few weeks – the worse the numbers were, the more likely the Fed was to act.”

The announcement had a positive impact on markets with the S&P 500 breaking above 2,800 for the first time in about a month.

Investors had previously questioned whether the Federal Reserve had run out of ammunition with their previous round of stimulus. Today highlights that wasn’t the case as the Fed said they were prepared to provide stimulus for as long as the economy needed it.FED’S POWELL SAYS THE FED CAN KEEP PROVIDING SUPPORT TO ECONOMY AS LONG AS NEEDS ARISE, NO LIMIT TO HOW LONG THEY CAN DO IT

— *Walter Bloomberg (@DeItaOne) April 9, 2020

Royal Dutch Shell share price pounced on by Saudi wealth fund

The recent drop in the Royal Dutch Shell share price (LON:RDSB) has proved too irresistible for the Saudi Arabian Public Investment Fund (PIF), who have bought a stake in the London-listed oil major.

The Wall Street Journal broke news of the purchase of Shell shares by the Saudi Arabia wealth fund on Wednesday.

The Shell stake was among a tranche of investment in European oil companies that include Total, Eni, Equinor and Royal Dutch Shell.

The exact amount of the investment in Royal Dutch Shell shares is not know but it is thought a total of $1 billion was invested in Royal Dutch Shell, Total and Eni.

The PIF is reported to have taken a $200 million stake in Norwegian national oil company Equinor.

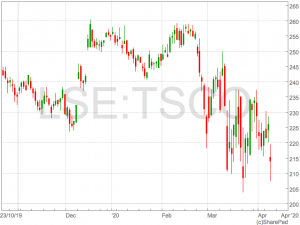

Shell share price

The $320 billion Saudi Arabian Public Investment Fund have taken advantage of a heavily reduced Shell share price that briefly sank as low as 895p intraday. The wealth fund is viewing the sharp decrease in the price of European oil shares as an opportunity to bolster their holdings in the sector, focusing on those companies that have announced cost cutting measures. Royal Dutch Shell were quick to announce a raft of measures to help preserve cash that included a reception to Capex and the scrapping of their share buyback programme. The FTSE 100 oil company has not amended its ordinary dividend, however, which will make it an attractive proposition to investors. Close watchers of Shell will note the face-ripping rally the Shell share price staged as it rallied through 1,000p, back up to to current levels around 1,480p. It is likely the Saudi wealth fund were major buyers during this period.Diversification

The purchase of shares in European oil companies breaks with the PIF’s recent trend of diversifying away from oil. Again stepping in the sweep up shares at knock-down prices, the PIF took a 8.2% in cruise line operator Carnival who has been ravaged by the spread of coronavirus, sending shares down over 75% from 2020 highs.Heineken withdraws 2020 guidance amid COVID-19 uncertainty

Heineken N.V. (AMS:HEIA) shares dropped on Wednesday after the company announced that it has withdrawn all guidance for 2020 as the COVID-19 outbreak continues to evolve.

Shares in the Dutch brewing company were down by almost 3% during trading on Wednesday.

Given the uncertainty surrounding the duration of the pandemic and its impact on the economy, the company has withdrawn its guidance for the 2020 year.

Heineken said that total consolidated volume is expected to decrease by 4% in the first quarter of 2020, with beer volume declining by 2%. The impact is expected to get worse in the second quarter.

As the illness continues to spread, several nations have been placed on lockdown to restrict the unnecessary movement of people, with only essential stores and outlets open.

“With the spread of the Covid-19 crisis to all geographies, multiple countries have taken far-reaching containment measures such as restrictions of movement for populations and outlet closures, sometimes combined with the mandatory lockdown of production facilities,” Heineken said in a statement.

“This constitutes a major negative macro-economic development and as such it is having a significant impact on Heineken’s markets and on its business in 2020,” the Dutch brewing company continued.

“In these very trying times, Heineken’s priority is to ensure the health and welfare of its employees, customers, and business partners. All Heineken teams are mobilised to enable the company to face this unprecedented crisis in the best possible way, and to protect the long-term potential of its brands and businesses.”

Shares in Heineken N.V. (AMS:HEIA) were down on Wednesday, trading at -2.36% as of 14:33 CEST.

UK insurers Aviva, RSA, Hiscox, Direct Lend scrap their dividends

UK insurance companies have suspended their dividends following pressure from the Bank of England’s Prudential Regulatory Authority.

Aviva said in a release “the Board has taken this decision in the wake of the unprecedented challenges COVID-19 presents for businesses, households and customers, and the adverse and highly uncertain impact on the global economy.”

The Prudential Regulatory Authority wrote to both UK insurers and banks at the end of March advising them to cease payouts to help ensure financial stability during a coronavirus-induced recession.

RSA were due to pay a dividend 14th May which will now be cancelled.

Martin Scicluna, Chairman of RSA, said:

“This is a difficult decision, not least in terms of the initial impact it will have on shareholders. The Company has a strong capital base, but we think it is right and prudent, for the many businesses and people that we support as well as wider stakeholders, to take these steps now, and ensure that RSA is well placed to continue doing what we can to help through this crisis.

“No company exists in a vacuum and at this time we judge it to be in the best long term interests of RSA to show forbearance on dividends and maximise our capability to support customers under the terms of their respective policies and play our part in industry initiatives to support relief efforts.”

Legal & General decided against Bank of England warnings and said they were going to proceed with a £750 million dividend payment which saw their shares soar.

The news insurers were to cut dividends came as Tesco confirmed they were going to maintain their dividends despite rising costs.

Investors have suffered a raft of dividend suspensions since the spread of coronavirus caused an economically damaging lockdown.

However, many of these suspensions were precautionary and are likely to be reinstated when the economy begins the recovery.

Tesco to maintain dividend despite higher costs

Tesco (LON:TSCO) are to continue to pay their dividend after it experienced a jump in sales due to coronavirus panic buying. However, this uplift may be short-lived as the group expects to suffer up to £925 million in additional costs through the pandemic.

In a trading update and preliminary results for 2020 the retailer said it had seen a circa 30% increase in sales during the onset of the coronavirus pandemic which had cleared the supply chain of certain lines. This is now said to be stabilising and they see stores well stocked.

The group said they had been on a hiring spree to meet demand, leading to higher overall costs as it supported employees unable to work due to illness or isolation.

Despite the expectation of higher costs, Tesco said they plan to pay their full year dividend of 9.15p.

The full year dividend would be in addition to a proposed special dividend from the sale of the Thai and Malaysian business.

In early March, Tesco announced it was selling the Thai and Malaysian business unit for a consideration of £8.2 billion, to help focus the business.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

Shares is Tesco were down over 4% following the announcement.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

Shares is Tesco were down over 4% following the announcement.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

Shares is Tesco were down over 4% following the announcement.

Tesco have proposed to return $5 billion of the proceeds of the Asian business sale to investors by way of a special dividend.

Commenting on the results, CEO Dave Lewis said:

“COVID-19 has shown how critical the food supply chain is to the UK and I’m very proud of the way Tesco, as indeed the whole UK food industry, has stepped forward.

In this time of crisis we have focused on four things; food for all, safety for everyone, supporting our colleagues and supporting our communities.”

“Initial panic buying has subsided and service levels are returning to normal. There are significant extra costs in feeding the nation at the moment but these are partially offset by the UK Business rates relief.”

“Tesco is a business that rises to a challenge and this will be no different. I would like to thank colleagues for their unbelievable commitment and customers for their help and understanding. Together, we can do this.”

Shares is Tesco were down over 4% following the announcement. ASOS shares jump after placing, coronavirus hits sales

ASOS (LON:ASC) has raised £247 million through a placing to help strengthen the groups balance sheet in the midst of the coronavirus crisis.

ASOS shares rose over 30% following the announcement of the successful placing conducted by JP Morgan as the market rewarded the company’s nimbleness.

ASOS are the first company to conduct a significant share sale in the coronavirus crisis.

The rise in ASOS shares also comes after the online retail company released first half results demonstrating strong sales, before the onset of the coronavirus lockdown.

ASOS revenue grew by 21% to £1.59 billion from £1.34 billion the year prior, in the six months to 28th February.

The strong sales were a result of a push into social media driving higher customer retention and acquisition.

However, the company said it has been adversely impacted by the spread of coronavirus and saw sales down in the region of 20-25% in the period since the end of the half year.

Nick Beighton, CEO of ASOS, commented:

“ASOS had a strong start to the year, making significant progress against the priorities we set out and delivering a better than anticipated first-half performance, driven by the operational improvements we are making to the business.

“Along with other businesses, we have been significantly impacted by the COVID-19 outbreak. Our first priority was to quickly put in place the necessary measures to ensure the health and wellbeing of our people. I have been extremely impressed with the pace of change and the flexibility our teams have shown in adopting these new ways of working. I’d like to thank them all for the way they have responded.”

“Since then, we have been focused on keeping our business delivering for customers whilst implementing a series of actions to mitigate the sales impact we have been experiencing. At the same time we have been working to strengthen our financial position, including reaching agreement with our lenders to provide us with additional short-term financial flexibility.”

Mr Beighton continued to explain how customer loyalty will provide ASOS with a steady demand through coronavirus, albeit reduced.

“The ASOS business model provides us with significant resilience and we are encouraged to have seen, across our markets, that where consumers are in lockdown, ASOS continues to be an important part of their lives. We have a global platform with the capacity and capability to drive our future growth as demand returns and against that backdrop we are looking to raise incremental equity capital to ensure we have sufficient resources to capitalise on the future whatever it may hold,” he said.

“The COVID crisis is clearly going to continue to be tough for everyone and the short-term outlook remains highly uncertain, but the measures we have taken ensure we are able to be clearly focussed on making sure that ASOS emerges as a stronger and better business.”

ASOS shares were up 33% to 2,085p in early trade on Wednesday.

Nick Beighton, CEO of ASOS, commented:

“ASOS had a strong start to the year, making significant progress against the priorities we set out and delivering a better than anticipated first-half performance, driven by the operational improvements we are making to the business.

“Along with other businesses, we have been significantly impacted by the COVID-19 outbreak. Our first priority was to quickly put in place the necessary measures to ensure the health and wellbeing of our people. I have been extremely impressed with the pace of change and the flexibility our teams have shown in adopting these new ways of working. I’d like to thank them all for the way they have responded.”

“Since then, we have been focused on keeping our business delivering for customers whilst implementing a series of actions to mitigate the sales impact we have been experiencing. At the same time we have been working to strengthen our financial position, including reaching agreement with our lenders to provide us with additional short-term financial flexibility.”

Mr Beighton continued to explain how customer loyalty will provide ASOS with a steady demand through coronavirus, albeit reduced.

“The ASOS business model provides us with significant resilience and we are encouraged to have seen, across our markets, that where consumers are in lockdown, ASOS continues to be an important part of their lives. We have a global platform with the capacity and capability to drive our future growth as demand returns and against that backdrop we are looking to raise incremental equity capital to ensure we have sufficient resources to capitalise on the future whatever it may hold,” he said.

“The COVID crisis is clearly going to continue to be tough for everyone and the short-term outlook remains highly uncertain, but the measures we have taken ensure we are able to be clearly focussed on making sure that ASOS emerges as a stronger and better business.”

ASOS shares were up 33% to 2,085p in early trade on Wednesday.

Nick Beighton, CEO of ASOS, commented:

“ASOS had a strong start to the year, making significant progress against the priorities we set out and delivering a better than anticipated first-half performance, driven by the operational improvements we are making to the business.

“Along with other businesses, we have been significantly impacted by the COVID-19 outbreak. Our first priority was to quickly put in place the necessary measures to ensure the health and wellbeing of our people. I have been extremely impressed with the pace of change and the flexibility our teams have shown in adopting these new ways of working. I’d like to thank them all for the way they have responded.”

“Since then, we have been focused on keeping our business delivering for customers whilst implementing a series of actions to mitigate the sales impact we have been experiencing. At the same time we have been working to strengthen our financial position, including reaching agreement with our lenders to provide us with additional short-term financial flexibility.”

Mr Beighton continued to explain how customer loyalty will provide ASOS with a steady demand through coronavirus, albeit reduced.

“The ASOS business model provides us with significant resilience and we are encouraged to have seen, across our markets, that where consumers are in lockdown, ASOS continues to be an important part of their lives. We have a global platform with the capacity and capability to drive our future growth as demand returns and against that backdrop we are looking to raise incremental equity capital to ensure we have sufficient resources to capitalise on the future whatever it may hold,” he said.

“The COVID crisis is clearly going to continue to be tough for everyone and the short-term outlook remains highly uncertain, but the measures we have taken ensure we are able to be clearly focussed on making sure that ASOS emerges as a stronger and better business.”

ASOS shares were up 33% to 2,085p in early trade on Wednesday.

Nick Beighton, CEO of ASOS, commented:

“ASOS had a strong start to the year, making significant progress against the priorities we set out and delivering a better than anticipated first-half performance, driven by the operational improvements we are making to the business.

“Along with other businesses, we have been significantly impacted by the COVID-19 outbreak. Our first priority was to quickly put in place the necessary measures to ensure the health and wellbeing of our people. I have been extremely impressed with the pace of change and the flexibility our teams have shown in adopting these new ways of working. I’d like to thank them all for the way they have responded.”

“Since then, we have been focused on keeping our business delivering for customers whilst implementing a series of actions to mitigate the sales impact we have been experiencing. At the same time we have been working to strengthen our financial position, including reaching agreement with our lenders to provide us with additional short-term financial flexibility.”

Mr Beighton continued to explain how customer loyalty will provide ASOS with a steady demand through coronavirus, albeit reduced.

“The ASOS business model provides us with significant resilience and we are encouraged to have seen, across our markets, that where consumers are in lockdown, ASOS continues to be an important part of their lives. We have a global platform with the capacity and capability to drive our future growth as demand returns and against that backdrop we are looking to raise incremental equity capital to ensure we have sufficient resources to capitalise on the future whatever it may hold,” he said.

“The COVID crisis is clearly going to continue to be tough for everyone and the short-term outlook remains highly uncertain, but the measures we have taken ensure we are able to be clearly focussed on making sure that ASOS emerges as a stronger and better business.”

ASOS shares were up 33% to 2,085p in early trade on Wednesday. Halifax: UK house prices stable before COVID-19

New data revealed on Tuesday that house prices in the UK were stable last month before the measures to contain COVID-19 were put in place.

According to the latest Halifax House Price Index, UK house prices in March were 3% higher than the same month a year earlier.

Meanwhile, house prices in Britain were flat on a monthly basis.

Last month was a turning point for the UK in its battle to contain the spread of COVID-19, as the government introduced stricter social distancing measures.

“The UK housing market began March with similar trends to previous months, as key market indicators showed a sustained level of buyer and seller activity,” Russell Galley, Managing Director at Halifax, commented on the data.

“Overall average house prices in the month were little changed from February’s record high, while annual growth nudged up to 3%,” Russell Galley continued.

“These factors all underlined a positive trajectory and increased momentum in the early part of the year, with confidence rising as political and economic uncertainty eased. However, it’s clear we ended the month in very different territory as a result of the country’s response to the coronavirus pandemic,” Russell Galley said.

The Managing Director added that most market activity “has been paused” as people are following government guidelines to stay at home.

Meanwhile, estate agencies, surveyors and conveyancers have been temporarily closed.

“With viewings cancelled and movers being encouraged to put transactions on hold, activity will inevitably fall sharply in the coming months. It should be noted that with less data available, calculating average house prices is likely to become more challenging in the short-term,” Russell Galley said.

“However, it’s still too early to properly assess what potential long-term impacts the current lockdown might have on the UK housing market. While there is very significant uncertainty at the moment, much will depend on the length of time it takes for restrictions to be lifted, the pressure that has been exerted on the economy in the meantime and the effect this has on consumer sentiment.”

All Cineworld cinemas closed amid COVID-19

Cineworld (LON:CINE) updated the market on Tuesday on its current position amid the evolving COVID-19 crisis.

Shares in the cinema chain soared above 40% during trading on Tuesday.

The company said that all 787 of its cinemas in 10 countries have been closed as a result of the virus outbreak.

Many governments have closed non-essential shops and outlets in an attempt to contain the spread of the illness.

Cineworld stressed the importance of conserving cash where possible and decided to suspend payment of its fourth quarter dividend, as well as upcoming 2020 quarterly dividends.

Additionally, the executive directors have voluntarily agreed to defer payment of their full salaries and any bonuses which they are entitled to, Cineworld added.

“Every effort is being made to mitigate the effect of the closures, to assist our employees and to preserve cash,” the cinema chain said in a statement.

“These efforts include discussions with our landlords, the film studios and major suppliers, as well as curtailing all currently unnecessary capital expenditure,” Cineworld continued.

“This is a painful but necessary process as before the onslaught of the COVID-19 virus, we were excited and confident about the Group’s future prospects. We are also discussing the Group’s ongoing liquidity requirements with our RCF banks.”

The COVID-19 outbreak continues to develop in the UK, and people are being encouraged to stay indoors in order to help contain the spread of the illness.

With most of the country coming to a standstill, these are difficult times for many businesses.

Shares in Cineworld Group plc (LON:CINE) were up on Tuesday, trading at +40.12% as of 10:57 BST.