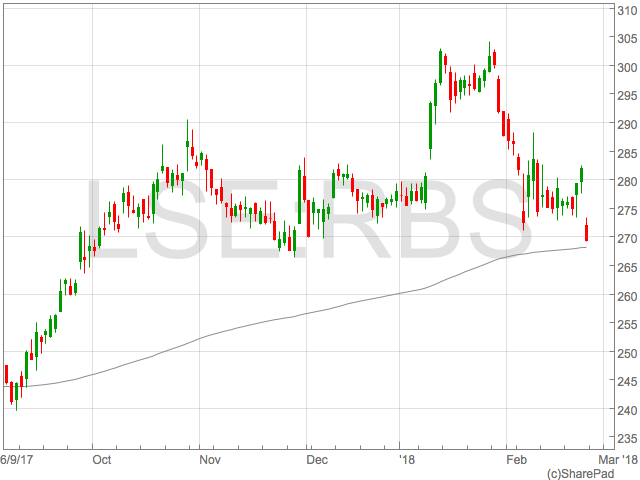

RBS reported its first full year profit for ten years on Friday as a sharp decrease in operating costs produced an attributable profit of £752 million.

RBS, still 71% owned by the tax-payer, also improved its capital position with CET1 rising 15.9%, although investors may have to wait some time for a resumption of dividend payments.

The UK banking group also announced significant investment into digital and innovation in the coming years.

Despite posting their first profit for ten years, shares in RBS fell in early trade as upcoming litigation charges from the Department of Justice overshadowed any profits. RBS still has to settle for a mortgage-securities scandal and is unable to pay any dividends until it is resolved.

Chief executive Roos McEwan said of the results:

Chief executive Roos McEwan said of the results:

“In 2017 we continued to make good progress in building a simpler, safer and more customer focused bank. I am pleased to report to shareholders that the bank made an operating profit before tax of £2,239 million in 2017, and for the first time in ten years we have delivered a bottom Iine profit of £752 million.

We have achieved profitability through delivering on the strategic plan that was set out in 2014. The first part of this plan was focused on building financial strength by reducing risk and building a more sustainable cost base. So far, we have reduced our risk-weighted assets by £228 billion and today can report a Common Equity Tier 1 ratio of 15.9% up from 8.6% in 2013. Our financial strength is now much clearer. Over the same period we have reduced operating costs by £3.9 billion. We still have more to do on cost reduction, however this reflects the progress we have made in making the bank more efficient”

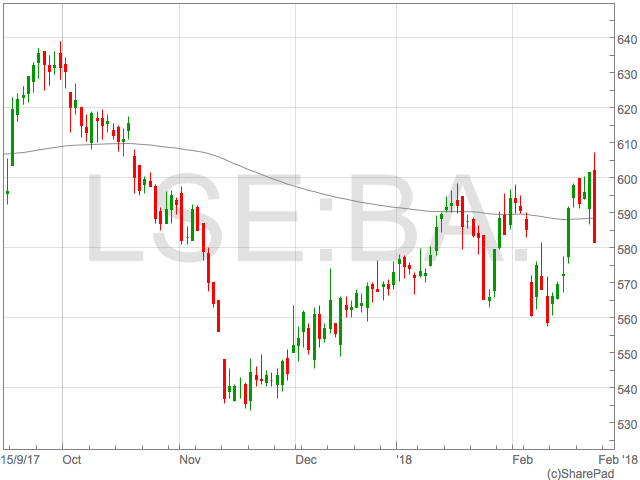

BAE received £20.3 billion in orders through the period with key orders for the F-35 Lightning programme and contracts for self-propelled howitzers.

Qatar also signed a contract for 24 Typhoon aircraft in December which is reported to be worth £5 billion.

Despite a flurry of deals, BAE says it expects earnings to be flat over the following year, disappointing markets who sent the shares 2% lower in an initial reaction on Thursday.

CEO Charles Woodburn said of the results:”We delivered a good performance in 2017, consistent with our expectations for the year. We start 2018 with a streamlined organisation and a strong focus on programme execution, technology and enhanced competitiveness, providing a solid foundation for medium-term growth. With an improving outlook for defence budgets in a number of our markets, we are well placed to generate good returns for shareholders.”

BAE received £20.3 billion in orders through the period with key orders for the F-35 Lightning programme and contracts for self-propelled howitzers.

Qatar also signed a contract for 24 Typhoon aircraft in December which is reported to be worth £5 billion.

Despite a flurry of deals, BAE says it expects earnings to be flat over the following year, disappointing markets who sent the shares 2% lower in an initial reaction on Thursday.

CEO Charles Woodburn said of the results:”We delivered a good performance in 2017, consistent with our expectations for the year. We start 2018 with a streamlined organisation and a strong focus on programme execution, technology and enhanced competitiveness, providing a solid foundation for medium-term growth. With an improving outlook for defence budgets in a number of our markets, we are well placed to generate good returns for shareholders.”

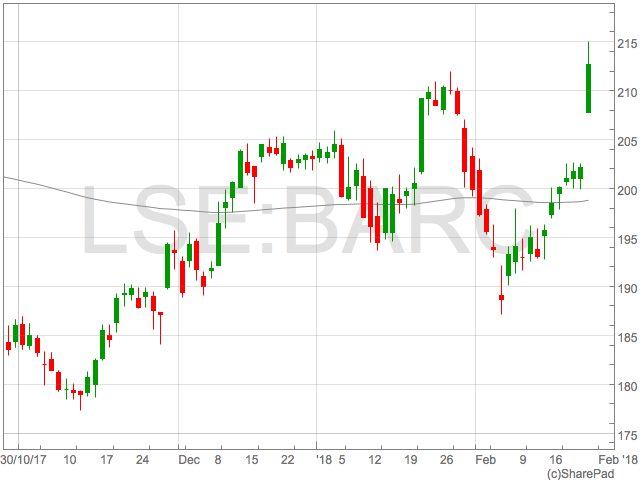

The results have given the bank confidence to outline plans for share buybacks and other capital distributions in the future.

Chief Executive, Jess Staley commented on the results:

“2017 was a year of considerable strategic progress for Barclays. The sell down of our shareholding in Barclays Africa, closure of our Non-Core unit, the establishment of our Service Company, and the creation of our UK ring- fenced bank, mean that, in terms of size and structure, we are now the diversified Transatlantic Consumer and Wholesale bank we set out in our strategy in March 2016.We have a portfolio of profitable businesses, producing significant earnings, and have plans and investments in place to grow those earnings over time.”

“We have already started to see some of the benefits of our work in 2017. Group profit before tax increased 10% year-on-year as a result of our team’s focus on execution. Barclays UK navigated the year well, reaching a digital banking milestone with our ten millionth customer. Within Barclays International, we increased Banking fee share in our Corporate and Investment Bank in 2017, and our Consumer, Cards and Payments business continued to produce very strong income while managing risk effectively.”

Shares in Barclays rose over 5% in early trade on Thursday.

The results have given the bank confidence to outline plans for share buybacks and other capital distributions in the future.

Chief Executive, Jess Staley commented on the results:

“2017 was a year of considerable strategic progress for Barclays. The sell down of our shareholding in Barclays Africa, closure of our Non-Core unit, the establishment of our Service Company, and the creation of our UK ring- fenced bank, mean that, in terms of size and structure, we are now the diversified Transatlantic Consumer and Wholesale bank we set out in our strategy in March 2016.We have a portfolio of profitable businesses, producing significant earnings, and have plans and investments in place to grow those earnings over time.”

“We have already started to see some of the benefits of our work in 2017. Group profit before tax increased 10% year-on-year as a result of our team’s focus on execution. Barclays UK navigated the year well, reaching a digital banking milestone with our ten millionth customer. Within Barclays International, we increased Banking fee share in our Corporate and Investment Bank in 2017, and our Consumer, Cards and Payments business continued to produce very strong income while managing risk effectively.”

Shares in Barclays rose over 5% in early trade on Thursday.